|

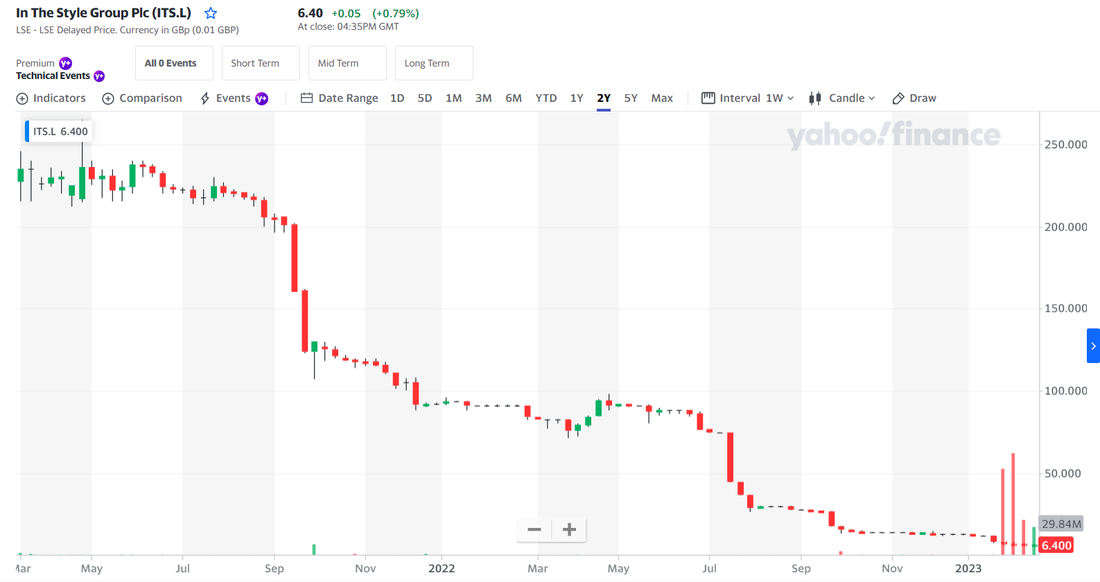

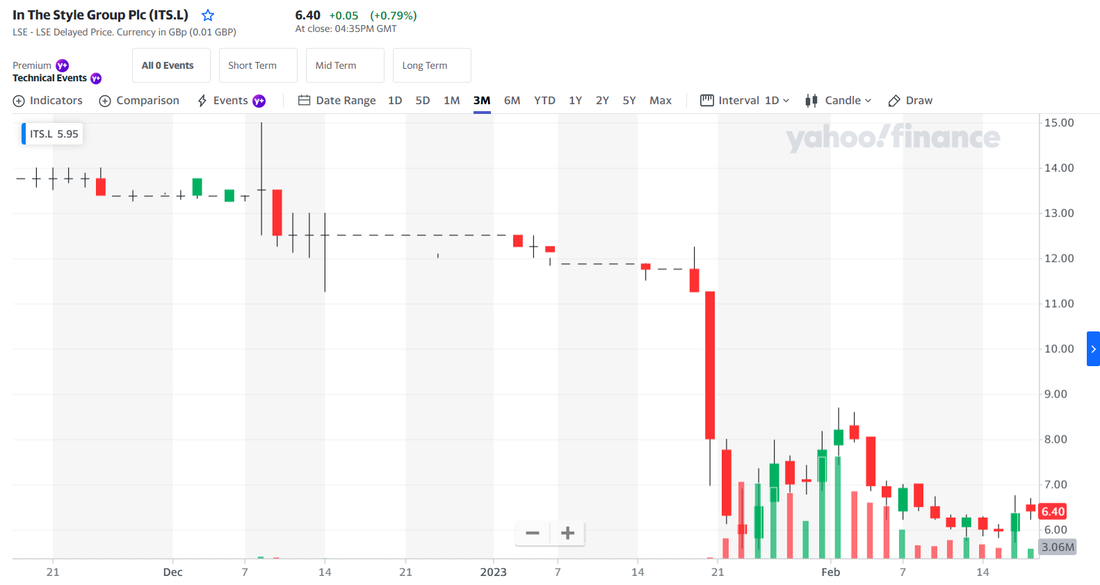

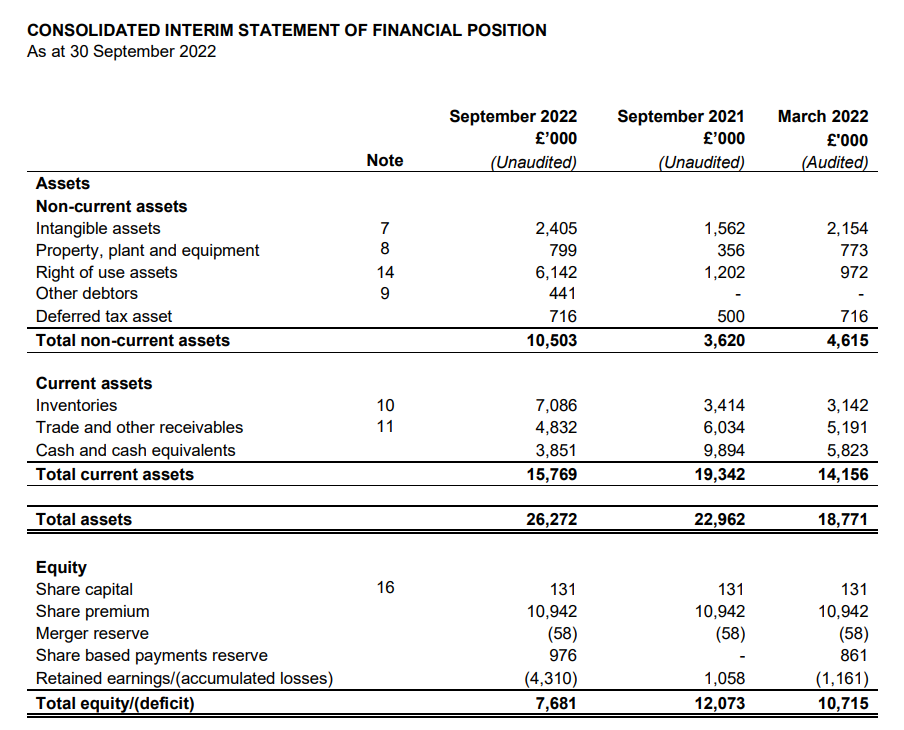

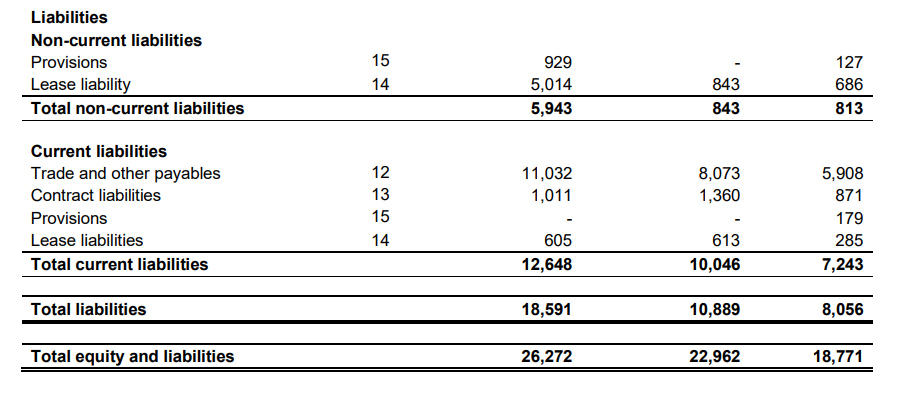

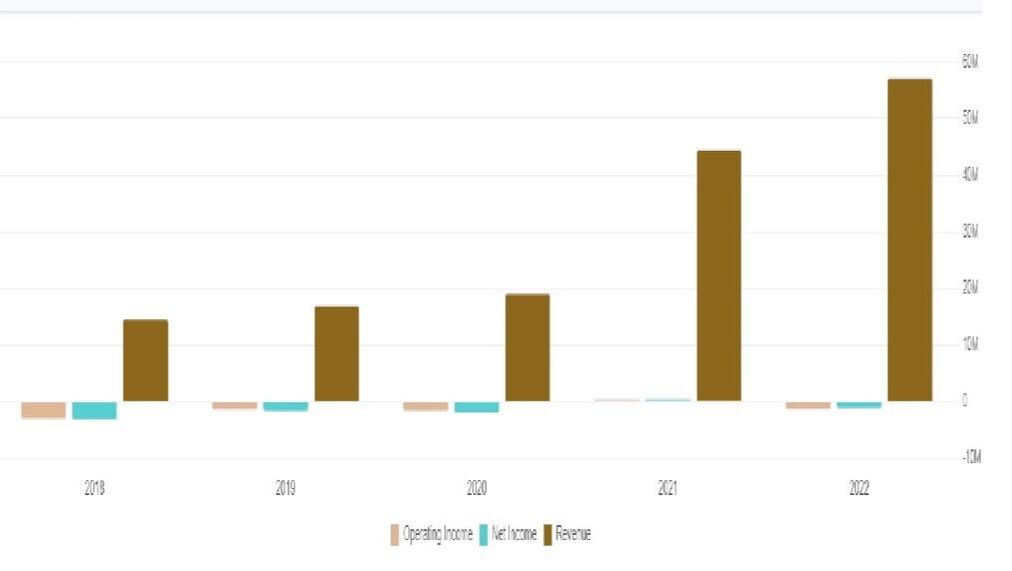

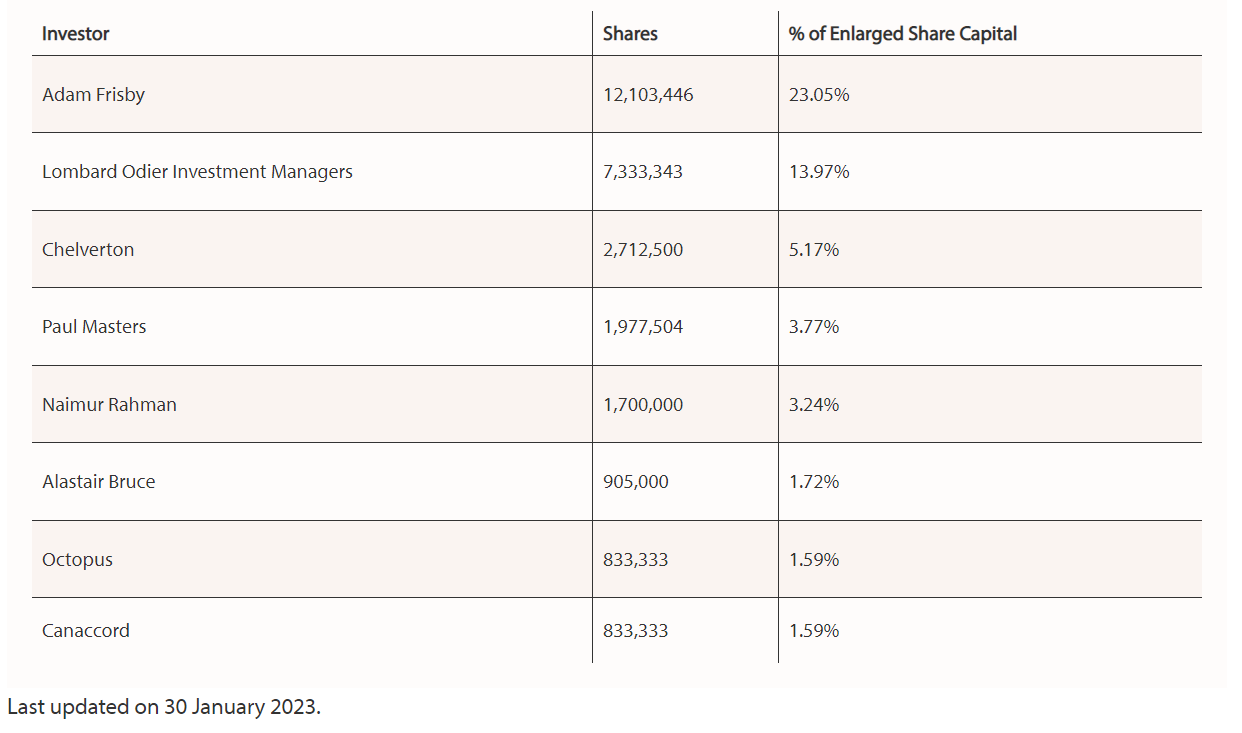

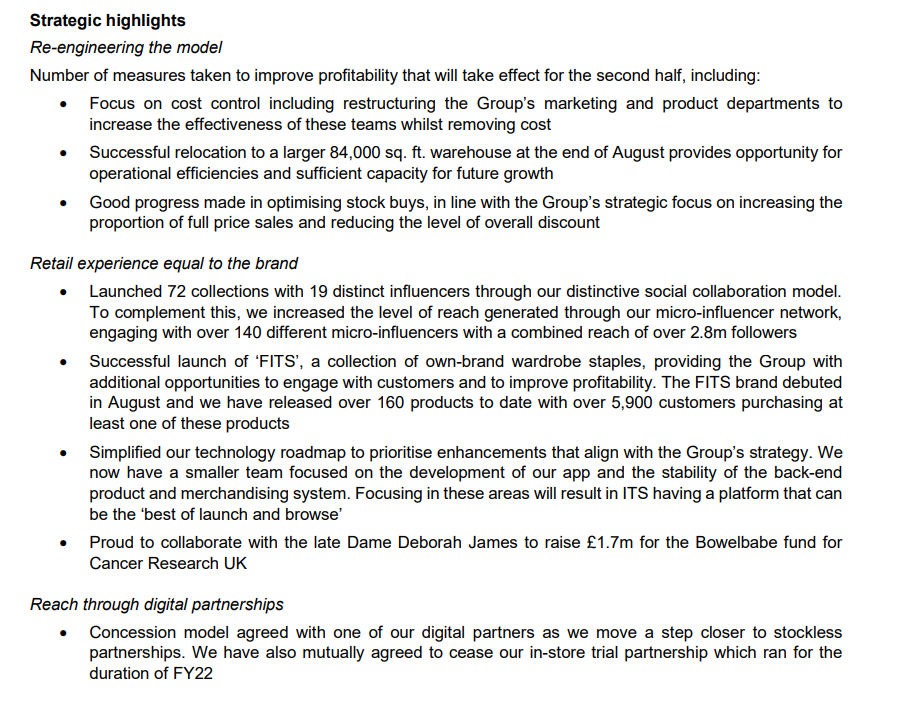

In The Style Group PLC (ITS.L) has been in a death spiral since its IPO and now hovers just above its all-time low. Yours truly has been accumulating since it found support. ITS operates as an e-commerce womenswear fashion brand in the UK, Europe and internationally. It sells its products through its e-commerce websites, app, and via digital retail wholesale partners. Numbers then chart. Market Cap = £3.356 Mil Share price = 6.4p Common outstanding = 52.5 Mil Public float = 40.4% (As of Jan 30th 2023) TBV = £5.276 Mil TTM Rev = £57.3 Mil TTM Op. Income = (1.5 Mil) What a blood bath, down 50% YTD, and 97% since floating. This is a prime example of why you should never consider buying an IPO unless the State is selling. Let's zoom in and take a look at the 3 month chart. The stock hit an all-time low of 5.9p in late January, bounced to a high of 8.3p in early February and then retested the low a few days ago at 6p. Notice the extremely heavy volume here, between 10 and 20 Mil shares changing hands each day over the last few weeks. Lombard Odier Investment Managers have been dumping their position along with Causeway Capital who were involved in the IPO. The primary reason for this selling is the fact that the company announced a strategic review in December. Maybe they are worried that the company will get sold off on the cheap given the present negative market sentiment toward it. Despite this heavy selling the stock appears to have bottomed out with buying pressure now building a floor. On to the latest financials. As always balance sheet first. Intangible assets here are comprised of software, stuff like the website and app. Whilst these are an important part of an e-commerce business I don't much care to include them in valuations since I lean much more heavily on tangible assets. If we are talking about a strong brand name, patents, unique datasets etc then maybe I'd consider them. In this instance I'm more interested in the tangible assets. TBV = £5.276 Mil net of £2.405 Mil of intangibles I'm not much interested in the PPE here either, it's mostly some fixtures and fittings and computer hardware. If it were buildings and land I'd be looking more closely. Let's scrub that off too. Adj TBV = £4.477 Mil vs a market cap of £3.356 Mil Given the company is currently loss making one can reasonably make a case this discount is justified. £1.011 Mil of liabilities are contract liabilities/deferred revenues but the lion's share are comprised of payables. Let see what has been happening on the income side over the last few years. The thing that jumps out here is that revenues have been growing like a weed. ITS was only founded back in 2013 and since their IPO in 2018 they've grown revenues from £14.7 Mil to £57.3 Mil in 2022. They've only managed to turn a profit in 2021 with op. income coming in at £519k and adj. net income (net of income tax credit) of £125k. At this point you are probably asking yourself, why am you telling me about a loss-making company whose stock has collapsed 97% since IPO with institutional players dumping their holdings since the strategic review was announced? Let's take a closer look at what they say in the review. The three key points for me are as follows; Firstly , the board believes the current market cap does not accurately reflect the value of the business. Secondly, a possible sale of the company could be on the cards, though management notes that at present there are no parties expressing an interest. Thirdly, the founder is returning to the role of CEO in an effort to address the current situation. This third point is the most interesting to me. The founder, Adam Frisby, started the business with £1k in seed capital back in 2013 and has delivered 8 years of consecutive growth, growing revenues from £0 to £57 Mil. Not only this but he has significant skin in the game, owning around 23% of the common outstanding. I'm willing to bet the founder is going to be pretty darn motivated to right the ship here. Not only that, if a sale is on the cards I'm inclined to think he is going to want to fetch a much higher price than the current market cap. The latest filing, FY 2023 interim results, reveals both the good and bad. Bad news first; 1st half Revenues are down 11% due to negative consumer sentiment. Fears of a looming recession and rising household costs are clearly impacting discretionary spending. The firm is still loss-making, printing an operating loss of £3.1 Mil in H1 2023. On an more positive note we have the following; The key bullish points for me are the relocation of operations to a larger warehouse, implementation of cost control measures including a reduction in headcount, and a focus on reducing discount sales in favour of higher price point items. What do I think ITS is worth? It's currently loss-making so valuing it based on discretionary earnings is out the window. I'm assuming a sale is on the cards and a potential buyer would be likely valuing the business based up revenues and inventory. We know revenues are down by 11% in H1 FY2023. Assuming full year revenue is down by the same percentage we are likely to see annual revenue of around £50 Mil. What % of revenue might a buyer be willing to pay here? 10%, 15%, 25%? That would be roughly £5-12.5 Mil. How about the inventory? In the latest report management claim that replacement cost of inventory would not be materially different to stated book value. Assuming the buyer pays stated book value for the inventory that's £7 Mil. Being a fan of Graham and Schloss inventory is my least favourite of current assets so I'm inclined to mark it down by 50% to £3.5 Mil for a more conservative valuation. With all this considered my range of value is as follows; Optimistic value is 0.25 x projected annual revenue of £50 Mil + inventory at stated BV of £7 Mil = £19.5 Mil Conservative value is 0.15x projected annual revenue of £50 Mil + 0.5x inventory at stated BV of £7 Mil = £11 Mil Pessimistic value is 0.1x projected annual revenue of £50 Mil + 0.25x inventory at stated BV of £7 Mil = £6.75 Mil This is obviously a pretty wide range of value with a blue sky upside potential of 6.6x, a more conservative assumption of 3.3x and a pessimistic assumption of 2x. I'll admit 6.6x is highly unlikely here but a double or triple is not out of the question if the thesis plays out. What are the risks here? First and foremost is the risk that the founder doesn't manage to right the ship. What he has achieved with the business thus far is pretty impressive but as the old saying goes; 'Past performance is no guarantee of future success'. One could also cite multiple headwinds for the company. The switch in market sentiment from growth to value, the inflationary environment squeezing margins and further depressing sales, rising interest rates impacting borrowing costs. The list goes on... Maybe the situation continues to deteriorate and the company ends up getting sold at fire sale prices. Maybe no buyer emerges and sales keep dropping, if losses persist and cash runs out it could be lights out. Thus far there's no sign of insider buying, I'm watching to see if this changes going forward as this would be a key bullish indicator that the situation is improving or that insiders truly think that the stock is significantly undervalued as they assert in their filings. Talk is cheap, I want to see them put their money where their mouth is. Time to wrap things up.

ITS is currently hated by the market, down 97% from its IPO price. Institutional players have been running for the exit since news of a strategic review broke and sales have started to contract after a period of impressive growth. On the flipside we have the founder returning to the helm with significant skin in the game and his personal pride at stake. If anyone is going to fix the situation it is going to be him. An asset based margin of safety is minimal here and yet the massive growth over the last several years can't just be disregarded. Things look pretty bad right now but that is exactly when I like to buy. Sentiment toward the company is almost universally bearish and yet most of the bad news looks priced in to me. The stock looks to have found a floor as buying pressure soaks up the downward force of the sellers. I expect the stock to just move sideways on choppy action as the market waits for news with bated breath. As always the thesis is simple, in this case I'm betting on the jockey. Thanks for reading, David Disclosure: Long ITS.L

18 Comments

Charles Gripp

2/24/2023 09:23:51 am

Is there an advantage to using candles over a line chart for your style of TA?

Reply

David

2/24/2023 08:52:46 pm

Hi Charles,

Reply

Nick

10/3/2023 08:55:37 pm

What’s happened to Its ? I can’t find it quoted . Thanks ,Nick

Reply

Mark B

2/25/2023 03:03:22 am

David, thanks for the write-up. Looks like February has seen some insider buying too!

Reply

Mike

2/26/2023 10:49:14 pm

I hope this doesn't end up like windeln de AG. A very small, German company that sells baby items online. The sales are high but the company has not managed to control its losses until today. The stock trades for 5 cents or so.The retail business is tough. There may also be oversaturation. Possibly windeln de is worth nothing as it may never make a profit.

Reply

Mike

2/27/2023 08:56:57 am

One more addition: Windeln de is in bankruptcy proceedings and no buyer has been found.

Reply

David

2/28/2023 07:47:55 pm

Hi Mike,

Mike

3/2/2023 08:51:47 pm

I think the growing sales at a sharply declining stock price is indeed extraordinary. I am curious to see how this will develop. The stock could go to zero or rise sharply.

Hao Ding

2/27/2023 09:19:18 pm

Thanks for the write-up. Very interesting and it's on my watchlist as well.

Reply

David

2/28/2023 07:44:02 pm

Hi Hao,

Reply

Hao Ding

3/4/2023 02:41:32 pm

Thanks David, I have spent more time on ITS. I think we are aligned that on asset basis there is no margin of safety but as long as the company survivies, upside is enormous (est. ~5-10x and evne more if it goes back to growth mode).

Mike

3/7/2023 07:34:01 pm

The stock crashed today. I guess because of the following news "Proposed cancellation of admission to trading on AIM"

Reply

David

3/7/2023 08:29:45 pm

Yep, the board is recommending a sale of the business for £1.2 Mil and the deal is structured so that the founder retains his state in the new enterprise whilst minority holders get thrown under the bus.

Reply

Charles Gripp

3/8/2023 12:24:52 am

Wouldn't ITS be a good candidate for further research now that is it is going to be sold for more than it's current MC? I just put $50 for tuition.

Mike

3/12/2023 02:05:41 pm

to Charles Gripp: Actually, the stock has become much cheaper. However, if the stock is no longer tradable and minorities are not bought out, this is of little use. I can then no longer sell the shares or perhaps privately. This is also the disadvantage of such small shares that have also lost a lot of value. The risk of delisting is significantly increased.

Mike

3/18/2023 10:07:35 am

While I find small-cap stocks very attractive, I'm not so sure about buying small stocks that have fallen sharply in price.That the stock can return to its original value is hopeful thinking. The price has fallen because the companies are not financially weak or the market has collapsed. Often these are also companies that have no future at all. Where is the evidence that this works? I think you should mostly ignore the price chart and buy based on fundamentals and the business model only.

Reply

Bluedot

4/7/2023 11:21:15 am

Hi David, very interesting special situation. Do we know how this is going to play out after the recent news? At the moment the company changed it's name to Itsarm PLC a company that is a cash shell after they sold it's operating business for 500k and they want to do a Members Voluntary Liquidation (MVL)and distribute the net proceedings to the shareholders.

Reply

Bluedot

4/7/2023 11:26:15 am

It would make sense that the costs will be around those 250k and it's priced about right

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed