|

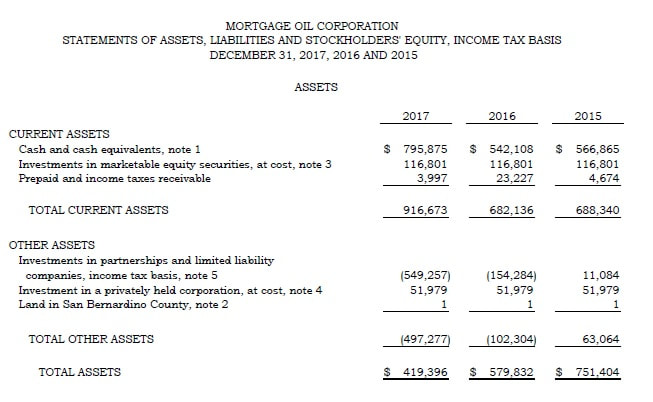

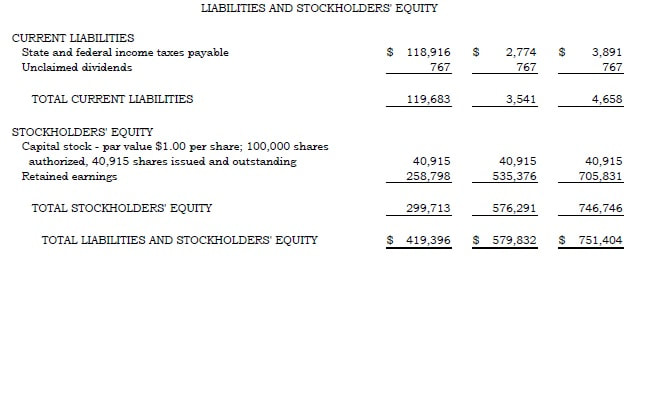

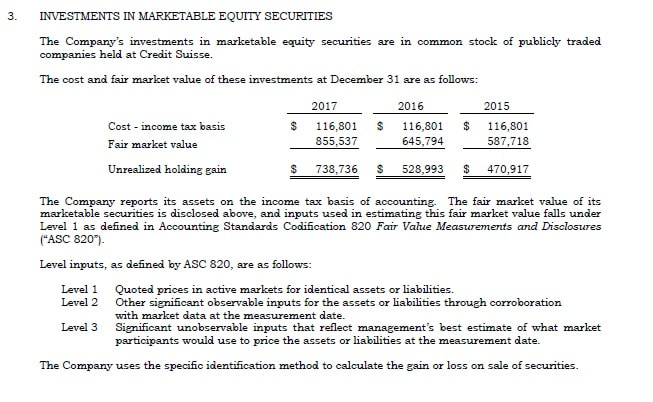

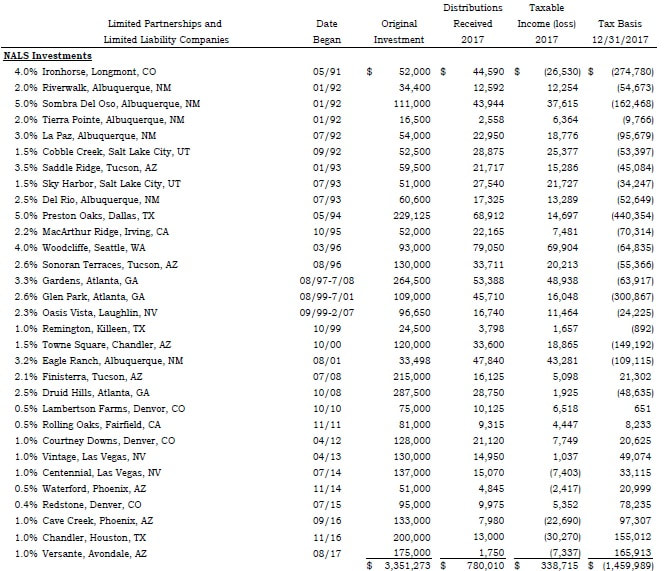

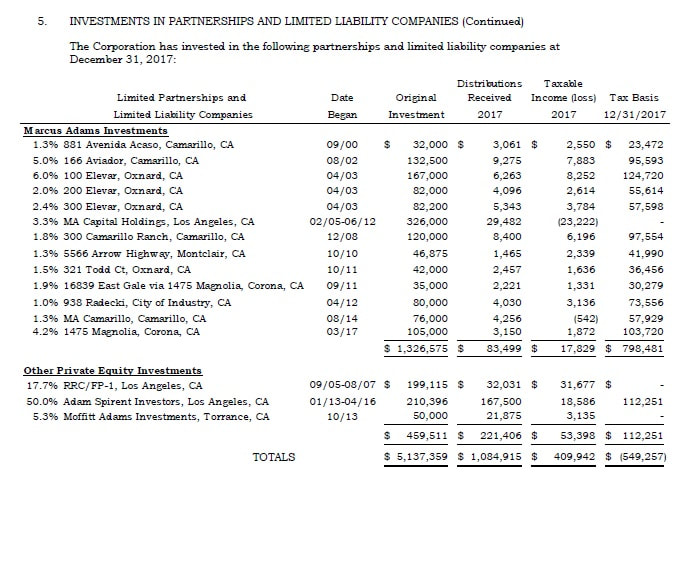

Today's stock is another pink sheet from the Walker's Manual of Unlisted Stocks (2002-2003 6th Edition). First things first, Mortgage Oil Corp (MGAG) isn't an oil company, it's a real estate investment company with some cash and investments on its balance sheet. Walker's informs us that the firm was spun off in the liquidations of Mortgage Guarantee Company and Mortgage Service Co. in 1946 and 1949 respectively. The mineral, oil and gas rights that the firm once possessed were distributed out to shareholders as dividends in 2005. Since 1991 the company has been primarily engaged in investing in Real Estate Limited Partnerships and LLC's. How exciting I hear you say!, bear with me as it gets interesting. Let's look at some numbers; Market Cap = $2,864,050 Shares outstanding = 40,915 Price per share = $70 Spread = 54.43% Dividend per share = $10 Dividend Yield = 12.82% Now to the company's most recent financials to take a look at the balance sheet; What do you notice? I see the following; a) Investments in marketable securities marked at cost, what's their current market value? b) Investments in real estate partnerships and LLC's being carried at negative value, what is their true value? c) Investment in a privately held corporation carried at cost, what is it's current value? d) Land in San Bernandino County carried at $1, what is this land and what is it actually worth? Lets see what the notes to the financial statements tell us; As you can see, the current fair market value of these securities is over 7x the cost price. If we amend the stated Book Value to account for this unrealized gain we get a figure of $1,038,449 Now to the investments in the partnerships and LLC's MGAG is carrying these investments on it's balance sheet at a value of -$549,257 despite the fact that it's original cost price for the combined entities is $5,137359. This is a result of the fact that MGAG has received distributions in excess of the income of the Partnerships and LLC's, as such the company must decrease the amount carried on the balance sheet to account for this. In 2017 alone MGAG received $1,084,915 in distributions. Now the question arises, what is the true value of these investments and what is the future likely income? It can safely be said that their value is not -$549,257 given they returned over $1 Million in 2017. Assuming a value of $0 takes the adjusted BV up to $1,587,706. Now assets that are generating $1 Million a year are worth more than $0! If we back out the current assets of $916,673 from the current market cap we see the market is valuing the partnership/LLC investments at around $1.9 Million. That's about 1.9x current annual distributions. This seems like a major mispricing to me. Assigning a P/E of 7-8 which is common for a no growth stock (The distributions are growing but lets be conservative) we'd get a fair value of $7-8 Million for the partnership/LLC assets, well in excess of the current market cap of $2.86 Million. Now to the investment in the private corporation and the land; After digging around to try and find some info on Debisys Inc I came up empty handed so I'm not sure what the likely value of this investment is. As for the land, given it's only 0.3 acres it is probably not worth a great deal but certainly a lot more than the $1 it is carried at.

All in all, I think a fair value for MGAG is probably in the $8-10 Million range given the cash, marketable securities and interest bearing assets it owns. You knew it was coming, now for the bad news, This stock is illiquid, really illiquid! The last trade I could find was 200 shares in July 2010! What a sad ending to such an interesting story. Maybe not, things can change, volume can spike based on sentiment, markets can crash creating panic, the internal situation at companies can shift if insiders or majority owners seek change. What's to be done?, wait and watch or put a GTC limit order in and keep your fingers crossed. Thanks for reading, David Disclaimer: The author (unfortunately) holds no ownership in MGAG at the time of writing

9 Comments

Damian T.

11/1/2018 09:28:30 pm

Hi David,

Reply

David

11/2/2018 06:13:37 pm

Hi Damian,

Reply

Damian T.

11/2/2018 09:39:26 pm

Thank you for sharing tour knowledge, and for your quick response!

Reply

Peter Q

11/23/2019 05:02:27 pm

David,

Reply

David

11/24/2019 10:21:29 am

Hi Peter,

Reply

Peter Q

11/24/2019 02:20:51 pm

https://web.tmxmoney.com/quote.php?qm_symbol=mgag:us

David

11/24/2019 09:11:57 pm

Thanks for the link Peter, that is very useful indeed.

Reply

1/31/2020 06:26:15 pm

Almost wonder if an insider or large shareholder used your post to sell out...stock has gone from 70 - 300 pretty quickly :)

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed