|

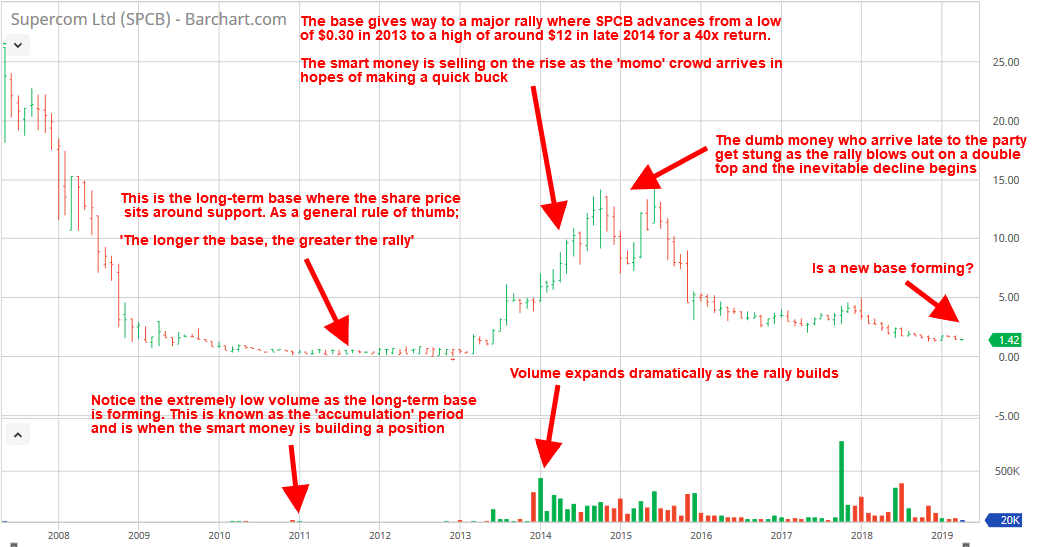

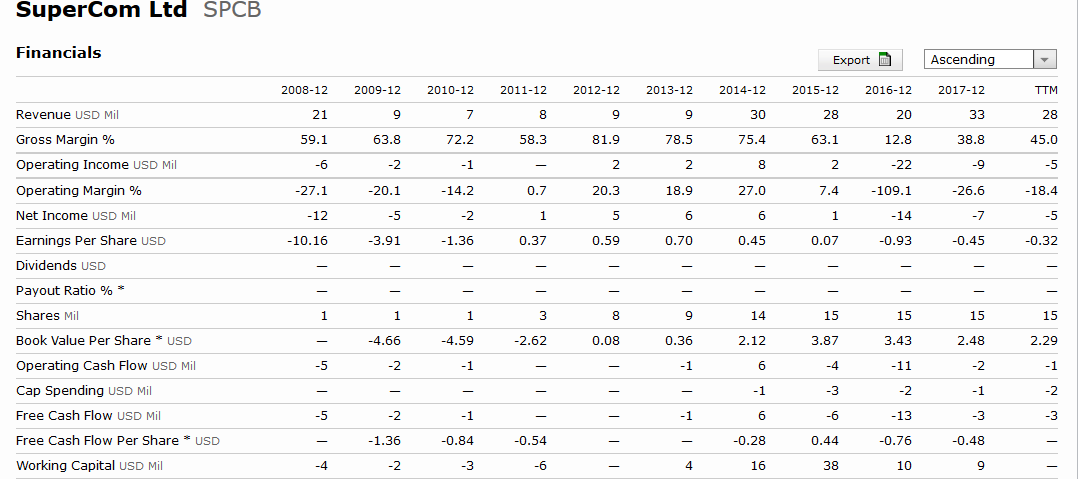

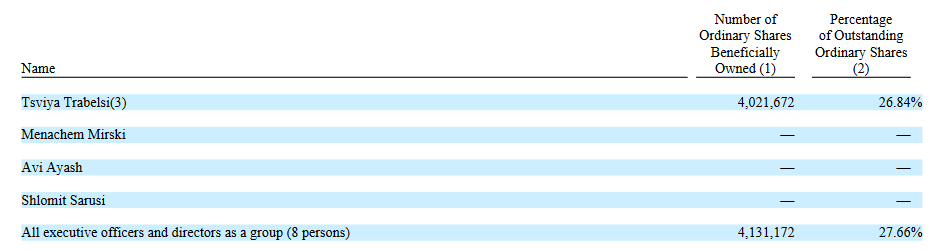

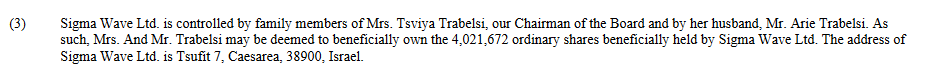

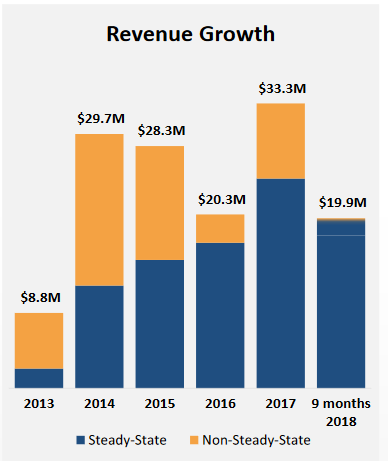

I was recently recommended the book 'Insider Buy Superstocks' authored by Jesse Stine (Thanks for the suggestion Jan!) and got a real kick out of reading it. Unlike many value investors, who only have eyes for the numbers, I am very interested in looking at charts in order to uncover potential investment opportunities. I decided to see if I could find some 'superstocks' candidates by following Jesse's advice. This is how I came across Supercom Ltd (SPCB) SPCB is an Israeli based nano-cap technology company which floats on the NASDAQ. The firm provides governments and other public/private clients with various services including digital identity solutions, tracking and security products. Here's some vital statistics; Market Cap = $21.24 Mil Price per share = $1.42 Shares outstanding = 14.958 Mil Insider ownership = 27% P/B = 0.62 P/S = 0.77 P/E = Currently loss making D/E = 0.15 Current ratio = 2.44 SPCB doesn't fulfill all the criteria which Jesse outlines in his book but ticks enough boxes to warrant taking a closer look. First I'll show you the charts As you can see from the charts, SPCB has sold for a much higher price in the past. The company has been around since 1988 and doesn't look like it will be going out of business any time soon. Prior to the current CEO taking over in 2010 SPCB had fallen on hard times and ended up trading on the OTCBB market after the 2008 financial crisis. In August 2013 the company enacted a 1-4.25 reverse stock split and returned to the NASDAQ. Several years of profitability followed until 2016 when losses returned. Why the decline in share price over the last few years? The company's revenues and earnings have historically been quite lumpy with periods of profitabilty giving way to loss-making years. A few things I notice. a) We've had a large rise in shares outstanding in the past but the figure has stabilized over the last few years. b) Revenues and earnings have been lumpy over the past decade and dropped significantly in the last financial crisis. This is partly due to cyclical pressure effecting SPCB's client base and the fact that varying contract cycles result in fluctuating figures from year to year. c) Whilst SPCB is currently loss-making these losses have begun to narrow over the last few years. Now to the most interesting part of the story. Firstly, SPCB is somewhat of a family affair. Arie Trabelsi - President and CEO (Joined in 2010) Tsviya Trabelsi - Chairman of the board (A. Trabelsi's wife) Barak Trabelsi - EVP and GM (A. Trabelsi's son) Ordan Trabelsi - President of Americas (A. Trabelsi's son) The most recent Annual report reveals the following; So as of May 2018 the Trabelsi family owned around 27% of the company through Sigma Wave Ltd Then in August 2018 a company press release revealed that; "CEO, Arie Trabelsi, has notified the Company that he has initiated a program to purchase up to One Million of the company's ordinary shares on the open market." "I believe the SPCB current stock price levels do not reflect the high intrinsic value of the company. This program provides me the ability to opportunistically acquire SuperCom shares and underscores my ongoing belief in the Company" - Arie Trabelsi Fast forward to November 2018 and we get another company press release which reveals; "Arie Trabelsi, has notified the Company that he has purchased 365,000 of SuperCom ordinary shares in the open market under his personal purchase program and plans to continue to purchase through this program." Then in December 2018 we get yet another update which reveals; "SuperCom President and CEO Arie Trabelsi has notified the Company that he has expanded his personal share purchase program from 1 million to 2 million shares. To date, he has purchased 596,000 SuperCom ordinary shares in the open market through this program, and he plans to continue to purchase shares through this program." "SuperCom is executing against its business plan, and the Company's operations and capital structure are aligned to drive strong earnings growth going forward," commented Mr. Arie Trabelsi, President and CEO of SuperCom. "I see inherent, unrealized value in the Company, well above current stock trading levels, and I plan to continue to acquire shares going forward. My belief in the Company and in its prospects remains undiminished." - Arie Trabelsi It seems Mr Trabelsi is pretty bullish on SPCB's prospects and thinks the shares are undervalued. He's expanded his personal share purchase program from 1-2 million and has already bought back 596,000 shares. As noted earlier SPCB is still loss-making but these losses are narrowing and there have been some positive developments with the business. The firm has been increasing steady-state revenue as a proportion of total revenues. This should somewhat reduce the volatilty in future revenues and earnings. The most recent results for 3rdQ 2018 were a mixed bag;

Nine Months Ended September 30, 2018 Financial Highlights (Compared to the Prior Year Period)

After reading through the accompanying conference call transcript I found the following; "Revenues are at $6.1 million this quarter, down year-over-year. But this is mainly attributed to minimal e-Gov project deployment revenues this quarter, which were meaningful in 2017, contributing about $8 million for 2017 annual revenues. e-Gov's project revenues can be lumpy. And over the past four years, have range between $3 million to close to $20 million annually based on the progress of the projects being deployed that year. Given our sound track record in this niche industry, successfully deploying large scale EIG projects the national governments around the world, our technology and our pipeline, we expect more wins and increases in e-Gov project revenues from 2018 levels." "As the revenues from each of our business segments grow, we expect gross margins to grow as well, leveraging the fixed costs, which make up part of our cog (cost of goods) such as 24/7 maintenance and tech support. Furthermore, our team of outstanding employees around the world, have been working exceptionally hard this year to tighten manage cost, unleash operational synergies and cutout redundancy. And this is a significantly improved operating structure we've reached in this quarter." "Non-GAAP gross margin was high as 59%, and sequential and year-over-year quarterly improvements to non-GAAP core operating expenses reaching a low of $2.5 million this quarter, a 41% improvement or $4.2 million in the previous year period. We are seeing sequential and year-over-year improvement to EBITDA margins as well reaching a highest 30% this quarter. We haven't seen this kind of numbers at SuperCom in years, they resemble, the lean operating structure of 2015 before acquiring five additional companies, most of which were out of bankruptcy." So the long and short of it is that revenues have fallen due to the lumpy nature of the e-Gov contracts and should improve over the coming year. The company's cost-cutting program appears to be going well which is improving margins. Management expects margins to grow as revenues increase due to operating leverage. Here's what I think, I'm interested enough to write SPCB up and put it on my watchlist but I'm not buying at this point. I like the following;

I don't like the following;

For now I'm going to wait and watch. If the CEO keeps buying and the next earnings report is half decent it will be worth taking a closer look at the short-term chart. Without the formation of a long-term base it's difficult to envisage any kind of significant rally occuring but that doesn't mean it can't happen. If volume spikes on a positive earnings report and SPCB moves above it's magic line the stock could start to run. If the earnings are so-so or disappointing then the stock could fall below it's current support of $1.25 or just tread water. Either way I'll be watching. Thanks for reading, David

5 Comments

me

4/26/2019 05:38:20 pm

I wouldn't touch it since they are not paying their employees.

Reply

David

4/26/2019 05:44:58 pm

Hi, thanks for the info.

Reply

Jonathan

8/20/2019 11:17:12 pm

Hello David,

Reply

David

8/21/2019 08:35:42 pm

Hi Johnathan,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed