|

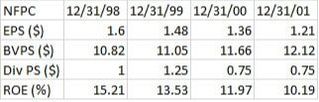

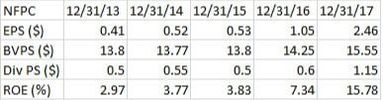

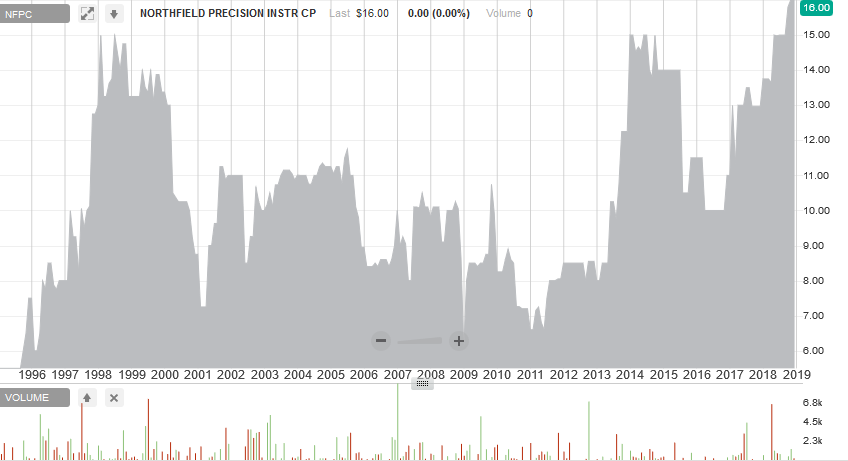

I recently contacted Northfield Precision Instruments Corp (NFPC) to see if I could get hold of the company's current financials. They kindly offered to mail them out to me, no questions asked, and I received them a few days later. I wish all dark companies were as amenable to requests! Here's the back story on the firm. NFPC is a New York based manufacturing company whose business involves the manufacture of precision instruments including air, diaphragm and collet chucks. The firm was founded in 1952 and went public in 1959 with intial product offerings including "micro spin bearings, precision gear blanks, precision shafting, precision limit stops and miniature slip clutches for the electronic industry". The company has since grown its product range and now serves the following industires; automotive, aerospace, electrical/electronic, medical/optical, machine tool, plastics/ceramics, appliance, and education/training. NFPC currently trades on the OTC markets and is classed as 'Pink No Information' and 'Dark or Defunct'. So we have a company which has been around for years engaged in the unexciting business of making small parts for machinery, they don't file with the SEC and their website looks 20 years out of date (Remeber Lynch's advice, companies with crappy looking annual reports etc are probably frugal and don't wish to waste money on flashy graphics). I'm interested so lets keep digging. Now to some numbers; Market Cap = $3,747,792 Shares Outstanding = 234,237 Price per share = $16 Spread = 18.68% Average Vol (30D) = 51 52WK Range = $13-$16 Dividend = $0.75 Dividend Yield = 4.69% The tiny market cap, low share count and illiquidity are all good signs. Now we'll dig into the company's most recent annual financials (Dec. 31st 2017) to see if we can figure out what NFPC is worth. Firstly to the balance sheet; Current Assets = $3,117,028 which includes; Cash = $702,060 Receivables = $932,976 Inventory = $1,376,547 Other Current Assets = $$105,445 Fixed Assets = $1,644,250 which includes; PPE = $1,578,067 Security deposits = $637 Officer's Life Insurance = $85,546 Current Liabilities = $653,774 Long-term liabilties = $483,429 Total Liabilties = $1,137,203 Book Value = $3,644,075 And now on to the income statement; Sales = $7,225,759 Gross Profit = $3,668,257 Operating Profit = $$861,815 Net Profit = $575,210 So NFPC is currently trading at; 1.02x BV 0.52x Sales 6.5x Earnings We'll now take a trip back in time to see what NFPC has looked like in the past. The following data is cobbled together from information I found in my old Walker's Manual and the 2015 & 2017 annual reports that NFPC sent me. As such I only have data for the periods 1998-2001 and 2013-2018 but this is enough to make some basic inferences. As one can see, both earnings and dividends have been lumpy over the last 20 years and this is not suprising given the cyclical nature of the manufacturing sector. Book value has grown at an annualized rate of 1.93% between 1998-2017 which is below the long-term (1913-2015) average U.S. inflation rate of 3.18%. The company has historically paid out a large portion of its earnings as dividends which is both a blessing and a curse. The high yield is obviously appealing to some investors but the lack of reinvested earnings may have limited the company's growth. So what is NFPC worth?, It has a history of profitability so one could argue it is at least worth BV which gets us to $15.55 Typically a no growth company is assigned a P/E of 7-8. Whilst NFPC is growing we know it's earnings are likely to suffer when the next down turn comes around so we'll value it at a 7-8 P/E and assume no growth. This gets us to $17.22-19.68 What if earnings are cut in half when the next recession hits? EPS of $2.46 becomes $1.23, Valued at a P/E of 7-8 gets us to $8.61-$9.84 Can we stretch the valuation and assume a P/S of 1 giving us a fair value of $30.84?, I'm inclined to say no. Dark companies are always going to sell at a discount to their listed peers and we are looking at a cyclical firm. The most I would go with would be a P/S of 0.75x which would be $23.13 So, we've got an intrinsic value range of around $9-23. This is a wide range of potential value. I'm drawn to the lower end of the range given where we are in the current cycle. I think in the next 5-10 years NFPC is going to trade closer to $9 than $23. The current share price of $16 sits squarely in the middle of the range. The current dividend yield of 4.69% plus BV growth of 1.93% gets us an assumed return of 6.62%. I'm of the opinion that a much lower entry price is required to make this a viable investment. Now to the chart; NFPC's share price has been on an upward trend over the last few years on the back of stronger earnings growth , a recent write up over at Focused Compounding may have also driven it higher. The stock currently sits at an all-time high of $16 above it's previous point of resistance of $15 which was hit back in the late 90's and 2014-2015. Previous support levels appear to be around $6.5-7 which were touched after the dotcom bubble, the 2008 financial crisis and in 2011.

The current rise has not been on heavy volume suggesting there could be further upside but Ted Warren would say it was limited. This rally was not built from a long-term base but rather from an intermediate short term base of $10 between 2016-2017. Ted would say that one should not expect much beyond a 50% rise, given that NFPC has moved up 60% I'm not confident it will run much higher. There's also no guarantee that the BV can offer a floor on the stock price, the stock has sold below BV before and it can fall below it again. I know I said earlier in the blog post that NFPC should be at least worth BV but what I think doesn't drive the stock price. Stock price movement is driven by perception, not facts and figures. This isn't to say that the facts and figures are irrelevant but virtually everyone is irrational most of the time. Stock prices are driven by sentiment, stories and emotions. The time to buy is at the point of maximum pessimism, when a stock languishes after the heavy selling of a downward trend has subsided and the public have given up the ghost. Investors should avoid buying into upward trends built on short-term bases, especially those which rally on heavy volume. The upside comes from feelings of revulsion, turning to indifference. and then to increasing interest in a stock. Patience will reward investors with a more suitable entry point for NFPC, somewhere closer to $7. The lower the entry point, the higher the potential upside. Thanks for reading, David The author holds no ownership in NFPC at the time of writing.

9 Comments

David

11/28/2018 07:16:47 pm

I thought you'd get a kick out of that Dan :)

Reply

Dave

1/4/2019 08:44:23 pm

I just found the blog today (and thank you for creating it). It appears that you fish in the same waters as Oddball Stocks and No Name Stocks.

Reply

6/28/2019 06:27:32 pm

David,

Reply

David

6/28/2019 07:03:52 pm

Hi Trey,

Reply

6/29/2019 03:40:55 pm

David,

Luke

9/16/2019 06:23:48 pm

Trey, when did you receive your 2018 Annual Report and what brokerage do you use? I still have not received mine.

David

6/30/2019 02:01:21 pm

Hi Trey,

Reply

David

9/16/2019 09:08:36 pm

Hi Luke,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed