|

Today's guest post comes from Svenda's Manual of OTC stocks and focuses on the undervalued OTC retail asset play Horizon Group Properties (HGPI) Over to Jan with the analysis. Note: Subscribers of the Microcap Review, a Seeking Alpha marketplace, had an early access to the report. Dear readers, This analysis is taken from my Svenda’s Manual of OTC stocks which I released two months ago. There are thirty more such in-depth report in the manual alongside countless smaller reports which cover more than 350 stocks. As readers of Elementary Value you can purchase the abridged version of the manual for $199 here and the full version for $399 here. You can read more about the manual here. Date Published – 05/01/2018 Update Comment The stock has gone slightly down, however I believe that the fundamental value of the company could still be present as the underlying fundamental performance does not seem to be overly challenging. They are in a stressed sector (retail), but as alluded to in the report the outlet centers could be positioned to withstand some of the pressure. Horizon Group Properties – Valued as if retail is already dead and economy is tanking Summary points

Investment Thesis I believe that investors should benefit from accumulating a position in Horizon Group Properties (HGPI), a developer of outlet centers, due to the following points;

On the other hand, one has to account for the following;

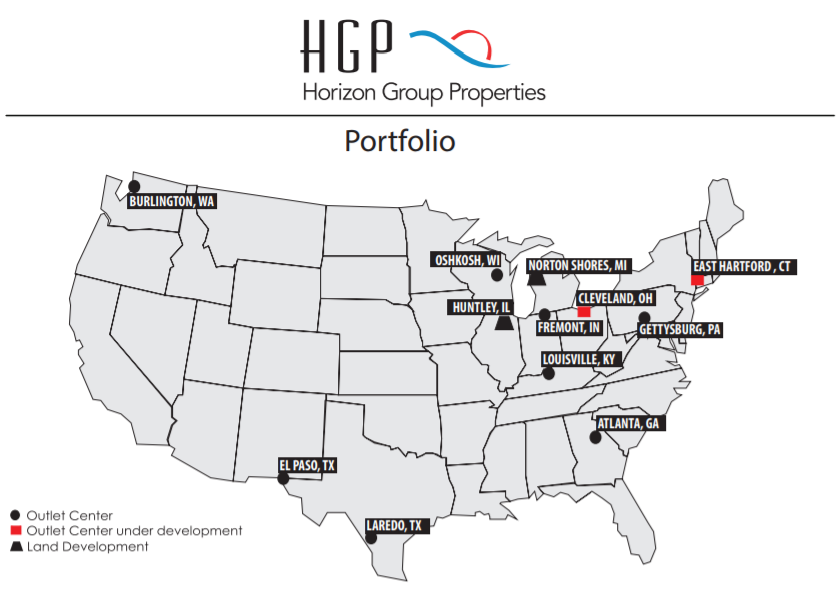

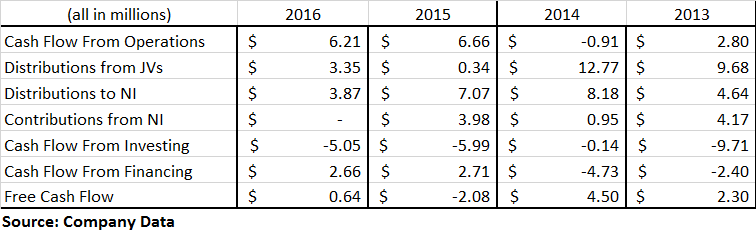

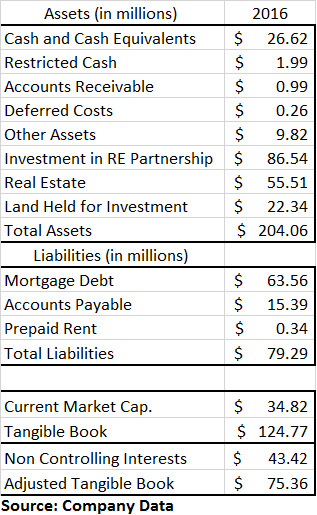

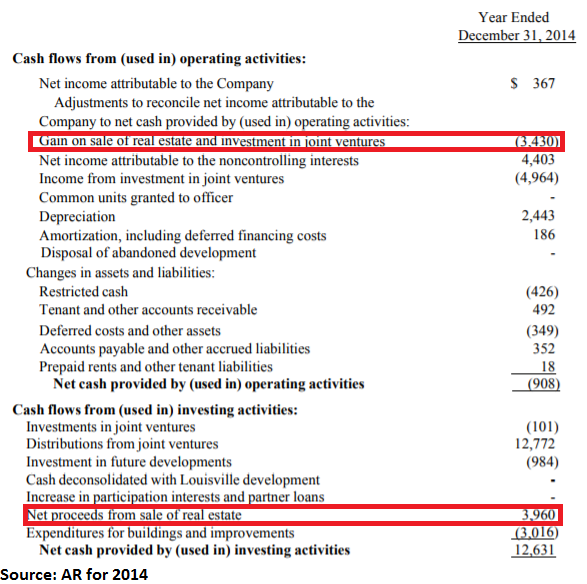

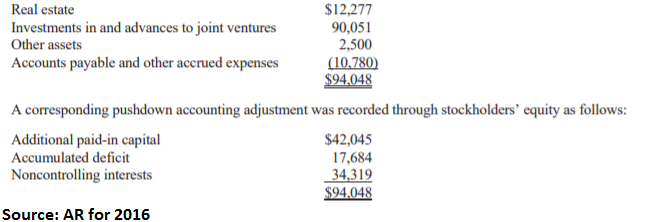

To conclude, the company is trading as if all the risks have already transpired and the economic situation in the US is similar to the financial crisis. In my view, this is a favourable time to enter into a position because the downside is limited even if this scenario does play out. I would also note that while there is always a scenario in which the stock goes to zero, the company is partially shielded from this because they own the land on which the outlet centers stand. This should present further margin of safety. Only excessive leverage would destroy it. Finally, getting shares might not be that easy but volume does not seem to be an insurmountable challenge. There were months where liquidity reached around $30,000. Corporate Overview – Outlets are not classic malls Horizon Group started out in the year 1998 and they were focused on outlets in the very beginning. The group purchased a portfolio of struggling outlets which the management has sought to turn around and sell. They were eventually successful, but the process was challenging and they even faced a proxy battle from their shareholder base. The shareholders were not content with the way the company managed the turnaround strategy due to the debt issues that they were facing in the middle of the progress. This might have also motivated the company to go dark in 2003. After the sale of the portfolio in around 2006 they focused on building up their own portfolio of outlets as well as purchasing several of these properties. That is how they ended up with the current portfolio of three controlled outlets and partial ownership of five other outlet centers as can be seen below. They usually partner with the listed REIT, CBL & Associates Properties to develop the outlet centers. They also own land, most important is the Huntley area, which they bought as an investment and which they opportunistically sell from time to time. You can also see that they are developing two new outlets. They are also developing one project in Malaysia which is located near Kuala Lumpur, the capital city. One might think operating such a business model reliant on the US consumer and thus the macro economy would be extremely challenging due to today’s economy and retail sector which is struggling to keep up with e-commerce. However, one is likely to be positively surprised. Unlike the classic mall, the outlet business model is still working. The retail woes of the rest of sector do not really apply to them due to the original use of outlets by brands (store of imperfect goods) and the macroeconomic situation is not as important given the discount nature of the stores. All of the partially owned joint venture outlets are profitable on the income statement (HGPI breaks down each outlet) and while HGPI does not show individual results of their three controlled outlets they are also likely to be profitable given their consolidated income statement. The company also states that the same-store sales are not in a continuous decline. The management certainly recognizes the future headwinds in their ‘shareholder letters’ at the beginning of each annual report, but they point out that retail brands are likely to continue supporting the outlet model even if they close down their own shops. The cash flow situation of the whole company is also far from dire. While sometimes the CapEx and developments might put pressure on the cash generation as you can see below this is not really that frequent. Note: I had to adjust the cash flow for the transactions between the non-controlling interests and joint ventures in order to arrive at an estimate of ‘free cash flow’. The company does not provide annual financials past this time frame. I would also point out that the company seemed to have gone through the financial crisis relatively unharmed as seen via the Q3 report from 2010. They had to get financing but overall the performance did not seem catastrophic. However, while the broader macro trends might not be of significant concern as the underlying performance is solid, there are several smaller risks that are worth considering. Namely, it is the risk of oversaturation of outlets and specific risks with two outlets. Given the fact that the outlet model works, there is a fair number of companies that are bullish on the sector and that focus on new developments. The listed Tanger Factory Outlet Centers can be an example. The management of HGPI has also frequently mentioned this in the annual reports and they said that the growing number of outlets could depress the market rates and significantly increase competition. While outlets might be relatively safe from new entrants (as the proximity of outlet centers is likely a significant factor), the impact is unlikely to be minor. Thus, if the new development is not going to stop the underlying performance could become harder to sustain at the current level. However so far this has not materialized. The second risk that could slightly derail the current performance could be the outlets in El Paso and Laredo which are near the Mexican border. These might be subject to impacts of Trump administration or of forex movements. In fact, HGPI wanted to sell the outlet in El Paso last year alongside the Oklahoma outlet (which they eventually sold), but the buyer backed off from purchasing El Paso due to the current climate. However, the management has mentioned that the performance in El Paso has so far been okay and that the launch of Laredo (they opened the doors last year) went well. While the current performance does not seem to be at the risk of completely turning around in the next few years, the long-term outlook is certainly challenging. Outlets might lure consumer due to its discount nature but it is unclear whether this alone can support the model as e-commerce is likely capable of achieving similar features. Although perhaps outlets might survive as they are also pitched as an ‘experience’ for the consumer, an all-day trip with different activities put on top of shopping. While this might be the case this is hardly an exciting business model. All this being said brands are not yet pulling their support for outlets, in fact, according to the management of HGPI, they are doing the opposite and thus this long-term challenge might nervously hover above the industry but is not yet an immediate issue. Valuation of JV assets and consolidated outlet centers While the macro factors are important here, there is one thing that is going to alleviate the need to be overly bothered by the outlook of the outlet centers and that is the current valuation of the company. As you can see below the company’s tangible book is currently heavily discounted by the market. Note #1: I take away further $6 million from tangible book as this value is associated with development costs which depend on the successful launch of the proposed outlet centers. Note #2: I add leftover common units of the CEO and one director that can be converted into the shares. This amounts to roughly 0.6 million new shares. This can be traced to their proxy. Note #3: I adjust the balance sheet for the sale of the Oklahoma outlet which occurred last year as this at some point increased the cash position by $19 million and decreased the JV asset line by the same amount as the company mentioned that the carrying value roughly equates that of the sale. I believe that the carrying value of the assets likely fairly represent the market value due to the following points. Whenever the company sold a material amount of their land or interest in the JVs they recorded a gain. An example can be seen below. Furthermore, the company is accounting for some joint ventures via the equity method which given the significant amount of distributions that are being received can lead to undervaluation. The item on the balance sheet can also be simply undervalued due to the fact that the JV is now a fully operational outlet center yet the cost of the investment is based on the initial investment into the development project. I would recommend looking at the sale of the HMG’s Orlando project as a clear example of how this undervaluation can arise. Thus, even if some of the controlled assets might be overvalued, the JVs could offset this. Due to all this, the discount alone should be sufficient to show that the valuation is not reasonable given the underlying performance of the outlets. The company is valued as if the negative macro trends were already a reality. Amster Transaction in 2016 However, there is one specific data point that I believe is the strongest argument supporting undervaluation. What I have in mind is the 2016 transaction with Howard Amster, a key shareholder who through this transaction now owns over 60% of the company and who has been increasing his ownership throughout the past 15 years. As aforementioned in the thesis, this was a transaction where Mr. Amster ceded his interest in several of the JVs where HGPI was already involved (notably the Oklahoma outlet) for 3,250,000 shares of HGPI. Thus, in essence, HGPI ‘bought’ the interests for the shares. What is intriguing is the ‘price’ for which the company has done so. Below you can see the clear breakdown of how did the balance sheet change as a result of the transaction. The total value of the new assets (some of which are now consolidated as a result) amounts to $94 million, however in order to determine the actual value that HGPI received one has to subtract the value of noncontrolling interest. Thus, the net asset increase for HGPI is $59.72 million. Again, I believe that the carrying value of the asset could be relatively accurate (more so in this case as the Oklahoma sale came from this asset group) or at least not wildly overvalued. When we know the net asset increase we can then calculate the implied valuation of the shares in this transaction. This is the core of the argument. Dividing the asset value by the number of shares shows a value per share that is four times higher than the current price ($16.96 per share). This shows that the insiders could believe that the value of the whole company is significantly higher than the current market cap. One can also look at this in another way. One can take the average share price of HGPI (let’s say $4 per share) and assign that to the newly issued shares that Mr. Amster got his hands on. This would mean that shares that are now worth roughly $13 million ‘bought’ assets worth $59.72 million. The absurdity of the valuation is further showcased in the sale of the Oklahoma outlet. HGPI ‘owned’ through various entities 8.71% of the Oklahoma outlet before the transaction. After the transaction, this ownership rose to 33.79%. They then sold this ownership for net proceeds of $19 million. This means that Amster’s transaction contributed $14.1 million that would have otherwise gone to Mr. Amster. This is already higher than the current valuation of the issued shares, i.e. the rest of the asset base did not cost HGPI a penny if you think about it in that way. Now that we understand the implications, it is intriguing to look at the share price development of HGPI. The stock has barely moved and completely failed to break through previous share price despite the clearly positive news. I believe that this comes down to the relative obscurity of the company, because I have not been able to find any clear reason that would justify the share price action or lack thereof.

I believe that the implied price/cost is an attractive argument also because HGPI is relatively unknown OTC company with shareholders that almost controlled the company before the transaction. This means that they could have certainly arranged the deal in a way that would be beneficial for them (i.e. dilute the other minority shareholder more). The only risk that they were up against is their shareholder base that would have to launch a shareholder lawsuit, but who knows how likely that would be. The fact that the transaction implied the aforementioned valuation means that they either could not or did not want to screw over the minority shareholders. Why do such a transaction then? It could be that Mr. Amster wanted access to the company’s NOLs. He is also not going to miss out on the upside of the asset base as he now owns over 60% of the company and perhaps it was the control of the entity that he was aiming for. In fact, the reality that he is now in control could be a risk, especially since the transparency of the management is not the best. While they provide enough information about the underlying performance of the outlets, one crucial thing is missing and that is a breakdown of carrying values for the JV investments. While they specify the carrying value of their controlled assets, the JV investments are only bundled together. I do not necessarily see a reason for this when they provide a summary of financials for each JV. The company also stopped publishing quarterly reports or at least did not yet publish the ones for 2017. I have not found an email that I could reach out to, but I am going to call the offices to ask for an explanation. The only thing apart from the transparency that I saw as a potential red flag regarding management is this event from the life of the CEO that led to his divorce. While he seems to be a relatively efficient manager, his personal life raises red flags. While the last few points raise questions regarding the management, I believe that the valuation offsets this as well, at least according to the information that is now available. Moreover, these points are also insufficient arguments to try to explain the current discount. When the company released the annual report, which showcased all the positive information, the investors likely did not know about the fact that they are going to stop reporting, yet did not purchase the shares. What is next? So far, we have learned that HGPI is trading at a deep discount and that this does not make much sense given the underlying performance of the outlet centers, recent transactions and the general trend in outlet space. What is going to unlock the value then? This is the main question to which I have not been able to find a clear answer, and which could slightly decrease the attractiveness of the stock (not the downside protection however). The company is developing two new centers that could open this year. One in Hartford construction of which started in October 2017 and the other one in Malaysia which could open in the middle of this year. Once these developments are finished the projects could bring a new stream of cash flow to the company which could potentially push the shares up a bit. As aforementioned the company noted that they originally wanted to sell the El Paso outlet alongside the Oklahoma one. They could still try to solicit offers for the property which could also help the shares. The cash from the sale of Oklahoma could also act as a small catalyst. While they are unlikely to send out a dividend, they might not immediately invest the proceeds as the management has mentioned that they want to be cautious in the current market. Perhaps they could pay down debt with the cash or keep it on the balance sheet which could crystalize the undervaluation further. I would also point out that while the management might not want to liquidate the whole portfolio in the near future, they are also unlikely to distort the value. As they seem to be relatively rational regarding the current market they are unlikely to significantly increase their leverage and grow the company. This shields investor from increased exposure to the macro factors. Lastly, while the motivations of the management might be unclear, Amster as well as the CEO, who owns roughly 20% of the company, should be careful regarding the company’s future given their stakes. Conclusion Even if one assumes a depressed scenario in which the economy tanks and the retail industry is going to continue to face challenges, the valuation of the company is still okay. The discount is large and clearly devoid of the current reality, thus investors are well defended from many negative scenarios. While the catalyst is not clear now, I do not believe this should be an insurmountable challenge that would prevent investors from ultimately profiting as Amster and the CEO both own material stakes in the company. Financial Disclosure: I do not own shares in the aforementioned company at the publication date.

2 Comments

11/24/2021 12:47:43 am

Thanks! Let us know what other kinds of information you’d like to see and we’ll try to add it in the future. Best of luck!

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed