|

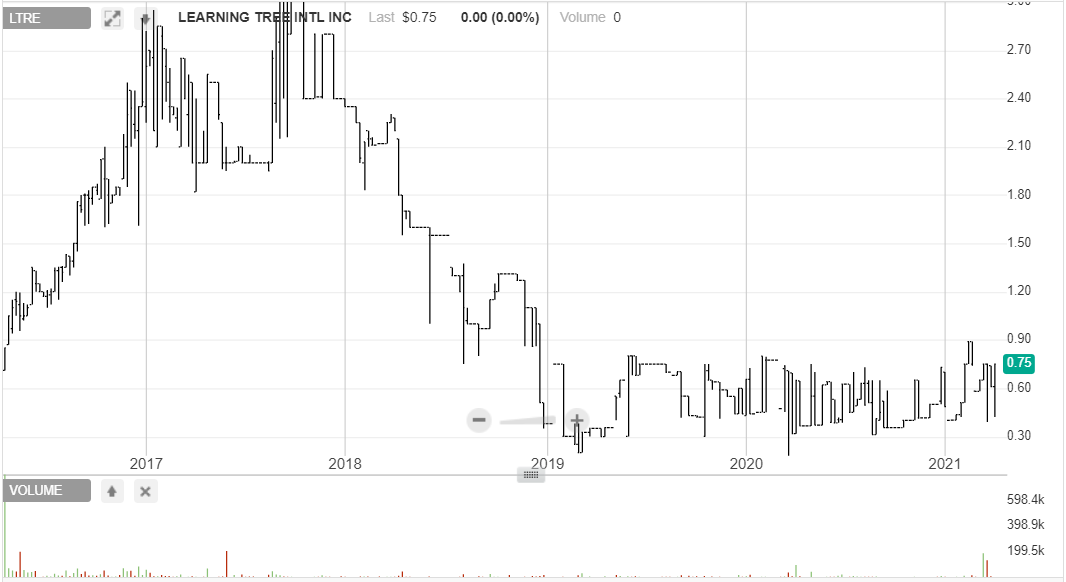

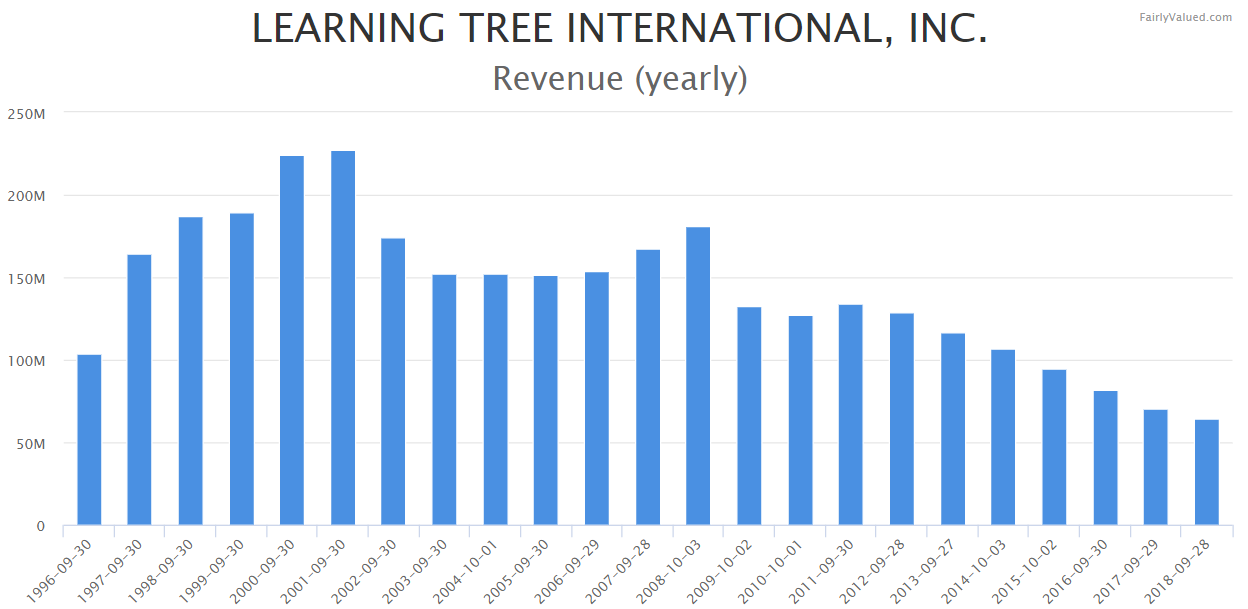

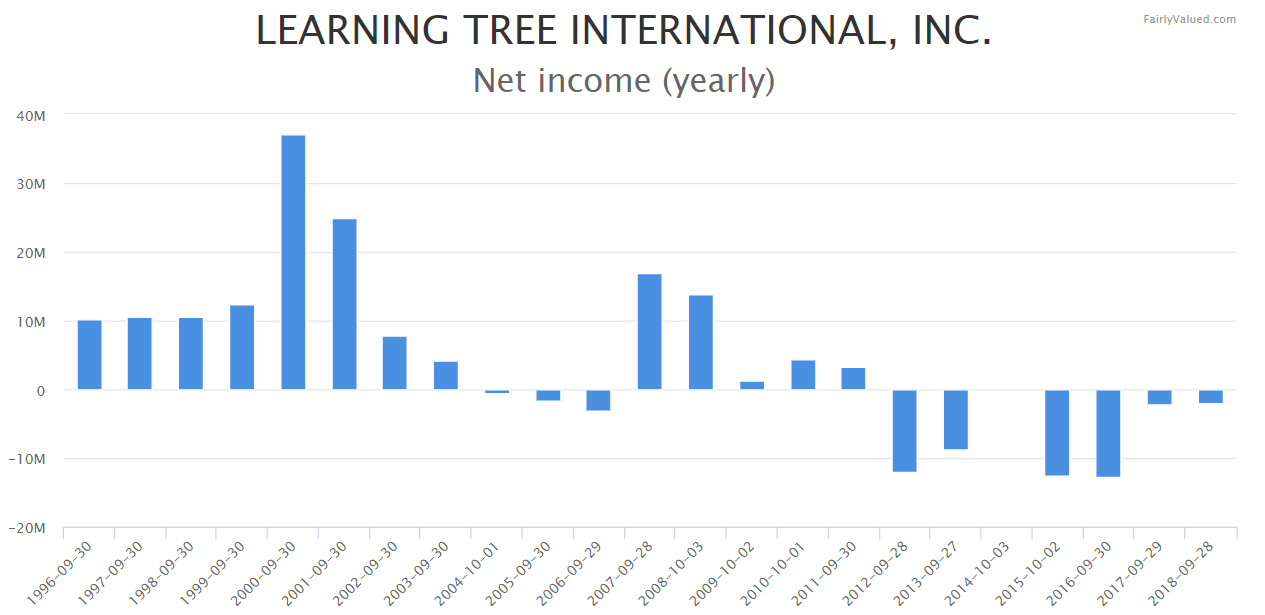

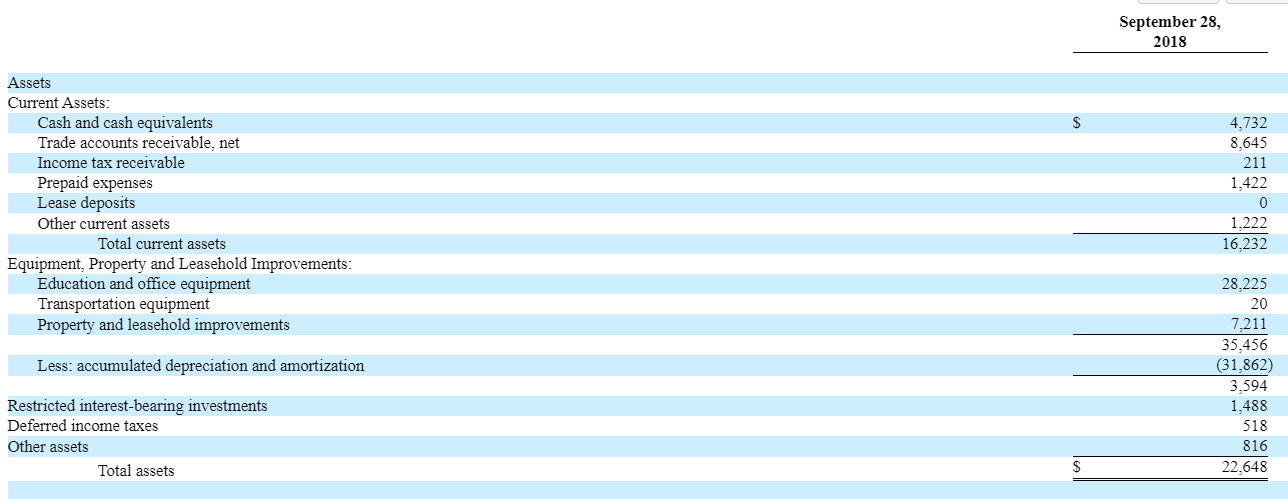

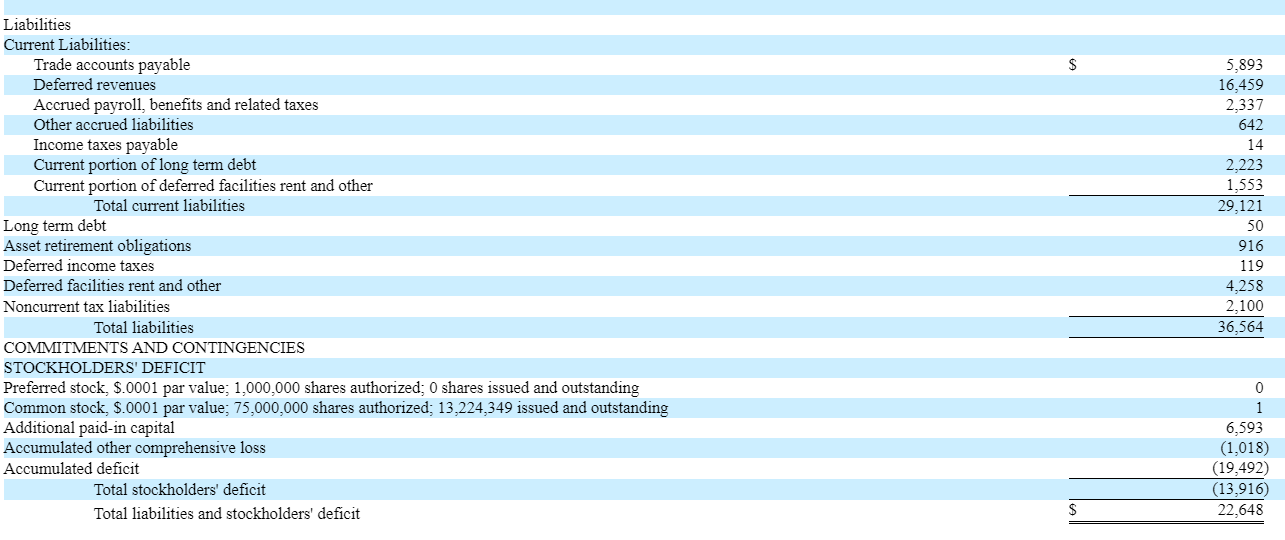

Learning Tree International Inc (LTRE) issued its last financials in late 2018 and then went dark in early 2019. Since then there's been very few updates regarding the company's fortunes other than the occasional news release on their website. The market hates uncertainty and the stock price has responded in kind. I first came across LTRE whilst rooting through old nano-cap pitches on V.I.C. I found it along with AFFY, MYRX and ORGN . It didn't take much digging to pique my interest. The V.I.C. write-up garnered zero responses, bearish to most but bullish to me. (Big thanks to zach721 for writing it up, his write-up has a lot of great info and is worth a read.) I checked the stock message boards and twitter for any chat, nothing but bot chatter for years, my excitement grew. Then I pulled up the long-range chart and began to salivate like Pavlov's dog. What a chart! Four years ago the market thought the stock was worth $2-3. Ten years ago it was priced at $9-10. And now it sits at $0.75. After bottoming out at $0.20 in early 2019 the stock has been building a base on low volume for the past two years. The 5 Year chart shows a little more detail. You can see clearly that the stock has moved from the mark-down phase into the accumulation zone. It is currently bouncing along in a narrow range between support of around $0.37 and resistance of around $0.75. Some numbers and then we'll get to the backstory; Market Cap = $9.918 Mil Share price = $0.75 Common = 13.22 Mil Float = 2.46 Mil Some blurb on the company from OTC markets; "Learning Tree International is a leading worldwide vendor-independent provider of training and education to business and government organizations for their IT professionals and managers. In addition to training, we support our customers by providing a suite of skills enhancement services which help the companies assess, identify and remedy skill gaps within their IT infrastructure." Okay, here's the scoop. LTRE was founded back in the early 1970's by a guy called David C. Collins who evidently had a lot of success and grew the company to a market cap of a few hundred million dollars (It briefly touched $1 Bil around the peak of the dotcom bubble). Unfortunately he didn't keep up with the changing times and was still doing stuff like mailing out physical catalogues whilst his competitors were adapting to the shifting sands beneath them. Take a look at revenues and earnings before the firm went dark. Back in the late 1990's LTRE was pulling in annual revenues of $150-200 Mil and Net Income of around $10 Mil. Things started to turn sour as the company didn't adapt to the changing economical and technological landscape. Prior to going dark in early 2019 the firm was still pulling in $64 Mil in annual revenue but was losing a couple of Mil a year. The trend was decidedly negative. Here's where it gets interesting. In June 2018 an 8-K was released announcing that the founder was going to sell his majority ownership in the company and resign from the board. "On June 29, 2018, Learning Tree International, Inc. (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”) with The David C. Collins 1997 Trust, The Mary C. Collins 1997 Trust, DCMA Holdings, L.P., The Adventures in Learning Foundation, The Collins Family Foundation, The Collins Family Trust, The Collins Charitable Remainder Unitrust No. 97-1, Dr. David C. Collins and Mary C. Collins (collectively, the “Collins Parties” which collectively represents the owners of a majority of the outstanding shares of common stock of the Company), and The Kevin Ross Gruneich Legacy Trust, as the buyer (the “Trust”). The Purchase Agreement generally provides for the sale by the Collins Parties to the Trust of the Collins Parties’ beneficial ownership of 7,495,332 shares of the Company’s common stock, par value $0.0001 (the “Common Stock”), for a purchase price paid by the Trust of $7,495,332 or $1.00 per share (“Sale Transaction”). The Company became a party to the Purchase Agreement for the limited purposes specified in the Purchase Agreement, which includes providing certain disclosures to and post-transaction nomination rights for the Trust. The Company received no proceeds from the Sale Transaction." A guy called Kevin Gruneich took control of the company buying 7,495,332 shares (57% of the common out) at $1 a piece. He also got a directorship and became Chairman of the board. As part of the agreement he also entered into a credit agreement with LTRE guaranteeing them financing of up to $5 Mil. Turns out Gruneich has some pedigree; "Mr. Kevin Gruneich serves as chairman at Learning Tree International, Inc. He served as an Equity Analyst of Bear Stearns Companies Inc., Research Division; Vermeulen-Raemdonck SA, Research Division; Oppenheimer & Co. Inc., Research Division and Crédit Suisse AG, Research Division. Mr. Gruneich served as Senior Managing Director, Senior Publishing/Information Analyst and Co-Head of the Global Media Research Group at The Bear Stearns Companies in New York. He served as Managing Director (highest designation) and Publishing/Information Analyst at CS First Boston for 14 years. During his career, Mr. Gruneich was named to Institutional Investor Magazine's All-America Research Team for 20 consecutive years and in many of those years was ranked number one in his sector. He is a member of Impact Partners, focused on social-impact documentary filmmaking. He serves as Director of Questar Assessment Inc. He serves on the Advisory Board of Ivy Asset Management. Mr. Gruneich sits on the Boards of The University of Iowa Foundation (as well as its Investment Committee), and Spy Hop Productions (one of the country's leading youth media arts programs). Mr. Gruneich graduated with an MBA in Finance from The Wharton School, University of Pennsylvania and earned a BBA (double major: Finance and Industrial Relations; minor: Political Science) from The University of Iowa." One thing that caught my attention was; "He serves as Director of Questar Assessment Inc." After a bit more digging I found another press release that noted; "Mr. Gruneich served as a Director of Questar Assessment beginning in 2008 until its sale to ETS (Educational Testing Service) in 2017." So, it sounds like Gruneich has some experience with education companies and has probably bought LTRE to right the ship, modernize the business, and then sell it for a profit. Back in 2012 Mill Road Capital put out an offer to buy the company at $5.80 a share so there's past evidence that outside buyers perceive some value here. Whilst I'm not exactly sure how the turnaround is going the business doesn't appear to be in terminal decline. Various press releases on the company website note awards, contracts and new offerings. A new CEO also joined the firm in March 2020 so it seems plenty is happening behind the scenes. I contacted their IR dept. to see what they had to say but the secretary was pretty cagey with me. Hey, at least I got a response! As always, I focus most of my attention on the balance sheet. I like to make sure the company can keep the lights on till the situation improves. It's a few years out of date now but let's look at the last publicly available financial statements, namely the FY2018 10-K, to see what the balance sheet reveals. It doesn't look good at first sight with a Stockholder's deficit of ($13.916 Mil) and a negative Working Capital position to boot. Looking closer though and $16.459 Mil was deferred revenues. This is one of my favourite liabilities to look for as it tells you that company is getting paid up front before providing the product or service. Much better than a business where you do the work and then have to chase up the receivables. Cash was $4.732 Mil and receivables eclipsed payables by a decent margin. We also know that the firm had a credit line of $5 Mil to draw on and it has probably received some funds under the CARES act which will end up being written off too. There was no sign of prefs or warrants but there were 600k in stock options. LTRE also had NOL carry-forwards of $27.473 Mil. How to value this one? By going dark the firm is likely saving $500k-$1 Mil in annual fees and there's a good chance their rent obligations will have gone down if they have been moving toward a more blended approach with a greater focus on online courses. Perhaps the pandemic will have hastened this transition. Assuming the firm was no longer bleeding read we could maybe value it at 0.75-1x annual sales. Assuming they are still around $60 Mil and that would be 5-6x the current price, or roughly $3.40-4.50 per share. We don't really know if revenues have been declining though, if we assume they've dropped to $30-40 Mil it should still be worth $2.25-3.0 per share if they're breaking even or turning a profit. Without current figures these are all just shots in the dark but I'm willing to bet that the stock is worth more than $0.75. We know the new owner thought it was worth paying $1 per share for and he doesn't strike me as the type of guy to pay over the odds. If he is successful in stabilizing the business and returning it to profitability I don't see why this can't fetch a 0.75-1x Sales multiple. What are the risks? The firm is dark, we don't know much about what's been happening to the finances these last few years. LTRE was loss making and looked in decline prior to moving into the shadows and there's no guarantee that this negative trend has since turned positive. Gruneich owns a controlling position and I've not seen any evidence thus far that he has the interests of minority shareholders in mind, maybe he does but the picture is unclear at present. The stock could always drift back down to support and just keep building a base for years if no news or catalysing event emerges. The flipside is that Mill Road Cap, Osmium Partners and a few other outfits are still holding shares so I'm guessing they think this investment has legs. For me the thesis is simple;

a) The stock is trading below the price the new owner paid b) It's likely trading at a fraction of annual revenues c) It's trading way lower than the offer price Mill Road Capital put out in 2012 d) Going dark will have lowered the firm's operating costs. e) The stock has bottomed out on the long-range chart and is building a base I don't see the stock moving much lower here, it's bottomed out and volume is light. The public float is very tight and any hint of good news, a big contract win or a return to 'current reporting', and the stock moves up. For now it's just a case of playing the waiting game... David. Disclosure: Long LTRE

16 Comments

David

4/5/2021 08:40:09 am

Thanks Dan.

Reply

Bit LayZzz

4/6/2021 08:14:53 am

Solid find for this post pandemic labor force, will be watching this one closer. Also mentions in the write up that they are based out of DC and the new CEO has a successful history with the IRS and DHS. Could be a big deal down the road.

Reply

Mike

4/6/2021 11:01:51 am

Do you know why they don't have to file for bankruptcy with the negative equity? That is not clear to me. Usually you can do a subordination on loans. However, I do not see that here.

Reply

David

4/6/2021 09:23:08 pm

Not sure. All I know is that the new majority owner extended the $5 Mil credit line plus a big chunk of the liabilities were deferred rev.

Reply

Mike

4/6/2021 11:38:07 pm

BTW it seems that the reversal effect (= buying at maximum pessimism) is less important than the size effect. A study from London shows that the smallest stocks (smallest equally weighted decile) with the worst past returns, performed the best with a return of 279% over the next 5 year period. However, the smallest stocks with the best past performance did also quite well with a performance of 205%. This is quite surprising. So small size was in this study (much) more important than stock price reversal. This study covers London stocks for 38 years!

Reply

Mike

4/7/2021 10:26:27 am

To give some additional interpretation of the data: The worst past performing decile did on average 187% and the best performing 126% in the next five years. The smallest decile did on average 245% and the largest 108%. The difference for the size effect is much higher. The average of the smallest decile 245% was not much different compared to the worst performing, smallest decile of 279%.

Reply

I would be very cautious relying on results based on the bottom decile of stocks.

Reply

Mike

4/8/2021 12:44:54 pm

Thanks. I agree that there are probably some issues with the data quality of “nano” stocks in research papers. Usually, these stocks are also categorized as “uninvestable”. These stocks are certainly uninvestable for funds and institutional investors because of the very low liquidity. However, as a smaller, private investor I can usually trade these stocks.

GM

4/10/2021 03:54:33 am

HI Mike, I'll try and clarify the central issue and reframe it for clarity.

Reply

Mike

4/10/2021 08:18:35 am

To prove something with data might be difficult. The smallest stocks are tracked by cero analysts. They are also very illiquid. That there is an illiquidity premium has been covered in research papers. The market for such stocks may not be efficient at all because of very limited trading and no valuations. Basically, one can assume that the biggest mispricings should occur with such stocks. (This does not mean that all these stocks are generally good investments. Many are probably bad investments).

mike

4/27/2021 07:17:48 pm

Have you ever analysed Windeln.de from Germany? It is very small. It could go bankrupt. However, compared to the sales of the company, a value of 3 Mio. EUR is very low.

Reply

David

5/8/2021 10:22:02 pm

That one looks a bit too hairy for me, surprising as that may sound!

Reply

mike

6/9/2021 09:38:42 pm

I missed this one. Windeln did go up to to EUR 4, 4x or so.

Mike

5/10/2021 06:45:04 pm

Hong Kong has also interesting charts and the reporting is in English. Just check Cool Link Holdings 8491. But even for me this looks too risky.

Reply

Mike

5/15/2021 09:41:15 am

I found further evidence for the performance of nano caps in this free book. Interestingly, the value effect was stronger than the size effect. They tested the performance of the 100 smallest stocks with a min. market cap of 10 Mio. This is really small.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed