|

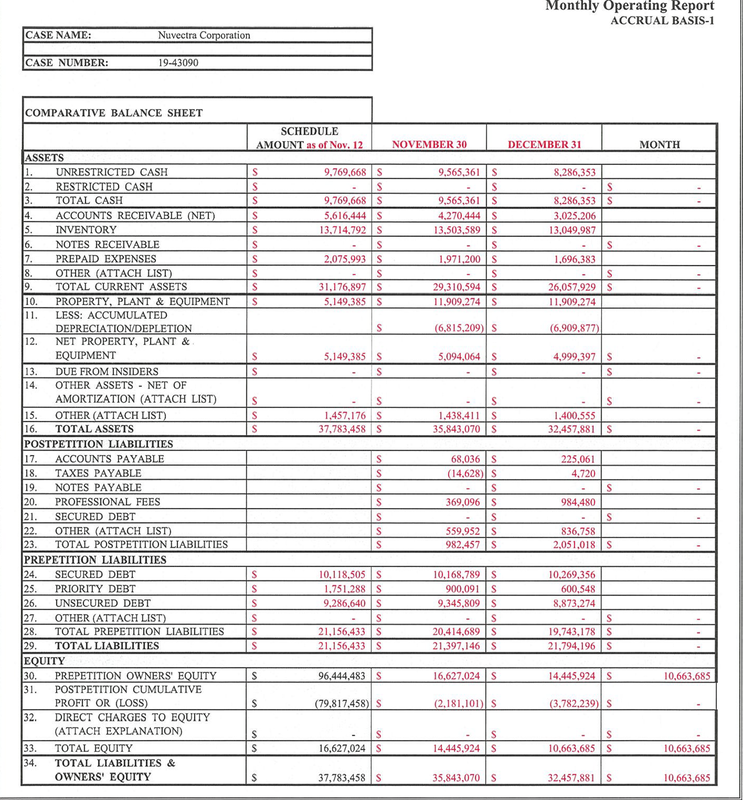

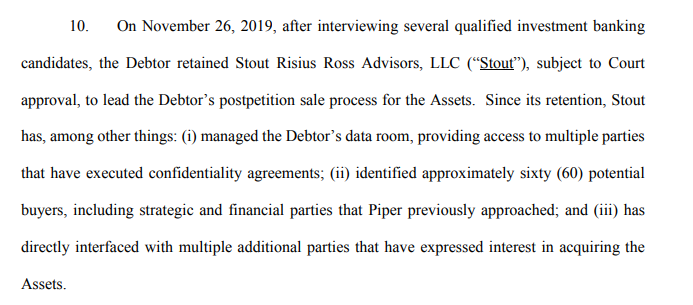

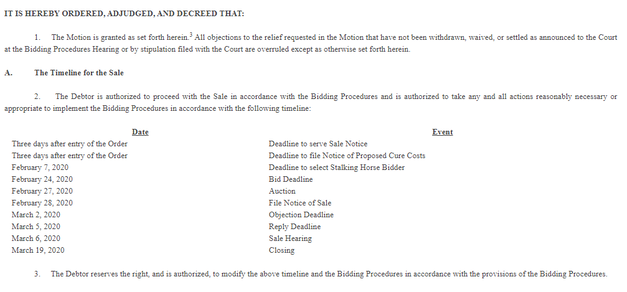

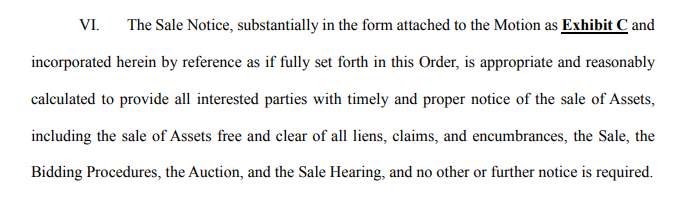

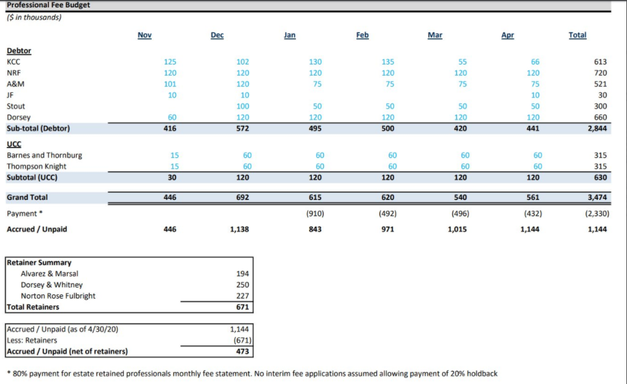

Nuvectra Corp. (NVTRQ) commenced Chpt. 11 bankruptcy proceedings on November 12th 2019. The share price took a nose dive from $1.39 to $0.22, since then it's been trading in the $0.10-0.20 range. Upon first glance it looks like game over for the common, but sometimes looks can be deceiving. Let's take a step back in time. In March 2016 Integer (Formerly Greatbatch) spun off QiG Group LLC which converted into Nuvectra Corp shortly before the completion of the spin-off. Nuvectra became a publicly listed medical device company and it's common stock was floated on the Nasdaq under the ticker NVTR. You can read about the spin-off here. As part of the spin-off Nuvectra received some intellectual property for use in the development of medical devices for the treatment of neurological disorders and chronic pain. NVTR's primary product for development was Algovita, an FDA approved implantable medical device utilizing a spinal cord stimulation (SCS) system for the treatment of chronic pain of the trunk and limbs. Unfortunately the spin-off agreement meant Nevectra was tied into a 5 year manufacturing contract with Integer which resulted in poor margins for the Algovita product. Despite the fact that the Algovita product was doing around $47 Mil in annual revenue and growing, it was unprofitable and Nuvectra ran into problems. The gross margin on Algovita was below the industry standard for such products but Nuvectra's hands were tied. Sales weren't the problem, profits were. Losses began to mount and in August 2019 Nuvectra announced it was "exploring strategic options to enhance shareholder value". The situation didn't improve , losses continued and the share price began to fall. As November rolled around the Chpt 11 proceedings were announced and the bottom fell out of the stock. Nuvectra's stock was de-listed from the Nasdaq and it began trading on the OTC markets under the ticker NVTRQ (the Q denotes that the firm has entered bankruptcy proceedings). Some readers will be aware that in virtually all bankruptcies the common becomes worthless since it sits at the bottom of the cap stack. There is rarely anything left for shareholders once the secured/unsecured creditors, lawyers and bankers have received their portion of the liquidated assets. And yet, NVTRQ hasn't gone to zero, volume has dropped off since the heavy selling on the bankruptcy announcement subsided. The share price has been bouncing around between the $0.10-0.20 range and shares are still being traded. Why? Me and a fellow investor have been looking through the Q tickers for the last few months and NVTRQ came on the radar, we didn't dig too deep and moved onto the next one. A few weeks passed and I was contacted by another investor who had examined the bankruptcy in closer detail uncovering some interesting things. At this point I 'd like to extend my thanks to @FBuschek for all his work on NVTRQ. I recommend you all follow him on twitter and ask him to start a value blog! :) For those of you who don't know, the public can pull up the court docket for a bankruptcy and read through the filings. You can find the docket for the NVTRQ case here. Okay, here's where it gets interesting. Rather than opting for a Chpt. 7 bankruptcy where the company is shut down and all the assets are sold off Nuvectra has gone down the Chpt. 11 route instead. Chpt. 11 gives a company time to reorganize it's business affairs and restructure it's debts. It can opt to sell some of its assets or the whole company as a going concern. As part of the bankruptcy Nuvectra is legally obliged to file a monthly financial report. Let's take a look at the balance from the most recent report which you can find here. As you can see , according to the last available filing NVTRQ had total assets of $32,457,881 and total liabilities of $21,794,196. BV stands at $10,663,685 vs a Market Cap of $3.22 Mil. Now obviously the argument can correctly be made that certain assets must be heavily marked down in a bankruptcy since it is a distressed situation. This is correct but in this instance it is not the focus. This investment thesis hinges upon something else. What the balance sheet doesn't capture is the potential value of Nuvectra's I.P. pertaining to it's two products, the FDA approved Algovita and pre FDA approved Virtis. An FDA decision for Virtis is due in H1 2020 so it's value is limited at the present time. Algovita is an FDA/CE approved product which has been implanted into 5,000 patients, prior to bankruptcy it achieved annual revenue of $25 Mil in FY 2017 and $47 Mil in FY 2018. What would a potential bidder pay for that? 1x, 2x, 3x or 4x Rev? To further bolster the case for the value of Algovita on Dec 31st it received another FDA approval ; "On December 31, 2019, the U.S. Food and Drug Administration (the “FDA”) granted full-body magnetic resonance (MR)-conditional approval for the Company’s Algovita® spinal cord stimulation product. The approval was granted following the FDA’s 180-day review process with respect to the Company’s previously announced regulatory submission in June 2019." Prior to the bankruptcy Nuvectra had racked up an accumulated deficit of around $150 Mil. If the company sells some of it's assets such as Algovita and continues as a going concern it will have a sizable amount of NOL carry-forwards to utilize too. The plot thickens! Nuvectra is now moving forward with a stalking horse bid process. For those who don't know, a stalking horse bid process involves a bidder being selected, they are then invited to table an initial bid which acts as a price floor for an asset or group of assets to be auctioned off. As part of the deal, if the primary bidder is outbid they get a compensation fee, usually around 3% of the transaction cost. The latest 8-K notes the following; "The Company may select a Qualified Bid as a “stalking horse” bid. The Order provides that if a stalking horse bidder executes a purchase agreement on or before February 7, 2020, the stalking horse bidder is entitled to receive deal protections consisting of (i) reimbursement of reasonable out-of-pocket expenses, subject to an aggregate cap of $250,000, and (ii) payment of a break-up fee equal to 3.0% of the cash purchase price set forth in the stalking horse bidder’s Qualified Bid." The stalking horse bid process is good for the bankruptcy estate and the creditors as it ensures that the assets aren't just sold off at fire-sale prices. Prior to the Bankruptcy there were around 45 potential bidders who had expressed an interest when Nuvectra announced it was exploring strategic alternatives in August 2019. Post bankruptcy this number has increased to around 60 interested parties; Whilst I was finishing my buying spree news came through that the court had approved the sale and stalking horse bidding process. Here's the timeline for the sale. The Order approving the bid and auction procedures also notes the following; The important part in the above except is "the sale of Assets free and clear of all liens, claims, and encumbrances..." So, things are moving fast here. Feb 7th is the deadline for selecting the Stalking Horse Bidder. Feb 24th is the deadline by which all bidders have to submit a bid. An auction is held on the 27th and the whole deal closes by March 19th assuming no objections. There's the possibility of some 'cure costs' depending on how the executory contract plays out. The bidder can choose to buy certain assets or just buy NVTRQ outright as a going concern. The break down for the possible cure costs can be seen here. If the buyer just keeps all the contracts in place then the cure costs are minimal, those that aren't retained by the buyer must be 'cured' by the debtor. The largest portion of the $2.86 Mil pertains to the employment contracts of the CEO and CFO, around $2.18 Mil. If they are kept on cure costs are negligible. Assuming NVTRQ fetches a decent price for it's assets then it's no major issue if it ends up on the hook for all the costs. The other costs to consider are those of the lawyers and bankers overseeing the proceedings. You'll see them listed on the balance sheet in the post-petition liabilities section and labelled 'professional fees'. The above report is on an accrual basis so those aren't the final costs. Below is the professional fee budget schedule. Bear in mind this is a just a projection though, the fees can and commonly do overrun this. Thus far there's an overrun of around $200k which is negligible. The total projected cost is around 3.5 Mil but given the overrun I'd add another $1 Mil to that. This investment doesn't succeed or fail based on professional fees and cure costs though, it's all about the I.P. for the two products. I have no idea how to value this as it all comes down to what a bidder is willing to pay for Algovita, Vertis or the whole business. Maybe it's $25 Mil, maybe $50 Mil, maybe even $100 Mil. Your guess is as good as mine. Medtronic, Stryker, Abbott and the other big players have a lot of cash to deploy. If a bidding war gets underway then the sky is the limit. One thing I'm pretty sure of is that it is probably going to be a lot more than the current market cap of $3.22 Mil. I can't say for sure though. What are the risks here? The first one is the fact that you're reading a blog post about a bankruptcy case written by some random guy on the internet, I'm not a bankruptcy lawyer, I've never taken any law classes, I'm just a guy who's read through the court docket, checked the financials and looked up the definition of some legal terms. Don't invest based on what I'm saying, I could be dead wrong here. The second risk is that a deal gets done but the winning bid isn't large enough to cover the liabilities and costs, the common ends up with nothing. The third risk is that the deal plays out but somehow the common gets screwed in the process. Maybe insiders cut a deal that massively dilutes minority shareholders, there's always a chance. The fourth risk is that the deal ends up falling through, NVTRQ has to honor all it's liabilities to it's creditors including any lawyers/bankers fees and the rest. It moves into Chpt. 7 and sells off it's remaining assets at fire-sale prices. The common is left with nothing. And so it is. To the moon, to zero, or somewhere in between. Let's find out which. David. Long NVTRQ

51 Comments

Dan

1/19/2020 02:56:03 pm

An interesting situation where NOLs are involved is (US listed) $MACK. They have biotech milestone rights for ~12x the current stock price (including net cash on hand). Obviously the probability is not incredible that the milestones will be met but the downside may be protected by NOL carryforwards potentially worth more than $4. So if the milestones don't pay out I imagine an effort will be used to pursue usage of the NOLs. The company is controlled by activists so I do believe that either a high percentage milestone payout or NOL usage situation or both.

Reply

David

1/19/2020 03:37:31 pm

Thanks Dan,

Reply

Dan

2/8/2020 04:18:49 pm

Activist investors.

Valuecat

1/19/2020 03:14:39 pm

Strangest bankruptcy I’ve seen. Who takes 45mm in cash and pays off the banks immediately in exchange for nothing?

Reply

David

1/19/2020 03:49:27 pm

Hi Valuecat,

Reply

Tom

1/19/2020 04:43:30 pm

Why does management not hold? If prospects were good, you'd see management buying.

David

1/19/2020 05:06:27 pm

Hi Tom,

Reply

Frank

1/20/2020 12:23:43 am

Hello. Thanks for the article.

Reply

Valuecat

1/20/2020 01:40:58 am

It is not known if he owns it now. Year end holdings of institutions will come out by Feb 15. If Scion owned back in September, he got bagged like everyone else. So, not really relevant, unless he doubled down after bankruptcy.

Reply

Dan

1/20/2020 02:43:22 am

So where do you guys come out sizing a position such as this, or situations such as AFFY or MYRX? Or other situations with high expected value but with decent probability (or non-zero probability) of being worthless?

Reply

Chris

1/30/2020 12:14:45 am

This is the question. Generally I dump these into the "too hard" pile but maybe the approach with this and the Couchman NOLs is to buy them as a basket totaling one's standard position size??

Reply

wabuffo

1/20/2020 03:44:38 pm

Interesting idea - but there is a big watchout when dealing with Chapter 11 cases. Even if a sale is successful, the Court has not begun to adjudicate claims. Before a POR (Plan of Reorganization) can be filed, the Court will have to set a bar date for filing claims. I guarantee you that there are going to be more potential claims than are currently showing up in pre-petition liabilities.

Reply

David

1/20/2020 08:40:39 pm

Hi wabuffo,

Reply

There's been some interest expressed by the DoJ in forming an equity committee. If you hold shares of NVTRQ, ping me at [email protected] and I'll connect you with them.

Reply

Donald

1/21/2020 09:32:10 pm

My research synopsis:

Reply

T

1/22/2020 08:40:15 am

Just posting so I get notifications for new comments.

Reply

Christopher Hampton

1/23/2020 11:09:47 pm

I have been in touch with the DOJ regarding the formation of an equity committee--and they were promptly responsive. I would encourage shareholders to reach out and protect the value of your investment.

Reply

John

1/29/2020 12:03:44 am

So I am new to all of this but I hold a substantial number of shares that were obtained for very low prices. What exactly is the function of this equity committee? I have read all of this documentation and like some others, I don't really understand the reasons for the bankruptcy filing unless it was due to those unfavorable manufacturing contracts. I want to do everything that I can to maximized the value of what I currently hold, so I am monitoring this very closely. Thanks!

Reply

Christopher Hampton

1/30/2020 08:14:15 am

The equity committee represents the interests of the shareholders, and protects those interests. with an equity committee in place i would consider this a low-risk, high-return investment.

Reply

Flame

1/30/2020 03:29:03 am

Nvtr has more than 350 patents with 0 value in the asset amount. There are a lot of dark secrets within nvtr.

Reply

S

1/30/2020 08:37:34 pm

The patent issue is also something that should be raised by an equity committee.

Reply

Peter

1/30/2020 07:08:07 pm

Anyone know what's going on? It just dropped 27%.

Reply

Ric

1/30/2020 07:17:18 pm

NVTRQ just filed its BK plan which states that equity will be wiped out -- no distributions. Not sure if that's just a placeholder plan to keep deadlines tight or what.

Reply

1/30/2020 09:03:08 pm

Ric can you provide a link to the document that says Equity interests are wiped out? I don't doubt you I'm just wondering if you heard that shareholders get nothing or are 100% certain and actually read it for yourself? I cannot find a new report filed today either. There were a couple dated yesterday.

Reply

S

1/30/2020 09:12:01 pm

http://www.kccllc.net/nuvectra/document/list/5044

S

1/30/2020 08:35:02 pm

I just read the filing. It appears the company is trying to pull a fast one with the secured creditors.

Reply

Christopher Hampton

1/31/2020 02:32:06 pm

This is why we needed an equity committee

Reply

Christopher Hampton

1/31/2020 04:37:16 pm

or "need' an equity committee i should say. I doubt the court will approve this plan, and it does not address where excess recovery would go. They do specifically say that no debtor can receive more than 100% of what they are owed.

Reply

Christopher Hampton

1/31/2020 08:07:14 pm

...although we did get several pieces of new information. For instance that Stout has "directly interfaced with several additional parties that have expressed interest in acquiring the debtor's assets.'

Ric

2/1/2020 12:38:34 am

So now I'm getting confused.

Reply

S

2/4/2020 05:51:01 pm

from the yahoo message board:

Reply

Jon

2/6/2020 09:40:37 pm

Done! Thanks for providing the template, hopefully they get enough responses.

Reply

Peter Orlicki

2/5/2020 02:55:58 pm

Ok. Now it's up 55%. What happened this morning?

Reply

Jon

2/7/2020 08:35:51 pm

Hi all, does anyone know when and where we will find out about the stalking horse bid from today, if there is one. What places may report on this or where is a good place to go digging for info? It’s an intriguing case for sure!

Reply

Valuecat

2/7/2020 08:46:51 pm

Hoping it will be made known.

Reply

Christopher Hampton

2/7/2020 08:54:43 pm

I think company mgmt is doing its best to discourage shareholders. And that will include not naming a stalking horse today.

Jon

2/14/2020 03:44:49 pm

Hi guys, so looks like either no stalking horse bid or it’s not been made public.

Reply

Valuecat

2/14/2020 03:50:39 pm

Ghosted

Reply

Christopher Hampton

2/14/2020 04:18:58 pm

Lol, Elementary's thesis of "to the moon, or zero" still stands. I'm not so sure we have had any new info since the new year that impacts the likelihood of the outcome.

Reply

Curt

2/15/2020 02:45:18 am

From the "Objection of Official Committe of Unsecured Creditors to Debtor's Motion of Interim and Final Orders"

Reply

S

2/18/2020 03:37:56 pm

Good to see someone's wise to the game being played here.

Reply

Valuecat

2/18/2020 03:42:25 pm

No explanation ever given.

Peter

3/2/2020 06:51:57 pm

Does anyone know the outcome of the auction? How does it affect us?

Reply

David

3/2/2020 06:57:26 pm

Hi Peter,

Reply

Curt

3/3/2020 12:05:55 am

The Unsecured Creditors Committee is petitioning to postpone the Sale Motion for a reasonable period of time to allow the parties to determine whether the Sale is truly in the best interests of the Estate.

Reply

S

3/3/2020 03:09:26 pm

Page 11 of this document

Reply

Curt

3/3/2020 03:02:03 pm

Motion by Unsecured Creditors Committee for Derivative Standing to prosecute Estate Claims against the Pre-Petition Lenders.

Reply

Steve Kilsdonk

4/3/2020 01:05:06 am

Posting only to trigger future notifications.

Reply

Randy

8/3/2020 11:57:42 am

Anyone know the latest on NVTRQ? thx much

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed