|

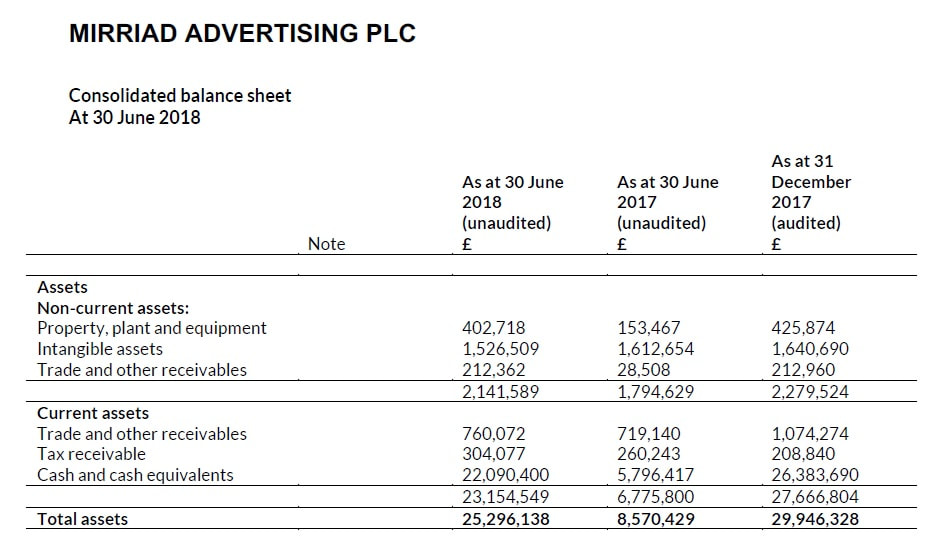

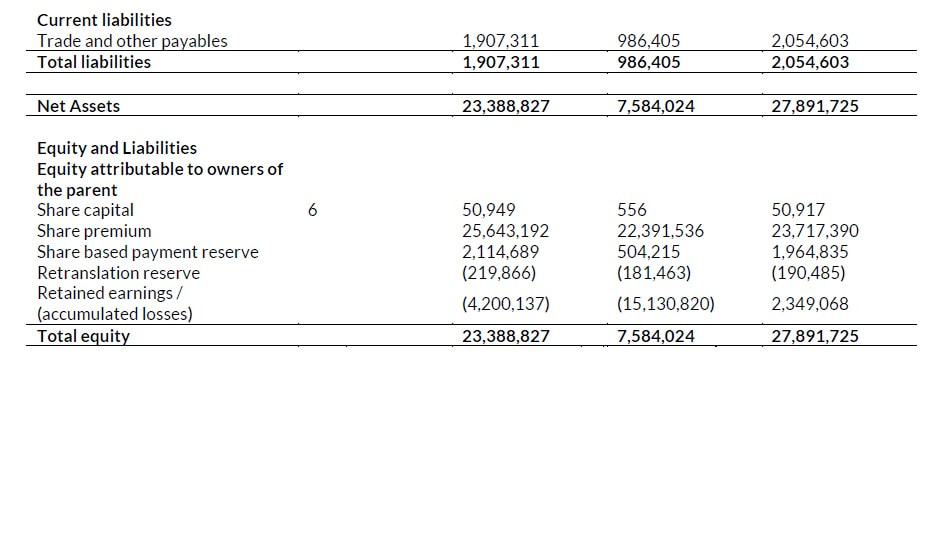

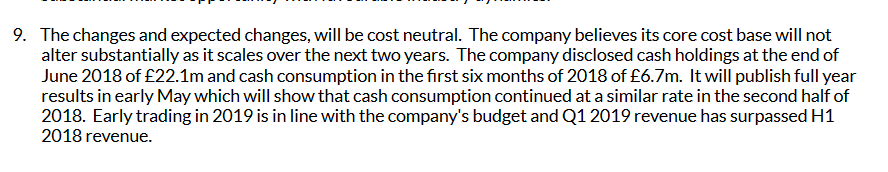

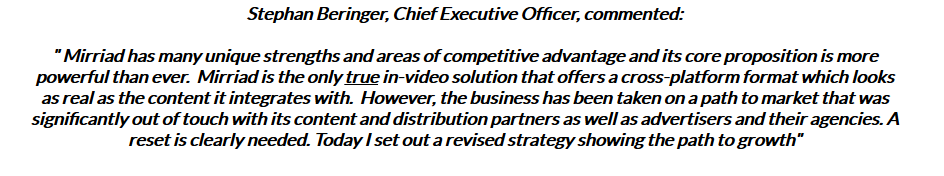

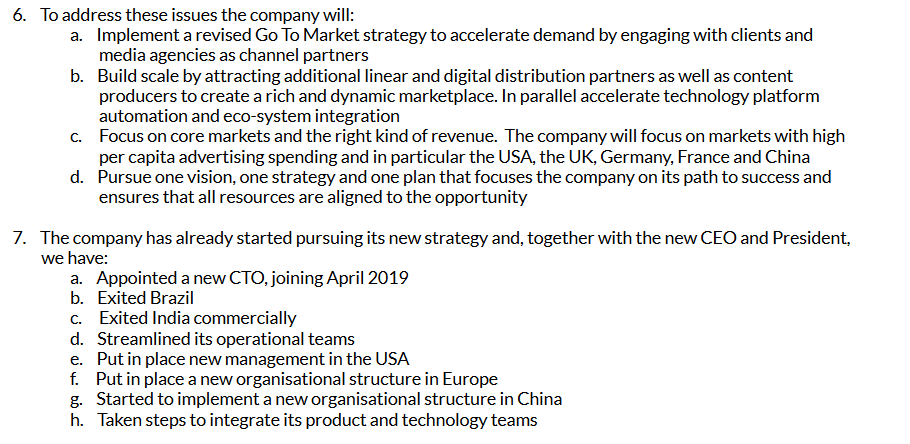

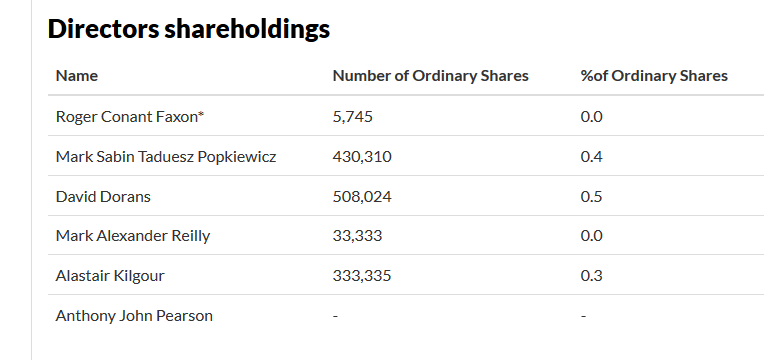

Today's stock is yet another nano-cap tech firm which floats on the AIM market of the LSE. Mirriad Advertising PLC (MIRI:LON) is a UK-based video technology company which is focused on the development of native in-video advertising (NIVA). The firm's patented technology enables the insertion of advertising into existing video which cannot be skipped or blocked. It won't come as any surprise to those who follow my blog that MIRI is tiny, dirt cheap and in a spot of bother. MIRI began trading on AIM (Alternative Investment Market) after an IPO in December 2017. Since then it's share price has fallen from a high of 62.5p to a low of 4.20p, it currently languishes at 5.75p. Since inception the firm has performed poorly with little sign of meaningful revenue growth, from £710,000 in 2016 to £870,000 in 2017. Half year results for 2018 were even worse with revenues of £120,000 for 6 months to June 2018 vs 2017 half year revenue of £352,000 (2018 full year results are due 9th May 2019) Losses have risen fro £7.2 Mil in 2016 to £11 Mil in 2017, Half year losses for 2018 amount to £6.5 Mil. To make things worse MIRI has been burning cash at a rate of around £1-1.2 Mil per month. At this point you are probably asking why on earth I'm even telling you about this stock. Two reasons; 1) The company is selling at a discount to net cash 2) Change is afoot. We'll start by taking a look at the most recent financials to see what we can find on the balance sheet. So as of the June 2018 interim results we had the following; Current Assets Trade receivables £760,072 Tax receivables £304,077 Cash £22,090,400 Total liabilities £1,907,311 This equates to; NCAV(Net Current Asset Value) = £21,247,238 Net Cash = £20,183,089 The company then released a strategy update on March 27th in which they revealed the following; So the firm has been burning through cash at a rate of £6.7 Mil every 6 months and this cash burn continued at a similar rate in the second half of 2018 and the first 3 months of 2019. To err on the side of caution I'm going to assume a future cash burn of £7 Million every six months or £1.17 Mil per month. This rate of cash burn for the second half of 2018 and the first 3 months of 2019 would shave another £10.5 Mil off the assets side of the balance sheet resulting in; NCAV (Net Current Asset Value) = £10,747,238 or 10.22p per share Net Cash = £9,683,089 or 9.21p per share Current Market Cap is £6,044,556 or 5.75p per share Shares outstanding = 105,122,717 MIRI is thus currently trading at; 0.56x NCAV 0.62 Net Cash Now on to the change I mentioned about. Firstly the old CEO, Mark Popkiewicz, was recently replaced by the current CEO Stephan Beringer. From what I can gather the old CEO was pretty bad and despite the company having a good product mismanagement left the firm floundering. The current CEO had the following to say in the recent strategy update; It's good to hear that the new CEO not only appreciates that MIRI has a unique product with real potential, but that he also aknowledges that the firm's previous strategy was misguided. In the strategy update the company notes the following; "Mirriad's Go To Market strategy has historically been flawed. There was previously a lack of focus on the demand side of the market (media agencies and brands/ advertisers) and the company had spread itself over too many markets" MIRI's revised strategy is then outlined as follows; According to the most recent insider ownership information I've managed to find it doesn't appear that management has much skin in the game. This data is from June 2018 so we may see some insider buying been reported in the near future giving the current discount to net cash and the possibility of a turnaround. News of directors buying would certainly prompt a rally in the share price. What might happen?

The new CEO could fail to turn the ship around, revenues may not grow and large losses could continue. The cash pile could be burnt through forcing the company to issue equity or debt to keep itself afloat. The stock could go to zero. Or The new CEO could begin to turn the ship around. Some contracts could be signed, revenues and earnings could grow and the stock could take off and become a multi-bagger. I'll hop on for the ride. Thanks for reading, David Disclaimer: Long MIRI

6 Comments

rukawa

4/7/2019 04:34:11 am

How did you find this one?

Reply

David

4/7/2019 11:28:01 am

Hi rukawa,

Reply

rukawa

4/14/2019 04:58:41 pm

Thanks!! Excellent blog btw, I really like it.

Reply

Peter

4/20/2019 04:46:12 pm

I really enjoy your posts. I am not as sanguine as you are about companies that are constantly loosing money but I appreciate your write-ups nonetheless. Thanks again for sharing your hard work!

Reply

David

4/20/2019 10:30:43 pm

Hi Peter,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed