|

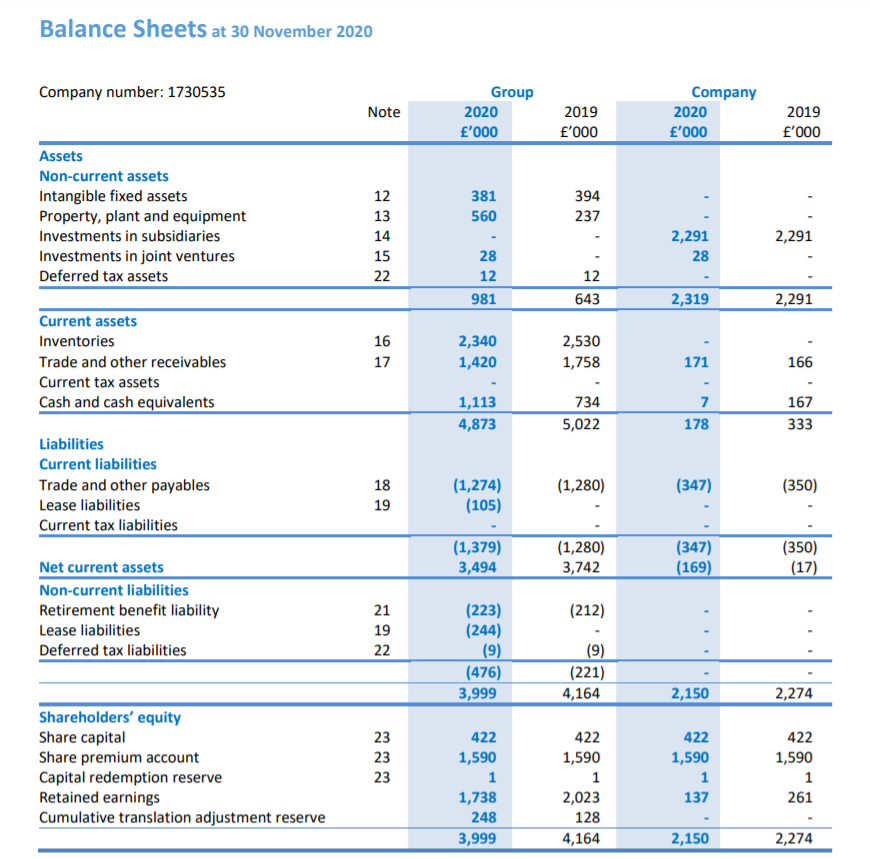

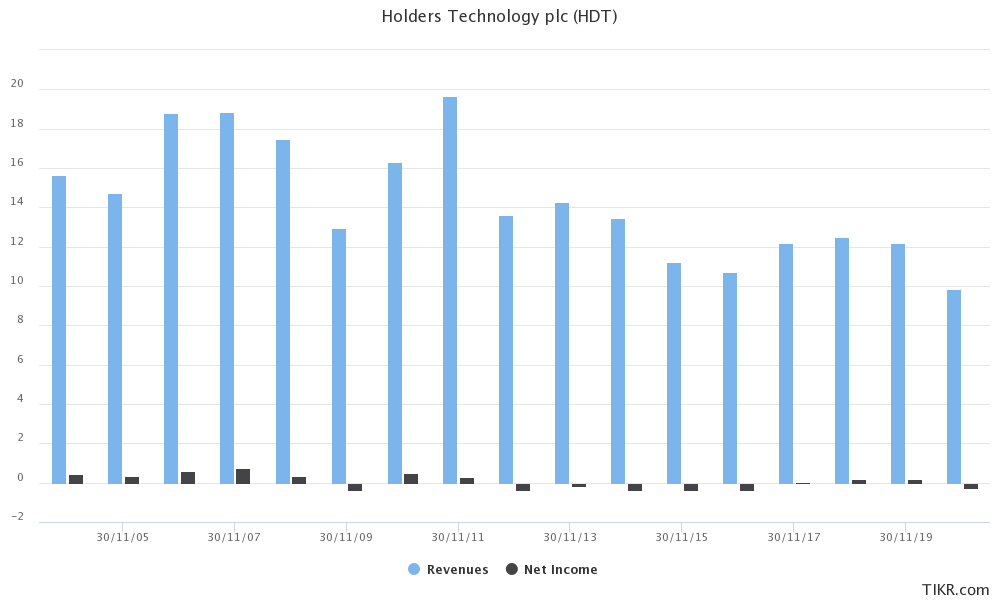

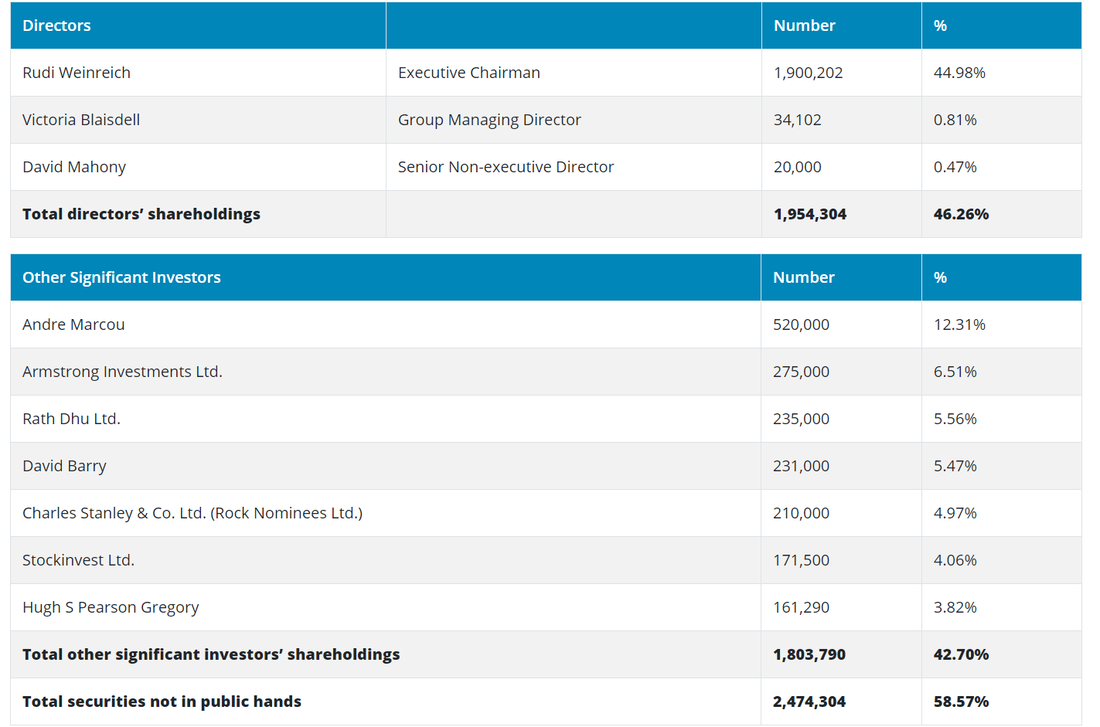

Holders Technology PLC (HDT.L) is selling below liquidation value and building a base on the long-range chart. It's only a matter of time before the stock begins to break out and I'll be there when it does. Here's the business description and some numbers then we'll move on to the main course. "Holders Technology plc, together with its subsidiaries, supplies specialty laminates and materials for manufacturing of printed circuit board in the United Kingdom, Germany, and internationally. The company also operates as a lighting and control solutions provider. Its products include heatsinks, LED drivers and PSUS, LED light sources, lighting tracks, and optics and reflectors, as well as provides wireless lighting control, and smart lighting and building solutions. Holders Technology plc was founded in 1972 and is based in London, the United Kingdom." Market Cap = £1.86 Mil Share price = 44p Spread =18% Common outstanding = 4,224,164 Public Float = 41.43% TBV = £3.62 Mil TTM Revenue = £9.84 Mil TTM Net Income = (£0.26) Div Yield = 1.18% The first thing I do when I look at a stock is to check the chart. Let me tell you what I see. The stock is sat in the accumulation zone and has been building a base for over 5 years. Rather than a flat or rounded base HDT.L is forming what 's known as an ascending triangle. You can see the support level rising as buyers become more impatient to build a position and sellers relinquish their holdings under the assumption that the stock is just dead money because it hasn't moved up yet. If you look closely you'll also notice a false break-out that quickly fell back down, this is a bullish signal that adds technical strength to the stock. The other thing I notice is that the stock has the potential to trade at a much higher level if its prospects improve or the market's sentiment toward it changes. All it takes is a year or two of rising revenues, or a swing from loss to profit to move these tiny illiquid stocks up significantly. Once demand overwhelms supply and the stock successfully breaks out , resistance will flip to support and an up-trend will be underway as all the pent up energy is unleashed. Okay, we'll take a look at the most recent financials now, as always starting with the balance sheet. Current assets = £4.873 Mil Total Liabilities = £1.855 Mil NCAV = £3.018 or 71.4p per share A stock trading at 0.62x NCAV sounds like a good deal to me. TBV = £3.606 Mil or 85.3p per share if you net out the intangibles and deferred tax assets. On a revenue basis the stock trades at 0.19x TTM revenue, again this is too cheap to pass up. Lets take a peek at historical revenues and earnings. You can see revenue took a hit due to the pandemic. In the prior three years it was trending around £12 Mil. HDT.L also booked a loss of (£260k) for the last financial year but was profitable in the prior 3 years. I'm willing to bet now that the pandemic is subsiding and a trade deal between the UK and EU has been struck business will pick up going forward. One thing I'm pretty excited about is the potential of 2 new joint ventures the company is involved in. No only is the firm expanding it's lighting control solutions business into several new markets but they are also branching out into data analytics. I'm no tech expert but I hear a lot of talk about the 'Internet of Things' and 'Smart Buildings'. I can see a lot of growth potential in an area like this and it's an interesting potential catalyst to drive future revenues and earnings. Okay, time to look at ownership. Founder and Exec. Chariman Rudi Weinreich owns 44.98% of the common and aggregate director holdings stands at 46.26%. 58.57% of the common is not in public hands meaning the public float is tight, exactly how I like it to be! What risks do I see. The first is that these two JV's don't work out and it ends up being a waste of time and money, it's a fairly common occurrence and can't be ruled out here. Another risk is that revenues don't recover and the firm remains unprofitable eroding the asset base and acting as a drag on the share price. Maybe the company decides to delist, the share count has remained pretty static since HDT.L went public and a major reason for floating is to access capital in the markets. I don't see this as a likely scenario given the ownership by other entities and individuals who would probably oppose it. Another one is the potential for a buyout coming in below fair value. Again, I see this as unlikely but the boss-man is 74 now and may decide it's time to retire soon. There would need to be approval from other shareholders for this to happen though and I doubt they would be willing to accept a low-ball offer for their stock. Time to summarize the thesis.

HDT.L is selling below liquidation value and at a fraction of annual revenues. It has a good chance of swinging back to a profit and growing revenues. The 2 JV's embarked upon in 2020 could act as potential catalysts From a charting point of view, the stock has been building a base for several years and is primed to break-out to the upside soon. The set-up looks right to me here, the capital structure, tight float, price chart and fundamentals all make me bullish. HDT.L is too cheap to ignore. Thanks for reading, David Disclosure: Long HDT.L

12 Comments

David

6/8/2021 06:15:01 pm

Thanks for taking an interest in my work Tim.

Reply

mike

6/9/2021 08:31:25 am

How do you buy this? at the bid price? If you buy it at the ask price you "lose" immediately around 20%.

Reply

David

6/9/2021 07:14:13 pm

GTC limit order and the patience of a Buddhist monk.

Reply

Yas

6/9/2021 11:37:24 am

Tim,

Reply

Peter

6/13/2021 08:34:39 pm

hmm but the 5 year chart does not look that great and the stock trades at a 5 year high. You could argue that the more distant past is not so relevant because the market, competition, company changed.

Reply

David

6/13/2021 09:39:19 pm

The longer a stock spends building a base in the accumulation zone, the more technical strength it acquires and the higher it will rise once it breaks out. All companies go through phases where their fortunes rise and fall. I prefer to buy stocks when they are sat at long-term support and are ignored or hated by the market. Downside is limited and upside is magnified if one buys in the accumulation zone.

Reply

Peter

6/18/2021 08:41:51 am

But the whole thing is controversial. Investors who hold this share now also look at the chart (just like you). They also come to the conclusion that the share is in a "low". So they will not sell. They might sell because they expect the business to deteriorate. Such technical analysis is far from perfect.

MM

7/14/2021 12:43:36 pm

Peter, I recently found this blog and have a somewhat similar approach. Maybe I'll take a shot at explaining what I see:

yas

9/7/2021 11:40:28 am

Good call on this one David - has been heading sharply higher in recent weeks.

Reply

David

9/7/2021 08:47:00 pm

Thanks yas,

Reply

5/26/2024 12:50:40 am

This was lovely, thanks for sharing

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed