|

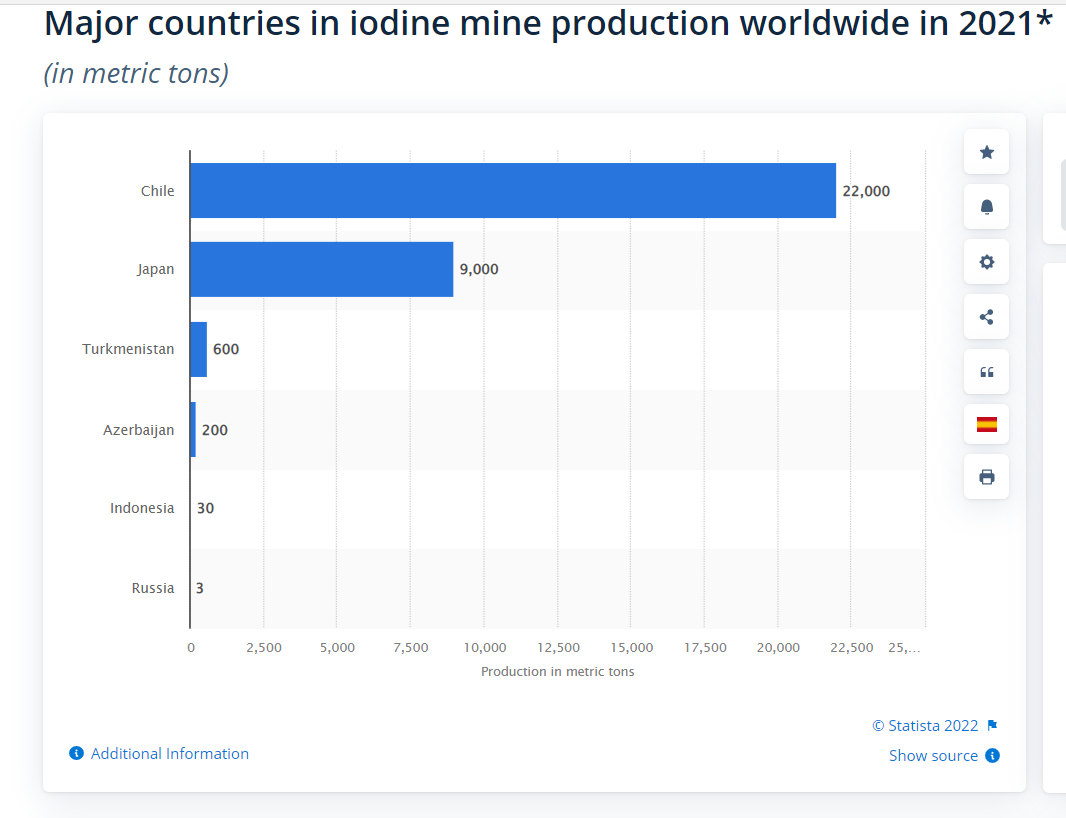

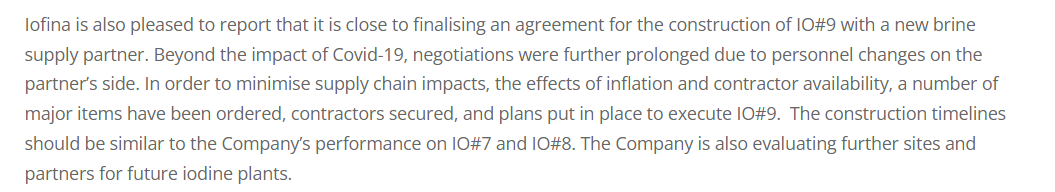

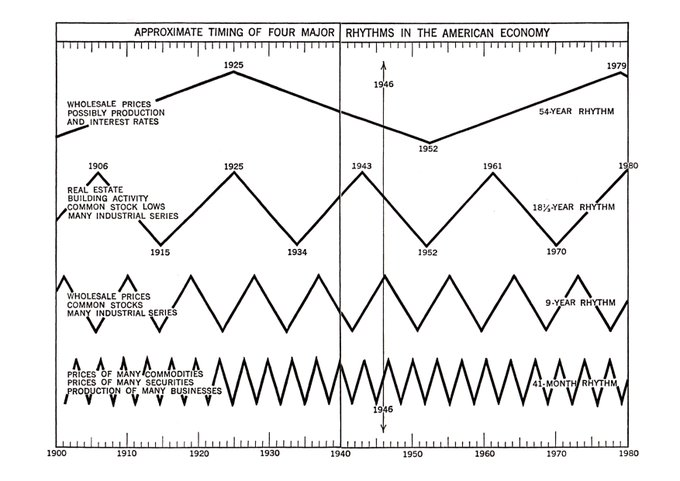

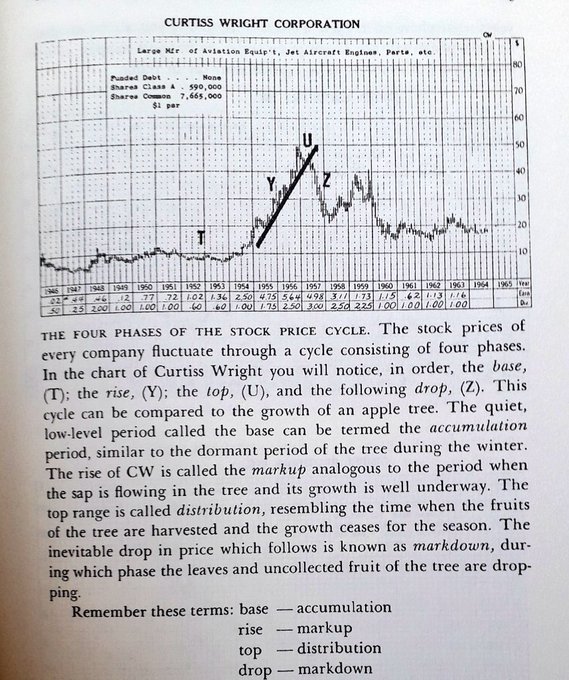

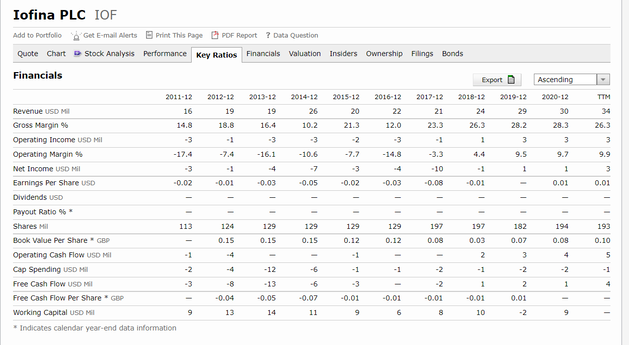

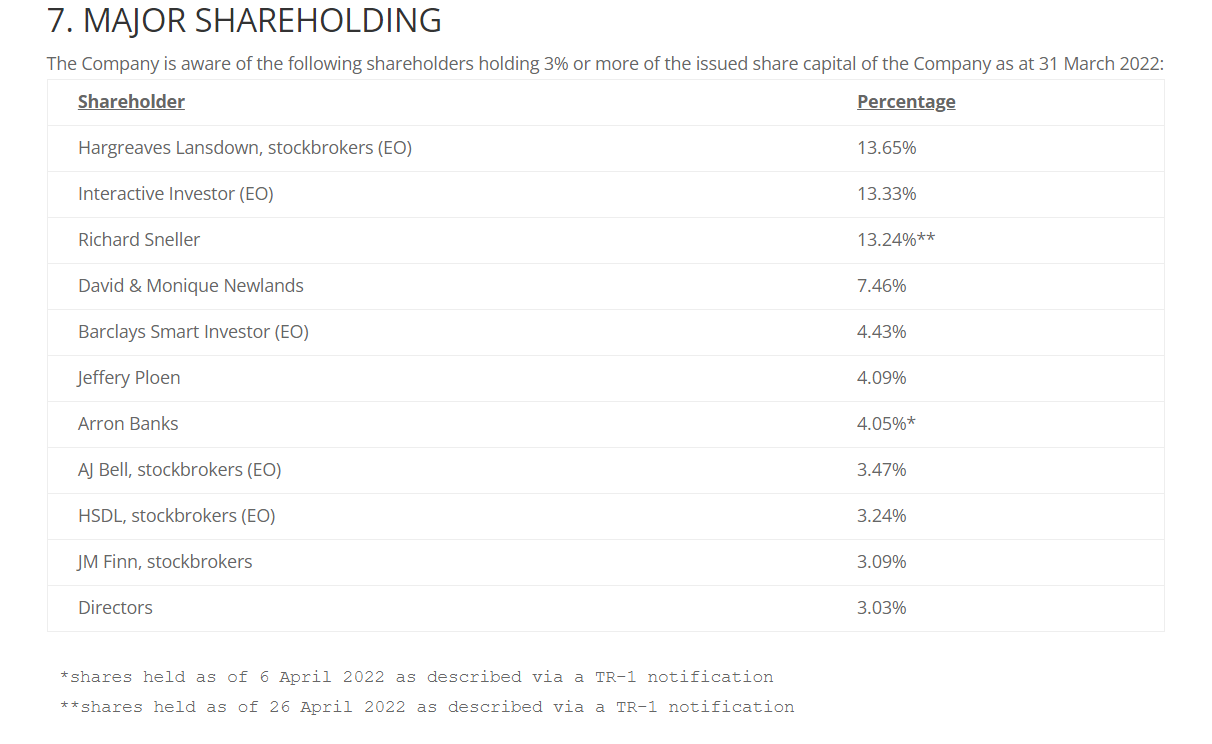

There's an old saying among those who study the price charts; “The bigger the base, the bigger the rise; the bigger the top, the bigger the drop.” A key thing I look for when sifting through stocks is to find those which have been building a base for several years on the long-range price chart. The numbers, capital structure and the situation are all important too but I always begin with the chart. Iofina PLC (IOF.L/IOFNF) was recommended to me by a reader of the blog a few months ago and I initially passed on it due to the market cap and share count being higher than I usually favour, but I found myself coming back to the chart on several subsequent occasions and digging deeper into what was happening with the company. Time for a closer look. IOF is an AIM/OTC (Also listed on the French and German exchanges) listed specialty chemicals holding company, their subsidiaries are primarily engaged in the E&P of iodine as well as the production of halogen based chemical products. They claim to be a low-cost producer of iodine and use a somewhat novel extraction process. Unlike other producers who extract iodine from ore IOF partners with O&G companies to get access to brine water, they extract the iodine from the water and then it is sent back to their partners to be disposed of. Numbers then the chart. All figures in USD as IOF reports in this currency. Market Cap = $51.50 Mil (£40.96 Mil) Share price = 26.84 cents (21.35p) Common outstanding = 192 Mil TBV = $27.13 Mil TTM Revenue = $34 Mil TTM Op. Income = $3.37 Mil TTM Net income = $2.36 Mil (Net of PPP loan forgiveness) Doesn't look cheap on the current numbers. One look at this chart and my mouth starts watering. The stock has been building a base for nearly 6 years now. The message boards are populated by despondent shareholders waiting for something to happen. Some of them bought in at much higher prices only to see their investment fall in value. Buying in the mark-down phase is a recipe for disaster as negative momentum carries the stock lower. Management has not delivered on a bunch of things, mistakes have been made, and of course they have had to contend with the pandemic, lockdowns and subsequent supply chain disruptions. Some investors have given up on IOF altogether and sold out in disgust or simply due to impatience. This quiet price action is highly disconcerting to most. For others, this is the ideal time to be buying, when the stock is out of favour and languishes in the accumulation zone it begins to change from weak to strong hands. Why has the stock been sat down in the low range all this time? For one it's fortunes are somewhat tied to the O&G industry, when E&P activity is limited so are the supplies of brine water to extract the iodine from. More recently there's been a bunch of issues related to a lack of production increases to capitalize on rising iodine prices. IOF is in the process of building a new plant but the project has been stalling for a while now. Another blunder which warrants a mention is management's bizarre foray into the hemp industry. They sank $900k into a purchase of organic hemp seeds with a view to hemp plant/cbd production. Unsurprisingly this financial escapade has been an abject failure and they are now looking for buyers to take the seeds off their hands. After reading about this debacle I though of that apt word coined by the legendary fund manager Peter Lynch Diworsification! How about the large write-down in the value of their Montana Atlantis Field holding?, down from $5,841,415 to a net carrying amount of $235,979. Oof! They eventually sold it for $255,308, not the sort of thing you want to see as a shareholder. *Correction; the $225k sale was of equipment and not the lease which they still hold. Whilst it has been impaired it could potentially be economically viable if gas prices climb high enough. Thanks to @Hbenoliel for spotting this error. Things are now starting to look up for IOF. Much like many other commodities, iodine prices are on the rise. The current global spot price for iodine stands at $60/kg, up 20% since the start of the year. Inflation looks like it might not be quite so 'transitory' as the central planners have been claiming, this is bullish for commodities like iodine. I think there's a good chance iodine price keep on rising for a number of reasons. The heightened potential for nuclear conflict has prompted a rise in demand for iodine tablets. If the conflict intensifies or spills over into a full blown NATO/Russia war then demand will keep growing. Demand for iodine used in the health care industry has been increasing as many parts of the world have opened up. There's a big backlog of medical procedures to get through, iodine is used in x-rays and antiseptics among other applications. A large amount of iodine production comes from Chile, I'm not betting on it but there's a good chance that Chilean production gets impacted by rising energy prices. Factories in numerous countries have had to halt production or ask for government assistance to keep running due to rising energy input costs. It's also worth mentioning that rising food prices have been prompting civil unrest in developing nations. Food riots and civil unrest could also effect exports. One other potential bear case on Chile, they just elected a far left candidate who is unlikely to be a net positive for private companies operating in the country. Maybe taxes get hiked and labour unions organize strikes. We are starting to see strikes and logistics delays in Chile effect iodine exports with the market already in deficit. Another bullish development for IOF is that they appear close to striking a deal with a new brine water supply partner. Once the deal is signed they can get on with building the new plant and increase production. You can read more about it in the Q1 2022 update. As I mentioned earlier, the stock doesn't look cheap on the current numbers; P/S = 1.51 P/E =21.8 P/TBV = 1.9 Not what you'd call a classic value stock. Much like my O&G plays this investment is based upon my belief that we are in the early innings of a commodities bull market. I think inflation will be around for a while and prices will keep rising. Take a look at the following chart taken from this book written back in the 1940's. It shows the approximate timing of four major cycles in the American economy. The one I want to draw your attention to is the top one. This 54 year cycle last peaked in 1981 when interest rates topped out around 15%. It then bottomed out around 2008 and the next peak should arrive around 2035. The upward arc of this cycle is characterized by rising wholesale prices and interest rates. In an inflationary or stagflationary environment commodities stocks tend to do very well. Now to another chart taken from my favourite investing book. Take another look at the long range chart for IOF. It is still sat down in the accumulation zone and the mark-up phase is ahead of us. The 6 year base and quiet price action has prepared a sound foundation for a large rise as the stock has gained a great deal of technical strength. Let's look at how the numbers have been trending. The trend looks positive to me. Revenues have grown from $16 Mil in 2011 to TTM $34 Mil. Operating and net income have turned positive and are growing. I'm not a big fan of the dilution that has taken place with a share count up from 113 Mil in 2011 to 193 Mil. Thankfully this dilution seems to have tailed off in recent years. If iodine prices keep rising and we get another plant coming on line this growth should continue. If Chilean production gets seriously disrupted things will start to get very interesting. Time to look at ownership. Despite the share count being higher than I normally favour the public float is pretty tight. 31.87% of the common is held by private investors and insiders including the businessman Arron Banks, former IOF Interim CEO & Pres/Co-Founder Jeffery Ploen and retired fund manager Richard Sneller. The latter has been building his position for several months now and recently added another 1.7 Mil shares. I share his bullish view of IOF and have been buying too. What risks do I see here? The thesis is fatally impaired if my commodities bull market call is incorrect. If O&G prices collapse we can kiss goodbye to all that brine water to extract iodine from. Maybe iodine prices top out much sooner than I expect. Maybe revenues stall out and profits stagnate, if so paying the current price wouldn't seem like such a bargain after all. The stock might just drop back down and keep building a base for several more years. FULO build a near two decade base before it finally exploded into the mark-up phase. Often an investment thesis can take longer to play out than we think, sometimes being early is just the same as being wrong. Time to wrap it up.

IOF doesn't look cheap on the current numbers but if revenues and earnings keep growing then the current price will turn out to be a good entry point. After years of mistakes, mis-steps and delays things finally seem to be looking up for the company. The stock recently hit a new 52-week high and my reading of the chart leads me to conclude the accumulation phase is coming to an end and the mark-up phase is on the horizon. Like they say, the bigger the base... Thanks for reading, David Disclosure: Long IOF

2 Comments

gert

3/15/2024 04:39:06 pm

Hi David, great analysis! I agree with your thesis. Iodine is still on the rise, revenues and operating income increasing as well. Yes the stock is not cheap but Ted says timing is more important than price :-) Timing do seems right after a very long 6Y base and quiet action at the end. Compare with the 1,5Y base before stock peaked in 2013. Seems promising for a big(ger) rise now. 'If' that is the case then current price will be very cheap in hindsight :-) I think I will buy the stock but consider it as a long term play ( ie. limit my expectations) . Thank you for your great work and best regards, Gert (Belgium)

Reply

mr.gorillaz

7/4/2024 05:56:50 pm

any update? wtf was that with the hemp situation?

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed