|

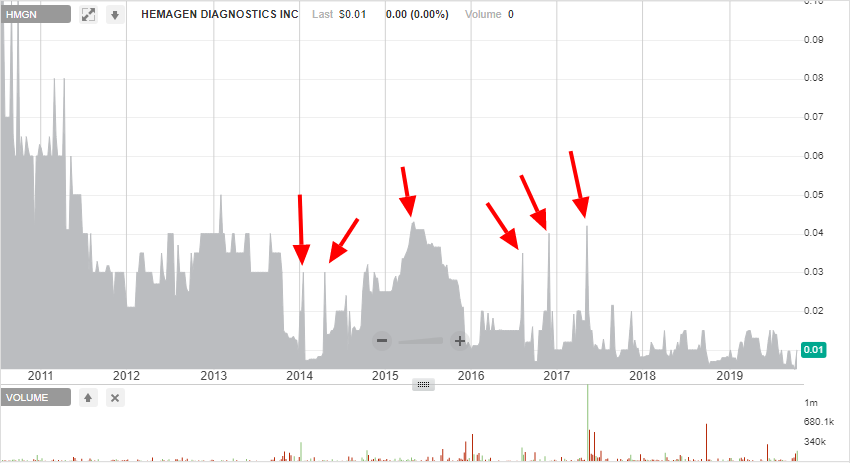

If you are a die-hard value investor who bases investments solely on the numbers and thinks using price charts is superstitious nonsense you ain't gonna like this one. Don't worry though, there's plenty more numbers based deep value plays coming to the blog. Ted Warren fans read on. Hemagen Diagnostics Inc (HMGN) came onto my radar much like many other stocks do, I spotted it whilst manually going through the OTC markets and decided to conduct a bit of scuttle-butting since it fit my mold. A few numbers; Market Cap = $155k Share price = 0.01 Common = 15,500,281 Spread = 77% Right, we'll start with the bad. The firm went dark back in 2013 and the finances were a train wreck. The last 10-K issued before they filed a form 15 showed the following; Negative BV of $3.5 Mil Accumulated deficit of $26.7 Mil Loss making and working capital barely positive Here's the long range chart so you can gaze upon the carnage and value destruction. I know that most bottom fishers would probably assume HMGN is dead and move on to the next one but my curiosity always makes me keep digging. First things first, I went to the website and noticed it has a 2019 copyright, a sign of life perhaps? Next I looked up the website URL on the wayback machine, HMGN has had a website since the late '90s and has updated it a few times, it still looks 20 years out of date though! Turns out the firm was founded back in 1985 by a bunch of scientists from Boston University of medicine. They make diagnostic kits which are used in veterinary and human diagnostic tests, stuff like auto-immune disorders and infectious diseases. I then managed to find out that the firm's products are still being sold on various websites. You can see some examples here and here. Next port of call was Google street view to see if I could find the HQ. So we now know that as of Nov 2016 HMGN's HQ was still at the listed address. Notice the 5 cars parked out front? I remember reading in one of the filings the firm used to have around 15 employees but whilst digging I found this stellar review left on indeed.com by whom I'm guessing is a former employee :) "no direction, poor management only 5 people working a 9 person business most co-workers are hard workers and get no credit,while the lazy ones get the pat on the back" If you want to read another amusing interview story for HMGN see here. Okay, so it looks like we can assume the firm is alive and has 5 employees. The digging continued and I then found this job advert posted around Aug 2019. At this point I'm thinking to myself the following; a) HMGN is still alive. b) It is selling it's products through various outlets. c) By going dark it's probably reduced it's costs by $700k-1 Mil per year, the last 10-k showed they'd lost $965k in 2012 and $919k in 2011. Perhaps they are at break-even or turning a profit now. d) It has a nice chunk of NOL carry forwards to offset taxes. The last 10-k stated around $8 Mil (probably around $6 Mil at a 25% tax rate) and R$2,046,907 to offset taxes on the firm's Brazilian subsidiary. e) Business can't be catastrophically bad if the company is hiring. I then went back to the price chart and zoomed in little. I've included some nice big red arrows to make it abundantly clear what I'm noticing when I look at this chart. I'm seeing stock spikes and run ups of several hundred percent.

At this point I started buying. Some readers will be aghast at the fact I'm buying without current numbers given the poor state of the firm before it went dark. With stuff like HMGN I'm buying based on the price chart and what the scuttle-butting has turned up. You can call it speculation if you like, for me it's a combination of perceived hidden or potential value and my observations of the chart. I can't tell you exactly what HMGN should be worth but I'm pretty sure its more than $155K. If I had to pick a number based on the NOL's and the fact that the business is still a going concern able to employ 5 people I'd say it could be closer to $500k, maybe more. I'll add a few other things; Based on the last 10-k management owned around 46.5% of the common . Insiders, namely the CEO and his father, owned a decent chunk of the debt and were rolling it over; "TiFunding, LLC, a Delaware limited liability company owned by William P. Hales, the Company’s Chief Executive Officer and President, and his father, provides a senior secured line of credit facility to the Company for the purpose of financing working capital needs. TiFunding acquired this facility on February 7, 2011 from Bay Bank, FSB for approximately $360,000, and increased the line of credit to $1,000,000 dollars. On October 1, 2012, the TiFunding increased the line of credit to $1,500,000. Interest expense related to this line of credit for the fiscal years ended 2012 and 2011 was $78,748 and $35,335, respectively. The facility’s term maturity has been renewed and is now due on October 1, 2013. The line is renewable annually and provides for borrowings at an annual interest rate of 9%. Maximum borrowings under the facility not to exceed $1,500,000 are based on certain receivables and inventory of the Company. The facility is secured by a first lien on all assets of the Company. In connection with the facility, the Company issued to TiFunding warrants to purchase $1,000,000 in shares of the Company’s common stock at an exercise price of $0.20 per share. These warrants are exercisable at any time until February 7, 2016 and have certain demand registration rights. The expense related to the warrants is being amortized over the life of the warrants and is included as interest expense in the accompanying financial statements. As of September 30, 2012, the outstanding balance on the facility was $976,868. The Company is in compliance with all of the covenants in the facility as of the date of this report." The warrants expired in 2016 and from what I can tell most of the issued stock options will have expired as well. Who knows what's been happening in the darkness though. It's pretty obvious that the CEO has not been running the firm in the interests of minority shareholders and as an owner of some the debt he was earning a decent amount in interest plus his salary which was $149k in 2012, about the same as the current market cap! The flip side is he was keeping the company afloat. My buying has not gone unnoticed, the bottom fishers over at Investor Hub spotted the increased trading activity and began sniffing around. they found the website and rang the front desk confirming that the business is still alive. The stock has begun to move up. I'm up 66% from my average cost price and the stock is up 150% from it's most recent low. This is what happens with these tiny stocks that have been left for dead. Once folks get clued up that there is some potential they begin to take off. I'm not too interested in what might make this stock go up, whether it's management starting to communicate again or if it's other investors bidding the stock price up. I never buy with any particular expectation in mind, I simply look at the chart, do some digging and then buy if I think there is some potential for a strong upward move, then I just wait. It's really that simple. We'll see what happens with this one. Thanks for reading, David Long HMGN

5 Comments

G

10/14/2019 08:31:14 am

Nice write up, thanks!

Reply

David

10/14/2019 06:24:26 pm

Hi G,

Reply

mike

10/14/2019 03:50:00 pm

It seems that the last trading day was Oct 9. The stock fluctuated from 0.0055 to 0.01 during the day. So it is a bit difficult to determine the current price as the spread is cracy. Trading volume was below 1k on Oct 9.

Reply

mike

10/28/2019 09:37:36 am

It could make sense to focus on small, global stocks instead of U.S. stocks. The reason is that according to the Economist "The greenback looks unusually strong"

Reply

Kolak

5/26/2020 01:24:32 pm

If go to Maryland SDAT website, you will notice that the company is current with its Annual Report and Personal Property Tax filings.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed