|

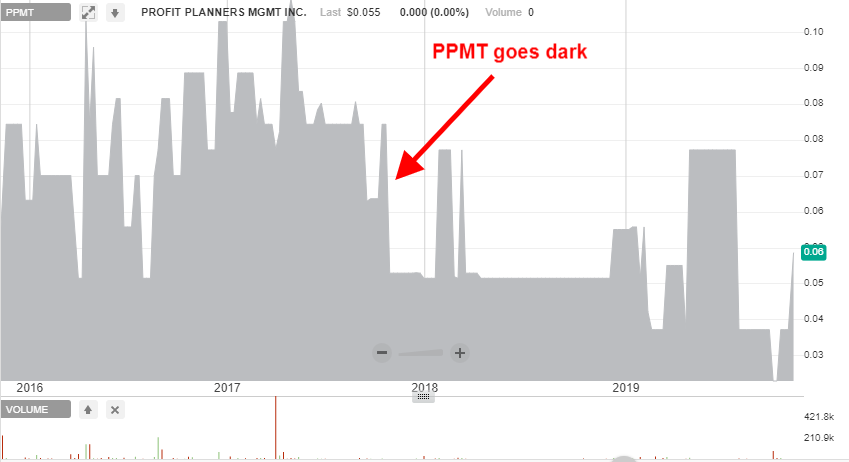

Profit Planners Management Inc (PPMT) ticks all the boxes to be included in my basket of stocks. It's dark, illiquid, minuscule and has plenty of hair on it. We'll start with a few numbers and a quick description. Market Cap = $355k Share price = $0.055 Spread = 65% Common = 6,468,393 PPMT is a business consultancy and advisory firm which provides its clients with services including SEC consulting, CFO and accounting services, CPA services and business & tax services. I came across the company shortly after they had filed a form 15 and gone dark back in August 2017. At that time the stock was trading around $0.08, after the announcement it dropped to around $0.05 and has been there or thereabouts ever since. The last available financials for PPMT is the Q3 2017 10-Q from Feb 2017. They reveal both the bad and good. BV = -$425k Total Assets =$564k Cash = $386k Total Debt = $999k No warrants or pref's A big chunk of the debt, around $633k, was accrued officer's compensation (the CEO). Negative BV is never appealing but, in my opinion, it's better to have the debt owed to company officers than to the bank. If the bank calls in the debt it must be paid but the compensation can be put off till things improve. Once the officer's compensation is backed out the cash covers the payables. Now to the good, For Q3 2017 PPMT earned rev of $476k and net income of $68k For the 9 months of 2017 rev's were $1 mil and net profit was around $111k That's around $0.02 per share on a $0.055 stock for a P/E of 2.75 Here's the rev's and profits/losses for the previous few years; 2016 = $1.3 Mil/$129k ($0.02 per share) 2015 = $813k/-$291k 2014 = $703k/-$415k BV for the same period; 2016 = -$536k 2015 = -$665k 2014 = -$379k Whilst I can't say for sure I'm guessing that PPMT will still be profitable given it no longer has the burden of registration and filing costs. It has also got some NOL carry-forwards to offset taxes for a few years. Now we'll look at the hair on this thing. Whilst the firm is based in NY it's incorporated in NV. For those of you that don't know, corporate law in NV is not shareholder friendly which makes it easy for management to screw over minority holders. As a general rule , if you see a firm reincorporate to NV sell your stock as you are likely to get screwed. To compound the problem there is only one director on the board, can you guess who it is? Yep, it's the CEO and he owns 56% of the common. This means he can basically treat the company like his own little fiefdom, he's got majority voting rights , no one else on the board to challenge him, and no reason to put out financials unless forced to do so. For the past few years he's been paying himself around $286k, a truly egregious salary when one considers what the firm has been earning in that time. So, why am I telling about this piece of junk? A few reasons really. a) The likelihood of the firm trading at a super low P/E is appealing. b) De-registering will have lowered the firm's costs. c) I like to buy at the point of maximum pessimism. the long-range chart tells me most other investors have probably thrown in the towel with this one. Ted Warren fans will notice that PPMT has been building a long term base for the last few years, this is what he called the 'accumulation period'. This is exactly when I like to buy.

You'll also notice this stock has been down here before, back in 2011 it was trading at around $0.07 per share. Maybe some positive news will emerge to send the stock upward again. You never know what it might be with these tiny companies. Maybe they start filing again, maybe they pay a special dividend or do a tender offer. Perhaps they get bought out or an activist comes in to shake up the company. I like to buy here when the stock is sat around support and is building a base. You can see that the volume has dropped off and most investors have probably given up on the company by now. Things don't look good but yet the stock hasn't gone to zero, all it takes is some good news and the negative sentiment toward the company can start to change. There's no guarantee that things will improve though, maybe the firm remains dark and the CEO continues to run the company for his own benefit alone. Maybe this one ends up rotting in my portfolio. This is why I buy a basket of this stuff, over time I think the winners will make up for the losers , I just don't know which ones will run up and which ones will languish and die. I try and buy at the point of maximum pessimism guided by the long-range chart, ideally at a discount to tangible assets or at a low single digit P/E. Then it's just a question of patience. Thanks for reading, David. Long PPMT

3 Comments

G

11/11/2019 04:57:58 am

Nice one. All your picks make me dry retch just a little - that means you're onto something ;-).

Reply

mike

3/21/2020 07:07:39 pm

Is this a dark company now or do you still get financial statements?

Reply

David

3/21/2020 08:55:49 pm

Hi Mike,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed