|

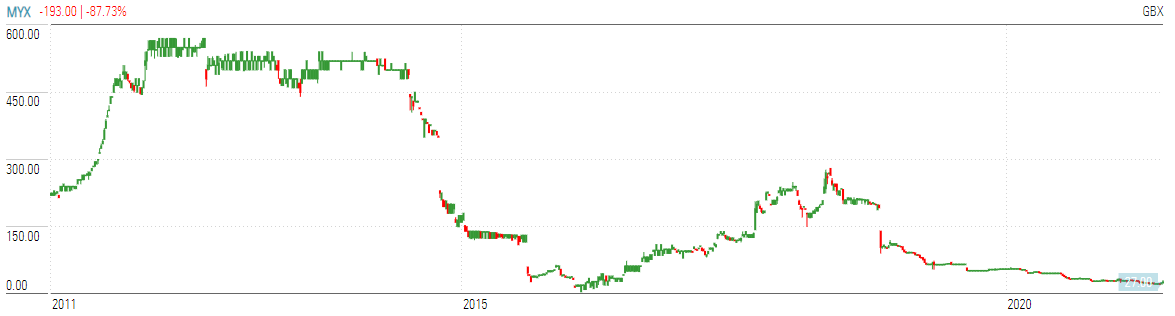

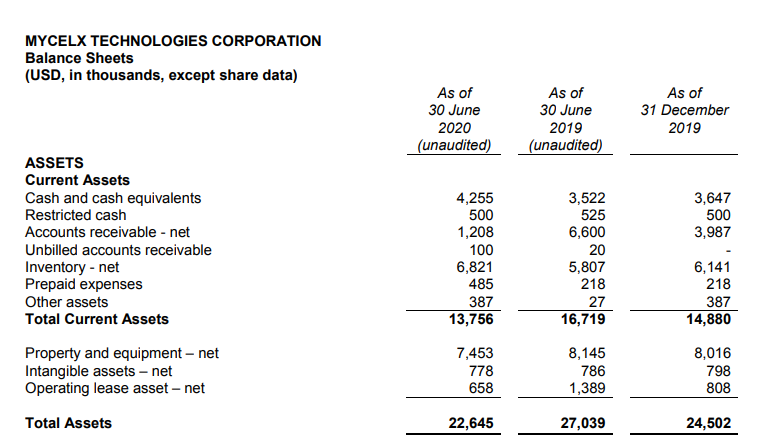

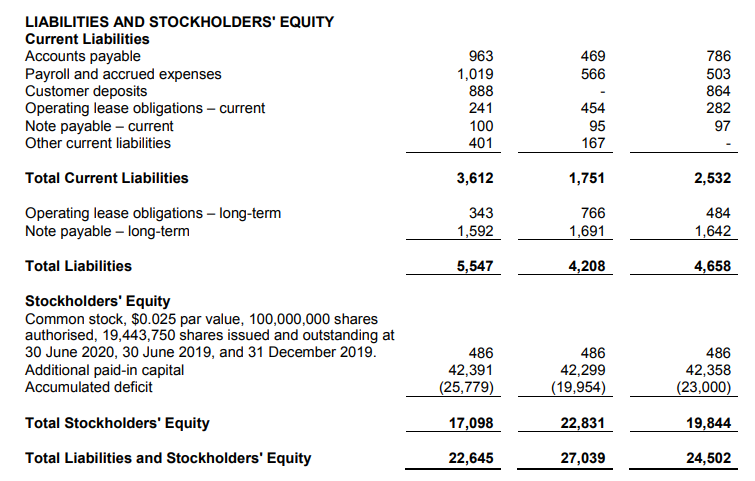

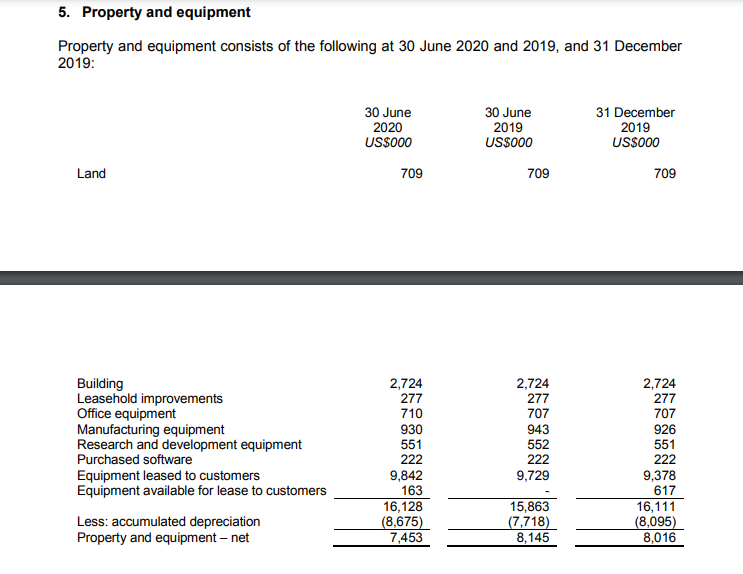

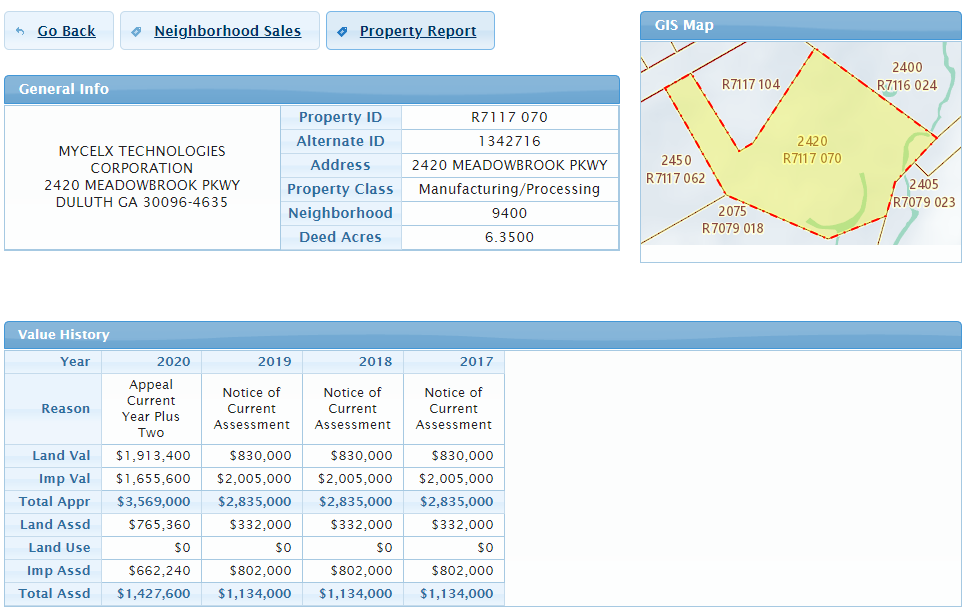

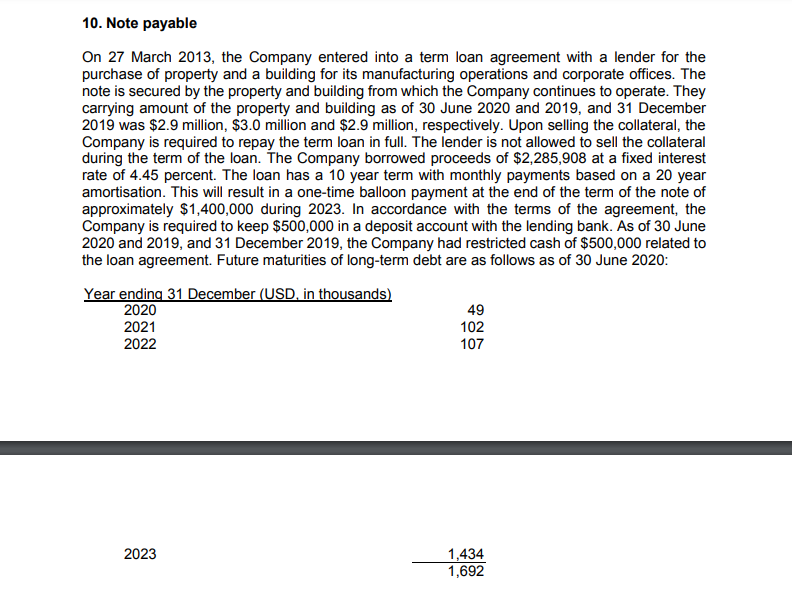

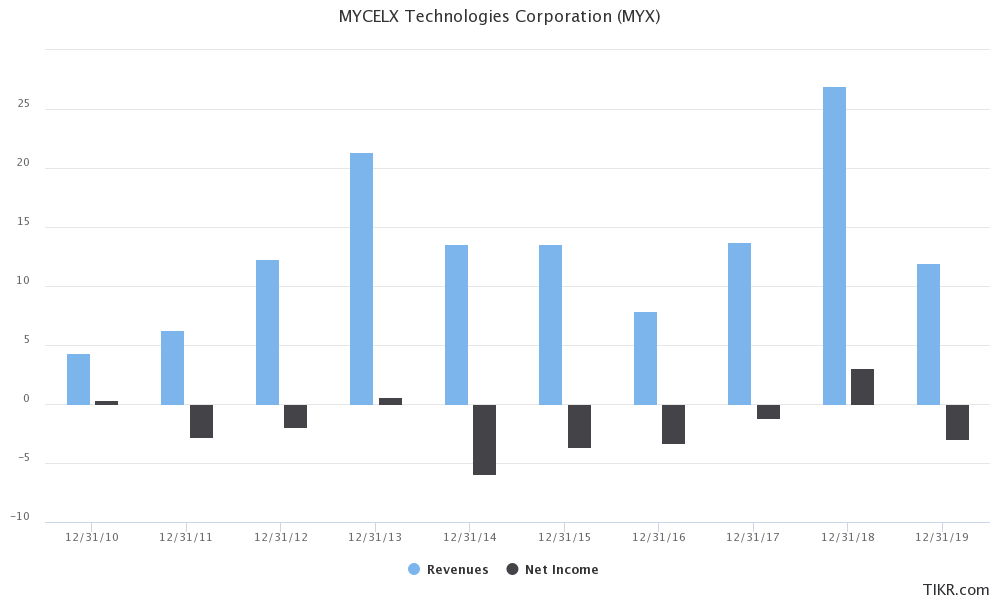

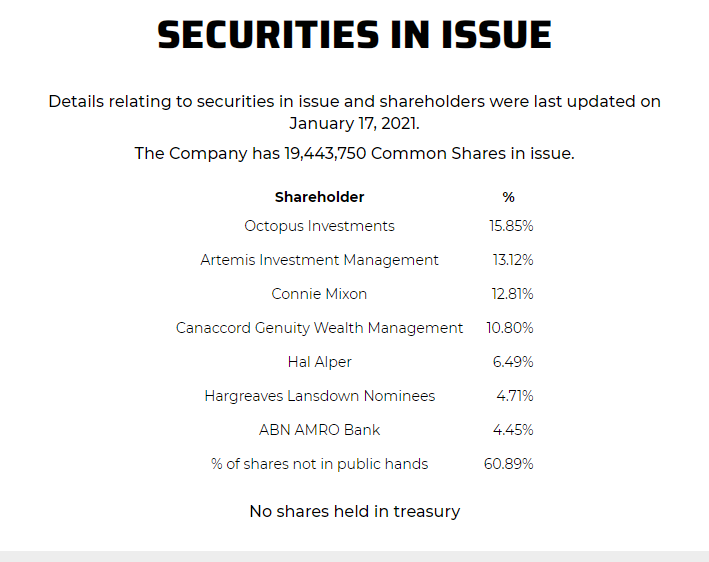

MyCelex Technologies Corp (MYX:LON) is currently sat way down on the long range price chart and selling at a discount to tangible assets, that's enough to get me interested. MYX is an AIM listed nano-cap firm involved in the O&G services market, they've developed a patented polymer which is able to remove hydrocarbons and other pollutants from water and air. Like many of the tiny companies I invest in, MYX swings between profit and loss and now is not exactly a good time to be an O&G services firm. We'll start with some numbers (All figures in USD since MYX reports in this currency); Market Cap = $7.27 Mil Share price = $0.37 (£0.27) Common outstanding = 19.44 Mil BV= $17.1 Mil Cash = $4.255 Mil Total Liabilities = $5.547 Mil Now on to the chart. The stock is currently sat at £0.27 ($0.37), down from an IPO price of £1.98 ($2.74) and a 2019 high of around £2.70 ($3.74). The market is not interested in the O&G industry and these tiny O&G services firms have been left for dead. MYX is so hated it's priced below a reasonable estimation of liquidation value. Sentiment is decidedly bearish and many think the industry is in secular decline. Fine by me, these are the types of stocks I look for. I want to find tiny companies whose shares are thinly traded and are sat way down on the price chart. I don't care if they are currently losing money, I'm looking to buy assets and sell earnings. Provided debt is at a reasonable level and the share price is backed by some hard assets I'm willing to bet that at some point the situation will improve. All I need to know is that the firm has enough supplies to wait out the storm till the good times return. As usual we'll start with the balance sheet. MYX reports bi-annually and their annual report isn't due till the end of May. We'll have to make do with the interim report for the period ending June 30th 2020 and take into account the potential for further cash burn. Current Assets stood at $13.756 Mil. Netting out the Total Liabilities of $5.547 Mil gives us a NCAV of $8.209 Mil If you want to be more conservative you could net out the restricted cash 0f $500k and prepaid expenses of $485k too. That would get us to an adjusted NCAV of $7.224 Mil. P/NCAV = 0.89 P/adj. NCAV = 1.00 Some of you Ben Graham fans have probably noticed that a decent chunk of the NCAV is comprised of inventory, you could mark that down by 50% to be ultra conservative but I'm not that picky anymore. We'll look at the PPE now. I'm not much interested in the machinery and other equipment, I'm only really looking at the land and building for valuation purposes. MYX is carrying land and a building, it's HQ, on the books at $709k and $2.724 Mil respectively. I looked up the property on Instant Street View to take a look. I then used the Gwinnett County tax assessor website to look up the tax parcel info. Total appraised value for 2020 is coming in at $3.569 Mil vs a combined stated value for the land and property of $3.433 Mil in the interim report, not much variance there so we'll stick with the lower of the two figures. MYX still has a note payable out on the property to consider. Netting out the note payable gets us a net asset value of $1.74 Mil for the property. Adding that to the adjusted current assets of $12.771 and then netting out the remainder of the liabilities, $3.855 Mil exc. the note payable, and we end up with a pretty conservative estimate of adjusted tangible BV. Adj. tangible BV = $9.090 Mil vs a market cap of $7.27 Mil Depending how you see it you could always add back in the restricted cash of $500k too since that is being held back under the terms of the note payable. Given the NCAV and adj. BV figures are based upon the interim report for the period ending June 2020 they should be taken with a pinch of salt. MYX booked a loss of nearly ($2.78 Mil) in H1 2020 vs a profit of $87k in H1 2019. Revenues and earnings are lumpy and the next report could reveal that the firm is continuing to bleed red ink. That's fine by me, I not anticipating a liquidation scenario here and just want to know that the firm can get by until revenues and earnings increase. Management has stated that they have a $1.88 Mil line of credit and can also pursue a sale/lease back of the property if they need additional funds. They are also carrying a PPP loan of $401k under other current liabilities which has a pretty good chance of being forgiven. All this makes me reasonably confident that the company can get by till its fortunes improve. Now well take a look at revenues and earnings over the last several years. I'll repost the price chart for comparison. Revenues rose from $4.3 Mil in 2010 to $21.4 Mil in 2013 and the stock responded rising from £1.98 ($2.74) to a high of £5.50 ($7.62) despite the fact that the firm only turned a profit in two of those four years. You can then see the share price collapsed through 2014-2015 before bottoming out in 2016 following a few years of declining revenues and rising losses. The stock then sat at support of around £0.20-0.25 ($0.28-0.35) through 2016 as it built a base before consolidating through 2017-2018. By late 2018 it had risen to around £2.40 ($3.32), all based upon a change in market sentiment as revenues once again grew and the firm swung back to a profit. That's a 10-12-bagger in 2 years depending on where you would have bought in. And now here we are back down in the doldrums sat around long term support with the market looking elsewhere. Things could get worse before they get better but I think downside is limited here. Let's take a look at share ownership. CEO Connie Mixon owns 12.81% and Founder/CSO Hal Alper owns 6.49%. They've not been buying more down here but at least they've got skin in the game.

You'll also notice that the public float accounts for only around 40% of the common out. This is music to my ears. Any sign of new contracts or other positive developments and demand will far outweigh supply. These illiquid stocks don't need much good news or change in market sentiment to have big upward moves. What are risks here? Maybe O&G prices remain depressed or drift lower, I think it's unlikely but who knows. Perhaps prices do move up but MYX loses out to larger competitors with competing products. Maybe they do score some more contracts but SGA costs run high and they keep bleeding red. Anything is possible but when the picture looks this bleak it doesn't take much to change market sentiment. I like to buy near the point of maximum pessimism and sell when the future looks bright. Buy assets and sell earnings. Thanks for reading, David Disclosure: Long MYX.AIM

13 Comments

Can Baran

2/14/2021 08:00:08 pm

Would be happy to be able to chat live with you on some details. A few things are a little hard for an amateur like me to understand

Reply

David

2/14/2021 10:46:50 pm

Shoot me an email or a DM on twitter with any questions you have.

Reply

Damon James Davies

2/15/2021 06:41:32 am

You certainly do your homework. Excellent

Reply

Mike

2/16/2021 08:36:43 pm

"Buy assets and sell earnings". This is quite controversial. It could also be "buy only cheap earnings" if you look at a newly published paper (see the link). However, I also think that the chart, valuation and small size of the company look interesting. https://review.chicagobooth.edu/accounting/2017/article/why-value-investing-buy-signal-out-date

Reply

Mike

2/16/2021 08:55:18 pm

An alternative that I like more than price / book is price / sales or enterprise value / sales for a company that has no earnings (considering that price to book is probably not so useful). The lower the better compared to the sector of the company.

Reply

BUD

2/17/2021 01:23:08 am

Nice writeup and interesting company. Do you know why they are AIM listed as a US company as opposed to OTC?

Reply

Log

2/18/2021 02:25:27 pm

MYX has announced the sale of their Georgian property for $5.4m. The financial gain adjusted for the debt obligation will be around $2.5m.

Reply

David

2/20/2021 10:12:04 pm

Heard about that, I'm surprised that they got that much for the property. Great news though!

Reply

mike

2/20/2021 11:23:08 am

Interactive brokers does not carry this stock unfortunately. (They have the smallest stocks from Japan and Hong Kong but strangely not from London).

Reply

David

2/20/2021 10:13:51 pm

Hi Mike, yeah I've been hearing a lot of investors say the same thing regarding IB not covering tiny UK stocks. I've had some US based investors tell me that Charles Schwab often covers them though so perhaps check them out.

Reply

mike

2/20/2021 11:37:24 pm

I contacted IB. sometimes they aditionally add a stock for trading.

Brandon

2/28/2021 06:25:54 pm

Hey David, love your stock ideas and especially how you engage with your readers in the comment section. I don't know how easy this would be to implement, but I really like being able to see the most recent comments on the home page. For example, you can see them on the right side of Dan's blog: http://www.nonamestocks.com. Just a thought!

Reply

David

2/28/2021 07:11:10 pm

Hi Brandon,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed