|

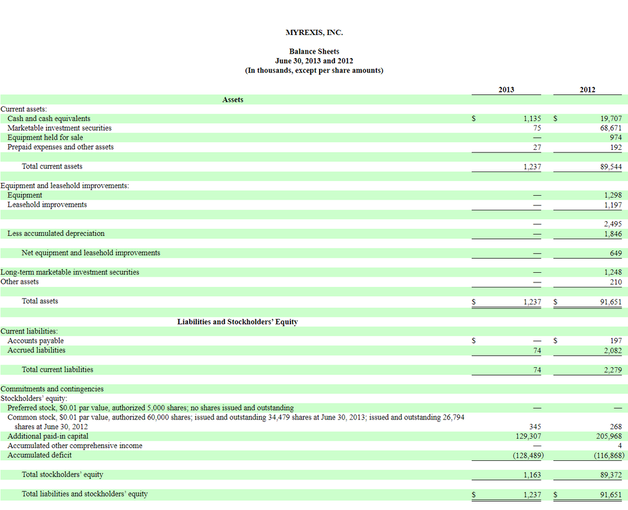

Myrexis Inc. (MYRX) is another NOL stub controlled by Johnathan Couchman. Much like AFFY, it's tiny, thinly traded and has significant upside potential. Couchman appears to have a penchant for these busted out bio-pharma firms, probably because they tend to rack up such huge net operating losses whilst trying to develop their products. The story with MYRX is not too dissimilar to that of AFFY. MYRX was created in June 2019 when Myriad Genetics (MYGN) spun off it's pharma R&D division with a chunk of cash. After spending $90 Mil of the $188 Mil in the coffers on R&D and marketing MYRX decided to rethink it's business plan. The late biotech executive Richard Brewer was hired as CEO in May 2012 in an effort to try and put the remaining cash to good use. Sadly Brewer ended up dying of a rare blood cancer disease and in November of 2012 management decided to just liquidate. A plan of liquidation was filed and a final distribution of between $2.72-2.91 was expected to be distributed to shareholders. A shareholder meeting to approve the liquidation was set for January 23rd 2013 You know where this is going, right? Enter Couchman! The day before the shareholder meeting was due to take place management issued an 8-K announcing that the liquidation was being called off and a special dividend of $2.86 per share was to be paid to shareholders instead. They also noted that; "Effective at 11:59 pm Eastern time on January 22, 2013, the Company entered into an employment agreement with Mr. Couchman. Mr. Couchman’s employment agreement provides for an initial term of one year subject to automatic one year renewals unless either party provides at least 90 days written notice to the other party that such automatic renewal will not occur. Mr. Couchman’s employment agreement provides for the payment of a salary at the annual rate of $1. Mr. Couchman will be eligible to participate in the Company’s employee and insurance programs generally made available to the Company’s executive employees in accordance with and subject to the terms set forth therein. Among other things, the employment agreement provides for Mr. Couchman to consider the acquisition of revenue or income producing assets, as well as related financings with respect thereto." Couchman was made CEO and the rest of the board resigned. Then in February 2013 MYRX issued an 8-K announcing that it had issued and sold 7 Mil shares to a Couchman controlled entity for a cost of $250k. This deal gave him control of 20% of the company. Around the same time Couchman brought in a couple of associates to add to the board. Once the special dividend was paid the share price dropped off a cliff as investors headed for the exit. MYRX issued a Form 15 in July 2013 and there's been no news since then. I love to see charts like this. A share price collapsing on heavy volume, then as the dust settles volume drops way off and a long base starts to form. In this accumulation period the public is selling out as shares change from weak hands to strong. It is in this quiet period that insiders and other 'smart money' buyers are building their positions in the shadows. Right, lets look at a few numbers for MYRX; Market Cap = $758,539 Share price = $0.022 Common = 34,479,051 The last financials before MYRX went dark show the following; Net cash was around $0.03 per share at the time.

Couchman put MYRX in stasis once he took over to minimize cash burn, the firm went dark which meant no filing or auditing costs and his annual wage is $1. Without current financials it's impossible to know how much of the cash has been burnt away through expenses. Maybe there's no margin of safety anymore. Now to the NOL carry-forwards. The 10-K notes the following; "At June 30, 2013 the Company had total federal and state tax net operating loss (“NOL”) carry-forwards of approximately $147,177,000, of which $17,491,000 is attributable to excess tax benefits for which no deferred tax asset has been established. If not utilized, the federal NOL carry-forwards will expire beginning in 2030 through 2033, and the state NOL carry-forwards will expire beginning in 2025 through 2028. The Company had approximately $3,006,000 of federal research tax credit carry-forwards, which can be carried forward to reduce federal income taxes. If not utilized, the federal research credits will expire beginning in 2030 through 2033. Additionally, the Company had approximately $1,066,000 of Utah research tax credit carry-forwards, which can be carried forward to reduce Utah income taxes. If not utilized, the Utah research tax credit carry-forwards will expire beginning in 2024 through 2027." At a 21% tax rate these tax assets would have a maximum value of around $30 Mil. Let's assume on 25% gets monetized, that's around $7.5 Mil or $0.21 per share. That's over 9x the current share price. Given Couchman's track record of monetizing NOL stubs I'm willing to take this bet. Thanks for reading, David Long MYRX Note: Thanks to ElmSt14 for his V.I.C. write-up on MYRX which I used to draw information for this post. His write-up is well worth a read.

9 Comments

Mike

1/12/2020 11:44:03 pm

I am wondering if you have seen the stock Cadogan on the London stock exchange. Fundamentals are: P/B of 0.3, P/E of 3.8, P/S of 1.2. MC is 12.2 Mio. and the company has cash of 13.7 Mio. and no debts. The have a lot of stocks but only few are traded and the stock is illiquid and at a multi year low. It also seems that their operations are improving.

Reply

David

1/13/2020 06:39:59 pm

Hi Mike,

Reply

Mike

1/24/2020 07:49:24 pm

However, I think the cheapest stocks can be found in more obscure markets e.g. in Hong Kong, Poland or Russia. E.g. Ka Shui int. (822) from Hong Kong trades at a P/B 0.36, P/S 0.2, P/E 3 and at an all-time low. On top of that, you get a dividend yield of 10%.

Dave Anderson

3/23/2020 06:56:59 pm

Maybe this is the market event that creates an opportunity here....patiently waiting.

Reply

Scott

8/7/2020 04:05:32 am

I noticed that Couchman filed a Statement of Ownership for shares of Enzon Pharmaceuticals, Inc. (ENZN). It looks like he bought shares of ENZN personally and through Myrexis. Does anyone know much about Enzon? Is it another Couchman NOL Stub?

Reply

David

8/8/2020 08:53:48 pm

Hi Scott,

Reply

Scott

8/9/2020 01:16:12 am

Thank you, David!

c chan

8/18/2021 08:49:39 am

Couchman recently filed a form 4 (https://www.otcmarkets.com/filing/html?id=15171190&guid=Ckb1knG_srAsj8h). Wonder if you have any thoughts on it?

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed