|

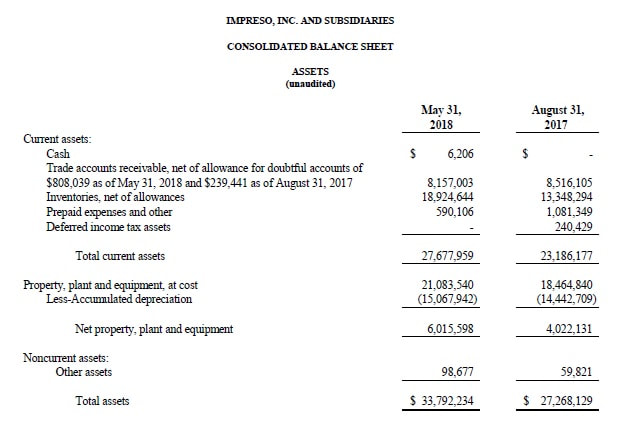

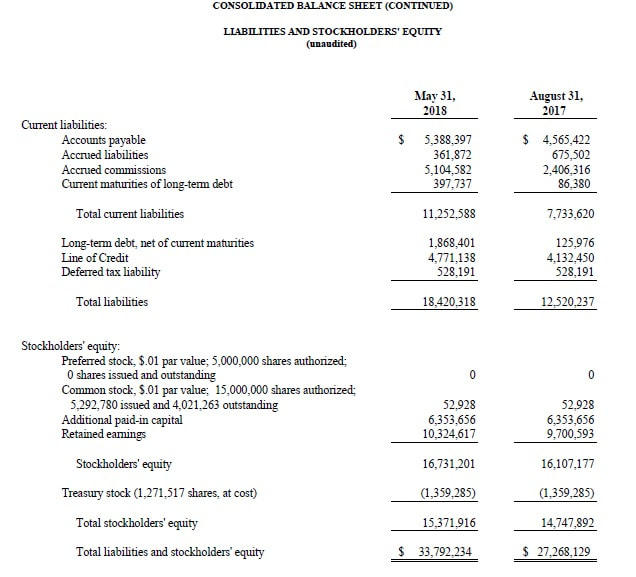

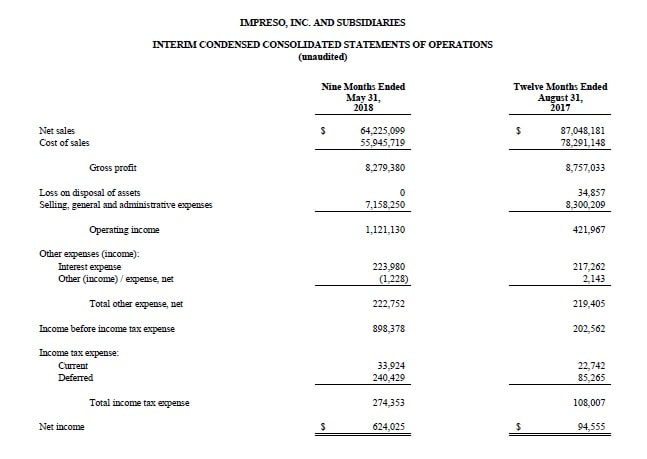

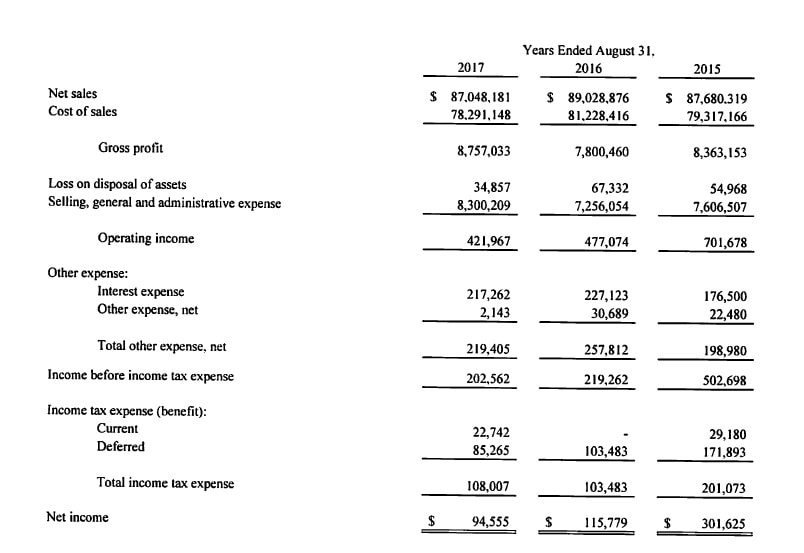

Whilst net-nets have all but dried up on the major U.S. markets they can still be found in the land of forgotten stocks, namely the OTC markets. This is the first in a number of net-nets I've recently uncovered which I'll be writing up as time permits. Impreso Inc (ZCOM) is a pink-sheet which is classed by the OTC markets website as Dark or Defunct, my kind of stock! First things first, Here's some blurb on the company from their website; "Impreso, Inc. is the holding company of TST/Impreso, Inc. (TST), a manufacturer and distributor to dealers and other resellers of various paper and film products for commercial and home use in domestic and international markets; Hotsheet.com, Inc., the owner of Hotsheet.com, an online web portal and directory; and Alexa Springs, Inc. a natural spring water bottling subsidiary. The primary operating company, TST, was founded in 1976. TST operates in the hard copy supply market, which encompasses those products used with a hard copy output or "imaging" device. Products include: Continuous Computer paper, Point of Sale/Add Rolls, Wide Format Engineering Rolls and Inkjet Media, Desktop Inkjet papers, High Speed Laser Roll papers, Transparencies, Processed Laser cut sheets, Thermal Fax paper and Copy paper. TST manufactures and distributes its products under its own Impreso label, generic labels and private labels. TST operates out of five facilities and public warehouse locations throughout the United States." Sounds boring and boring is good! Here's some numbers; Market Cap = $3,578,924 Shares outstanding = 4,021,263 Price per share = $0.89 Spread = 11% 52WK Range = $0.73-0.89 This is a good start. A tiny dark company with a low share count and a low share price is always worth digging into more. Why? Most investors steer clear of dark penny stocks and firms with tiny market caps, this lowers the competition. It is also a lot easier for a $3.5M firm to double in price than it is for a $3.5B company to. The low share count leads to illiquidity which is a turn off for most investors but this can drive significant price movement if demand ramps up. It also indicates that the firm is unlikely to have been issuing equity to keep the lights on. Now to the chart; I see a stock that has been left for dead having lost around 90% of its value since 1996. Volume has dried up and a long term base has been forming for the last few years with support at around $0.70. Now to the company's most recent financial statements which they have been kindly publishing on their website for the last several years (Always check the websites of dark companies because you can sometimes be pleasantly surprised!). Current assets clock in at $27,677,959 and Total liabilities stand at $18,420,318. There are no preferred shares or warrants outstanding and no operating leases listed elsewhere in the financial statements. This gives us a NCAV of $9,257,641 or $2.30 NCAV per share. At the current market price of $0.89 per share this stock is trading at 0.38x NCAV Now to the income statment to see if the company is turning a profit. ZCOM's financial year end is August but they've yet to upload their 2018 annual report, here's what the 3rd Q interim from May 2018 shows. 2017 profit was pretty weak but appears much stronger for 2018, at the current market price ZCOM is trading at 5.73x earnings for the 9 months ending May 2018. Depending on what the 4th Q earnings turn out to be we could be looking at a P/E of <5x. Now we'll take a look at ZCOM' s 2017 Annual report to see what earnings look like for the past few years. Earnings are lumpy but ZCOM has been profitable for the last few years. Looking further back the firm made a loss of $143,381 back in 2014 but has been profitable in every other year between 2012-2018.

What is ZCOM worth? Given that the company is profitable it seems fair to assume that ZCOM should be at least worth it's NCAV of $2.30. If you think a profitable company should be selling at book then ZCOM's fair value per share comes in at $4.29 which is the present BV. What are the risks with this stock? a) A large proportion of the NCAV is comprised of inventory and receivables. The most enticing net-nets are those where current assets are comprised of cash and equivalents. Inventory and receivables are less appealing since their value can be impaired in times of financial distress. b) Earnings are lumpy and ZCOM's business appears to be commodity based with no evidence of pricing power or competitive advantage. A financial crisis could push the firm into the red and see the NCAV contract if inventory has to be marked down or clients default on payables owed to the company. c) The firm delisted from the NASDAQ and stopped filing with the SEC in 2006, whilst it still publishes financials on its website it could go darker and cease communicating with share holders and investors. At present there is little evidence to suggest this is likely to occur but it can't be ruled out. d) Back in 2006 a shareholder lauched legal action againt ZCOM. The following can be found in the 2006 10-Q; "On January 19, 2006, Impreso, Inc. (the “Company”) was served with a shareholder derivative lawsuit. This action, is one in which one of the Company’s shareholders (the “plaintiff shareholder”) is asserting rights derived from the Company. The shareholder derivative action does not seek the recovery of damages from the Company, but rather asks that the Company recover damages in an unspecified amount from five of six members of the Company’s Board of Directors during a time period relevant to the petition’s allegations. The sixth, unnamed member of the Board of Directors during the relevant time period was appointed at the request of the plaintiff shareholder and voted in favor of the transactions about which the petition complains; the structure of the Company’s water bottling division, the Chief Executive Officer’s compensation package, and the Company conducting business with a company owned by the spouse of the Chief Executive Officer The parties are conducting discovery. Trial is reset for March 2007." After digging around on the firm's website and the internet I couldn't find out what happened with this case. Maybe it came to nothing but it's something I think warrants further investigation. In general a profitable net-net, dark or not, would go straight into the basket but the heavy weighting of inventory and receivables gives me pause for thought. I'd also like to try and find out what happened with this lawsuit. For now I'll keeping digging into this one. Thanks for reading, David Disclaimer: I hold no fractional ownership in ZCOM at the time of writing

2 Comments

David

10/30/2018 06:32:17 pm

Cheers Dan,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed