|

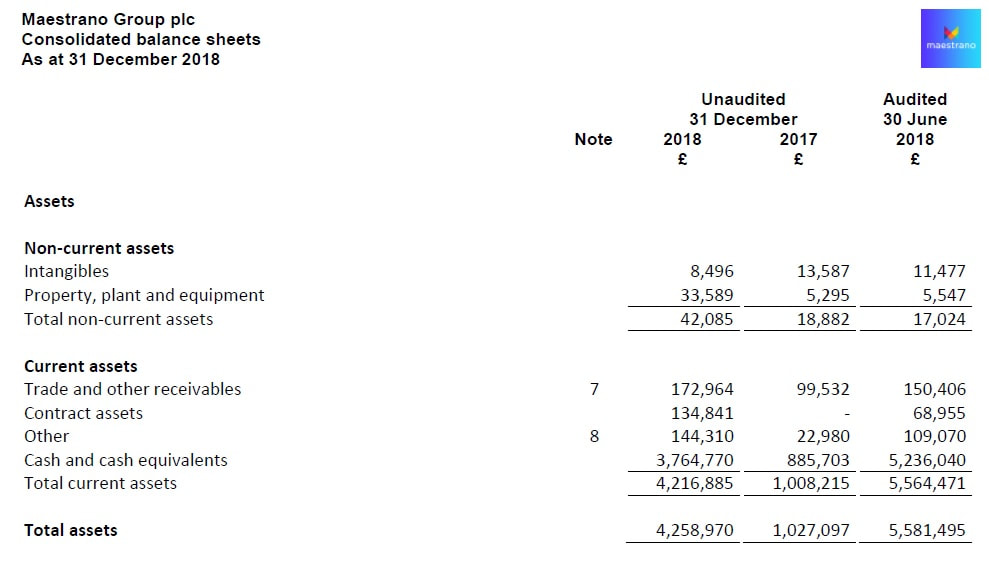

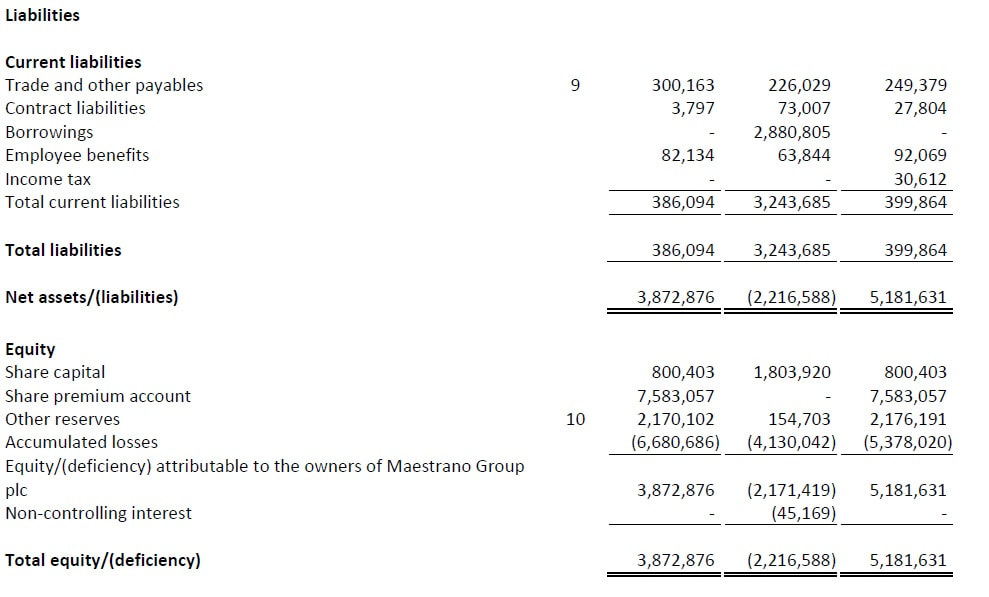

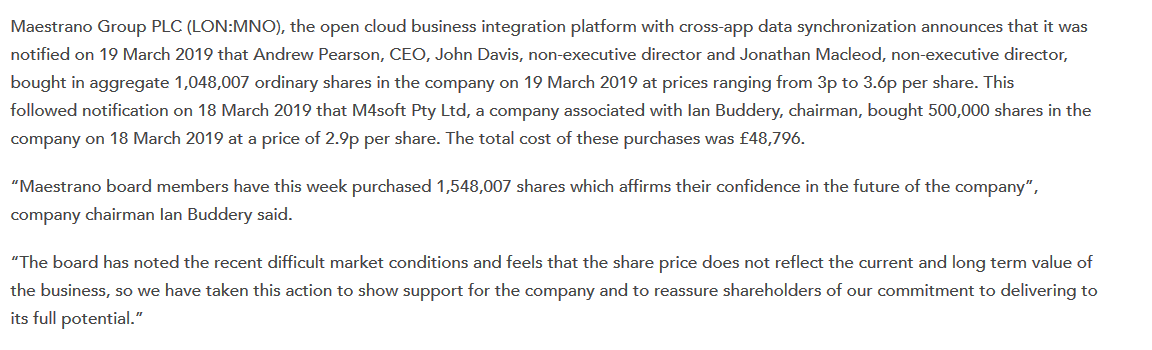

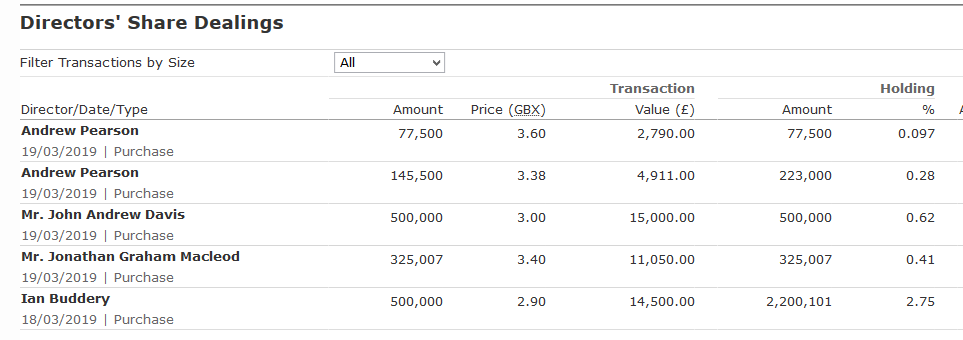

Regular readers of my blog will know that I like to focus on tiny unloved companies which have either been left for dead, are being ignored or are generally despised by those few investors that can bear to look at them. The more obscure or hated the stock is, the more interested I am , but I'm always looking at it from a deep value perspective. I want to buy assets at a discount to their tangible worth. Maestrano Group PLC (MNO:LON) fits the bill I came across MNO much in the same way I discovered ENET, by simply screening for relatively illiquid nano caps with a negative enterprise value. A typical screen would look something like this (I will play around with my screening criteria sometimes as interesting opportunities can also be found by sifting through low P/E, EV/EBITDA or P/S stocks etc); Market Cap < £50 Mil ( I want to be looking at miniscule companies that little to no institutional investors or analysts are interested in, or are even allowed to consider for investment.) Enterprise Value < £0 Mil (This gets you into discount to Net Cash territory!) D/E <0.2 (I want the firm to not be under financial pressure whilst things are not going well, this gives the company some time for the situation to improve without the risk of bankruptcy emerging.) Shares outstanding < 100 Mil (The more illiquid the stock is the more other investors are put off but when demand increases for these types of stocks large price moves occur. This allows for one to sell into heavier volume as investors become interested, if and when the company's fortunes improve) Share price < £3 (A low absolute share price is desirable as it is far easier for a 50 pence stock to triple to £1.50 than it is for a £10 stock to triple to £30. The psychology of investors is such that they have less inhibitions putting capital into low priced stocks depite the fact that they may or may not be more undervalued than their more expensive counterparts on an absolute basis.) Apologies for the detour, back to MNO MNO is a UK based software firm that offers a cloud based platform for SME's, banks and accounting firms. The company has operations in Australia, the US, UK and the UAE. The firm floated on the AIM (Alternative Investment Market) of the LSE back in May 2018 with an IPO price of 15 pence. Things have been downhill since then with the stock falling to a low of 2.50p, it is currently sitting at around 3.40p. Now we'll take a look at the company's most recent financial statements to see what's on the balance sheet. Net Cash (Cash and equiv's - Total Liabilities & prior claims) = £3,378,676 or 4.22p per share Net Current Asset Value (Current assets - Total Liabilties & prior claims) = £3,830,791 or 4.78p per share. Net-net Working Capital (Cash and equiv's + O.75x receivables + 0.5x Inventory/contract assets - Total Liabilities & prior claims) = £3,647,974 or 4.55p per share For the NNWC figure 'contract assets' are marked down 50% since these are essentially the inventory for MNO, I have also marked down 'other assets' by 50%. MNO's current Market Cap stands at £2,721,371 and it's share price is 3.4p Thus the firm is currently trading at; 0.81x Net Cash 0.71x NCAV 0.75x NNWC Shares outstanding currently stands at 80,040,331 Edit (04/04/2019) A reader has kindly pointed out that I neglected to compensate for a 3 month cash burn in my calculations (Thanks Harris!). Assuming a cash burn of £350K for the 3 months since the interim report would result in net cash of around 3.7p vs and share price of 3.45p resulting in a market price of 0.93x Net Cash. There are no preferred shares listed but there is an 'occupancy expense' of £118,485 on the income statement, if one were being highly conservative this could be added to liabilities and treated as an non-capitalized expense much like an operating lease. So the question you are all probably asking is, why is MNO so cheap? a) The company is very young and has yet to turn a profit. If expenses continue to exceed revenues the firm will remain in the red and cash burn will erode the current discount to tangible assets. b) Given the continued uncertainty surrounding the UK economy and BREXIT many companies are postponing investment until clarity emerges, this will no doubt be impeding MNO from securing certain business. c) One of MNO's main customers, a major US Bank client, is currently limiting the visability of MNO's paltform to its customers, the Bank wishes to pursue a "do it slow, get it right" strategy with the roll out of the platform. This is, therefore, acting as a drag on MNO's short-term financial performance. d) If the firm burns through its cash before it's performance improves it could be forced to issue equity or debt to raise capital, this could resut in a major dilution for common stock holders. Its not all bad news though. Revenues are growing, up 29% on the previous year. Now that MNO has successfully launched the first phase of it's platform with it's US bank client it expects to see further progress in 2019 with management reporting; "We successfully launched the first phase of a platform with a large and well-known USA based bank for a solution that is intended to reach up to four million small and medium business customers in due course. The launch of this complex solution was the culmination of much hard work from the Maestrano team and strong collaboration with the client. We expect the initial solution will be expanded during the coming year as the client methodically rolls out the solution to its customer base. Subscriber revenue from this client is expected to grow steadily during 2019." It has also launched a platform for a multinational value-add technology distributor with roll-out scheduled for Asia Pacific and Europe in 2019. MNO has also secured a conntract with a major Australia based bank for testing and pilot phases of its platform. Management reports; "Maestrano also commenced the implementation phase of a contract with a high-profile Australian bank for testing and pilot phases of a solution for its small and medium business customer base, initially targeted at the legal industry segment. This implementation work is scheduled to be completed during the second half of this financial year, with subscriber revenues expected to commence during the next financial year." Management is sending a clear signal that they believe in the company with the recent announcement of insider buying. Whilst insider ownership isn't large it is still a good sign. Chairman of the board, Ian Buddery has the largest insider ownership at 2.75%. Many investors will write off stocks like this as 'melting ice cubes'. I think differently.

I always buy these types of deep value stocks as part of a basket rather than as a stand-alone investment. Some go under, some go nowhere and some become multi-baggers. At the current price MNO isn't an outright net-net since it isn't selling at <67% of NCAV but the potential upside here is good enough to warrant a narrower margin of safety. All new companies need to expend capital to develop products and services but software firms have an advantage. Once the product has been developed it can be scaled without the need for a large increase in capital spending. The heavy work is done building the software architecture with the maintenace requiring lower capital expenditures. Buying below net cash gets you the operating business and all the other assets for free, if things improve the stock can make large moves upward. Into the basket it goes. Thanks for reading, David Disclaimer: Long MNO

4 Comments

Harris

4/4/2019 08:30:58 pm

Love nanocaps. Remember that the company reported the balance sheet as of December 31, 2018, and today is April 4, 2019. 3+ months of cash burn is significant for something like this. Another GBP 600k gone, perhaps?

Reply

David

4/4/2019 09:03:55 pm

Hi Harris,

Reply

Mike

7/16/2019 08:31:31 am

This seems to be taking a binary route. Either to zero, because the company is a startup, or a high return. Now the price is slightly above 1 and the market capitalization is about 1 million, i.e. the stock should now be much cheaper.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed