|

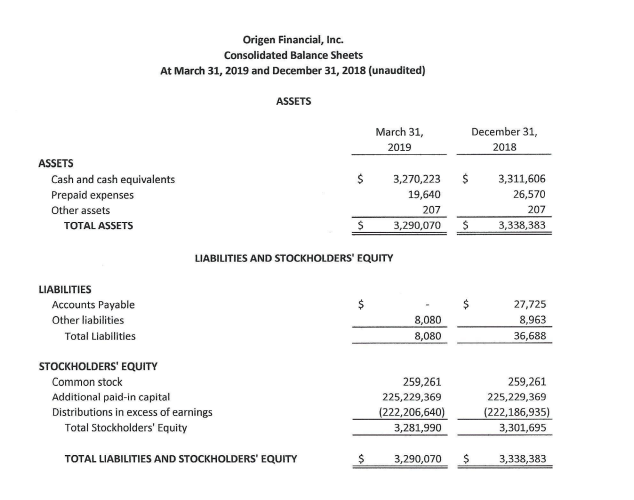

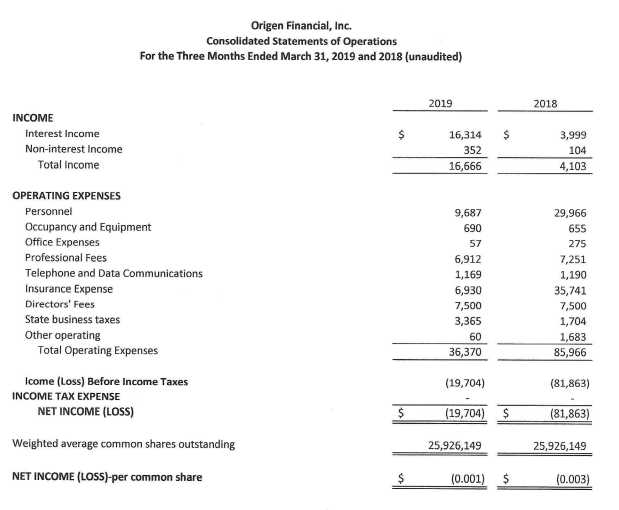

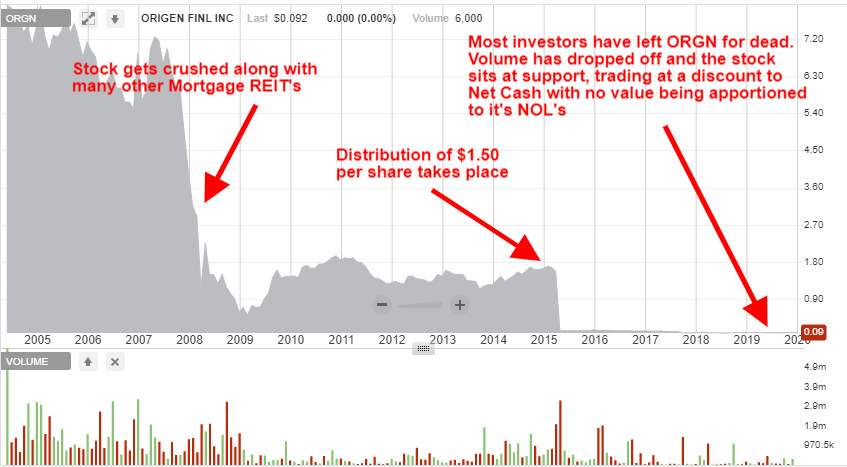

Origen Financial Inc (ORGN) is the first in a number of NOL stubs I'll be writing up here on the blog. It will come as no surprise to my regular readers that ORGN is a minuscule firm and it's stock is illiquid., just how I like 'em. Let's take a closer look, Market Cap = $2,385,206 Share price = $0.092 Common = 25,926,149 Spread = 30% No warrants of Pref's outstanding The company website provides a little background on the history of ORGN; "Origen Financial, Inc. (“Origen” or “the Company”) is an externally advised company specializing in the manufactured housing finance business that has elected to be taxed as a real estate investment trust (“REIT”). Origen ceased normal operation s in 2008, sold its loan origination and loan servicing operations and assets, and continued to manage its residual interests in secured loan pools. In January 2015, Origen sold substantially all of its remaining assets to an affiliate of GoldenTree Asset Management LP" You can read about the sale of assets to GoldenTree here The long and short of it is that ORGN received around $41. 1 Mil from GoldenTree for the sale plus it had around $6.1 Mil in other cash on hand. At the same time a planned merger with an affiliate of Mack Real Estate group was proposed with a Letter of Intent signed. This deal never played out and ORGN decided to pursue it's original plan of liquidation. You can read about that in this press release here. ORGN made an initial distribution of $1.50 per share in April 2015 "retaining approximately $6.2 million for expected dissolution and wind down costs and expenses and contingencies." Fast forward to September 2017 and management announced that they had decided against a full dissolution and liquidation, instead they opted to adopt a section 382 rights plan in order to protect tax attributes, namely the NOL's. You can read the press release here. Management noted; "As of July 31, 2017, the Company has Tax Attributes which may entitle the Company to reduce taxable income that may be generated in the future by approximately $76 million of net operating loss carryforwards." The adoption of the rights plan involved the issuance of "a dividend of one Series A Junior Participating Preferred Stock purchase right (the “Rights”) on each outstanding share of the Company’s common stock. " The release also noted; "The Rights are not currently exercisable and initially will trade only with the Company’s common stock. However, if any person or group acquires 4.99% or more of the Company’s common stock, or if a person or group that already owns 4.99% or more of the Company’s common stock acquires additional shares, then, subject to certain exceptions, the Rights would separate from the common stock and become exercisable for shares of the Company’s common stock having a market value equal to twice the exercise price, resulting in significant dilution to the ownership interests of the acquiring person or group. The Company’s Board of Directors has established a procedure to consider requests to exempt acquisitions of the Company’s common stock from the Plan if it determines that doing so would not limit or impair the availability of the Tax Attributes. The Rights will expire on September 12, 2020. The Rights may also expire on an earlier date upon the occurrence of other events, including a determination by the Company’s Board of Directors that the Tax Attributes have been utilized or are no longer available, or that the Plan is no longer necessary to protect the Tax Attributes. The Plan also may be terminated at any time by the Board of Directors before the Rights become exercisable. The Plan is similar to Section 382 rights plans adopted by many other public companies with significant Tax Attributes." The adoption of this rights plan basically protects the tax attributes of the firm whilst they explore ways to unlock this value. We'll now turn our attention to the most recently issued financial statements. You can find them here. As you can see, the firm had Net Cash of around $3.26 Mil back in March of 2019. Management has taken steps to reduce the cash burn to a minimum, around $20k per Q. Assuming this rate of cash burn has remained the same I calculate that ORGN has Net Cash of around $3.2 Mil vs a Market Cap of $2.39 Mil This means it's currently trading at around 0.75x Net Cash. The current discount to net cash and low burn rate grants investors time for the situation to play out. As for the NOL's, I'm no expert in this area and from what I can gather it's hard to pin down an exact figure for valuation. Assuming that all the NOL's are utilized and applying a 21% tax rate gets us to around $15.96 Mil. To be more conservative one could assume that only a portion of the NOL's are utilized. If we assume only 25% of the NOL's end up getting used that would be around $3.99 Mil Some investors argue that one should also apply a discount rate to factor in the time value of money. If that floats your boat go ahead but I'm happy to just put a big discount on how much of the NOL's end up getting utilized. Feel free to tear apart my valuation of the NOL carry-forwards in the comments section. Assuming my calculations are roughly right and not precisely wrong, On a per share basis if we include the marked down value of the NOL's and the Net Cash I get a rough value of around $0.277 per share Assuming we apportion no value to the NOL' s then I get a rough value of $0.123 per share. I always like to include a price chart in my write-ups so here it is. What are the risks here? Maybe management doesn't figure out a way to utilize the NOL's and the cash slowly burns away. Unlocking the value in NOL stubs is known to be both a complicated and protracted process with no guarantee of success. Maybe they do figure out a way to unlock the value and somehow minority shareholders get screwed in the process. Then again, maybe things play out well for shareholders. Perhaps the NOL's get utilized and the stock price rises. Perhaps management decides to just liquidate the firm and the remaining cash gets distributed to shareholders. Either way this situation will eventually play out and I'll be there when it does. Thanks for reading, David Disclaimer: Long ORGN Edit - ORGN have just announced that they are liquidating. They will be paying out between $0.10-0.12 per share sometime in Q1 2020.

https://www.prnewswire.com/news-releases/origen-financial-announces-dissolution-of-company-300979565.html

21 Comments

David

12/8/2019 02:23:01 pm

Hi Maarten,

Reply

Mike

12/10/2019 04:26:15 pm

I think it is possible to find cheaper stocks. E.g. the stock SIAF has a ridiculously low valuation e.g. a price to book of 0.01 and price to sales of 0.05. The company, however, is from China. This is a big red flag. Surprisingly, it has been reporting regularly for many years. therefore I think it is a real company - but either a cero or a multi-bagger. Did you ever cover it. Is this too good to be true?

Reply

Mike

12/10/2019 07:02:23 pm

Related to ORGN, my limited experience with cheap shell companies (without any sales) is no so good. Fraud risks are probably higher. I prefer stock with an active business. However, the good thing is that the cash buring rate of ORGN is low.

Reply

David

12/11/2019 08:50:43 pm

SIAF is almost certainly an RTO fraud, I avoid them like the plague.

Reply

David

12/12/2019 07:55:50 pm

I'm pretty sure SIAF is a fraud, I avoid Chinese RTO's like the plague.

Reply

Mike

12/13/2019 05:34:03 pm

I am not sure. If this is a fraud they could just go dark. Usually, Chinese frauds do not survive very long.

Doiminic

12/13/2019 07:39:41 pm

Hi David,

Reply

Wabuffo

12/20/2019 09:59:59 pm

They are trying to use the NOLs. They signed an agreement with Origen Phoenix LLC in Sept 2016. They were supposed to try to find investment opportunities.

Reply

Wabuffo

12/20/2019 10:15:03 pm

There's this one as well - which had an updated offer a few weeks later

Reply

David

12/20/2019 10:29:22 pm

Wabuffo,

Reply

Wabuffo

12/27/2019 05:41:27 pm

Well - that was fun. ORGN is wrapping it up and dissolving. Will pay out 10-12 cents.

Reply

David

12/27/2019 10:20:53 pm

Thanks for the heads up Wabuffo,

Wabuffo

12/20/2019 10:42:50 pm

On your chart, you show the $1.50 per share distribution in 2015. But ORGN's mgmt also distributed a total of $1.99 in sixteen liquidating distributions from 2010 to 2014 after their mortgage financing evaporated during the financial crisis in 2008. This mgmt team has been very shareholder-oriented.

Reply

David

12/20/2019 10:58:10 pm

That's really good to know,

Reply

mike

12/22/2019 09:07:59 am

Some shell companies in us have Tax losses. But so far I have not seen that a company could use them. I would not be optimistc about this.

Reply

David

12/22/2019 03:49:24 pm

I've come across a whole bunch of NOL stubs that have been successfully monetized, I know of numerous investors who specialize in this area of special situations.

Reply

Mike

12/23/2019 09:06:30 pm

Every company with a history of losses can use their NOL. But I am not sure for a shell company without an active business model. In my country, a merger of a shell company with another company mainly to use NOL would be classified as tax evation. They would also have to recognize deferred tax assets in the balance sheet if the utilization of NOL is probable. But that's not what they do

mike

12/27/2019 04:33:15 pm

Billing Services Group, listed in UK, looks cheap. Price to book is only 0.3, P/S 0.3. The company liquidates their operations and discloses about a cero return. Market cap is 3.4 Mio. Further, the company paid high dividends in the past. I dont really understand why this is so cheap. (They dont have goodwill in their balance sheet). I think it is likely that they will get more than 30% of book value in a liquidation scenario.

Reply

David

12/27/2019 10:57:25 pm

Hi Mike,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed