|

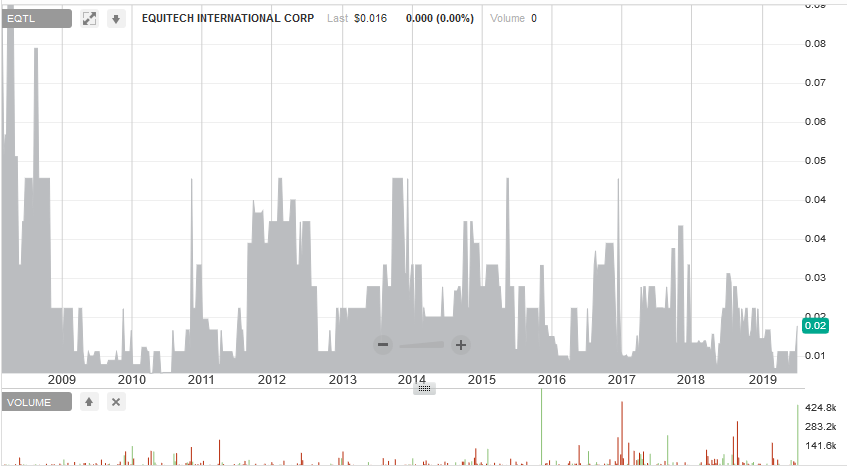

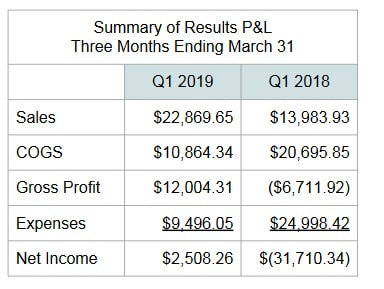

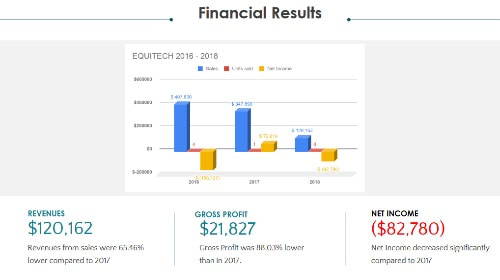

Equitech Int'l Corp (EQTL) interests me for two reasons; 1. I like the look of the long range chart. 2. Change is afoot. This stock is a little different to some of the others I own in that the share count is higher than I normally look for and there is limited financial data available to determine whether the firm is selling at a discount to it's tangible assets. The company has been in operation for around 20 years and is engaged in the production of spectrometers and probes for manufacturing firms in the plastics, chemical, food, ink and paint industries. Here's what I know; Market Cap = $1,840,000 Share price = $0.016 Common = 115,000,000 Float = 12,000,000 I have no idea what the current book value of the company is, nor do I know what it's debt and liquidity position is. What do I know? First to the charts; The 10 year chart shows that this stock has the potential to frequently move up several hundred percent and the long-range chart shows that it has been several thousand percent higher in the past but has been trapped in a narrow range for the past decade. Now to the change I mentioned about. The company has begun to emerge out of the darkness and there is potential for positive movement with the stock. After years of mismanagement and a poorly executed strategy to capitalize on the fibre-optic sensor technology the firm invented they appear to have seen the error of their ways. A licensing agreement with ColVisTech, a German startup company, which was putting EQTL at a cost disadvantage has been cancelled after sales dropped through the floor and customers deserted the firm. A new CEO has now been installed, a new website has been launched, limited financials have been provided, a new more competitive pricing structure has been unveiled, manufature of the company's products have been relocated back to the USA and the company has moved it's HQ from Florida to New Jersey. EQTL has also returned to profitability in Q1 of 2019 after making a loss of $82,780 in 2018. If the company can begin to get revenue back to 2016 levels and post a full year profit the stock price could move up significantly. There is obviously some risks here, once more comprehensive financials are released it could emerge that book value is actually negative and liquidity is poor with negative working capital. The firm could have to issue equity or debt for financing and the turnaround plan could fail.

Worst case scenario is I lose my principal, if things go well this could be a multi-bagger. I'm in at an average cost price of $0.01. Thanks for reading, David Long EQTL

11 Comments

David

7/1/2019 09:41:26 pm

Hi Dan,

Reply

David

7/1/2019 09:52:04 pm

I'll also just add that EQTL's website says Q2 '19 results will be available on 20th July.

Reply

mike

8/4/2019 04:01:14 pm

Price / Sale is around 18. I think other fundaments are not meaninful. So this is rather an expensive stock. That's keeping me from buying this stock.

Reply

David

8/4/2019 04:45:04 pm

Hi Mike,

Reply

Mike

8/25/2019 11:08:17 am

The old financials of 2008 can be found here: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00014940

Reply

Mike

8/25/2019 11:17:57 am

Sorry, I think this is another company.

Reply

David

8/25/2019 11:37:55 am

No worries Mike,

Rahul nath

7/17/2021 04:29:44 pm

Hi , David since i was wanted to know your style more , i hope u hold EQTL ? Its a just awesome return

Reply

David

7/17/2021 04:34:33 pm

Hi Rahul,

Reply

Chris

1/15/2022 07:10:51 pm

It looks like the company has been making a lot of progress. They have detached themselves from the German licensing agreement, merged with two other profitable business which allow them to be more vertically integrated, brought in a new investment, and now have international sales reps. Price had a bump last year but has settled back down. Thoughts?

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed