|

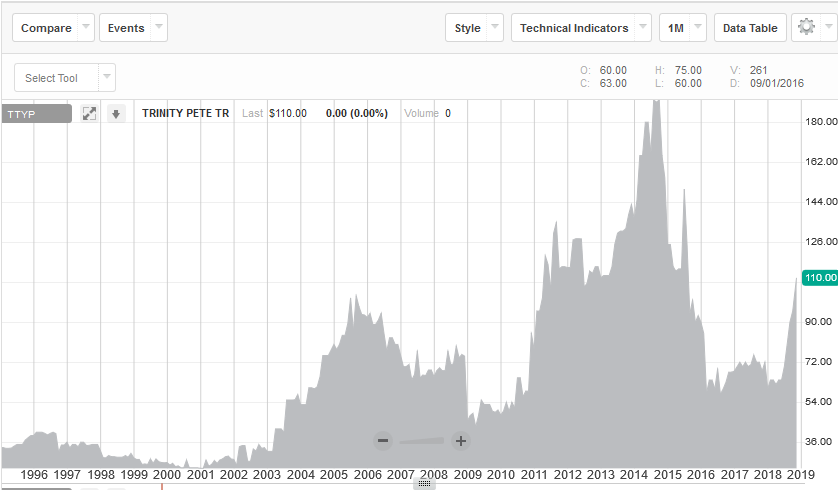

Howdy folks, I recently acquired some old Walker's Manuals of Stocks including the 6th edition 2002-2003 Walker's Manual of Unlisted Stocks (These books tend to trade at prices no self respecting value investor would pay but occasionally you can find them selling at reasonable prices. I recommend periodically scouring Amazon, Alibris and Abebooks to see if any cheap copies come up for sale). Whilst leafing through the 6th edition Manual of Unlisted Stocks I came across a number of interesting royalty trusts including Trinity Petroleum Trust (TTYP) The Walker's Manual lists TTYP as an 'entity with no existing activities'. It is essentially a unit trust which has royalty claims on oil and gas properties located in Louisiana. This type of corporate entity is not subject to taxation and so unit holders must file their own federal tax returns but the trust provides annual information statements to unit holders for inclusion in their tax returns. Since this trust derives its income from O&G properties it's royalty payments are subject to change as commodity prices rise and fall. Below is a chart of the trust's dividend payments to unit holder's for the period 2008-2018. As one can see, distributions fluctuate from year to year along with changes in O&G prices. Now for a few numbers; Current market cap = $21,120,00 Shares outstanding = 192,000 Price per share = $110 52WK range = $58.50-200.00 Dividend per share = $13.77 Dividend yield = 12.51% Frequency of dividends = Semi-annual Next we'll take a look at a long range chart of the stock; Whilst this is stating the obvious I'll say it anyway. The chart shows that the best times to buy TTYP are after a major market crash or when O&G prices are in a trough. Not only does one get a lower entry price but volume spikes make accumulating a position easier as dispondent market participants discard the stock in disgust or panic.

There are obviously some risks with this stock, Firstly, is there likely to be a secular decline in O&G prices as the world transitions to sustainable energy?, probably so but I don't think this will happen as quickly as some people anticipate. I'm willing to bet the world will be reliant on O&G for a significant portion of energy generation for the next 20-25 yrs. I also expect this decline to be a steady and protracted one rather than an abrupt drop. Secondly, and more importantly, what is the volume of O&G reserves at the Louisiana properties? After digging around I have yet to come across any information which points to the likely reserves present but I'm sure there must be a way to find out. In summary, whilst the 12.5% dividend yield makes TTYP appear attractive ths fact that we are now in the longest bull run in market history should be borne in mind. The stock is currently in an upward trend as O&G prices have been rising, market optimism is high and market participants are in good spirits. I 'll add this stock to my watch list for now and wait for a more favourable entry point to capture a higher yield and greater potential for stock price appreciation. As Sir John Templeton advised, the time to buy is at the point of maximum pessimism. Thanks for reading, David Disclaimer: The author holds no position in TTYP at the time of writing.

0 Comments

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed