|

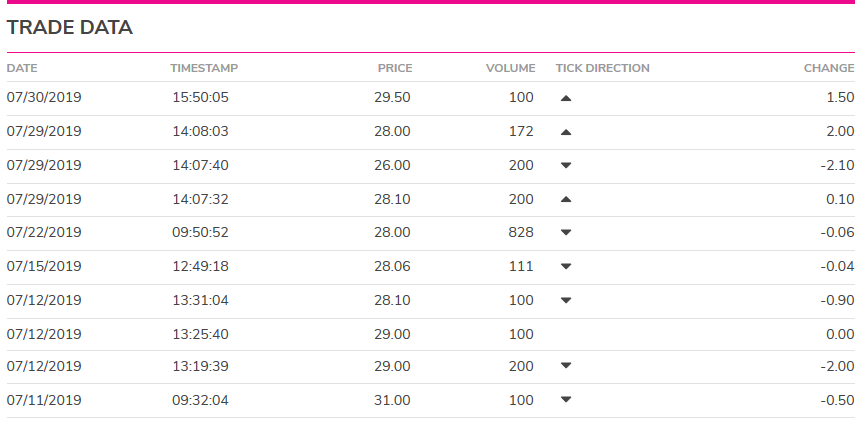

I found Conwest Associates L.P. (CWPS) whilst perusing through one of my old Walker's Manuals. It never ceases to amaze me how one can look through these books which are decades old and still find active value. Information on this limited partnership is scant. The OTC markets quote page on CWPS reveals virtually nothing other than a contact address and phone number. No market cap, no shares outstanding figure, no business discription, no website or even state of incorporation. What it does tell us is; Share price = $29.50 (Spread $28.00 / $32.00) Dividend per share = $4.42 This gives us an annual yield of 14.98% at the current market price. The stock is very illiquid with typically only a few hundred shares traded every other day or so. Thankfully we've got the Walker's Manual to provide us with a little more illumination. Walker's reports that; 'Conwest Associates, a limited partnership, was formed in 1996 upon the liquidation of The Consolidated Royalty Oil Company. The corporation's interest in ongoing oil and gas production royalties was transferred to the trust for the benefit of its shareholders....The partnership collects and distributes royalty payments. It has no further business. Substantially all of the partnership's revenue comes from oil and gas royalties from three payors.' Walkers also notes the following; Number of units outstanding = 606,434 (This would give us a current market cap of $17,889,803) Frequency of dividends = Quarterly Earnings per unit for the period 1997-2001 were as follows; 1997 = $1.52 EPU 1998 = $0.78 EPU 1999 = $$1.13 EPU 2000 - $1.78 EPU 2001 = $1.71 EPU Annual revenues and earnings for the partnership fluctuate from year to year based upon both the level of O&G production and O&G prices. Given the global push to move away from fossil fuels this is unlikely to be a favourable long-term investment but the short-to-mid-term value seems reasonable. In order to get financials for CWPS I suspect one will need to provide proof of ownership and be added to the share register. Here's a historical price chart for those of us who like to study them ; Given the current Shiller P/E for the S&P500 stands at 29.8 for an implied annual return of -1.78%, CWPS might not be such a bad place to park your money whilst you wait for the bear to rear it's head.

Thanks for reading, David Disclaimer: I do not hold fractional ownership in CWPS at the time of writing.

27 Comments

Daniel

8/5/2019 09:55:58 am

I don't think using running yield is the best way to determine whether this investment is attractive or not because the asset base is depleting. You would really require more information on the remaining assets and its expected life etc. Based on the current yield, if the life remaining is less than 6 years, you would lose money

Reply

David

8/5/2019 07:00:06 pm

Hi Daniel,

Reply

Mike

8/9/2019 08:19:32 am

Do you not receive financials as a shareholder? Usually, they have to provide these to investors.

Reply

David

8/9/2019 06:07:18 pm

Hi Mike,

Reply

mike

8/11/2019 07:49:23 pm

BTW it seems that reporting OTC stocks have higher returns than dark stocks, if you control for liquidity. See this study on page 3:

Reply

David

8/11/2019 09:21:29 pm

Hi Mike,

Reply

Mike

8/13/2019 09:46:55 am

Yes, I also follow Dan Schum. His performance is very impressive. The study above probably explains why. There is a very large illiquidity premium for tiny OTC stocks. Further, there is only little correlation betweent listed and OTC stocks.

Mike

9/16/2019 08:13:52 am

Another stock with a record high dividend yield of 16% is Global Trans. However, this is not a tiny stock. I think that the highest yields are currently paid in Russia.

Reply

David

9/16/2019 09:05:02 pm

Hi Mike,

Reply

Chris

9/18/2019 06:06:38 pm

Thank you for posting about this rather obscure company. Does anybody have the phone number or email of anybody at the company? I wanted to request financial statements from them, but I can't find the contact info. Thanks.

Reply

Ryan

11/17/2019 07:05:16 am

I'll give you a hint. Its asset is an override on conventional oil wells that aren't located in TX, OK, CA, CO or ND :)

Reply

Chris

12/26/2019 10:25:50 pm

The asset is the Salt Creek Field in WY, as Ryan alludes to.

Reply

David

12/29/2019 03:54:38 pm

Hi Chris,

Reply

IJW

11/18/2020 10:36:17 pm

Well it is at $16 now, are you a buyer?

Reply

Sjoerd

11/23/2020 09:28:00 am

Hey Chris,

Reply

Chris

8/20/2021 11:04:42 pm

Sure, anyone who wants can find me on twitter @chrisvirnig

Tom Simons

4/13/2022 11:55:29 pm

After folks passing away I inherited over a thousand shares of CWPS. Very loosely familiar with it. I retired in the "20-teens" as a geologist; over half my career in Prudhoe,though. Any reason why there has been zero price move in over a month?

Reply

Chris

4/14/2022 02:03:33 am

Hi Tom, as of last September, the SEC no longer allows publishing bid/ask for stocks that don't report financials to the SEC or to OTC markets. Functionally, virtually all brokers have taken this as their signal to disable buying these stocks. The only remaining buyers with the ability to bid are a handful of specialists offering very low prices.

Reply

Sjoerd

4/14/2022 10:08:47 am

Hey Chris, is the stock that is liquidating HRST?

Chris

4/18/2022 09:16:31 pm

Yep, that's the one.

Sjoerd

4/14/2022 10:07:42 am

Hi Tom, sorry to hear about your folks. CWPS pays a very good dividend and with current O&G prices, I see them paying out about $4-5 in dividends for this year. So option is also to just hold and real the dividends.

Reply

Tom Simons

4/18/2022 09:00:56 pm

Thanks, Chris, Sjoerd, for enlightenment. Somewhere in the distant past I knew this was the Salt Creek field. 'Not working in the patch around here for a long time...forgot all about it 'til recently.

Chris

4/18/2022 09:22:04 pm

We mean selling via your broker - that will not get you much because of the SEC regulations now. You may be better off negotiating a private sale with an interested party. These too will be seeking a steep discount most likely.

Tom

4/18/2022 11:15:50 pm

Thanks, Chris. Hope to speak with broker soon. I live in Casper, Wy, and have learned their are owners of CWPS hidden around here. What about putting a notice in the local paper?

Reply

Sjoerd

4/19/2022 12:40:02 pm

You can see production of Salt creek here:

Reply

Ryan

1/16/2024 05:44:50 am

Tom, would you have any interest in selling your shares? I have bought these in the past from individuals directly. Happy to reach out if so. I’m interested.

Reply

Gregory Halter

2/1/2024 03:48:45 pm

We have some shares we may be interested in selling.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed