Tools

Here's a list of tools and resources I use to help me research stocks and manage my portfolio. I'll periodically update it whenever I come across something that I think deserves a place on the list.

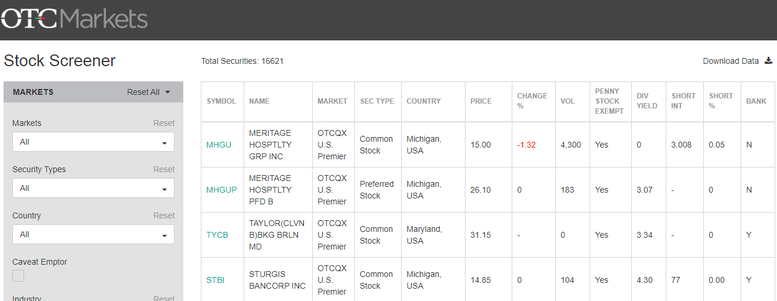

OTCmarkets.com

I spend more time on this website than any other. I like to use the screener they have to help me trawl through the thousands of stocks listed on the OTC markets. The screener doesn't have fundamental metrics so I use it in other ways by selecting certain markets, share price ranges, volume traded etc to group stocks into blocks which I can then manually work through. You can also download the raw data if you want to build your own database etc. I also use it to look up listed stocks since I like the user interface and I can navigate around the site quickly now. I spend around 10-20 hours a week working through lists of stocks and looking up ideas that people send me.

I spend more time on this website than any other. I like to use the screener they have to help me trawl through the thousands of stocks listed on the OTC markets. The screener doesn't have fundamental metrics so I use it in other ways by selecting certain markets, share price ranges, volume traded etc to group stocks into blocks which I can then manually work through. You can also download the raw data if you want to build your own database etc. I also use it to look up listed stocks since I like the user interface and I can navigate around the site quickly now. I spend around 10-20 hours a week working through lists of stocks and looking up ideas that people send me.

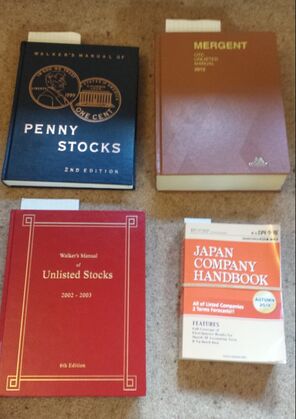

Walker's/Mergent Manuals

Over time I built up a little collection of old stock manuals produced by Walker's and Mergent. The Walker's manuals are no longer in print so you have to track them down on used book sites like Alibris and Abebooks. Mergent still produces an OTC unlisted manual but it costs around $1k brand new, again I just look for older copies which are selling for cheap.

Given these manuals are old the information is out of date and some of the companies no longer exist for one reason or another. Having said that you can still find a lot of interesting undervalued companies in there which are still in business. I find them useful to get a good summary of a firm's history and pick up clues about potential hidden value. Several of the stocks I've written up on my blog have come from looking through these manuals. If you want the Japan Company Handbook you can create an account at amazon.co.jp and order it from there.

Over time I built up a little collection of old stock manuals produced by Walker's and Mergent. The Walker's manuals are no longer in print so you have to track them down on used book sites like Alibris and Abebooks. Mergent still produces an OTC unlisted manual but it costs around $1k brand new, again I just look for older copies which are selling for cheap.

Given these manuals are old the information is out of date and some of the companies no longer exist for one reason or another. Having said that you can still find a lot of interesting undervalued companies in there which are still in business. I find them useful to get a good summary of a firm's history and pick up clues about potential hidden value. Several of the stocks I've written up on my blog have come from looking through these manuals. If you want the Japan Company Handbook you can create an account at amazon.co.jp and order it from there.

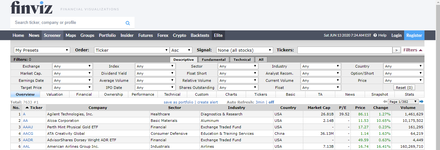

Screeners

I use a couple of free screeners when I'm looking through listed nano-caps on US and UK markets.

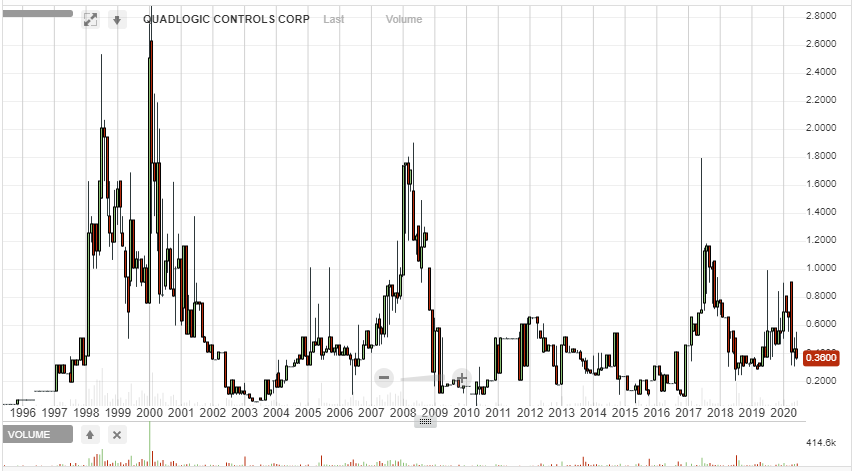

Finviz is one of my favorite screeners despite the fact that the data can be a little sketchy at times, I just like the look and feel of it. I usually don't screen on stuff like P/E or P/B anyway but instead screen by market cap, share price, shares outstanding and float. Then I just work my way up from the smallest companies to the $10-20 Mil range and eye each one up. I like the fact that you can select the monthly time frame and get a 10 year chart whilst looking at the basic numbers. It saves me wasted time as I rarely buy good numbers these days if the chart doesn't look right to me.

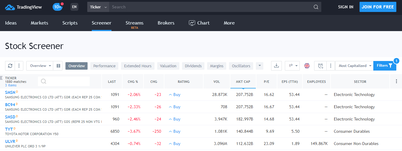

Tradingview is another great screener that I use for looking at listed US stocks and those which trade on the AIM (Alternative investment market) market of the LSE , the AIM market is where all the smallest UK companies can be found. Again I usually screen based on market cap, share price, shares outstanding and float but I sometimes use the EV metric and set it at <0 to look for firms selling below net cash, this is how I found MIRI:AIM and ENET:AIM. This screener does include OTCBB stocks but not the pink-sheets or grey market stocks.

I use a couple of free screeners when I'm looking through listed nano-caps on US and UK markets.

Finviz is one of my favorite screeners despite the fact that the data can be a little sketchy at times, I just like the look and feel of it. I usually don't screen on stuff like P/E or P/B anyway but instead screen by market cap, share price, shares outstanding and float. Then I just work my way up from the smallest companies to the $10-20 Mil range and eye each one up. I like the fact that you can select the monthly time frame and get a 10 year chart whilst looking at the basic numbers. It saves me wasted time as I rarely buy good numbers these days if the chart doesn't look right to me.

Tradingview is another great screener that I use for looking at listed US stocks and those which trade on the AIM (Alternative investment market) market of the LSE , the AIM market is where all the smallest UK companies can be found. Again I usually screen based on market cap, share price, shares outstanding and float but I sometimes use the EV metric and set it at <0 to look for firms selling below net cash, this is how I found MIRI:AIM and ENET:AIM. This screener does include OTCBB stocks but not the pink-sheets or grey market stocks.

Charts

I use a bunch of different websites for charts as sometimes you don't always get the full picture looking at one. Normally I'm already lurking on the OTC markets website so I tend to use that when first pulling up a chart. Over time I've noticed that certain stocks only seem to have shorter-range charts on their OTC markets quote page so I then check Bigcharts and Morningstar to get the full long-range charts.

I use a bunch of different websites for charts as sometimes you don't always get the full picture looking at one. Normally I'm already lurking on the OTC markets website so I tend to use that when first pulling up a chart. Over time I've noticed that certain stocks only seem to have shorter-range charts on their OTC markets quote page so I then check Bigcharts and Morningstar to get the full long-range charts.

Stock Message Boards

I like to visit stock message boards for a bunch of different reasons. Firstly it can be a good place to find out bits of useful information on obscure companies if you are willing to wade through all the posts. Secondly, it helps me to connect with like-minded people. I usually post links to any stocks I write up to share my work and people will get in touch and share information and other ideas with me. My favorites are iHub and Yahoo Finance but I also occasionally visit Stocktwits and Investors Hangout.

I like to visit stock message boards for a bunch of different reasons. Firstly it can be a good place to find out bits of useful information on obscure companies if you are willing to wade through all the posts. Secondly, it helps me to connect with like-minded people. I usually post links to any stocks I write up to share my work and people will get in touch and share information and other ideas with me. My favorites are iHub and Yahoo Finance but I also occasionally visit Stocktwits and Investors Hangout.

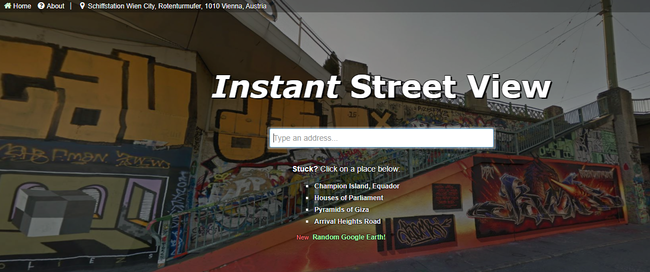

Instant Street View

Instant street view is a great website, it's powered by Google maps and is quick and easy to use. Whenever I'm researching dark or obscure stocks I'll look up the latest listed address to see if the firm is still based there. It can be useful to find out if dark companies are still in business and you can do stuff like count how many cars are in the parking lot to figure out how many employees they might have.

Instant street view is a great website, it's powered by Google maps and is quick and easy to use. Whenever I'm researching dark or obscure stocks I'll look up the latest listed address to see if the firm is still based there. It can be useful to find out if dark companies are still in business and you can do stuff like count how many cars are in the parking lot to figure out how many employees they might have.

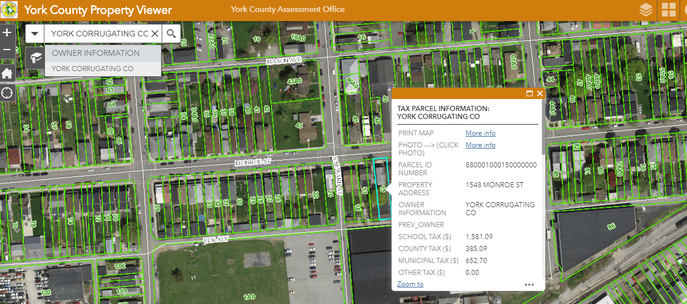

Tax Parcel and land registry Info

It can sometimes be hard to get an accurate value of real estate for dark and obscure companies, one useful approach I've found is to look up tax parcel and land registry info. Each county in the US has a local tax appraiser who periodically values buildings and land in order to calculate what property taxes an owner has to pay. This information is all in the public domain and you can usually look it up for free. Just figure out what county the company's real estate is located in and then search ('........ county tax parcel info ) or (....... county tax map).

Below I've included an example for you. A while back I was looking up a dark company, namely YCRG, which I'd come across in one of my old Walker's manuals. I did a web search for 'York County tax parcel map' and managed to find the York County, PA tax map portal so I could look up their real estate holdings and value appraisals.

See here.

It can sometimes be hard to get an accurate value of real estate for dark and obscure companies, one useful approach I've found is to look up tax parcel and land registry info. Each county in the US has a local tax appraiser who periodically values buildings and land in order to calculate what property taxes an owner has to pay. This information is all in the public domain and you can usually look it up for free. Just figure out what county the company's real estate is located in and then search ('........ county tax parcel info ) or (....... county tax map).

Below I've included an example for you. A while back I was looking up a dark company, namely YCRG, which I'd come across in one of my old Walker's manuals. I did a web search for 'York County tax parcel map' and managed to find the York County, PA tax map portal so I could look up their real estate holdings and value appraisals.

See here.

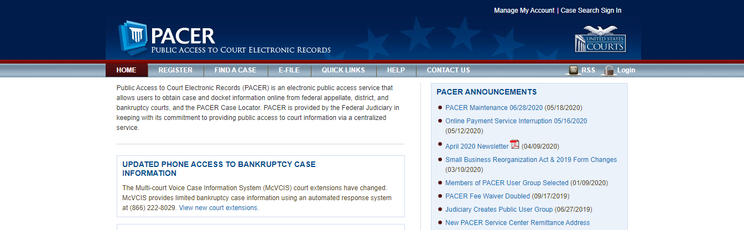

Court dockets and filings

Occasionally I'll look at bankruptcies and litigation stubs, in this instance I need to read through court documents to see what the situation looks like. Sometimes legal firms will post the court docket of companies they are representing for free on their websites but it is often subject to a time lag. Another solution is to create and account at the PACER website. PACER stands for 'public access to court electronic records' and is open to people from all around the world. You have to register and submit credit/debit card details but you can look up court dockets and view/download $30 worth of records each quarter without having to pay a dime thanks to their fee waiver policy.

Occasionally I'll look at bankruptcies and litigation stubs, in this instance I need to read through court documents to see what the situation looks like. Sometimes legal firms will post the court docket of companies they are representing for free on their websites but it is often subject to a time lag. Another solution is to create and account at the PACER website. PACER stands for 'public access to court electronic records' and is open to people from all around the world. You have to register and submit credit/debit card details but you can look up court dockets and view/download $30 worth of records each quarter without having to pay a dime thanks to their fee waiver policy.

Stockbrokers

Here's some stockbrokers that I use and recommend.

Interactive Brokers is my primary US account for OTC stocks these days. Since the new SEC rule regarding dark stocks came into force no US based retail brokers will let you trade Grey/Expert market stocks at the moment. Interactive Brokers is the same but they do allow me to trade pink-sheets including those on the 'limited info' tier.

IWeb Share Dealing is my main account for buying UK stocks and any listed US stocks they cover. I have an ISA account with them which allows £20k per annum to be put in which is sheltered from taxes such as CGT and dividend withholding taxes. There's a one off fee of £25 to open an ISA and that's it, no inactivity, admin or stock custodian fees to worry about. Trades are £5 a piece and you can get access to several European markets as well as some listed stocks in the US. The downside here is that they don't cover all the tiny listed US firms, FX charges are quite high, international clients aren't accepted and you can't hold multiple currencies. I like this account because it is cheap, offers the tax shelter and gives me access to the smallest UK firms on the AIM market.

Here's some stockbrokers that I use and recommend.

Interactive Brokers is my primary US account for OTC stocks these days. Since the new SEC rule regarding dark stocks came into force no US based retail brokers will let you trade Grey/Expert market stocks at the moment. Interactive Brokers is the same but they do allow me to trade pink-sheets including those on the 'limited info' tier.

IWeb Share Dealing is my main account for buying UK stocks and any listed US stocks they cover. I have an ISA account with them which allows £20k per annum to be put in which is sheltered from taxes such as CGT and dividend withholding taxes. There's a one off fee of £25 to open an ISA and that's it, no inactivity, admin or stock custodian fees to worry about. Trades are £5 a piece and you can get access to several European markets as well as some listed stocks in the US. The downside here is that they don't cover all the tiny listed US firms, FX charges are quite high, international clients aren't accepted and you can't hold multiple currencies. I like this account because it is cheap, offers the tax shelter and gives me access to the smallest UK firms on the AIM market.