|

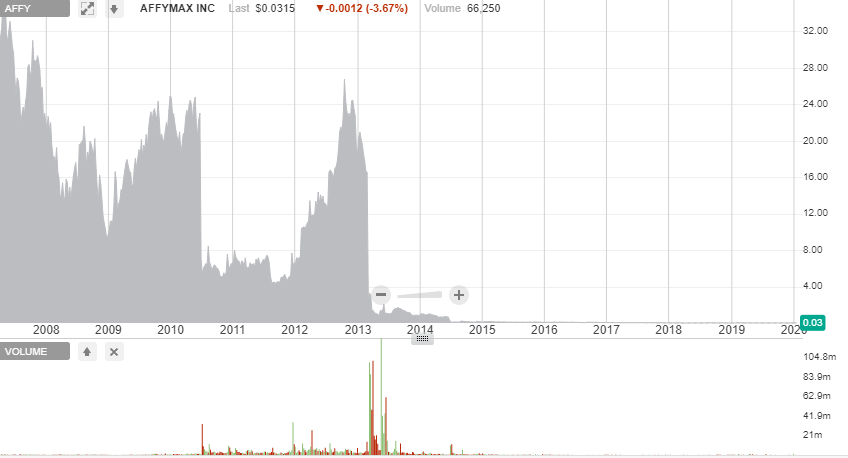

Affymax (AFFY) is a non-operating shell company which trades on the OTC markets. In a former life it was a bio-pharmaceutical firm engaged in the development of OMONTYS (peginesatide), a injection delivered pharma product for the treatment of anemia. OMONTYS passed phase 3 trials and all looked well but the product was recalled and sales were then discontinued in 2014 due to safety concerns, a small number of patients had serious and, at times, fatal reactions to the drug and it was subsequently shelved. The stock price promptly collapsed. As a result management prepared for a liquidation of the company. In Sept 2014 a gentleman by the name of Johnathan Couchman filed a 13D disclosing that he had acquired a 5% position in AFFY. This is the maximum stake an investor can acquire without triggering an ownership change and compromising any NOL carry-forwards. An announcement was made in Nov 2014 that management would pay out a final special dividend of $0.05 per share, it was also noted that Couchman had been appointed as the CEO, President and Class 1 director of AFFY. The rest of the board resigned and left Couchman to explore strategic alternatives. At the same time AFFY adopted a tax benefit preservation plan to protect the NOL carry-forwards. Before we learn more about Couchman we'll take a look at some numbers for AFFY; Market Cap = $2,346,438 Share price = $0.0315 Common = 74,490,09 I'm not sure of the exact cash position of the company at present as shareholders must fill in an Attestation of Stock Ownership form and fax it through to HQ to get current financials. I don't have a fax machine and I don't know anyone that does. Poor excuse I know, I'm working on it! The last 10-K issued by AFFY prior to the firm being taken over by Couchman noted the following;

"At December 31, 2013 , we had federal and state net operating loss carryforwards of $481.0 million and $491.0 million , respectively. The federal net operating loss carryforwards begin to expire in 2028 and state net operating loss carryforwards begin to expire in 2018, if not utilized. At December 31, 2013 , we had federal and state research credit carryforwards of $ 9.0 million and $ 7.0 million , respectively. The federal credits begin to expire, if not utilized, in 2022 and state credits are carried forward indefinitely." Not all of those carry-forwards are still viable though as there had already been an ownership change in the past. This news report notes the following; "The Company had federal NOLs totaling approximately $481 million at December 31, 2013, a substantial portion of which are limited due to a prior “ownership change” (as defined in Section 382 of the Internal Revenue Code)." I've not being able to get an exact figure for the what the current federal NOL carry-forwards are yet. for the sake of valuation I'm going to assume that only 25% are still viable. That gets us to around $120 Mil Now lets assume that only 25% of the remaining viable NOL carry-forwards get utilized, that gets us to round $30 Mil. That's around 12x the current market cap. Bear in mind we've not considered the value of the State NOL carry-forwards in the above figure. Depsite the fact that I've not been able to pin down an exact figure it seems pretty clear that there is the potential for significant upside here. As far as I understand it one has to wait three years in order to be able to utilize the NOL carry-forwards in transactions such as reverse takeover mergers (RTO's). The three year period has long since past so maybe a deal happens sooner rather than later. But why do I think a deal might happen at all? This brings us back to Mr. Couchman. He has a pretty decent track record of monetizing NOL stubs. Between 2007-2010 he successfully oversaw an RTO transaction between Golf Trust of America (GTA) and Pernix Therapeutics. GTA was a busted former golf course REIT with $85 in NOL's. This deal returned around 150% to GTA investors over the period of Couchman's involvement. Another one involved Footstar Inc (FTAR) and Xstelos Holdings. The former was a failing footwear retailer with NOL's of around $123. This deal resulted in a gain of around 140% for FTAR share holders. Couchman is also involved in a few other NOL stubs including Myrexis (MYRX) which I'll be writing up soon. So, what are the risks here. Well for starters, past success is no guarantee of future performance. Maybe AFFY doesn't pan out like the other deals have. It's been a while since Couchman took over and nothing has happened yet. Maybe the firm ends up just being liquidated and the common ends up with little to nothing. I'm an optimist though, when things look bleak or downright moribund I think to myself "Just imagine what will happen to this stock if some good news pops out of the ether". The share price has being building a base for so long it's like a tightly coiled spring just waiting to be released. AFFY is tiny, thinly traded and has been left for dead, and yet the potential for significant upside remains. Into the basket it goes. Long AFFY Note: I'd like to say thanks to clancy836 for his V.I.C. write-up on AFFY which is where I drew a bunch of information from to write this post. I recommend reading it for a more detailed appraisal of the investment. I'd also like to thank the anonymous Nonamestocks.com reader who mentioned AFFY which is where I got the idea from originally. Thanks! :)

9 Comments

Tim Eriksen

1/12/2020 10:27:03 pm

Couple of things. Love your blog and ideas. Have some concerns about NOL analysis.

Reply

David

1/12/2020 10:53:27 pm

Hi Tim,

Reply

Brandon

1/20/2020 02:03:57 am

Hey David,

Reply

6/16/2020 01:21:47 am

is couchman still alive? just odd this shit has been around now for years w no action

Reply

David

6/17/2020 06:16:25 pm

Yeah, Couchman is still in the game.

Reply

Kristin

6/19/2020 04:58:50 am

Very interesting post on AFFY. To be clear, there is not a 3 year waiting period on utilization of the NOLs in a reverse merger or any other transaction for that matter. The 3 year period has to do with how long the calculations are measured and can be shorter if there is an "ownership change".

Reply

David

8/8/2020 09:23:32 pm

The following proposal of tax credit cash-outs could provide an additional catalyst for AFFY, MYRX and other NOL shells with tax credits on the books;

Reply

Interesting stuff about AFFY. I used to work at that company. It was sad to know that their drug killed people but was still approved by the FDA. Really sad to know that people were going to die ... and they did. Of course nothing happened to anyone who worked there... except they wen to the next place and made a lot of money. Well, for the stock, I have been assuming that a reverse-merger is in the cards. Why else would Couchman be involved? Seems like the waiting time has passed, and any lawsuits have probably passed their timeframe too (?). Not sure what is holding up a reverse-merger and then using whatever of the NOLs which are allowed ....?.... I noticed that NKLA -- Nikola Motor Company--- got into their IPO via a reverse merger... probably for different reasons ... well, anyway, good to know that there still may be some action with this stock.....I bought for 10 cents ... but they issued a 5 cent dividend .... so I'm in for 5 cents ....haha ... well, who knows .... I advise people to buy FCEL .......

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed