|

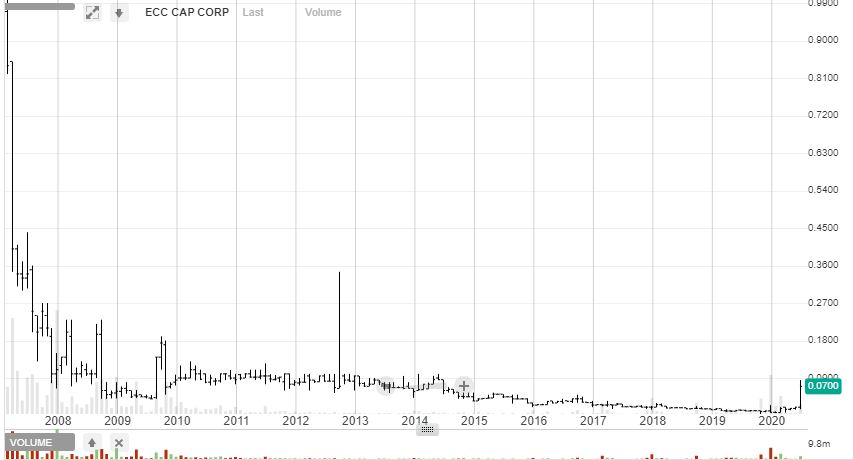

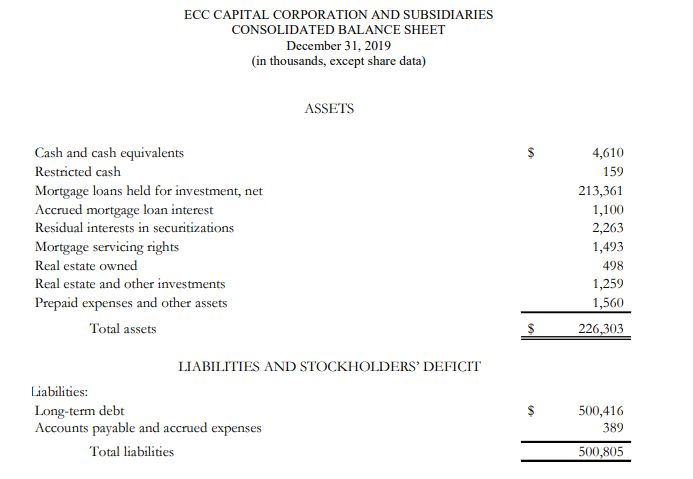

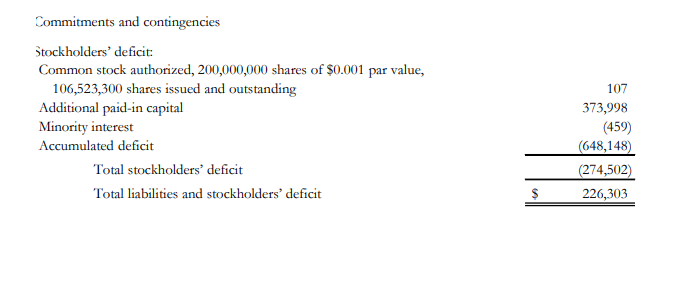

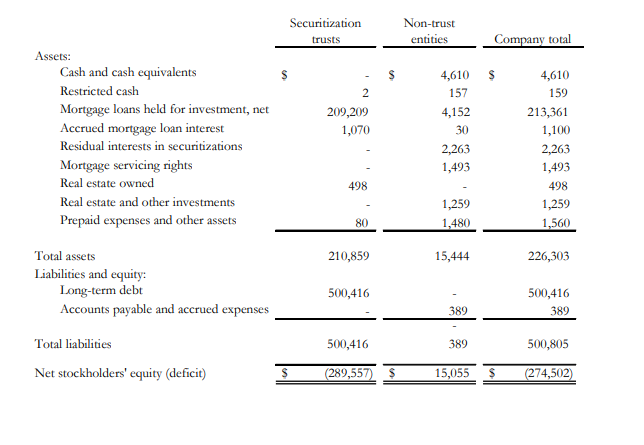

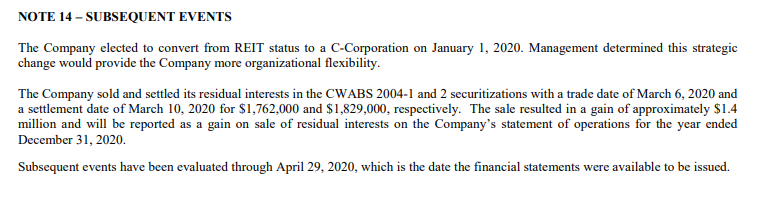

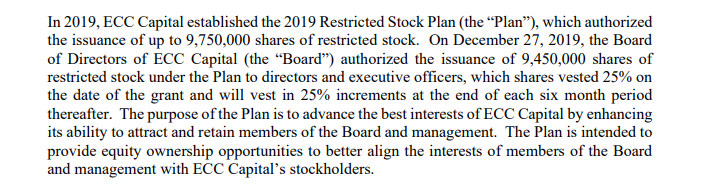

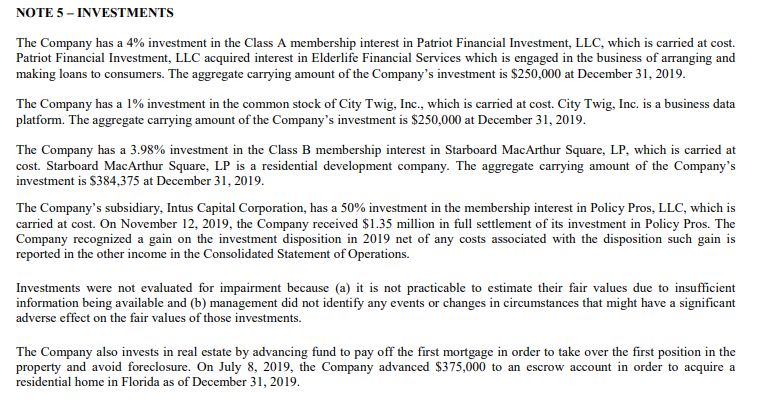

I initially bought ECC Capital Corp (ECRO) back in February of this year after a much smarter investor than myself told me about it (Thanks Bill, you totally nailed it!). To understand the full picture with ECRO we need to take a walk through the halls of history back to the Great financial crisis of 2008. ECRO was a failed subprime mortgage REIT that owned a bunch of mortgage assets including some subprime toxic sludge which it had sold to Bear Sterns in 2006. After selling its subprime book it was left with some equity interests in various securitization trusts, a batch of performing mortgages and some litigation claims against Bear Sterns and ECRO's former lawyers. ECRO assumed it was free and clear of any repercussions after the sale of the subprime book to Bear Sterns but it turned out that the lawyers had screwed up and the firm still had exposure. ECRO subsequently won 2 of its 3 litigation claims, one against Bear Sterns in 2009 and one against Latham, one of its lawyers, in 2011. The third suit against Manatt, another of its legal teams, was lost and ECRO had to pay out $7 Mil in 2016. The last available financials for ECRO were from 2008 and then it moved onto the pink-sheets, stopped filing financial reports, and the news flow dried up aside from whatever updates appeared on the company website. The company made a series of cash distributions to shareholders between 2008 and 2011 and then they stopped along with the news updates. The market assumed ECRO was either dead, dying or just lost interest in it. Aside from a single stock spike on low volume in late 2012 the trend was an uninterrupted decline, down from a high of $0.13 in March 2010 to a low of $0.0070 in Feb 2020. All the while though, my smart investor friend had been watching this moribund penny stock closely. Diligently digging around in the background, he'd uncovered the fact that the firm still had some performing assets on its books and suspected it was worth more than its then present value. Fast forward to 2018 and the news began to flow again. The company intimated on its website that it intended to revoke its REIT status then it did a u-turn. Then in 2019 it finally went through with it; "The Board of Directors of ECC Capital Corporation, a Maryland corporation Corporation , pursuant to Section 5.7 of the charter of the Corporation (the has determined that, effective January 1, 2020, it is no longer in the best interests of the Corporation to continue to qualify as a real estate investment trust (a REIT ), and, accordingly, the Restriction Termination Date as defined in Section 7.1 of the Charter shall be January 1, 2020. Simultaneously, the Board of Directors of the Corporation also decided that it is in the best interests of the Corporation that one of its subsidiaries qualify as a REIT beginning in 2019, and, accordingly, the Initial Date as set forth in Section 10.1 of the Charter shall be January 1, 2020. Accordingly, the ownership and transfer restrictions set forth in Article X of the charter shall be effective as of January 1, 2020. " Then, after trading hours on the 16th of June the unthinkable happened. ECRO posted its 2018 and 2019 audited financial reports on it's website, 11 years after the last one had been released! The share price shot up from $0.03 to $0.08 on heavy volume and has subsequently traded in a range of around 5-6 cents. Here's the 6 month chart to give you a bit more context. What does the 2019 annual reveal? Upon first inspection the balance sheet doesn't make much sense. It says ECRO has assets of $226 Mil and $500 Mil in debt. The way the accounting is laid out is misleading as it includes the total assets and liabilities of the securitization trusts which ECRO has an equity interest in. To see the actual assets and liabilities of ECRO you have to go to note 1. The middle column named 'Non-trust entities' is the one we are interested in. It tells us that ECRO has net stockholder's equity of $15,055,000 which includes $4,610,00 in cash and equivalents. Total liabilities stand at £389k. Even this isn't the full picture though. Note 14. adds some more color. So in March ECRO sold its residual interests in the securitization trusts for $3.591 Mil netting a $1.4 Mil profit on their stated BV of $2.263 Mil. That means ECRO has a net cash position of $7.812 Mil and a Net BV of $16.455 Mil. The common outstanding data listed on the OTC markets is out of date and thus the listed market cap is wrong too. In the June 2020 business update management put out on the company website common outstanding was listed as 106,523,300 but there's a restricted stock option plan in place which will have added some more shares to the pile. Assuming another 25% vested on June 27th then the current share count and market cap should be as follows; Common = 108,885,800 Market Cap = $6.424 Mil On a per share basis that would give us 7.17 cents in net cash and 15.11 cents in Net BV. Shares are currently trading at $0.059 a piece so it's still selling at around 0.82x net cash and 0.39x net BV even now. The income and cash flow statements are a convoluted mess which don't reveal anything of use due to the mixing of expenses for the securitization trusts and ECRO. You can look at the 2018 net BV and adjust for any gains on sales of assets or fair value adjustments to get a rough idea of the firm's operating costs. It looks to be around a million bucks per annum. Despite the run-up in price ECRO still looks cheap, if the trend of selling assets at a premium to booked cost continues we could see the cash pile grow. Investments are listed in the footnotes here; The other point of interest is what ECRO does with all the cash. Now it has de-REITed its options have grown and it's got a chunk of NOL's to boot. Maybe management decides to deploy the capital into some performing assets to capture the benefit of the NOL's or perhaps they just end up selling the rest of the assets and liquidating, time will tell. The 2019 financials note that; "As of December 31, 2019, the Company has approximately $163 million and $122 million in estimated federal and state net operating loss carryforwards available to reduce future taxable income of its TRSs, which begins to expire in 2026. Such losses may not be fully deductible due to changes in ownership rules under Section 382 of the Internal Revenue Code and the uncertainty of taxable income in future periods. As of December 31, 2019, management does not believe there have been any limitations on deductible losses resulting from applying the provisions of Section 382 limitations." Insiders have skin in the game. The chairman, Steve Holder, owns the lion's share with an estimated 45% of the common. A few other things to mention. There's a 2.5% ownership limit for outsiders so there's virtually no chance of any activism here; "Since January 7, 2008, ECC Capital’s charter has prohibited stockholders, other than persons for whom an ownership limit waiver exists, which includes Steve Holder, from owning more than 2.5% of its common stock. The Amendment and Restatement maintained the ownership limitation at 2.5% of its common stock." Finally, access to the company website is blocked to all non-US users so you'll have to use a VPN to access it. Is it a buy at this price? I think so and I've bought more since the price started to drift back down. I don't know what might happen here but it's too cheap to ignore. What are the risks? Management could just take all the value via dilution through more restricted stock plans. They could also burn through the cash pursuing strategic alternatives that turn out to be dead ends. They could go dark again and not communicate for the next decade. There's a whole bunch of ways it could not pan out for minority holders. The flip side is that management could just call it a day and liquidate the business or sell it. They could find a new business venture or acquire some productive assets and monetize the large NOL base they have. In penny stock land it doesn't take much good news to get a stock moving. We had silence for a decade and then the stock moved from $0.0070 to 8 cents in the space of a few months. For sure that was a big move but I don't think we are done yet, with that cash position, evidence of profitability and a huge NOL base I'm willing to bet there's more upside in this one though we may have to wait to see it.

I've got time and they say patience is a virtue. Thanks for reading, David Disclaimer: Long ECRO

5 Comments

Bob

12/21/2020 11:22:03 pm

Interesting thanks

Reply

Mike

12/24/2020 11:04:34 am

I am somewhat sceptical about the U.S. market. One indicator of the attractiveness of a stock market is the number of net-nets one can find. This approach was proposed by James Montier (goes back to Oppenheimer I think). In the U.S., the number is extermely small, indicating a highly overvalued market. This therefore seems to apply to very small companies as well, since net-nets are usually very small.

Reply

8/14/2021 06:40:17 am

Why are the "securitization trusts" balance sheet, particularly the liabilities, part of the stock's liabilities? Usually I related to the "company total" to see what the company is really liable for.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed