|

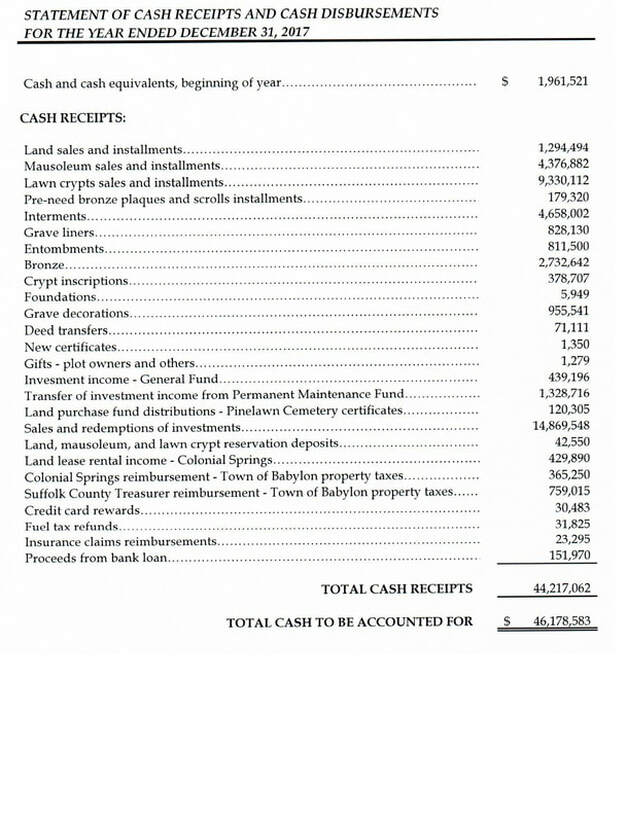

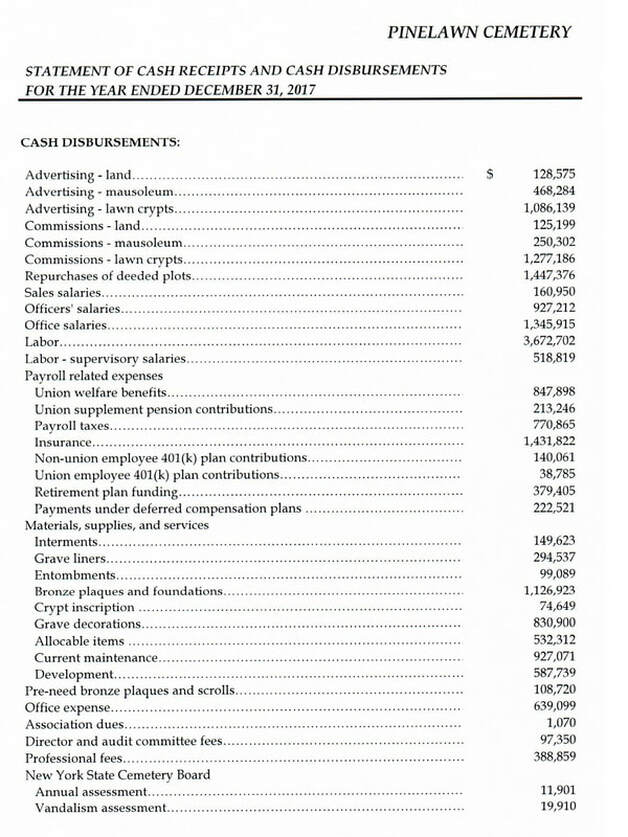

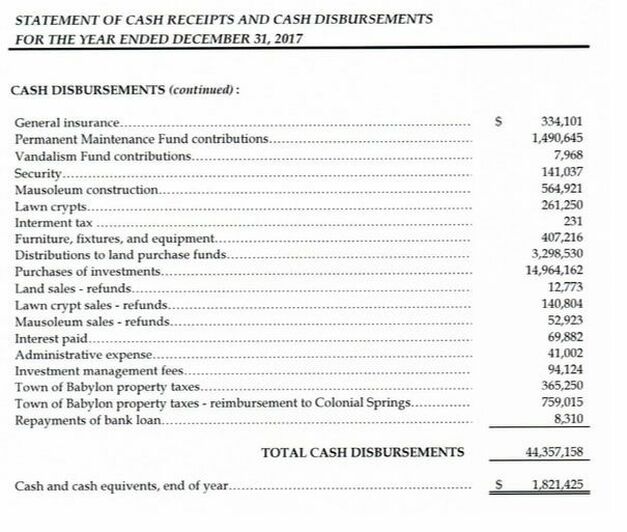

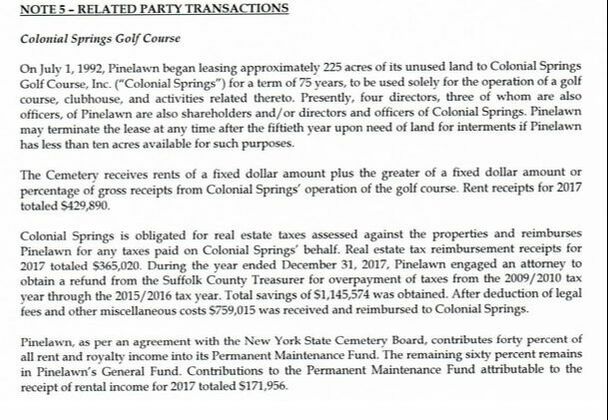

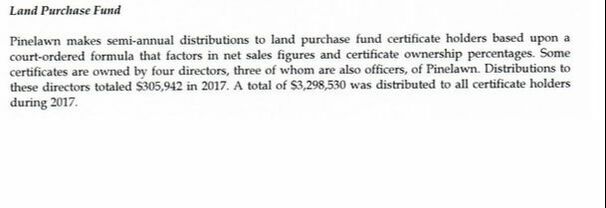

Hi there, In this post I'm going to return to a stock I've written about in the past. My first post on Pinelawn Cemetery (PLWN) was written back in August of last year and it can be found here. At that time I didn't have any financial statements so I was just making an assessment based upon what little information I had managed to cobble together. Recently a gentleman with many years experience as an investment professional reached out and provided me with a copy of PLWN's financials for the 2017 Financial year (Thanks Ron!). PLWN's method of accounting is on a cash basis rather than the GAAP method since it is organized as a not-for-profit corporation with it's books and accounts being based upon the principles of fund accounting. The following statements include only the activity (cash receipts and disbursements) and cash & equivalents balances of the general fund. Investments, property & equipment, other assets and liabiities are not recognized, nor is there any information on the Permanent Mantenance Fund, Perpetual Care Fund and Vandalism Fund. Let's have a look and see what we can find out. The above statements show that PLWN began 2017 with $1,961,521 and ended the year with $1,821,425 with cash disbursements exceeding cash receipts for the year. It also shows that PLWN is receiving rental income, $429,890 in 2017, on land it is leasing out. The concern with a stock like PLWN is that the cemetery runs out of land to sell for new plots and the dividends dry up, the fact that it is leasing out land suggests it has quite a lot of spare capacity left. The footnotes provide more interesting information on this issue; We now know that PLWN owns a tract of land covering around 840 acres and that it has leased out around 225 acres to a near by golf club for a term of 75 years, with the option to terminate the lease after the 50th year if PLWN has less than 10 acres available for internment of the deceased. Whilst we don't know the exact amount of land PLWN has filled thus far it seems reasonable to assume it has plenty of space left given that the company chose to lease out nearly a quarter of its land for a long term lease. Next I wanted to find out how many shares are outstanding. Whilst no figure is explicitly stated in the financial statements I found the following in the footnotes; As I understand it dividends appear to be paid semi-annually from the land purchase fund to the fund certificate owners which include four directors.

We now know that a total of $3,298,530 was distributed in 2017 and I will assume that the same figure of $26 which was paid out in dividends per share in 2018 was done so in the previous year. $3,298,530 / 26 = 126,866 shares outstanding At a current price per share of $235 PLWN's current market cap = $29,813,510 With a current dividend of $26 per share PLWN is yielding around 11%. Not a bad ROI considering the lack of interesting investment opportunities in the wider markets at present. Thanks for reading, David

15 Comments

10/21/2019 11:48:14 pm

David,

Reply

David

10/23/2019 07:49:30 pm

Hi Trey,

Reply

mike

10/31/2019 10:02:28 pm

I only found a dividend history for 2 years. I am wondering if this company paid dividends before 2018. Why did they even start paying a dividend? It's difficult to evaluate.

Reply

10/31/2019 11:24:38 pm

They have been paying dividends for near 100 years, and are doing so based on a court ordered formula.

Reply

David

11/3/2019 08:48:02 am

Hi Trey,

Ryan

11/17/2019 02:49:50 am

Trey,

Ryan

11/17/2019 02:33:28 am

About 5-6 years ago, I had tried to get financials on Pinelawn from an old lady that worked at the cemetery and handled the accounting. She refused to give me any detail and put me in touch with their attorney, who also said, since ownership of the security was technically purchase money debt owed by a non-profit company, I was unable to look at any records. He said the NY corporation code did not apply in this case.. I sort of left it at that. I am impressed you were able to obtain these financials! Do you know how these were obtained by your friend Ron?

Reply

david flood

11/17/2019 11:09:45 am

Hi Ryan,

Reply

david flood

11/17/2019 11:14:56 am

Hi Ryan,

Reply

David

12/26/2019 07:08:41 pm

Did you ever pull the financials from NYSD website? They were more like tax returns than the posted financials. Do you have a copy of the financials you posted that you can send along?

Reply

David

12/26/2019 10:34:43 pm

Hi Dave,

Reply

EHS

2/19/2020 02:56:25 pm

Thanks for the write-up.

Reply

Greg Z

8/7/2022 07:07:18 am

Here I found a Pinelawn request including 2019 annual financial report.

Reply

David

8/7/2022 09:10:20 pm

Hi Greg, if you are outside of the US you can open an account with the Canadian broker Questrade and trade Expert/Grey market stocks. If you are in the US you'll have to find a specialist brokers but they typically require one to be a Accredited Investor/High net worth Individual.

Reply

Greg Z

8/7/2022 09:26:23 pm

Good stuff, thank you! I'm in the EU, will take a look at Questrade. I've been using Firstrade for US stocks and happy with it for the most part except the OTC limitations. Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed