|

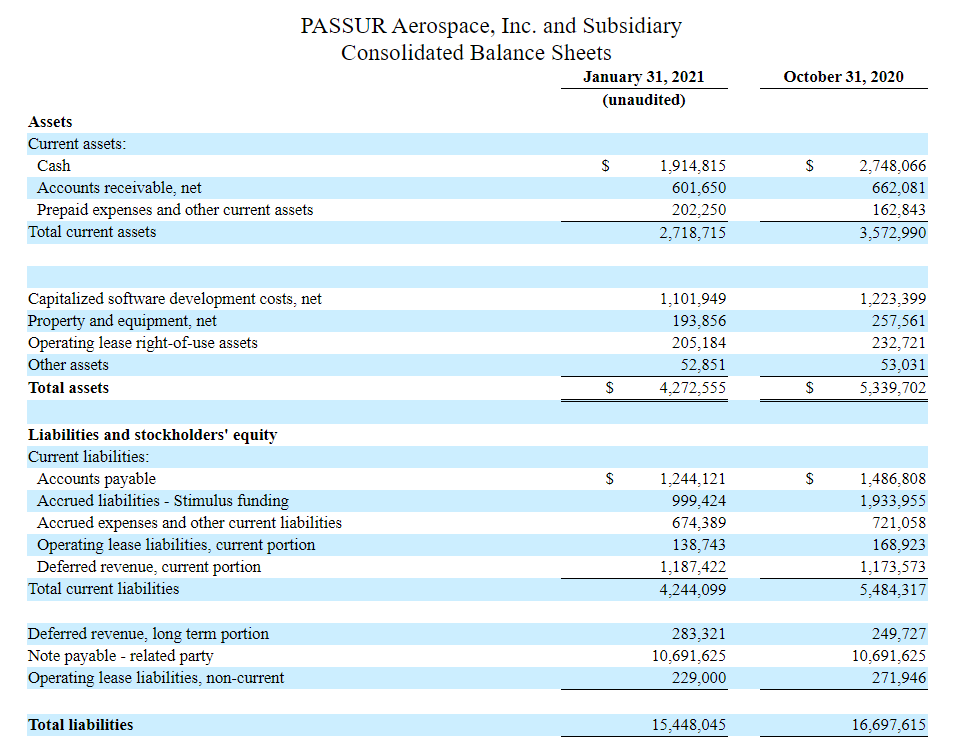

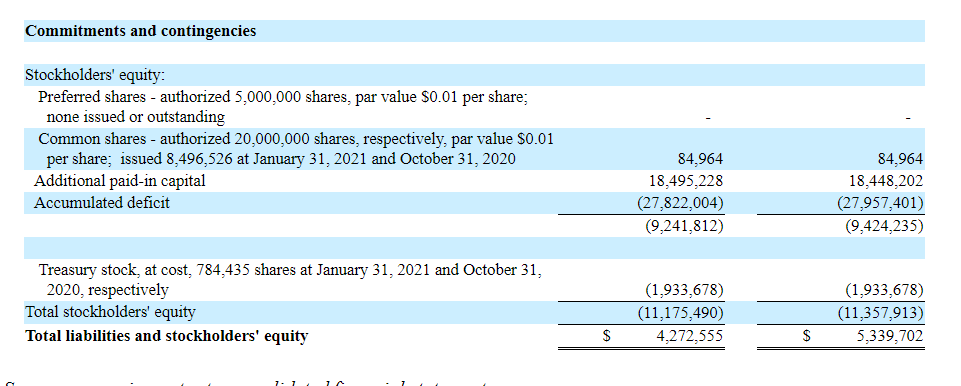

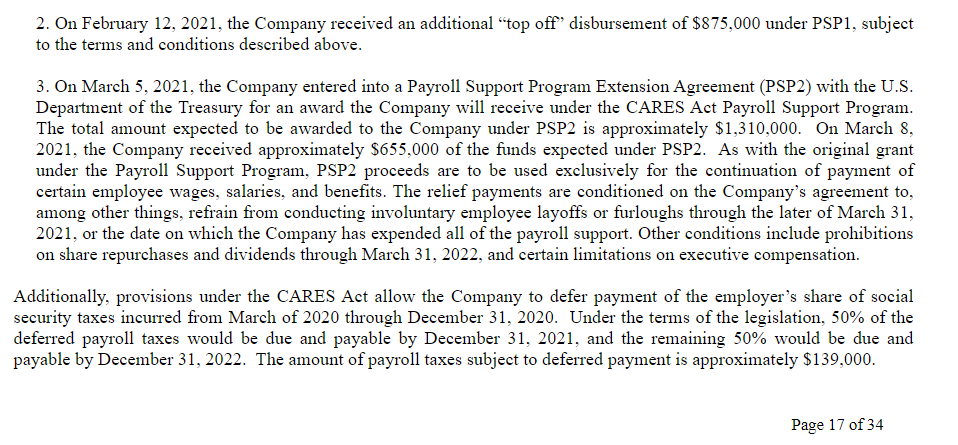

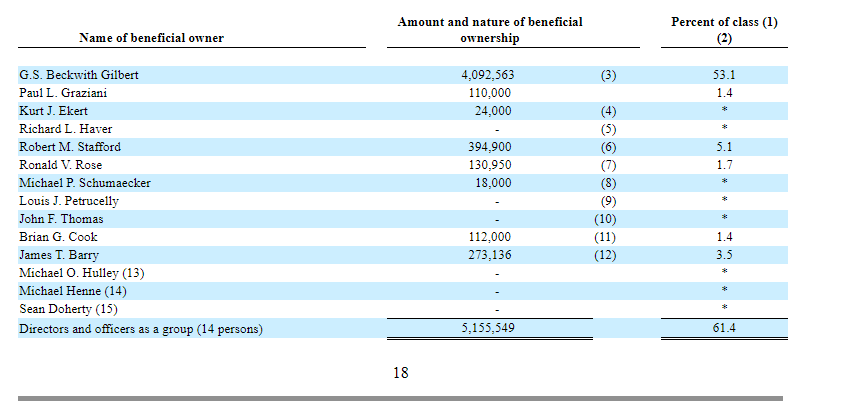

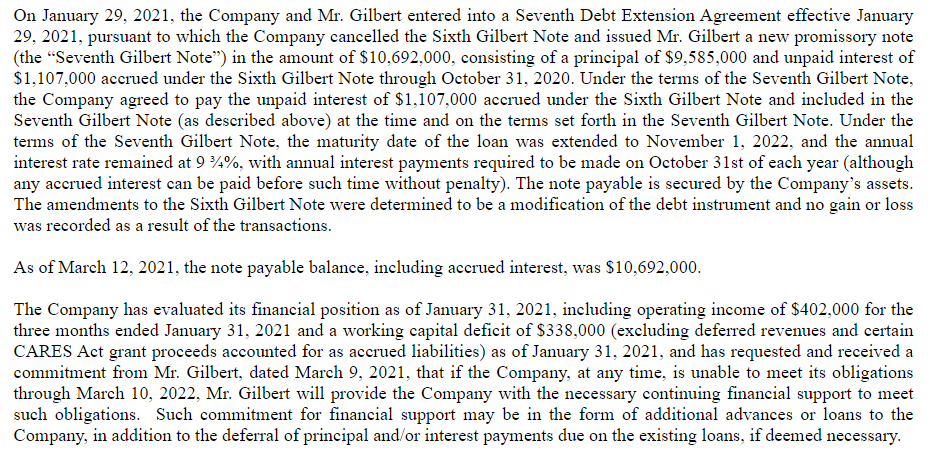

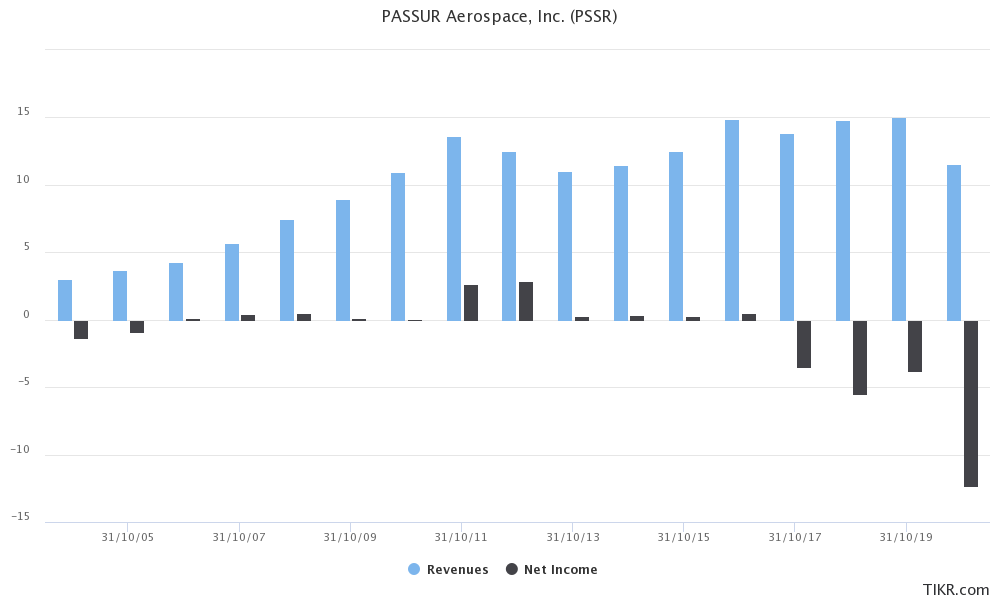

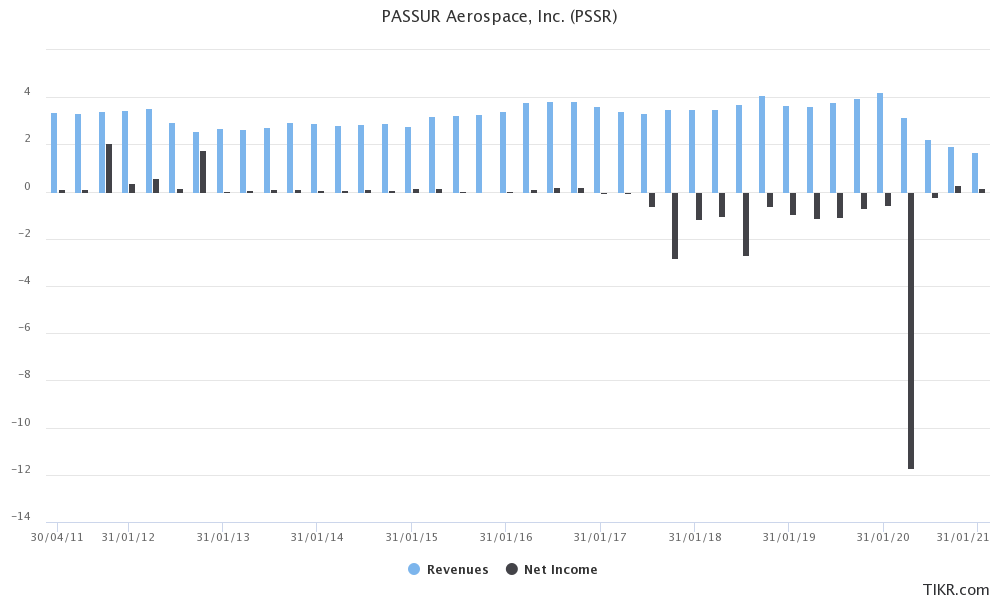

PASSUR Aerospace Inc. (PSSR) is at a multi-year low on the long-range price chart and the market is not interested in it. Worth a look. PSSR was founded back in 1967 and operates in the aerospace industry. The firm provides software tools for airlines and airports to help them manage the huge amounts of information they have to deal with. This, in turn, allows their customers to make better decisions and to run more efficiently. Their latest 10-Q provides the following description; "PASSUR® Aerospace, Inc. (“PASSUR” or the “Company”), a New York corporation founded in 1967, is a leading business intelligence company, providing predictive analytics and decision support technology for the aviation industry primarily to improve the operational performance and cash flow of airlines, airports, fixed based operators (FBOs) and air navigation service providers (ANSPs). The Company is recognized as a leader in providing a cloud-based platform, ARiVA™, that manages and optimizes operations for our customers." I have a penchant for looking at tiny companies that are currently distressed yet have some potential. PSSR fits my niche like a glove. One of the first things I do when looking at a new stock is to pull up the longest range price chart I can find to get a snapshot of the market's sentiment toward a given company, both past and present. An observation of price action, volume, support and resistance can tell you a lot about both the company and the market's view of it. The first thing that jumps out is how much the market hates this stock right now. It has been down here before in the '90's and the '00's, each time building a base before making major upward moves. It's pretty obvious that PSSR's operating history has been lumpy and that the situation is not good right now. Hardly surprising given that the company operates in the aviation industry. Let's zoom in a bit and take a closer look. The stock started its most recent downtrend in early 2017, falling from around $4.2 (ignoring the stock spike to $7 on low volume) to a low of 22 cents in the tax loss selling season of late 2020/early 2021. Since then it has moved up 2.6x and is currently sat at 58 cents. Despite the move up the stock is still well ensconced in the low range. I'll throw out a few numbers and then we'll dig in. Market Cap = $4.47 Mil Share price = $0.58 Common outstanding = 7.71 Mil BV = (11.175 Mil) TTM Rev = $9 Mil TTM net income = ($11.585 Mil) No prefs or warrants but there's some stock options out. Clearly it doesn't look cheap on an assets or earnings basis given both BV and net Income are negative. All we have is the discount to revenue and that's justified given the current state of the finances. Along the way I've been learning that it sometimes pays to dig into seemingly bad situations to see if they are rotten to the core or if there are some seeds of potential to be found beneath the bruised flesh. Balance sheet time! After a little digging the situation appears less dire than first expected. They've got $1.9 Mil in cash to keep the lights on for now, $1 Mil of which appears to be stimulus funding which shows up under their current liabilities. After rooting about in the notes I noticed that they received a "top off" disbursement of $875k in Feb under PSP1. They are also due another $1.31 Mil from PSP2, $655k of which they received on 8th March. That's around $4 Mil in total to keep paying the wages till business picks up. Another $1.47 Mil of liabilities is deferred revenue. Then we have the Note payable of $10.692 Mil to a related party, better that the debt is owed to an insider rather than the bank who usually call it in at the worst possible time. It turns out the insider bankrolling the company is the Chairman, majority owner and former CEO. A gentleman by the name of G.S. Beckwith Gilbert. Here's some blurb on him I found on the company website; "Mr. Gilbert is Non-Executive Chairman of the Board of Directors of the Company, and has served as the Chairman of the Board since his election in 1997. Mr. Gilbert also serves as the Chairman of the Executive Committee. Mr. Gilbert was appointed Chief Executive Officer in October of 1998 and served as such until his retirement from that post on February 1, 2003. Mr. Gilbert is President and Chief Executive Officer of Field Point Capital Management Company, a merchant-banking firm, a position he has held since 1988. Mr. Gilbert is also Chairman Emeritus of the Board of Fellows of Harvard Medical School, a Director of the Yale Cancer Center, and a member of the Council on Foreign Relations. Mr. Gilbert’s current service as Chairman of the Board of the Company and Chairman of the Executive Committee and prior service as Chief Executive Officer of the Company, as well as his prior board and executive management experience, allow him to provide in-depth knowledge of the Company and other valuable insight and knowledge to the Board." Mr Gilbert is a wealthy guy and seems pretty content to just keep rolling the debt over, that's fine by me too. Keep this ship sailing till it reaches richer waters Captain! He currently owns around 53% of the common and insiders as an aggregate own around 61% (inc. currently exercisable stock options). That means the public float is pretty darn tight. Just how I like it. Mr Gilbert is not only rolling the debt over but he is also guaranteeing financial support to the company until the situation improves. Right, we'll take a look at revenues and earnings to see what's been happening. There's a few things to mention here. You can see on the quarterly chart how revenue falls dramatically when the pandemic hits, we should see some recovery here as the vaccine roll-out continues and the aviation industry starts to recover. Management have stated that they expect business will pick up in the 2nd half of the year. You'll also notice that huge net loss that hits in 2020. This was, in part, due to a large asset write-off relating to a legacy business segment. PSSR used to operate a network of sensors for aircraft surveillance but new rules brought in by the FAA now mandate all aircraft to be fitted with ADS-B (Automatic dependent surveillance - Broadcast) technology. This technology allows the aircraft to determine its position via satellite navigation and then periodically broadcast that data in order for it to be tracked. The new rules essentially rendered PSSR's network obsolete and huge write-downs followed. In my opinion this is actually bullish for PSSR's prospects as it can now focus all its efforts on pushing its data analytics platform to build up subscription revenues as the aviation industry recovers. Another chunk of the write-downs related to software development assets which took a hit once it became clear that contracted revenues would be impaired due to the pandemic. One last thing before we move on, after booking losses for the preceding several quarters it looks like PSSR has turned a corner and swung back to a profit. Not quite yet though, were it not for the utilization of stimulus funding credits and PSSR would still be bleeding red. I'm not overly concerned though, the firm has around $4 Mil in stimulus funding on hand or due in the coming months. Add to that the financial commitment provided by the Chairman and I think PSSR can keep going till the economic gloom dissipates. For those of you that would like to learn a bit more about the stock I recommend reading @longcastadviser previous excellent write-ups on the company which you can find here.

Okay, what risks do I see? The most obvious one is the lack of margin of safety. The large negative equity position and recent history of unprofitability are big risk factors and a serious cause for concern. Another risk is that Mr. Beckwith could just decide to call in the debt, the note payable is secured by the assets of the company and so minority holders could get wiped out. He's currently 76 years old so who knows how long he will keep rolling over the debt. Maybe he might just decide to take full control and then just sell the company. Customer concentration is a major risk too. The last 10-K noted that 3 customers accounted for 36% and 55% of total revenues in FY2020 and FY2019 respectively. PSSR is a tiny firm, they've got some larger competitors which offer similar services. These include "Sabre, Saab-Sensis, The Weather Company/IBM, Harris Corporation, Amadeus, Thales, IDS, Metron, FlightAware, and Mosaic ATM." Imagine what might happen if one of the big tech firms decided to move into this space! To say there's a lot of hair on this stock is an understatement but the flipside is that it has significant upside potential if just a few things go right. If the firm can keep going long enough for the aviation industry to recover maybe it can start to grow revenues and earnings again. Buying when market sentiment toward a company is so bearish means you don't need much to go right for the stock to start moving up. I like the set-up here, I like buying when the future looks bleak. Thanks for reading, David Disclosure: Long PSSR

5 Comments

Mike

3/16/2021 09:04:25 am

This is an interesting company. Quite unconventional and the quality of the company/stock is low. What is a bit worrying is that the company was already making losses before Covid. Cash flows are currently negative. However, I would still see it as an investment that could benefit from a brightening of the covid situation.

Reply

Mike

3/28/2021 09:50:57 am

btw it seems that the strategy to "buy at the maximum pessimism", which you follow, is originated from Sir John Templeton. Templeton was a global investor who preferred investments with low p/e ratios or low price to assets ratio. see here:

Reply

David

3/28/2021 10:18:56 am

My approach is partly influenced by Sir John, Walter Schloss and Ben Graham but also by Ted Warren who espoused the utilization of long-range price charts.

Reply

P

7/14/2021 01:39:53 pm

Hi David and all,

Reply

P

7/21/2021 04:11:17 pm

Any thoughts or feedback from anyone on my above post?

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed