|

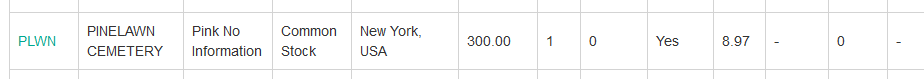

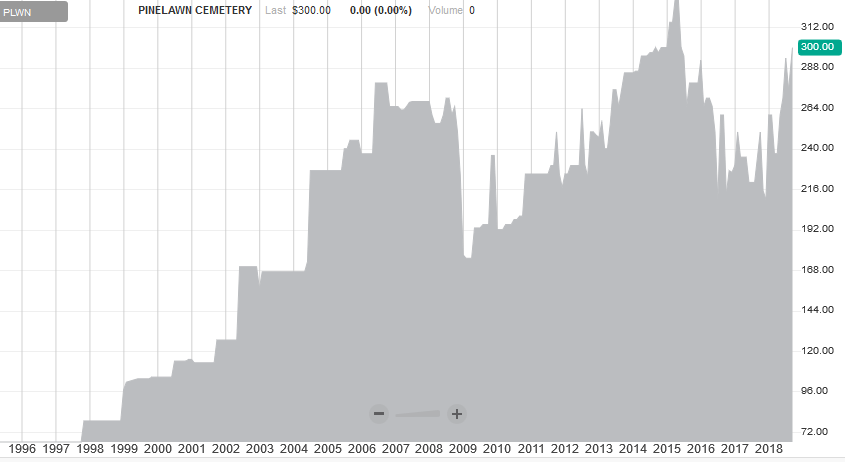

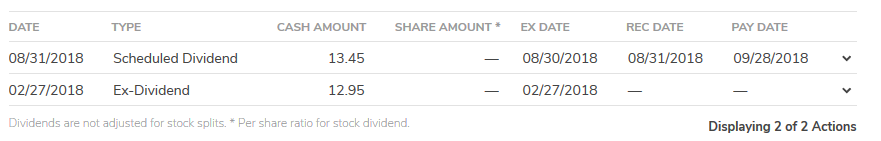

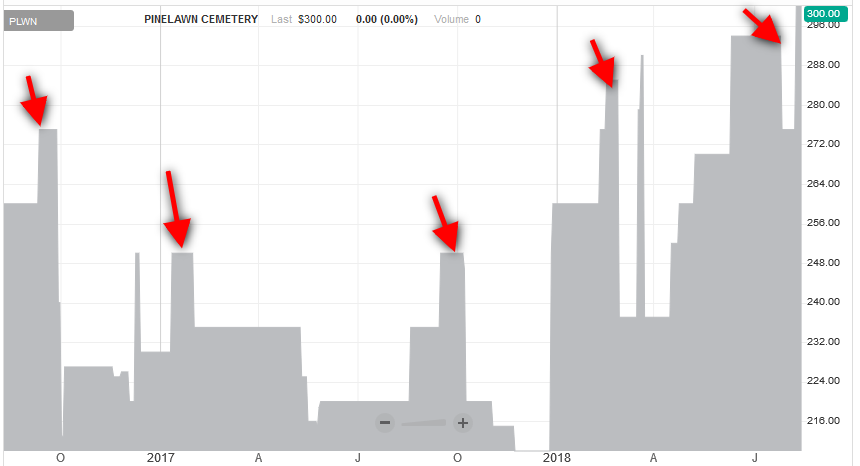

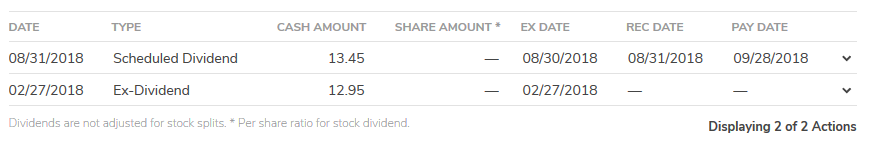

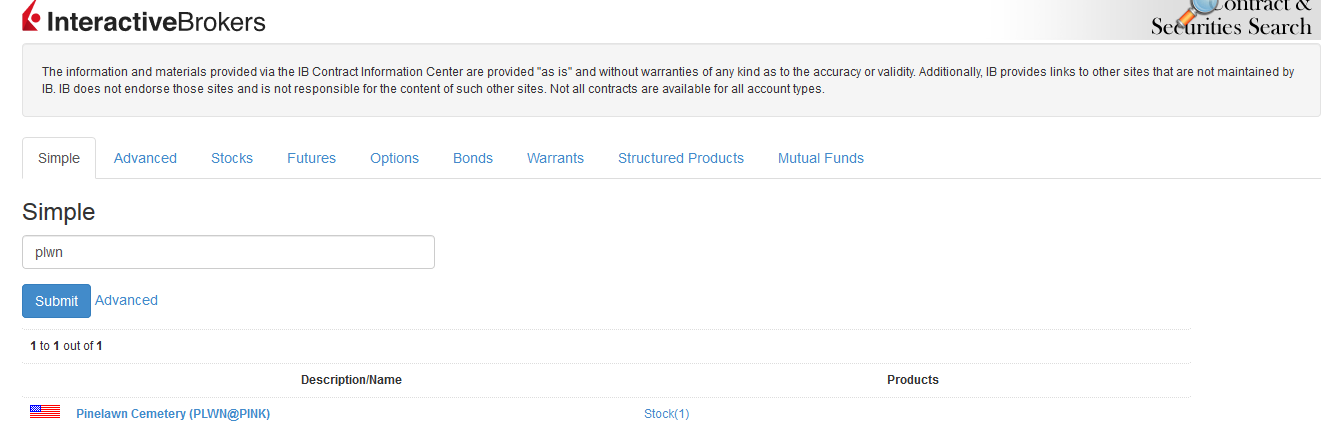

I have been following the work of Dan at nonamestocks.com with great interest over recent months. He focuses his attention on looking at micro/nano caps, OTC, dark and grey stocks in order to fish where there is the least amount of competition and to try and maximize his ROI. This approach seems well reasoned to me and Buffett/Greenblatt/Munger have all suggested individual investors managing relatively small amounts of money should pursue this course in order to uncover the most compelling investment opportunities and minimize their competition. With this inspiration in mind I have been trawling through the OTC markets on the hunt for potential investment opportunities. I came across PLWN by using the OTC markets screener to try and see if I could find anything of interest. This screener does not have all the ususal price and value metrics that most screeners have so you have to get creative with it. I hit upon the idea of omitting all the OTCQX and OTCQB stocks and all Pinksheets with current information to remove stocks which might show up else where (minimize the competition!). This left me with the Pink sheets with limited or no information and Grey market stocks. In number terms this works out at 9591 stocks to look through! I then decided to use the price function to rank these stocks by price per share to find the highest priced stocks, I figured the highest priced shares would be even more illiquid and even less likely to attract any interest. Whilst scrolling through the list I was looking out for a few things, dividend yields, boring names (As Peter Lynch suggests) and volume traded. On page 6 Pinelawn Cemetery (PLWN) caught my eye. As the old saying goes 'There are only two things certain in life, death and taxes'. At this point I had two thoughts, a) people keep dying no matter what the economy does and b) people are probably pretty adverse to owning shares in the cemetery business. The next thing I noticed was that the stock was listed as having an 8.97% dividend yield, Okay now I'm interested! I then looked to see what the share price is, $300 per share with a daily volume of 1! I then decided to pull up the quote page for the stock to see what else I can find out. As I expected their is very little information to be found and the OTC market is classing this stock as 'Pink No Information' and 'Dark or Defunct'. What I did notice is that the stock has a 52 week price range of $210-300 and that the daily volume could be 0 for a week or two and then have a day where 10-40 shares were traded. I also noticed that dividends are listed as $26.90 per share for a 8.97% yield on $300. Next I decided to play around with the chart functions on the overview page to see if I could find anything else out. It appears that the stock began to be actively traded back in 1997-98. Between then and now the stock price has ranged from $66 to $330 with volume ranging from 0 to 2.4k. As you can see it appears that dividends are paid bi-annually around March and September and that they look to be increasing. At this point I wondered if trading volume and price were tied to these dividend payment dates. I went back to the chart and narrowed in on the last few years to see if my suspicions could be confirmed. Sure enough I spotted the pattern, the stock price rises in the preceding months of the dividends being paid. Some selling occurs post ex-dividend date and further selling occurs when the dividend has been paid. At this point I'm thinking two things; a) if you wait for the sell off after the next dividend payment you can hopefully pick up some shares at a lower price with a higher dividend yield (Asssuming you can actually find a way to buy them!) and then benefit from both capital appreciation in the stock and the higher dividend yield. b) What if you just hold this stock indefinitely and keep collecting the dividends? Assuming that the share price drops to its 52 week low of $210 and the dividend per share stays at $23.90, what yield would that work out at? 23.90/210 x 100 = 11.38% So the posiibility exists to earn 11+% in dividends and $90 in capital appreciation on the stock if this scenario plays out. That would mean you could potentially make around $114 on a $210 investment in a year, that would be about 54% ROI. The next question I'm thinking is are the dividends growing year on year? At this point I'm not sure as I have no way of finding out since there is virtually no public information available on the company but looking at the rise in stock price from around $66 back in the late 1990s till now and the fact that the dividends in the chart below differ from one another by $0.5 leads me to suspect that they are rising. So assuming that dividends are growing by $0.5 per year would get you to around 2% growth per year. A growth rate of 2% wouldn't be great considering long-term inflation runs at around 3% but then why would the share price rise over the years if dividend growth wasn't outpacing inflation?, one could argue it has over the last decade given we've been in a deflationary enviroment with absurdly low interest rates. At this point my investigation comes to a halt as my crappy discount broker doesn't provide coverage of this stock and I suspect many of the larger firms don't either. After looking around it looks as though Interactive Brokers may cover the stock since it seems to be showing up on their contract and securities search function. Assuming one could obtain a share/s it might then be possible to write and request some financial documents to find out more information. For now I'll leave it there and if anyone has any comments, ideas, leads or criticisms of my thesis please let me know. I'm always looking to learn more about Investing. Thanks for reading, David

5 Comments

growthInvestor

12/10/2019 06:56:48 am

Hi David.

Reply

David

12/12/2019 07:53:56 pm

Hi there,

Reply

James

5/3/2021 02:33:14 am

David, thank you for the write up. Did you ever get the financials on this company?

Reply

David

5/8/2021 10:25:24 pm

Hi James,

Reply

whitney

8/12/2022 11:55:37 am

PINELAWN CEMETERY – MAKING A FORTUNE FROM “LAND SHARE CERTIFICATES”

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed