|

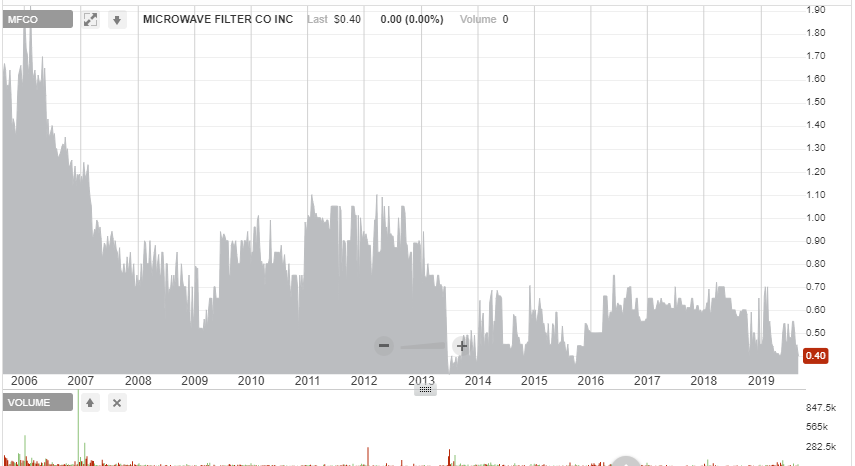

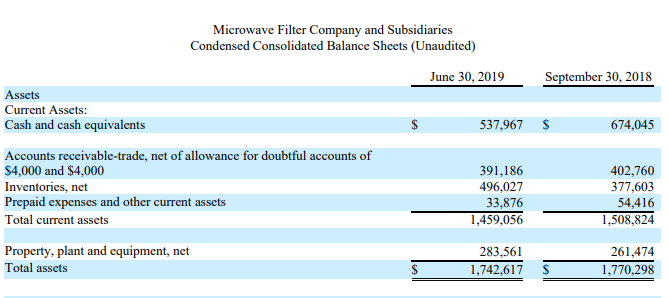

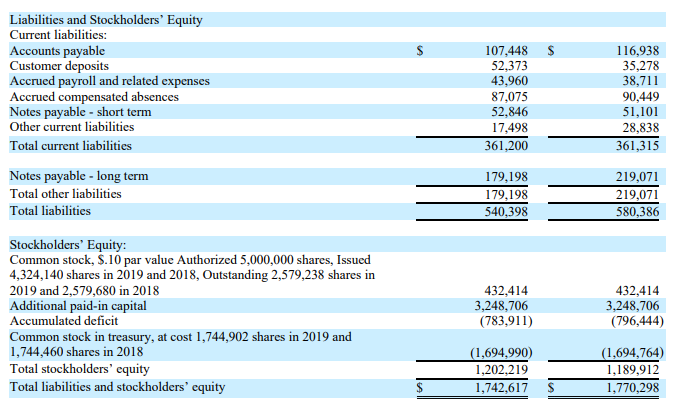

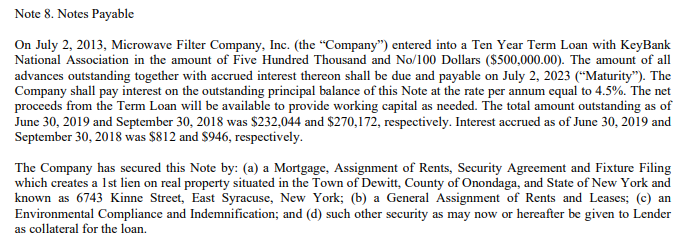

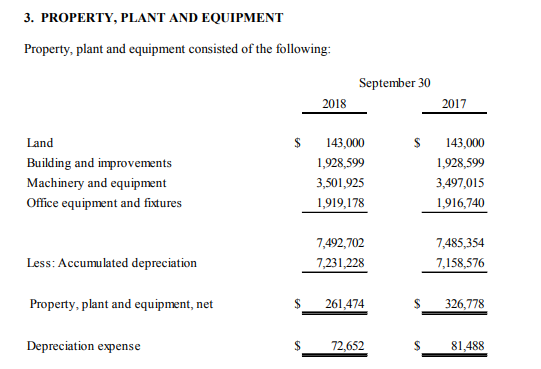

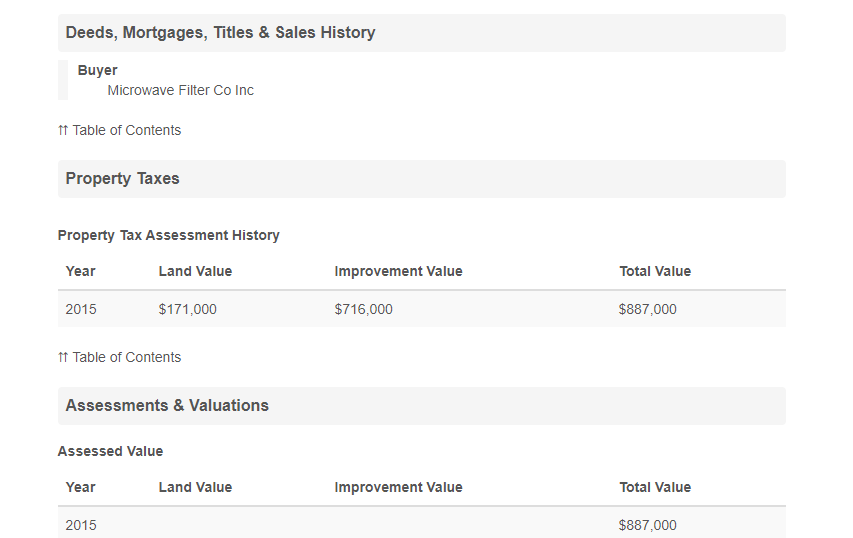

I came across Microwave Filter Co. Inc (MFCO) whilst trawling through the pink-sheets and decided to take a closer inspection after a few things caught my eye. Regular readers will know what I look for but for those who are new to the blog I'll fill you in. Ideally I'm looking for tiny, illiquid, unloved or forgotten companies which have been around for a while and have some potential, invariably they also tend to have some hair on them. MFCO checks all the boxes; The company formed in 1967 and lists it's business as follows; "Microwave Filter Co., Inc. manufactures, and sells electronic filters for radio and microwave frequencies. The filters process signals and prevent unwanted signals from disrupting operations. The Company serves cable television, wireless cable, broadcast, satellite broadcast, mobile radio, cellular telephone, commercial, and defense electronics markets." If you think the business description sounds exciting wait till you get a load of their website, a relic from the land that time forgot! Here's a few numbers; Market Cap =$1, 031,804 Share price = $0.40 Common = 2,579,238 No warrants or Pref's And here's the long-range chart; As you can see this stock tends to bounce around quite a bit. The company is currently hovering around break-even and has been losing money for the last few years. The latest financials, 3rd Q 10-Q 2019 show; Revenue for 9 months ending June 2019 as $2,746,029 with net income of $12,533 or $0.00 per share. The 2018 Annual report listed the following; Rev for 2017 and 2018 was $3,036,669 and $ 3,341,811 respectively. Net income for 2017 and 2018 was -$264,216 and -$16,059 respectively. Now to the things that interest me. We'll start with the balance sheet; So it appears that MCFO has a NCAV of $918,658 which offers some downside protection on the current market cap of $1 Mil. Adding in the PPE brings book value up to $1,202,219. When I was reading through the foot notes I noticed the following; Why would KeyBank extend credit of $500,000 secured against a property listed on the balance sheet as worth $283,561 or less? The latest quarterly doesn't break down the PPE so I went back to the last annual to see if I could find out anything more. Looking at this the building only accounts for around 25% of PPE so it's depreciated value would be $70K based on the 3rd Q PPE figure. There is no way MFCO's building is only worth $70K. Here's a few pictures so you can take a look for yourself. The company website states the following; "Microwave filter Company is located in the heart of Central New York State in what is known as “The Finger Lakes Region”. The company has occupied this modern 40,000 square foot facility since the early 1970’s. The facility has undergone many expansions and upgrades over the years. Our customers are always invited to visit when in our area. Please call for an appointment." I'm no real estate expert but a 40,000 sqft commercial building like that has got to be worth at least $1 Mil and probably more given that $500k in credit was extended against it. Assuming it's worth $1 Mil then BV should be closer to $2.1 Mil or $0.82 per share. Edit; I decided to try and get a more accurate idea of the real estate value. According to the link below the average P/SQFT for commercial real estate in New York State is around $100. https://www.reonomy.com/properties/commercial-real-estate/us/new-york/1 I couldn't find an average P/SQFT for East Syracuse but after looking through a bunch of other commercial properties in the area it seems they are priced at $80-100 per sqft with a lease price of $ 7-10 per sqft. This would put a value of around $3.2-4 Mil for the building and a potential annual leasing revenue of $280-400k per annum. A reader of my blog also tracked down a tax appraisal for the building which , as of 2015, put an appraised value of $887k. I also found out that Zeff Capital LP had made an offer to buy the company for $0.72 a share back in early 2018. Given the apparent undervaluation of the real estate this figure seems reasonable.

You can view the 8-K here At that point Zeff owned around 220k shares but then cancelled the offer and more recently reduced their holdings to around 97k shares. See here Another major shareholder, Gerst Capital, expressed support for the buyout offer and intimated that he would like to be appointed to the board if the deal fell through but management have, thus far, not entertained that idea. I've no idea what prompted Zeff to cancel the deal but since then MFCO has filed a form 15 which means it should be going dark. The form 15 was filed in May but the firm is still listed as a current pink-sheet on the OTC markets so I'm not sure what is going on there. Assuming MFCO is going dark (they indicated that they would continue to provide financials on their site) then they should reduce their costs significantly bringing them back to profitability. There are obviously some risks here, MFCO is currently dependent on a few clients for a large proportion of it's business. "Net sales to two significant customers represented 54.0% of the Company’s total sales for the nine months ended June 30, 2019 and net sales to two significant customer represented 42.1% of the Company’s total sales for the nine months ended June 30, 2018. A loss of one of these customers or programs related to these customers could significantly impact the Company." There's also no guarantee that going dark will bring the firm back into the black though there is a good chance it will. At present Zeff Capital still holds around 3.8% of the common and Gerst owns 11.5% via Gerst LLC and Gerst LP according to this proxy management owns 6.9% The firm has a backlog of around $700k, NOL carry forwards of around $700k and enough cash to cover their debts. $0.40 a share seems like a good deal to me and I think fair value is closer to $0.80 a share. If the firm starts to turn a profit $1 might not be out of the question. Let's see what happens. Thanks for reading, David Long MFCO

21 Comments

mike

8/24/2019 09:18:24 pm

In the last years this stock traded between about 40 cents and 1 usd. So a price of 80 cents is reasonable. Great find.

Reply

David

8/24/2019 11:13:52 pm

Hi Mike,

Reply

Love it! This stock has been on my list to buy for years and I've just never got around to doing it. I'll get there one of these days.

Reply

David

8/25/2019 09:09:51 pm

Hi Dan,

Reply

I really enjoy reading your analysis. Clear, straight to the point, showing the hard facts and little forecasting is needed. What I really like with these tiny stocks is that the present intrinsic value is easy to calculate (as long as you can dig for and find the information)

Reply

David

8/26/2019 07:02:14 pm

Hi Jan,

Reply

David

8/26/2019 07:07:23 pm

Hi Jan,

Reply

Mike

8/26/2019 07:11:56 pm

Hmm, the stock price did go up by around 50% today. This stock is very illiquid of course. I am wondering if this blog is already so popular that it can impact the price.

Reply

David

8/26/2019 07:43:29 pm

Hi Mike,

Reply

Mike

8/27/2019 03:46:12 pm

BTW where do you invest? I understand in U.K and in U.S. or also in other countries? I think Japan (e.g. the stock 7462) would also be interesting, but because of the language barrier, you probably have to rely on the financials only.

Reply

David

8/27/2019 05:14:09 pm

Hi Mike,

Reply

Mike

8/27/2019 06:58:33 pm

Yes, 7462 is not so low based on price to book. But it is low based on price to retained earnings. One study found that retained earnings are more relevant than net assets.

Reply

Mike

9/2/2019 09:02:26 pm

A cheap stock that I found is Imperial Ginseng, one of the world's largest growers of North American ginseng.

Reply

David

9/2/2019 10:11:31 pm

Hi Mike, have you checked to make sure it's not a Chinese RTO?, why is it selling so cheap?

Reply

Mike

9/3/2019 09:10:20 pm

I found this company with a screener based on fundamentals only.

Jason

11/11/2019 02:09:02 am

David,

Reply

David

11/11/2019 10:41:12 pm

Hi Jason,

Reply

David

11/12/2019 06:54:40 pm

Hi Jason,

Reply

Jim

11/12/2019 04:09:50 am

Thanks David, heard you speak on the last TIP... Loved the talk and enjoyed hearing your mindset. It was awesome. Thought I would comment here because I did go to school in the area and also have my doctorate in Microwave Engjneering. The inventory on their sheets could be greatly overstated because it could be for lower frequency equipment that is either not supported or used anymore. The Network Analyzers on the website looked so old that I don't think that there would be much salvage value in them either. On a different note, Syracuse does have a fair amount of RF companies so I would imagine that it could be ripe for purchasing. My last comment is that RF can sometimes be a "black art" so the company could pick up contracts here and there to remain solvent simply because they have a niche and are trusted by their customers. Thanks for the write up, really enjoyed it.

Reply

David

11/12/2019 07:00:38 pm

Hi Jim,

Reply

iota

8/7/2021 10:30:52 am

Hi David

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed