|

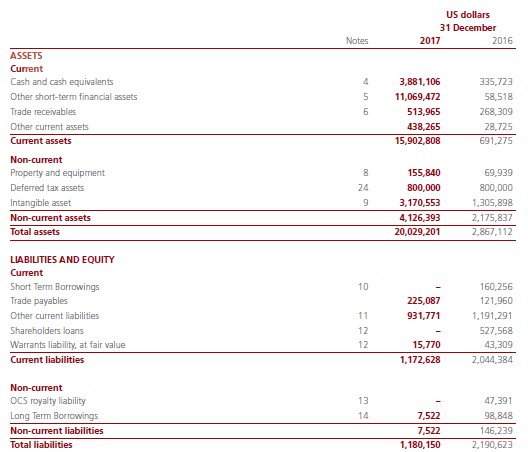

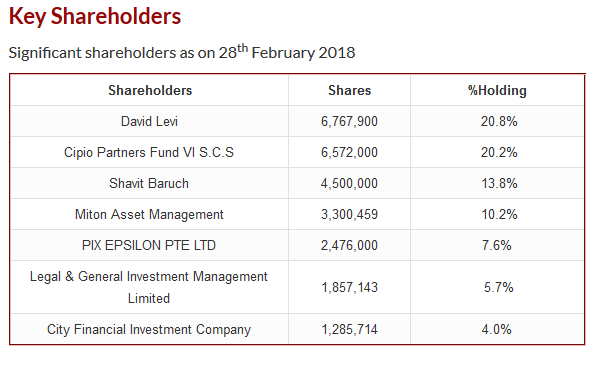

I stumbled upon Ethernity Networks Ltd (LON:ENET) whilst looking through companies with negative enterprise value. Amongst the usual garbage of Chinese RTO's and moribund financial firms I came across ENET. As it was listed as a technology firm I figured I'd check it out since they can often have plenty of cash sat on the balance sheet. The firm floated on the AIM (Alternative Investment Market) of the LSE back in June 2017 with an IPO price of £1.40. After a rise to £1.85 the share price has drifted down to a low of 27p and currently sits at 30p per share. The next port of call was the company's website to pull up the most recent financial information and take a look at the balance sheet. The company has $14,950,578 in Cash & equivalents and Total Liabilities of $1,180,150 Net Cash = $13,770,428 or £10,588,398 The firm's current Market Cap is around £9,755,455 meaning that ENET is trading at an 8% discount to Net Cash. Current shares outstanding = 32,518,186 So ENET has Net cash per share of 32p vs a current share price of 30p The other current assets are comprised of trade receivables and a grant from the European Union. I have no idea what contractual restrictions are placed on the grant other than the fact that it doesn't have to be paid back. Getting into the stock below net cash means you get the operating business, property and intangible assets for free. What's the catch? A number of things; a) The firm's performance since its IPO has been disappointing with revenues and earnings being impacted by an abrupt order cancellation from an OEM customer. Management notes that; "Revenues for 2017 were $1.52m (2016 $2.16m) with gross margins and operating profits of $1.30m (2016 $1.15m) and $152k (2016 $339k) respectively." - 2017 Annual Report b) Whilst the firm has been in business for the last 15 years it has only floated on the AIM market of the LSE for just over a year. Investor uncertainty and lack of coverage is also likely contributing to a depressed share price. C) The company is currently dependent upon a small number of customers, as of 2017 5 customers account for 77% of revenues. Despite the underwhelming performace thus far the company is still profitable having earned £159,471 or 1p per share in for FY2017. There are also promising signs that revenues and earnings have the potential to rise in the near to mid term; "We commenced discussions with a number of the major telecoms operators and Original Equipment Manufacturers (OEM’s) in the latter half of 2017, which are ongoing, regarding our solutions and we continue to receive confirmation of their interest to utilise our products and solutions in their networks. In recent months, their feedback has been that the Company’s offerings are unmatched by competitors in the market place, based on the market shift to the use of ‘cloud infrastructure’ at the network edge. Many of these discussions have advanced significantly having passed proof of concept and evaluation at the prospective partner level, including software companies, OEM’s and server “White Box” manufactures and we strongly believe that these will lead to future long term engagements." - 2017 Annual Report Management has some skin in the game with CEO David Levi owning 20.8% and VP R&D Shavit Baruch owning 13.8%. MY thesis for ENET is the following;

The company is trading at an 8% discount to net cash and a P/B of 0.64, it is profitable and has the potential to achieve higher revenues and earnings in the coming years. If news emerges of some major orders and revenues and earnings start to grow I think this stock has multi-bagger potential. Thanks for reading, David Disclaimer: Long ENET

7 Comments

Brandon

8/31/2018 08:59:40 pm

Hi David,

Reply

David

8/31/2018 09:09:34 pm

Hi Brandon,

Reply

me

9/2/2018 07:54:25 pm

Where did you see that the weighted average number is 32,518,186? According to the filing from June 19th this number is 25,397,245

Reply

David

9/2/2018 09:48:38 pm

Hi there,

Reply

Itay

9/3/2018 06:09:44 am

So, this is obviously wrong.

me

9/8/2018 12:24:05 pm

so, the latest filings shows that the shares count is 32,518,186. So, you got it right. Anyway, this is a melting ice cube...

David

9/8/2018 06:55:25 pm

Hi there,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed