|

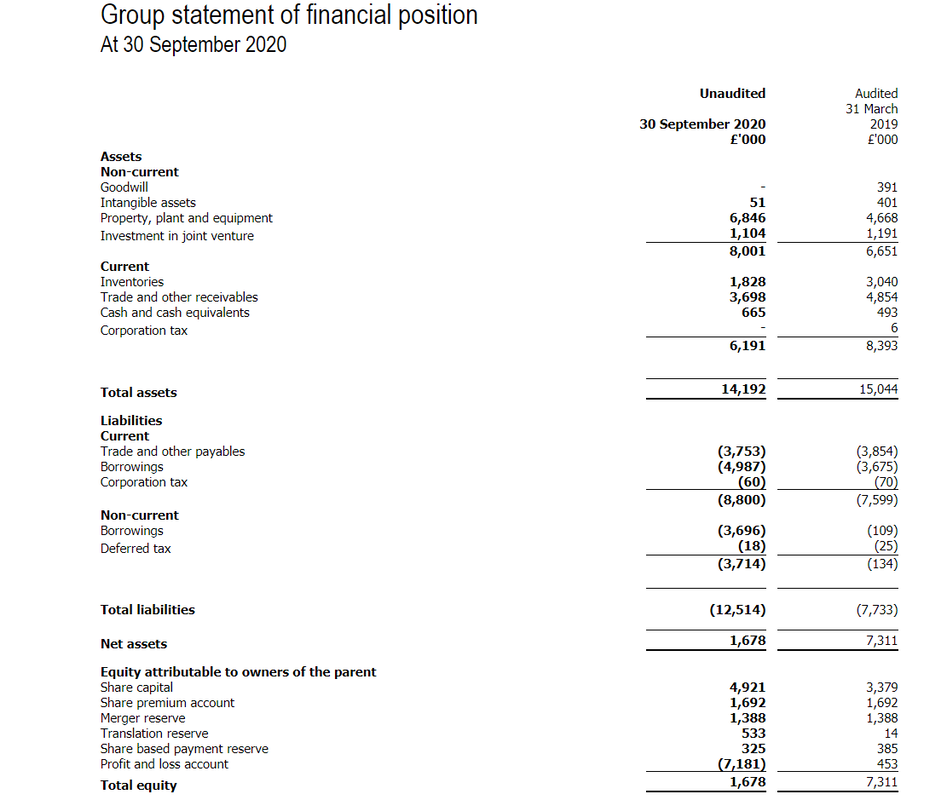

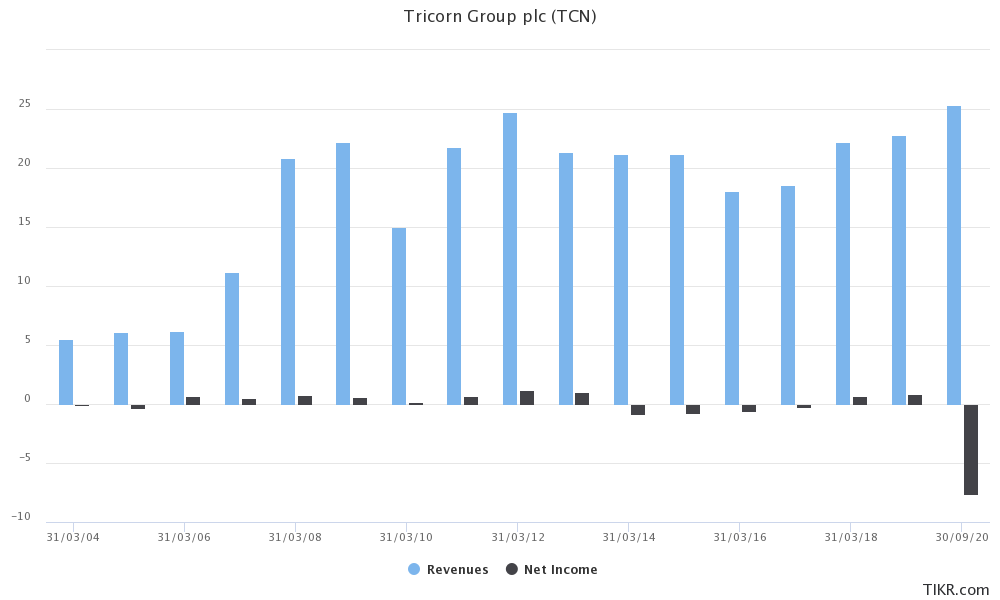

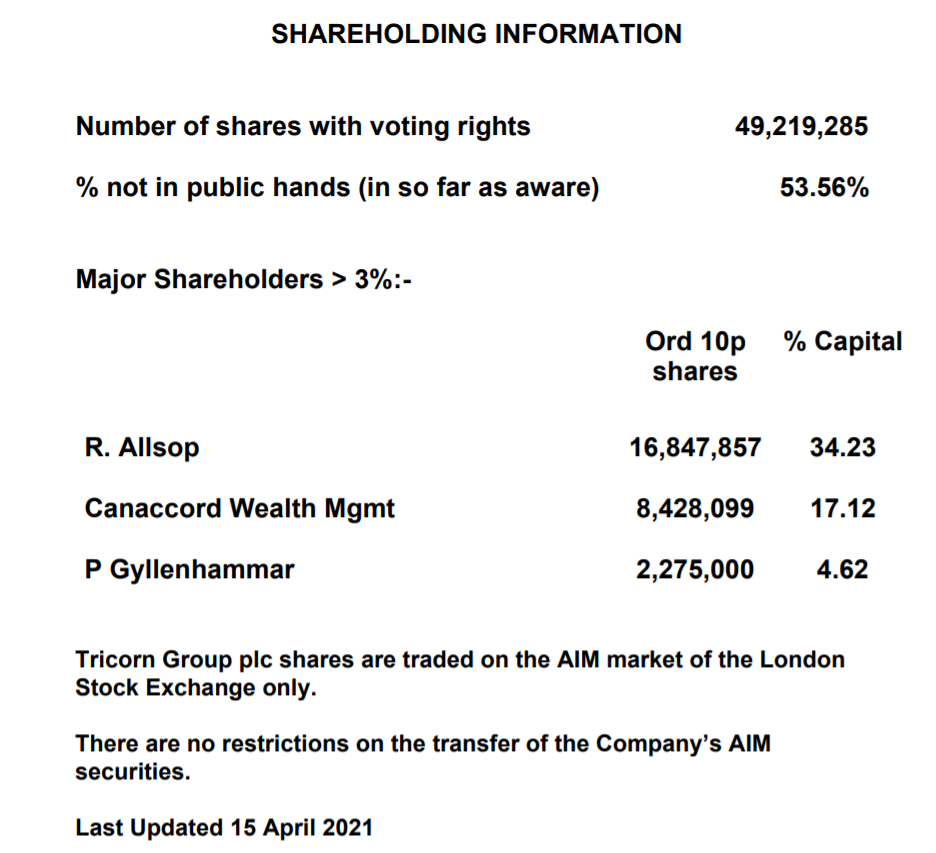

Most of my investment decisions happen very quickly now. It's rare that I labour over an idea to figure out if it's a buy or not. Tricorn PLC (TCN.L) is no different to the rest, Everything lines up; The market cap, share price, public float, price chart and situation. All just how I want them. Here's a quick company description and some numbers; "Tricorn Group plc manufactures and supplies pipe and tubing assemblies for companies worldwide. It operates through two segments, Transportation and Energy. The Energy segment provides manipulated tubular assemblies for use in power generation, oil and gas, and marine sectors. The Transportation segment offers ferrous, non-ferrous, and nylon material tubular assemblies for use in on- and off-highway applications. Tricorn Group plc was incorporated in 1986 and is based in Malvern, the United Kingdom." Market Cap = £3.814 Mil Share price = 7.75p Spread = 21% Common outstanding = 49,219,285 Public Float = 46.44% Est. BV = £2.5 Mil Loss-making Now to the main attraction, price chart time! One look at that long-range price chart and I've already got one foot through the door! Look at the cyclicality present in the chart, every 6-7 years the stock bottoms out before going on a monster run. 2003; Bottoms out at 3.86p before topping out at over 40p in late 2008. A 10-bagger in 5 years. 2009; Bottoms out at 5.78p before topping out at around 35p in 2011. A 6-bagger in 2 years and 3 months. 2016; Bottoms out 7.63p before topping out at around 35p in 2018. A 4.6-bagger in 2 years and 2 months. The long term support and resistance levels are clearly evident, the accumulation zones, periods of consolidation, mark-up phases, distribution tops and mark-downs. All of them are there for those who choose to look for them. Sadly, very few do. Many are fixated on quarterly earnings and trying to capture short-term gains. Those of us who take the time to study the long-range charts are rewarded for our dedication to this peculiar obsession. We get to observe the footprints of money. We get to peer through the window into the collective mind of the market and gauge it's sentiment toward a stock, both past and present. Let's zoom in a bit and see what else we can discern. The 5 year chart reveals that the stock has bottomed out after its most recent decline from mid-2018 to early-2020. It is now firmly sat in the accumulation zone where strong hands are quietly building a position in preparation for the next rally. This is how support is created, an equilibrium is formed by those selling in disgust or capitulation, and this selling is met by those buying with one eye on the past and the other on the future. Sentiment toward the company is currently bearish, chatter on the stock boards is light and bears outnumber the bulls. As you can imagine, the global pandemic and accompanying lockdowns have not done the company any favours. Let's dig into the business. The company has been granted permission to delay publication of audited results till June 30th so we'll have to make do with the unaudited accounts they released on March 31st. The report covers an 18 month period as the company has recently changed its accounting reference date. We'll start with the balance sheet. You can see that there have been some big write-downs on goodwill and intangibles, there's also been some write-downs associated with inventories, debtors and loss of contracts etc. There's been a shake-up in management recently including the appointment of a new CEO. Management also instigated an internal review of the company and it was revealed that there was a balance sheet risk identified. By all accounts the last captain of the ship wasn't big on effectively implementing internal controls. My interpretation of the accounts and the accompanying statement from the new CEO leads me to believe that there isn't an issue with fraud at the company but rather the accounting anomalies uncovered were a result of incompetence and poor management. You may think differently so don't take my word for it, as always do your own research. Since the issuance of these financials TCN has been awarded further funds for its US subsidiary under the PPP loan scheme In April the company issued an RNS noting that it's cash balances stood at £1.5 Mil. We'll have to wait for the audited results to hit in June but I calculate BV to stand at around £2.5 Mil though the firm will not doubt have burnt a little cash on wages etc. I normally like to buy at a discount to tangible assets but I'll make exceptions depending on the situation. I like the set-up here so I'm willing to pay above book. With that cash balance the firm should be able to keep the fires stoked till business picks up. I also think there's a good chance the 2nd PPP loan gets forgiven like the first one did. The UK Government is also backstopping credit extended to the UK subsidiary and maybe that gets forgiven too. Either way, I don't see the firm going under, now the lockdowns are lifting and business is improving I'm willing to bet brighter days are ahead for TCN. What about revenues and earnings? The last column in the chart represents the most recent unaudited financials and covers an 18 month period so revenues are a bit higher than they would be on an annual basis. For the prior two years revenues were coming in at around £22 Mil I don't know about you but I'll happily pay £3.8 Mil for £22 Mil in revenue for a company that's been left for dead and has decent business prospects going forward. As with all cyclicals you can see earnings are lumpy. The most recent column for net income shows that the firm lost a huge chunk of money resulting from the pandemic and write-offs etc. Prior to that you can see that TCN swings from profit to loss every few years. When times are good the firm pulls in between £0.7-1.0 Mil in net income. Assuming we return to these levels in short order that's a P/E of between 3.8-5.4. I'll take that bet. Okay, what about ownership? Notice anything interesting? Okay, I'll go first. Nearly 54% of the float is tied up, the stock is highly illiquid and the spread is wide. What do you think happens if and when the firm puts out a bullish press release or strong results? Who's R. Allsop? He's a Non-Ex Director and the former CEO. Little chance of this guy having paper hands and aside from the odd sale here and there he's been a net buyer over the years. Canaccord seem in no mood to sell either. They bought in way back in Sept 2017 around the 20-22p mark. I don't see them selling out down here unless it's a forced liquidation. Those of you who've read the book 'Free Capital' will know who the Swedish gentleman is. Peter Gyllenhammar is a private investor based out in Sweden who has a long track record of investing in the AIM market. He has a penchant for taking positions in tiny firms that are down in the dumps. He'll often push for change if management are not running the company in the best interests of shareholders. I've noticed he's scaled back his position a bit over the last month or two, I don't know if this is because he was pushing for change and met with resistance from management or if he is just reallocating capital. Either way it's not a huge position for him. Right, we should talk about risks. A big one is the amount of debt, despite the possibility of some loans being forgiven by the US and UK Governments there's still plenty of liabilities relative to assets. Another risk is the possibility that there are more skeletons hiding in the accounting office. It can't be ruled out. How long will it take for business to pick up? Maybe it's a long drawn out affair and TCN runs at a loss for the next few years. As well as the UK and US subsidiaries there is a Chinese joint venture to think about. Maybe it works out well but you can't rule out political risks. These could come directly from the CCP or deteriorating relations between China, the US and the UK. For me the potential rewards outweigh the risks here. The stock is sat way down in the accumulation zone, the public float is tight and shares are thinly traded. It's hard to see how business can get worse from here given the pandemic is receding and lockdowns are lifting. There's a new guy in charge and thus far he seems to be focused on fixing past problems and moving the company forward. If TCN swings to a profit or secures some big orders sentiment can quickly change. The price chart shows that the stock has sold several hundred percent higher in the past and yet here we are back down near the low again. This is exactly when I like to do my buying, as the stock languishes in the shadows and few care to pay it any mind. All that's left to do now is wait and watch. Thanks for reading, David Disclaimer: Long TCN.L

23 Comments

David

5/25/2021 11:55:07 pm

Thanks man,

Reply

mike

5/26/2021 08:07:36 am

interesting stock. difficult is the high spread of 20%+

Reply

Paul Singh

5/27/2021 09:57:30 pm

Thanks for sharing the idea. Really appreciate it.

Reply

David

5/27/2021 11:31:55 pm

Hi Paul,

Reply

Paul Singh

5/28/2021 12:24:55 am

Thank for quick reply, David. Ok I'll check with Degiro. Cheers!

Gamwah

5/28/2021 05:36:23 pm

Thanks for sharing, also helps with my own research and things to take into consideration.

Reply

P

6/1/2021 09:57:48 pm

Great find. Their Interest cover in 2019 was 5.55. This seemed high enough to reduce the risk. However, the unaudited figures released in March show an increase in current liabilities, specifically borrowings, of £1.3m. Non-current borrowings have also increased dramatically by around £3.6m. What are your thoughts on TCN repaying the debt? What options do you think they have? Thank you.

Reply

David

6/1/2021 10:28:59 pm

Debt is a concern for sure. If push comes to shove they could do an equity raise which would obviously result in some dilution, we'll have to wait and see how things go this year now the lockdowns are easing.

Reply

P

6/2/2021 09:36:29 am

Thanks David. I have noticed that in their unaudited results, a summary states, 'Successfully completed a Placing and Open Offer of new ordinary shares at 10p per share raising £1.34m (net of costs), strengthening the balance sheet and providing working capital headroom'. Therefore, dilution has already occurred. This was necessary to strengthen their balance sheet.

Reply

yas

6/3/2021 12:46:31 am

P, There has not been a dramatic increase in the number of shares prior to the recent aforementioned placing- more than a decade ago the number of shares stood at around (approx) 33,000000 so this is not a serial issuer of equity by any stretch of the imagination.

Reply

yas

6/30/2021 11:35:58 am

Poor update today - firstly the disclaimer but then I had invested on the basis of the unaudited results so assume no further skeletons notwithstanding the disclaimer today. But, more of a concern is the revelation today that further funds are necessary to bridge the gap to profitability. What we do not know is the amount required, nor the method by which funds will be secured. Debt is already a substantial burden and issuing equity here won't be ideal by any stretch of the imagination even if the amount required was modest.

Reply

P

7/21/2021 11:11:02 am

Thoughts on today’s drop?

Reply

yas

7/21/2021 12:35:18 pm

Well, they have conceded they cannot become profitable without access to more funds - the suns derived from recent grants/existing debt facilities being insufficient. In other words, they are stuck - issuing equity at this price is a bit of a non-starter. Increasing the debt facility (even if granted) simply compounds the problem (they ought to have tried to issue equity when the price was twice the current level). Anyway, they have opted for the option of putting themselves up for sale - which, against the background above, inevitably means they are not calling the shots in any negotiations. If you tell potential buyers we are stuck and likely not even a going concern absent a bid, you are hardly likely to attract great bids - the only exception to that would be if there were multiple potential bifdders and there was competitive tensions between parties. As for this blog, well, it is a bit 'promotional' for my liking. No discourtesy intended, but, from what i have seen, the author labours any investment that goes his way but then fails to mention those that go horribly wrong (as many seem to have from what I can see). It makes no difference to me since I make my own judgement and undertake my own analysis, but novice punters ought to take note. Caveat Emptor

Reply

David

7/21/2021 07:00:07 pm

Yes, the situation does not look good at present. Perhaps Gyllenhammar will try and buy them out on the cheap. We'll have to wait and see how this progresses, there's a chance they could sell off a division or their equity stake in the Chinese JV to raise some funds to keep them going but there's no doubt they are stuck in a difficult position. I am continuing to hold to see how it all plays out.

Reply

yas

7/22/2021 12:30:38 am

David,

zzz

8/21/2021 07:51:03 pm

wonder how performance would change if he wasn't pumping up illiquid microcaps on this blog. you'll notice many of them jump after being promoted here

David

8/21/2021 08:57:16 pm

zzz,

P

7/21/2021 01:03:41 pm

Thanks for responding Yas. As you can see on 1st and 2nd June 2021, I was critical about the firm, yet searching for positives.

Reply

yas

7/28/2021 08:07:08 am

Despite updating the market a week ago stating they are operating within facilities, only days later it appears things are tightening and restrictions are being imposed. Looks like it is game over, although shareholders might get left with a paltry sum from the proceeds of any sale once everything is accounted for.

Reply

P

7/28/2021 09:55:41 am

Interesting to see the update the morning. However, I’m not sure what their motivation was to publish. I can’t glean any useful info over and above their previous update.

Reply

yas

8/18/2021 11:48:24 am

So, not even the paltry sum I referred to above to be left for shareholders - they have made it fairly clear it is a wipeout for equity holders.

Reply

David

8/18/2021 05:49:35 pm

Looks like it is game over for equity holders, debt and liquidity was always a major risk here but I'm surprised management couldn't figure something out to keep the company going. My assumption that the company would survive and enter a new growth phase as they had done several times in the past proved to be wrong. In general I prefer companies with little to no debt and sufficient liquidity to see them through the bad times. This result shows me I should maintain that habit.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed