|

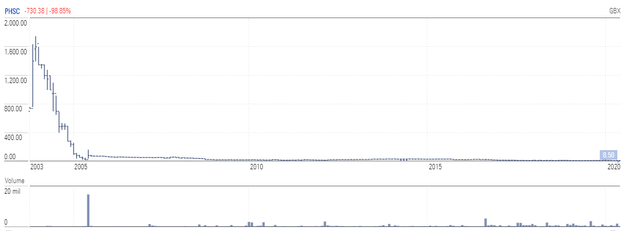

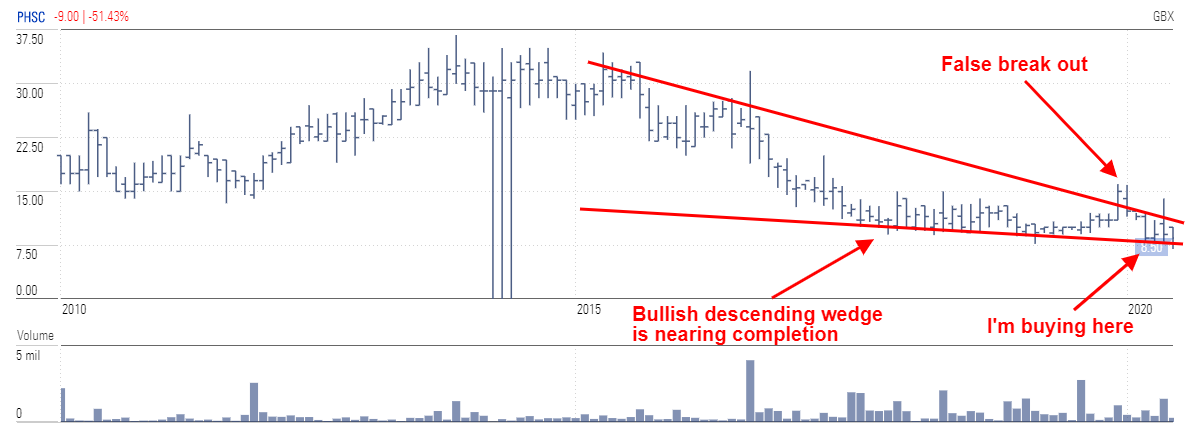

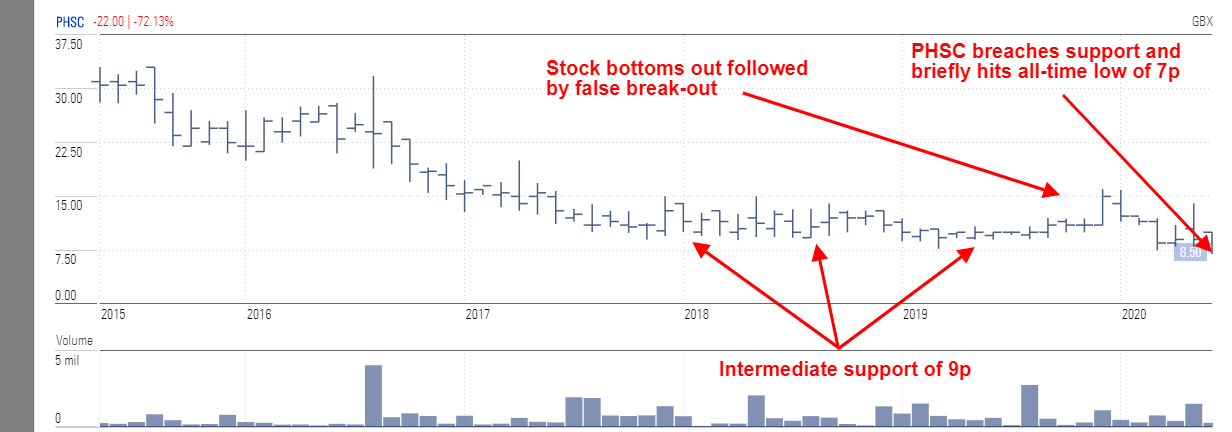

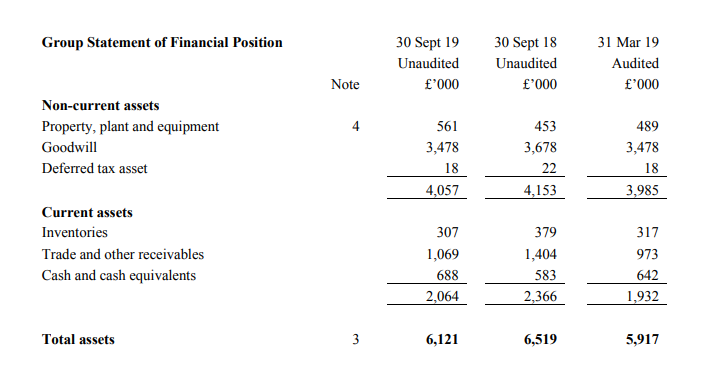

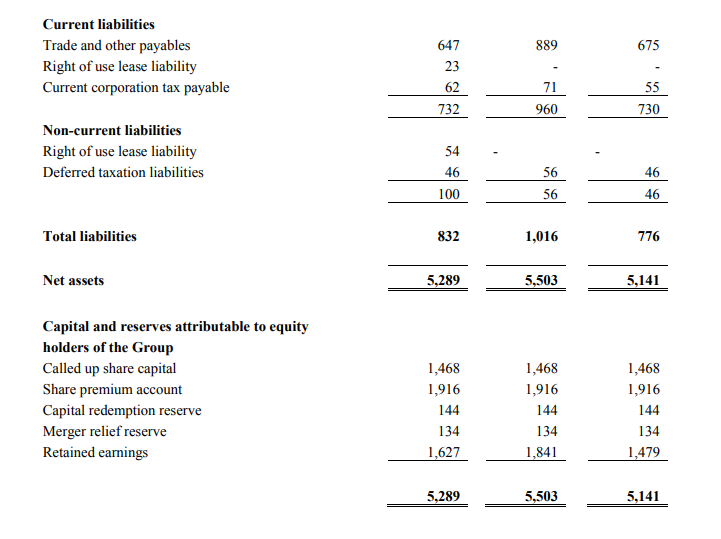

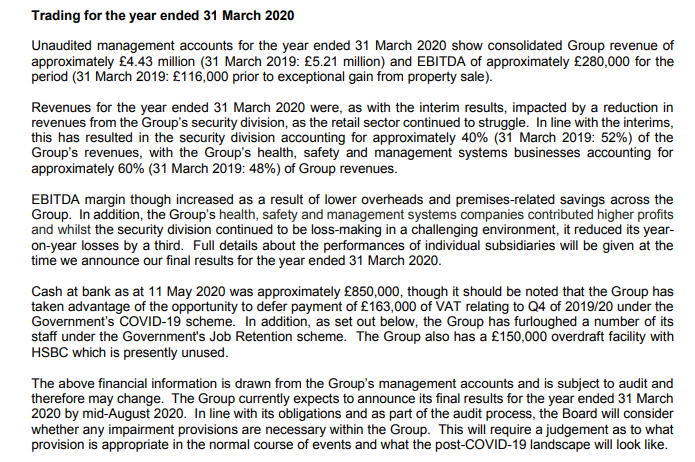

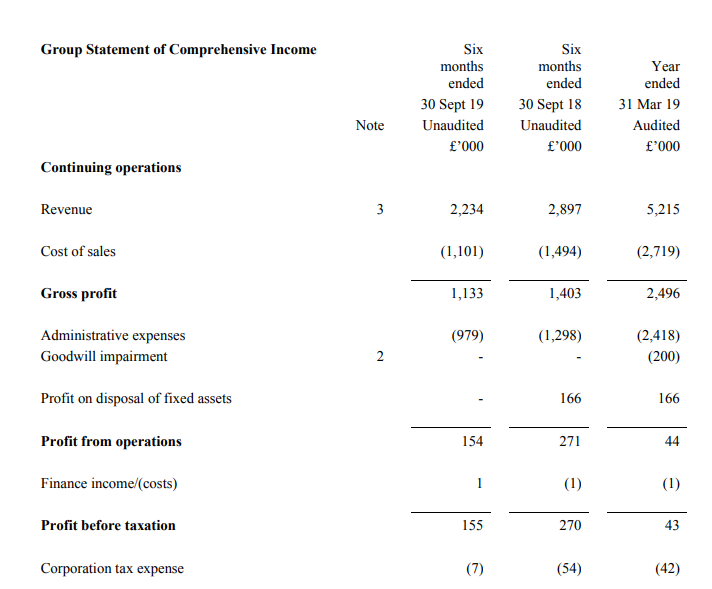

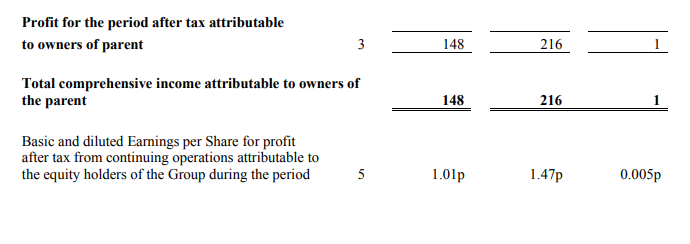

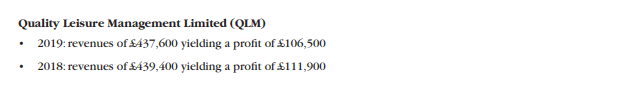

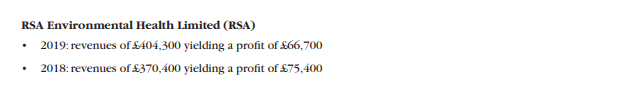

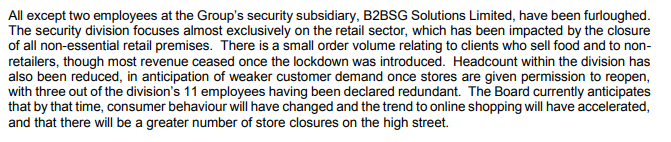

PHSC plc (PHSC) is a £1.25 Mil market cap firm trading on the AIM market of the LSE. It has current assets and PPE of £1.79 Mil net of Total Liabilities. At this price you get the operating businesses for free. PHSC is a holding company which was founded in 1990, it owns several subsidiaries which are engaged in the business of health & safety consulting and training. Here's a brief bio; "PHSC Plc operates through its subsidiaries, which provides a range of health, safety, hygiene, environmental and quality systems consultancy and training services to organizations across the United Kingdom. It operates through the following segments: Health and Safety Division, ISL, PHSCL< QLM and RSA. The company was founded by Nicola C. Coote and Stephen A. King in 1990 and is headquartered in Kent, the United Kingdom." Here's a few numbers; Market Cap = £1.25 Mil Share price = 8.50p Common = 14,677,257 (No prefs,options or warrants) Float = 8.32 Mil Spread = 11.11% Div yield = 11.76% If you've read my blog before you already know what the long-range chart is going to look like. Absolute carnage. Down 98.85% from the IPO price of £6.98 in Nov 2003 to it's current price of 8.5p just above it's all-time low of 7p. With a chart like that you could be fooled for thinking you are looking at a Congolese iron ore stock. Lets zoom in a bit. On the 10 year chart PHSC is down by 51% but has been forming a bullish descending wedge. In 2019 the stock bottomed out and then a false break-out came in late Dec/early Jan. This rise didn't hold and the stock dropped again as the pandemic hit and lock-downs came into force. At this point I started buying. On the 5 year chart you can see PHSC has been trapped in a narrow channel throughout 2018-2019 between intermediate support of 9p and resistance of around 12-13p. After the false break-out support was breached as PHSC dropped and hit an all-time low of 7p before a quick correction to 8.5p. Right, lets look at the balance sheet; The latest report, the FY 2020 interim, shows the following; BV = £5.289 Mil Current Assets = £2.064 Mil Cash = £688k PPE= £561k Total Liabilities = £832k Since then PHSC has put out a trading statement in relation to the pandemic which includes some limited unaudited financials for FY2020; Netting out the deferred VAT tax payment of the £850k in cash gets us back to £687k, around the same figure we find on the interim balance sheet. The cash covers the lion's share of the liabilities and at the current price PHSC is only trading at around £20k above NCAV. Add in the PPE and you are getting the operating businesses for free. I don't know about you but I'm happy to pay £1.25 Mil for £1.79 Mil in current assets and PPE net of all liabilities. I'm not much of a fan of goodwill and intangibles so I rarely apportion any value to them when looking at the assets. Goodwill can vanish in an instant if an acquisition turns out to be a dud and write-downs occur, better to buy at a discount to tangible assets. On to the income statement; Half year revenue was £2.2 Mil down by around £650k on last year's comp of £2.9 Mil. Half year net profit came in at £148k vs 216k for last year's comp. The May 2020 trading update completes the year with full annual revenue coming in £4.43 Mil and EBITDA of £280k. Time will tell what net income comes in at, could be negative if more write-downs occur. You'll see PHSC just broke even in FY2019 and take a look at column 5, there's an example of that goodwill impairment I mentioned earlier. PHSC wrote off an asbestos consultancy subsidiary, Adamson’s Laboratory Services Limited. The write-off was tempered by the fact that PHSC made a gain on a sale of the Adamson's owned property. Here's rev's and net profits/losses for the last several years; 2019 = £5.22 Mil / £1k 2018 = £7 Mil / -£166k 2017 =£7.16 Mil / -£691k 2016 = £7 Mil / -£414k 2015 = £7.73 Mil / £349k 2014 = £7.59 Mil / £494k 2013 = £5.79 Mil / £382k 2012 = £4.43 Mil / £299k As you can see, some years PHSC turns a profit, others it bleeds red. Retained earnings currently stand at £1.63 Mil so things haven't been all bad in recent years. Things get a bit more interesting when we start digging into the subsidiaries; Can you spot the odd one out? Every subsidiary has been turning a profit for the last few years apart from the security division, B2BSG, which has been running at a loss. Let's do a thought experiment. Imagine B2BSG doesn't exist. How would FY2019 have looked? The trading update says B2BSG accounted for 52% of revenues so lets scrub that off. 2019 annual revenue goes from £5.22 Mil to £2.5 Mil but net profit jumps from £1k to £138k Good things could also happen with the stock if management was able to turn things around at B2BSG and get it to break even. Judging by the numbers and the most recent trading update I think the B2BSG will either get written off, sold or continue to become a smaller part of the group's revenues and earnings; The thing I'm most excited about is the health & safety subsidiaries. As the lock-down continues to be lifted and businesses start to open up there's a good chance PHSC will start to get orders from firms looking to implement government guidance and avoid the risk of legal action if they haven't walked the legal line. Revenues and earnings may be depressed for a year or two as a recession is upon us but longer term I think there's a decent chance the order book grows. If you look back on the chart you'll see PHSC was selling in the low 30's between late 2013-early 2015. If it can get back to £150-200k in annual net income I can see it climbing to the low 20's. Now to the ownership; The co-founders Stephen King and Nicola Coote own 43.15% of the common between them so there's a real incentive for them to make the company succeed. The down-side is that the heavy insider ownership limits the likelihood of shareholder activism or buyouts.

At present the parent firm is spitting out around £147k in dividends a year, an 8.5p share price gets you a 11.76% yield. The firm has been paying out 1p per share for a good few years now and paid an interim dividend of 0.5p in Feb 2020. I don't see the dividend policy changing any time soon but who knows, if the recession bites hard enough they could cut it. Well, I'll sum up my thesis here. PHSC is selling at a clip above NCAV and at this price you get the operating businesses for free. The security division is a drag on performance but maybe this changes in the coming years. There's a good chance the health & safety order book grows and management have significant skin in the game. From a charting point of view a bullish descending wedge is nearing completion, the false break-out and the new all-time low will have also induced further selling from despondent holders. As Ted Warren noted; "There is no better proof that a stock will go up, than when it acts as if it can't." Risks abound though. There's £3.48 Mil of Goodwill on the books, who knows how much of that could end up as thin air. The security division looks decidedly moribund so revenues and earnings could decline further if the other subsidiaries don't see their order books rise. The chart looks right to me but further false break-outs can't be ruled out. Maybe PHSC remains trapped in a narrow channel bouncing between support and resistance for the next few years. You can never be sure. To me it's a bet worth taking, tangible assets selling a discount and the operating biz for free. I'm in. David Disclaimer: Long PHSC

15 Comments

Can Baran

6/28/2020 06:29:33 pm

Greetings,

Reply

David

6/28/2020 08:01:38 pm

Hi Can,

Reply

David

6/28/2020 08:04:06 pm

1) Finding companies with moats is not my thing, I just look at the long-range price chart and balance sheet and buy if it looks right to me.

Reply

David

6/28/2020 08:07:38 pm

Hi Can,

Reply

Håkan Liljeqvist

6/28/2020 08:50:27 pm

Very interesting! Curious. How big position of your portfolio do you give a bet like this? Asking because I am thinking a lot about how I should allocate my capital.

Reply

David

6/28/2020 09:08:29 pm

Hi Håkan,

Reply

Alex

6/29/2020 03:37:11 pm

Love the Post!

Reply

mike

6/30/2020 06:52:15 pm

I think that the amount of stocks below NCAV compared to the amount of all listed stocks indicates how cheap a stock market is. This is then usually a buying opportunity.

Reply

David

7/3/2020 06:36:08 pm

Hi Alex,

Reply

Alex

7/4/2020 06:09:55 pm

Thanks for the Reply!

Joe

7/8/2020 12:16:31 pm

Hi David

Reply

David

7/8/2020 06:33:22 pm

Hi Joe,

Reply

MARK

8/5/2020 07:59:08 pm

Hey David, TD Ameritrade doesn't have this stock available...any recommendations on brokers who offer non-US stocks?

Reply

David

8/8/2020 12:08:24 pm

Hi Mark,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed