|

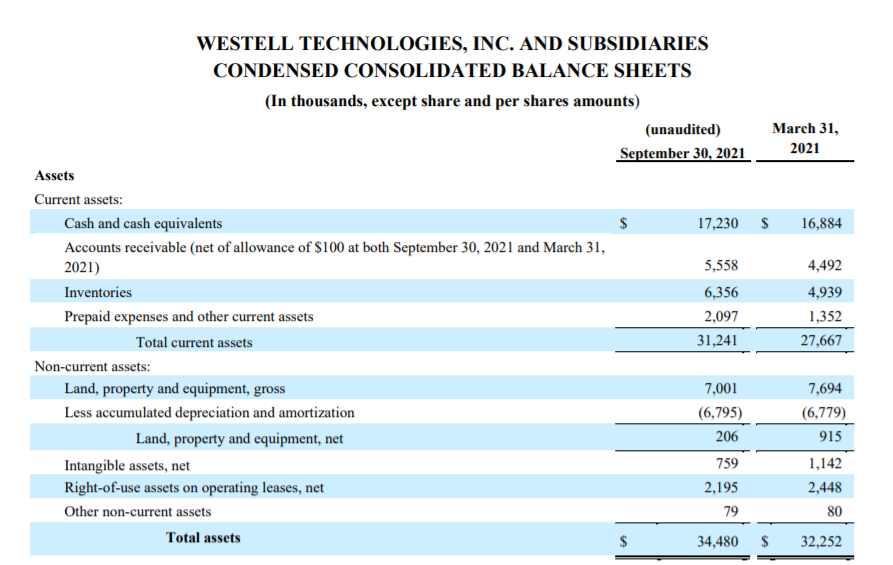

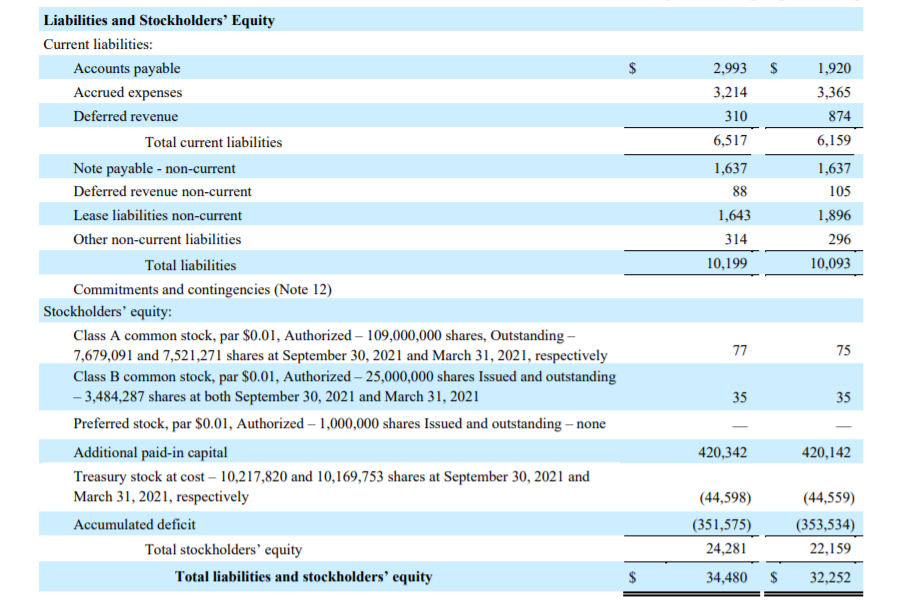

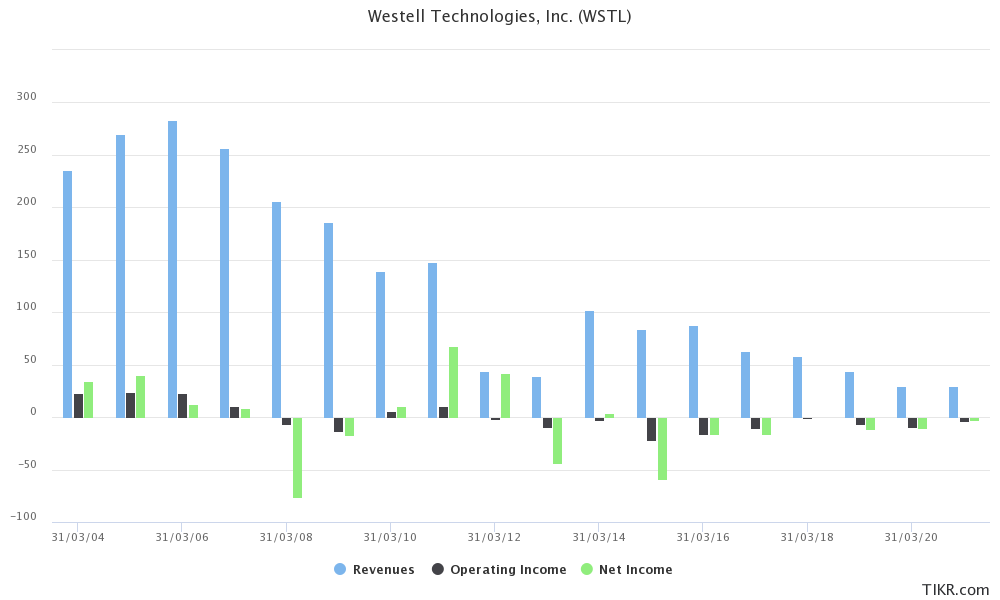

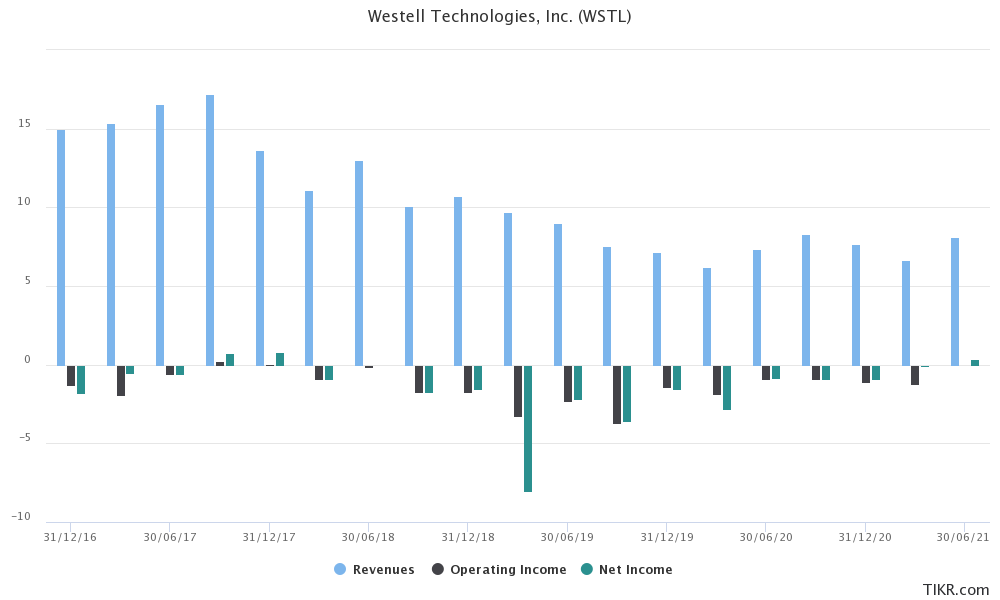

Today's market doesn't care about Westell Technologies Corp (WSTL). Most market participants are either repulsed by it, ignoring it, or have just forgotten about it altogether. Aside from a few net-net investors and some bottom fishers there's little attention being paid to it right now. The less attention being paid to a stock, the more I am attracted to it. There's plenty of reasons why WSTL is sat trading below NCAV on the pink-sheets but where others see risk I see opportunity. WSTL was founded back in 1980 and operates in the telecommunications industry. The company website describes their business as follows; 'Westell Technologies, Inc., headquartered in Aurora, Illinois, is a leading provider of high-performance network infrastructure solutions focused on innovation and differentiation at the edge of communication networks where end users connect. We enable service providers and network operators to improve performance and reduce operating expenses via a comprehensive set of products and solutions. With millions of products successfully deployed worldwide, we are a trusted partner for transforming networks into high-quality, reliable systems.' Their markets include In-Building Wireless Solutions, Intelligent site management and Communications Network Solutions. The stock has been pounded down into oblivion in recent years for a variety of reasons including declining revenues and chronic unprofitability. Charts then numbers. The stock is down from over $4 in late 2017 to $1.11 today. It bottomed out in early 2020 and is now building a base. It has ticked up of late after it emerged that Congresswoman Debbie Wasserman Schultz has recently bought a few shares. Someone get Pelosi on the phone! Lets zoom out a bit. Now we can really start to see the value destruction that has taken place. Back in late 2013 and early 2014 the stock was trading above $16. Whoever was buying up there has surely sold out by now . A decade of brutal share price decline will test the resolve of even the most diamond handed market participant! Time for the big picture. The long-range chart shows the tumultuous history of WSTL in all its ugly glory. Back in 2003 the stock traded over $43. In the dotcom boom it breached the $150 zone, and back in the mid 1990's it even traded in the low $200's. And now here we are, bouncing along support on low volume at just over a buck. No wonder pretty much everyone has given up on the stock. Management decided to delist in 2020 and did a reverse/forward split cash-out at $1.48 for holders of less than 1000 shares. It was the right thing to do given the firm had racked up an accumulated deficit of over ($350 Mil ) and was bleeding red in most years. The stock now resides on the 'limited info' tier of the pink-sheets and volume is light. On to the numbers. Market Cap = $12,391,350 (OTC Markets lists this wrong as Class B shares are not included) Share price = $1.11 Common outstanding (Combined Class A & B shares) = 11,163,378 Float = 6,877,675 TBV = $23,522,000 TTM Revenue = $31,531,000 TTM Operating Income = ($2,851,00) NOL's = $40 Mil On an assets basis WSTL is cheap and for good reason, several years of declining revenues and unprofitability will do that to a stock. How cheap is cheap? The latest quarterly reveals the following; Current assets =$31,241,000 Total Liabilities =$10,199,000 NCAV =$21,042,000 or $1.88 on a per share basis. Once a few adjustments are made it gets even cheaper. Lets scrub off the current and non-current deferred revenue of $398k since they relate to maintenance contracts (services) and not inventory (physical products). We can also scrub off around $1.64 Mil in liabilities since another PPP loan was just forgiven. Adj. NCAV thus stands at $23,077,522 or $2.06 per share. At this price the stock is trading at 0.59x NCAV and 0.53x Adj. NCAV Now the obvious argument here is that the discount is justified since WSTL is a melting ice cube. The company's financial history certainly supports this assertion. Revenue down from $236 Mil in 2004 to TTM 31.5 Mil. Negative Operating Income for the last 10 years. The picture looks bleak but the descent into the abyss appears to be coming to a halt. Here's the quarterly financial performance for the last few years. Notice how the downward trend in revenues seems to stop in 2019? Since then they appear to have stabilized and the operating losses have narrowed. In fact WSTL has posted a modest operating profit for the past two quarters. $10k in Q1 and $17k in Q2 Whilst I was going though some old filings and press releases I noticed that WSTL had appointed a new CEO in Sept 2019. Perhaps his appointment has led to a stabilization in the company, I can't say for sure but something positive seems to be happening. I know next to nothing about the Telecommunications industry but I figure WSTL might pick up some business from the continuing roll-out of 5G. I've also noticed the growing trend toward smart buildings, Internet of Things (IOT) and the deployment of autonomous monitoring systems. Maybe WSTL benefits from that, maybe some of those Biden infrastructure dollars trickle down to them too. It doesn't take much to move up a stock that's been left for dead. What are the risks here. The most obvious one is that the apparent stabilization of the company's financial performance is merely 'transitory' and the descent into the abyss will resume in short order. Losses could continue and the asset base could keep on melting away. Another major issue is the dual class structure and insider control. One of the directors, namely Robert W. Foskett, owns 100% of the Class B shares which carry 4 votes for each 1 vote that the Class A shares carry. This means that insiders are in control and shareholder activism is off the table. With that kind of voting power the board could pull all kinds of nefarious stunts and minority holders would be powerless to stop them. Maybe they just decide to take the company dark or private and rig it so minority shareholders get screwed in the process. There's all kinds of ways this could end badly. As is customary for me, I let the long range chart and balance sheet lead the way. WSTL is cheap on an assets basis and I'll hang my hat on that. The stock is sat close to its all time low on the long range chart and has begun to build a base on low volume.

The strength of the balance sheet creates a window of opportunity for the company's fortunes to improve. The chart shows what's possible if business picks up. My average cost basis is in the 90's and I've recently bought a little more above a buck, now the buying is done it's a question of holding on for brighter days. Thanks for reading, David Disclosure - Long WSTL

18 Comments

11/21/2021 08:51:25 am

Hi David, great write up!

Reply

David

11/21/2021 12:26:35 pm

Thanks for reading Thijs,

Reply

Bryan McPherson

11/21/2021 02:18:26 pm

Hi David,

Reply

David

11/21/2021 06:14:58 pm

Thanks for reading Bryan, much appreciated.

Reply

Alex

11/21/2021 05:50:12 pm

Hi David,

Reply

David

11/21/2021 06:14:00 pm

Hi Alex,

Reply

Anthony

11/22/2021 12:21:08 am

David,

Reply

Former Employee

11/29/2021 10:07:56 pm

I am a longtime (and now former) employee of Westell. As revenue has shrunk over the years, there have been continual employee layoffs, averaging once a year. I am one of the few who left of my own volition. Due to the shrinking number of employees, the release cycle of old products and development of new products is stretching. They have been largely unsuccessful in pivoting from old, dying products into new markets. I would look at more than just how cheap the stock is.

Reply

David

11/29/2021 11:07:17 pm

Hi,

Reply

Soren Pack

12/6/2021 05:35:01 pm

Hello David,

Reply

David

12/8/2021 05:47:24 pm

Hi Soren,

Reply

Hi David,

Reply

David

1/29/2022 12:42:14 pm

Hi Evan,

Reply

Greg Z

8/7/2022 07:41:27 am

Hi David,

Reply

David

8/7/2022 09:07:31 pm

Hi Greg,

Reply

Greg Z

8/7/2022 09:19:23 pm

Thanks, that's reasonable.

Pandya

8/22/2022 04:23:39 am

So, is Westell a good company to work for? They offered position in In Building products. I can't decide to whether to accept it or not. Thank you in advance.

Reply

VannyInvestor

3/24/2024 09:01:23 pm

WSTL definitely is positioning itself for something most likely a take private transaction. Estate planning, new director that specializes in this, stop putting out md&a, hoarding cash, selling inventory, credit line renewal.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed