|

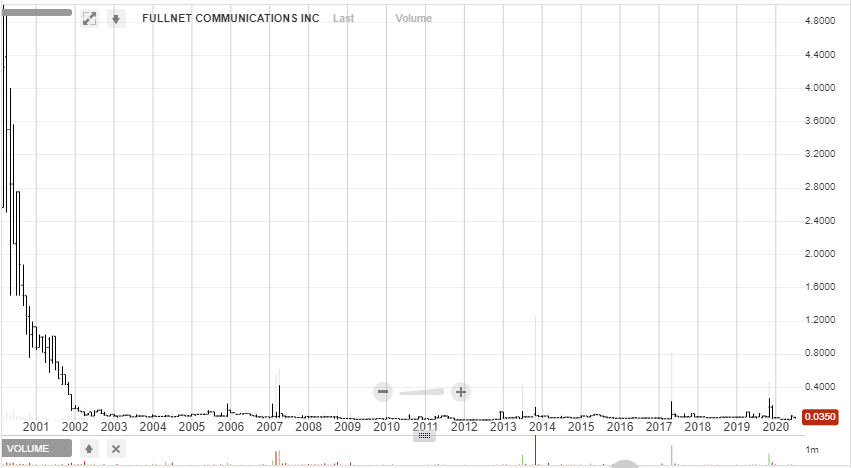

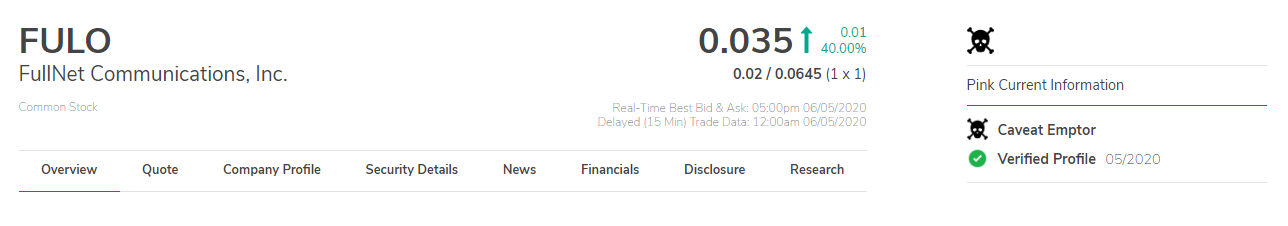

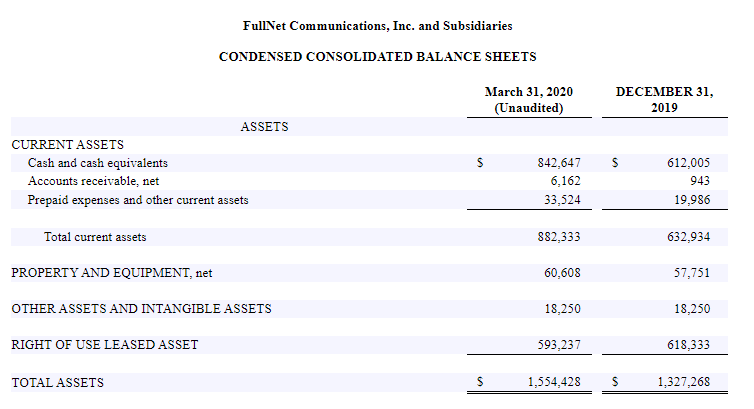

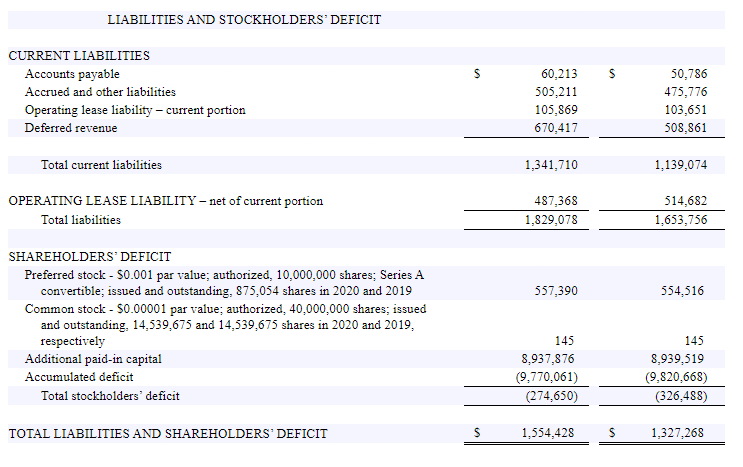

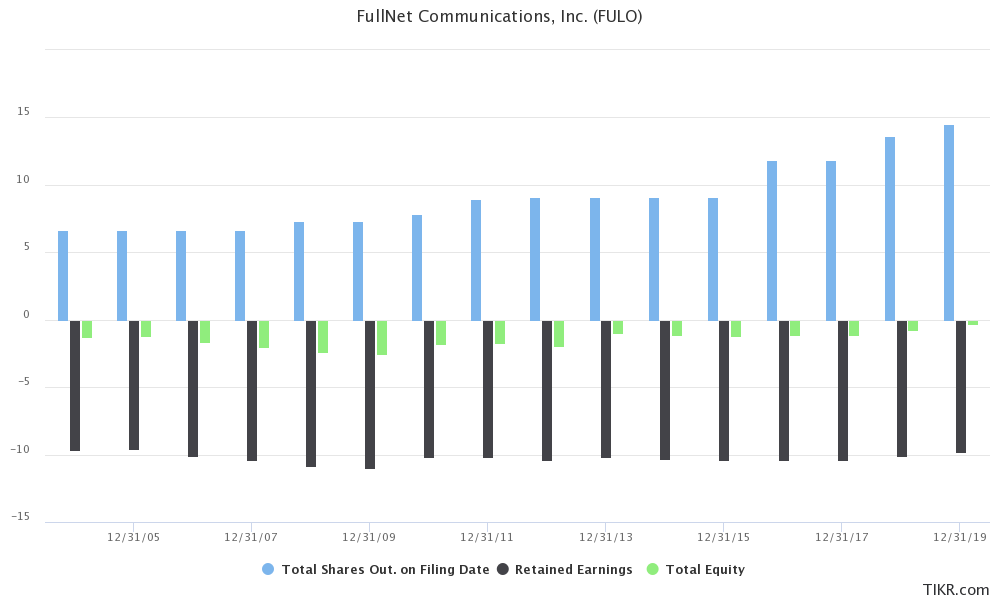

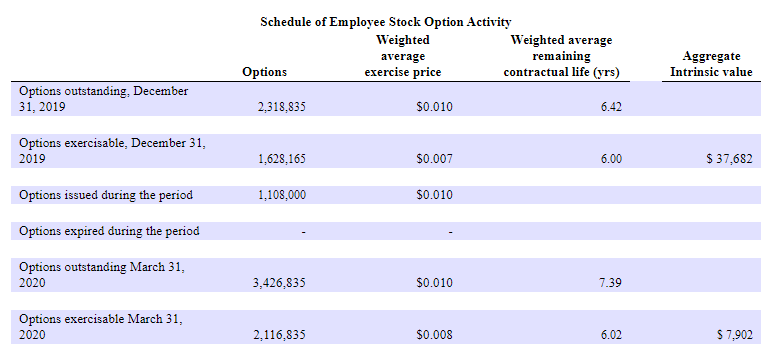

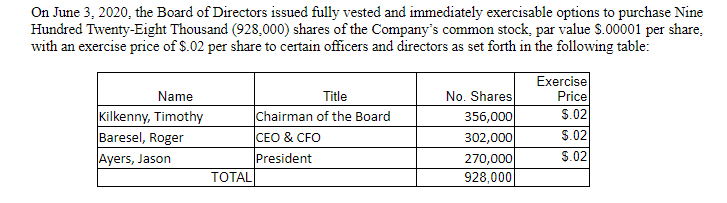

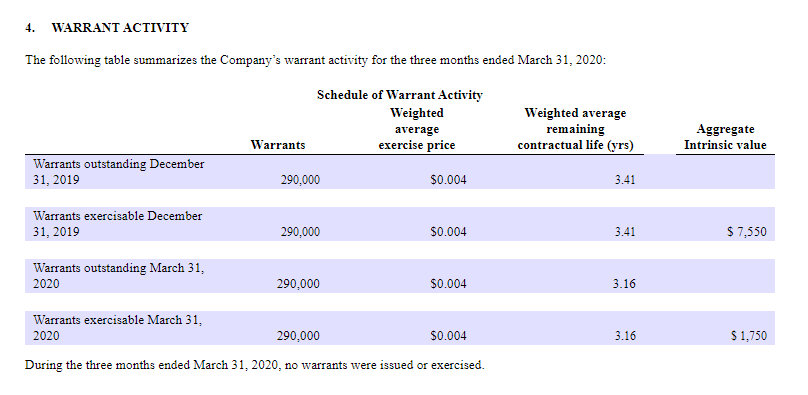

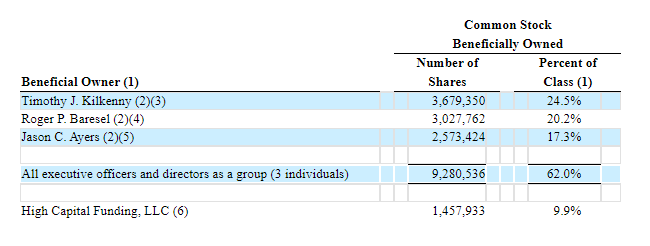

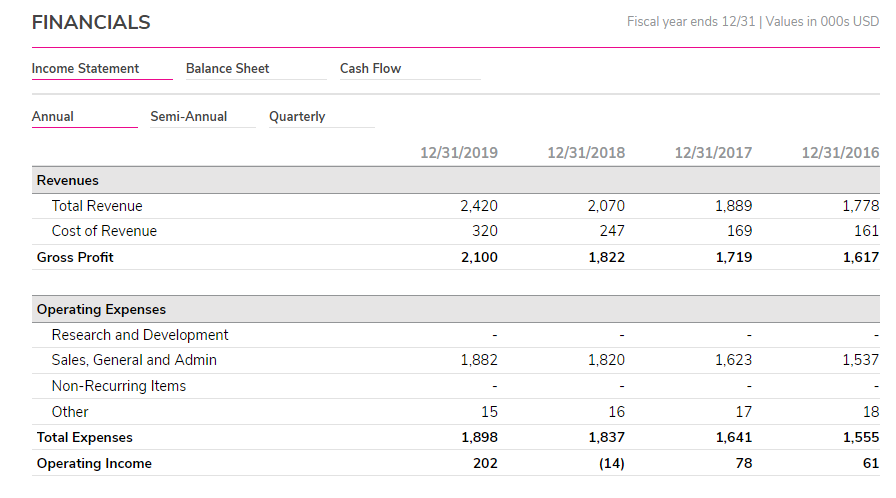

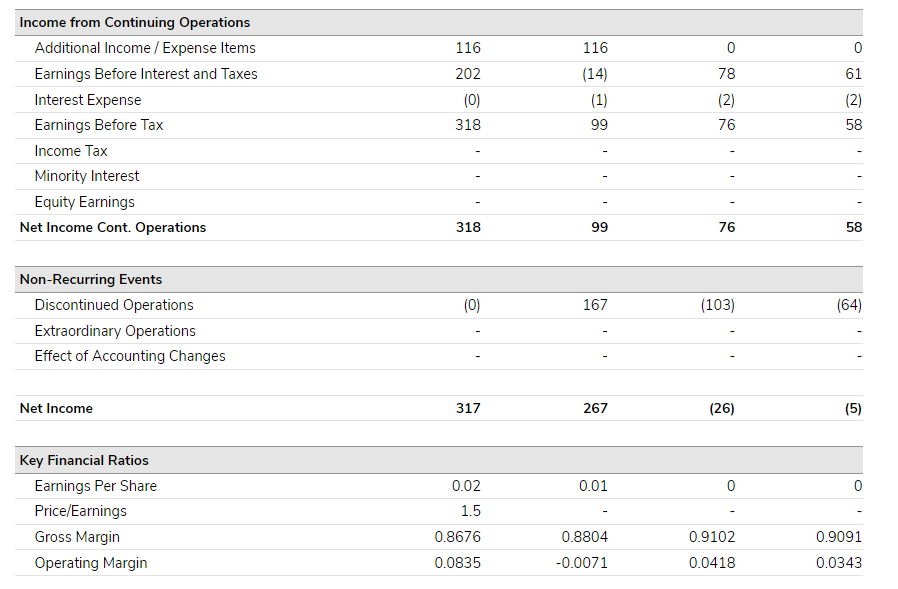

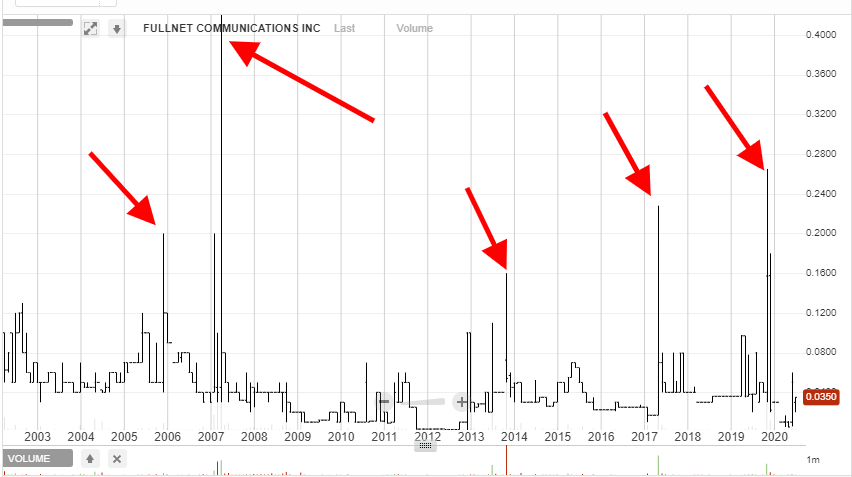

FullNet Communications Inc (FULO) is a tiny company trading on the pink-sheets, the float is low and it's shares are thinly traded. In some ways it is cheap, in others maybe not. Much like every other company I write up it's got plenty of hair on it. FULO was founded in Oklahoma back in 1995 and my old Mergent OTC manual notes the following; 'FullNet Communications is an integrated communications provider offering integrated communications, internet connectivity, and data storage to individuals, businesses, organizations, educational institutions, and government agencies. Through its subsidiaries, Co. provides internet access, web hosting , equipment co-location and traditional telephone services to residents and medium-sized businesses in Oklahoma." Get yourselves a sick bag and we'll take a look at the long-range price chart to see what story it tells us. That chart is ugly enough to turn Medusa to stone! It looks like this one IPO'd around the tail end of the dot-com boom and got obliterated when the market came to its senses. From a high of $5 in Feb 2000 to $0.035 today, what a fall from grace! The optimist in me says this thing has been building a base for nigh on two decades and is primed for a rise, maybe not but I'm sure you've not failed to notice those stock spikes hiding in there. Here's some vitals; Market Cap =$509k Share price = $0.035 Common = 14,539,675 Float = 6,188,730 Right, before we get to the financials I should mention that FULO has been designated with a 'Caveat Emptor' warning by OTC markets and sports a skull and crossbones on it's quote page. This warning can be applied for a number of reasons including "questionable stock promotion, known investigation of fraudulent activity committed by the company or insiders, regulatory suspensions, or disruptive corporate actions." After a bit of digging about the only reasons I found to justify this is a late filing of the 2016 and 2019 10-Ks and some issues with an old auditor back in 2013. You can read about it here. I'm no accountant or auditing expert but if I'm reading the linked document right it seems to suggest FULO were not at fault and it was sloppy auditing practices from Hood & Associates since they screwed up with two other companies too. FULO kicked them to the curb after that debacle and got a new auditor. See here. Maybe I missed something else here so do your own due diligence. Okay, get another sick bag ready and we'll take a look at the latest financials. Where do we start here? Negative BV of ($274,650) Negative working Capital of ($459,377) Accumulated deficit of ($9,770,061) To add insult to injury we've even got some prefs on there too, I'll tell you about the stock options in a bit! But perhaps things aren't quite as horrific as they first appear. Around $670k of the liabilities is deferred revenue and another £339,336 is unpaid dividends on the prefs. The latest 10-Q notes; "As of March 31, 2020, we had $842,647 in cash and $882,333 in current assets and $1,341,710 in current liabilities. Current liabilities consist primarily of $505,211 in accrued and other liabilities, of which $333,396 is owed to our officers and directors, and $670,417 in deferred revenue. Our officers and directors, who are also major shareholders, have agreed to not seek payment of any of the amounts owed to them if such payment would jeopardize our ability to continue as a going concern." I don't know about you but I feel a whole lot better knowing that the $333k is owed to insiders rather than the bank, for sure the debt is still real but it can be put off indefinitely until things improve. If we back out the deferred revenue BV suddenly turns positive to the tune of $395,767. Alas, that figure soon turns negative again, around ($161,623), when we account for the prefs. I remember noticing in my Mergent manual that BV was ($1,818,2020) back in 2010 so something positive seems to have been going on. This chart shows both the good and bad. Negative BV has been narrowing in recent years, down from ($1.96 Mil) in 2012 to ($333k) in Dec 2019 and now ($274k), if you are backing out the deferred revenue and adding back in the prefs then it's ($161,623). The flip side is that the share count has been growing, up from 6.65 Mil in 2004 to 14.54 Mil by March 2020. Now's as good a time as any to tell you about the stock options; Options outstanding as of March was 3,426,835 bringing the fully diluted share count up to 17,966,510. But wait, we're not finished yet. An 8-K released on June 5th added the following; That brings us up to 18,894,510. Still not done, there's some warrants too! Let's hope management doesn't decide to pay out the unpaid pref dividends in stock as that would add another 20.6 Mil shares to the pile! Here's a break-down of current ownership as of Dec 2019; So, management has significant skin in the game but all those stock options being issued as compensation don't help us minority holders on the outside. I think that's all the bad news out of the way now. Let's take a look at the income statement for the last few years ; Revenues have been growing for the last few years, up from $1.78 Mil in 2016 to $2.42 Mil in 2019, not only that but FULO has managed to begin to turn a profit. You might also notice that things would have looked even better were it not for those losses from discontinued operations . We might just have turned a corner there, in the 2019 10-K I found the following; "In response to the changes in the telecommunications market and deterioration in our ability to effectively compete, we made the decision in the fourth quarter of 2017, to affect an orderly exit from the CLEC business. On October 27, 2017, the Company’s board of directors adopted a plan to exit the CLEC business as soon as possible through the sale of its wholly owned CLEC subsidiary and/or substantially all of its CLEC subsidiary’s operating assets. We were in negotiations with a potential buyer at December 31, 2017, which buyer subsequently purchased substantially all of FullTel’s operating assets pursuant to an asset purchase agreement which was executed and closed on February 1, 2018 (“the Sale”). The Company determined that the Sale represented a strategic shift that will have a major effect on the Company’s operations and financial results since it represented a complete exit from the CLEC business and, therefore, classified its CLEC subsidiary as held for sale at December 31, 2017. The Company recognized a gain of $233,277 on the Sale based on total consideration of $264,872 less total basis in the assets sold and transactions costs of $31,595. The assets sold consisted primarily of customers and associated customer premise equipment. " Time will tell whether management's assertion that the sale of it's CLEC business "will have a major effect on the Company's operations and financial results ". At the very least it seems that the company has a better chance of staying in the black now it's sold off the legacy business which was acting as a drag on results. Right, let's take a look at those stock spikes. 3x on vol of 135k in 2006

5x on vol of 300k followed by 8.8x on vol of 1m in 2007 2.2x on 2m vol in 2013 13.4x on vol of 1.3m in 2017 6.6x on vol of 762k in 2019 These stock spikes can occur for all sorts of reasons such as stock promotions, news reports and pump 'n dumps. Providing it is upward movement the reason why doesn't matter much to me. If a stock spikes quickly like that there's a very good chance it will just drop back down, strong upward moves are built slowly and on low volume, when you see volume and share price explode based on nothing substantial sell into it whilst you can, it's here today and gone tomorrow. What's FULO worth? Some will argue it's not worth anything with all that hair on it. I'm not so sure, it's generating positive operating earnings and net income, revenues are growing and BV is moving toward positive territory. Is 2.5x op. earnings a fair price? Imagine what happens if management really does turn the ship around. Imagine what might happen if BV turns positive, the 'Caveat Emptor' label gets removed, dilution is halted, and the company remains in the black. Valued at 5x Op. Earnings this one is a double worth around $1 Mil, maybe it even manages a good run of profits and sells for a P/S of 1, that would be around 4.5x from here. Who knows, it could catch another stock spike and run up 6x. Then again, maybe management is wrong and the exit from the CLEC business is a false dawn. Perhaps FULO just swings back to a loss, the dilution continues unabated and this turns out to be a death knell stock . I guess I'll find out, David Disclosure: Long FULO

7 Comments

G

6/8/2020 05:37:28 am

This one is really "out there"!

Reply

David

6/11/2020 02:46:38 pm

Hi G,

Reply

mike

6/11/2020 06:03:24 pm

The bid-ask spread is very high, almost 100%. I am wondering if you can buy at bid price or if this takes many weeks/months.

Reply

David

6/11/2020 06:12:41 pm

Building a position in these tiny companies can take time. Sometimes a bid gets filled quickly, other times it can take weeks or months. I've had bids out on some stocks for over a year without getting filled.

Reply

mike

6/27/2020 01:06:12 pm

I think it might make sense to buy stocks of very small companies that are low valued based on Price / Earnings (or even better EV/EBIT) ratio.

Reply

4/9/2021 11:24:17 pm

Hi David,

Reply

David

4/11/2021 01:26:23 pm

Hi Stephen,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed