|

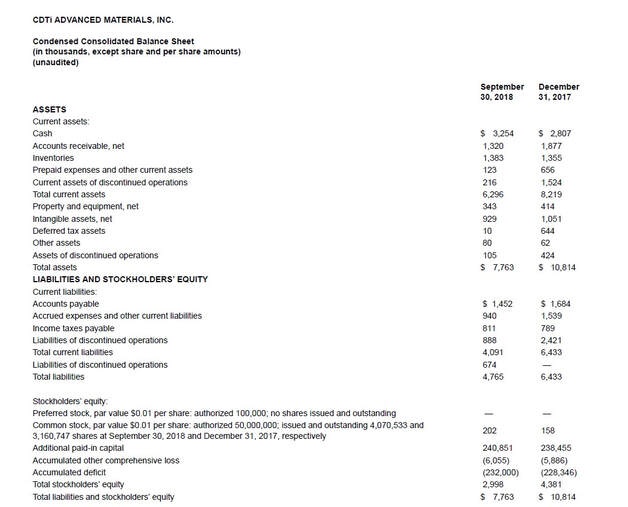

CDTI Advanced Materials Inc (CDTI) shares many characteristics with the other companies I like to look at. It's tiny, illiquid and has both problems and potential. The firm recently delisted from the NASDAQ and has since announced it is going dark, I'm interested! First, here is a brief description of the company's operations and some basic numbers; The company website describes the firm as a 'clean tech emmisions control company that designs, develops and manufactures sustainable solutions to reduce emissions of on-and-off-road engine applications.' They also note; 'With headquarters in Oxnard, California and operations in the United Kingdom, Canada, France, Japan and Sweden, our cleantech company has a unique perspective on global solutions for emissions reduction. Backed with regulatory verifications and approvals, we have created a suite of products that are cost-effective, sustainable and used with proven success in new equipment and retrofit applications' With the increasing regulations on emissions one would assume there should be short-to-mid-term demand for the firm's products but long-term demand is less likely as transportation becomes increasingly electrified. I'm not particularly interested in the long-term future of the company, I'm not looking for a wonderful business at a fair price and I'm not concerned with finding companies with moats. I'm looking for stocks that are over sold or have the potential to move up if the situation improves. Now the numbers; Market Cap = $1,139,749 Share price = $0.28 Common = 4,070,533 The firm is tiny, has a low absolute share price and low share count making it illiquid. Just what I'm looking for! Now to the charts, first the 1 yr and then the long-range; If you need to excuse yourselves to go and throw up I understand. Not me though, I love to see charts like this. I want to see a stock that is absolutely hated, that is being pounded down into oblivion by the market. I want to see a stock that investors are fleeing from like it is a plague ridden rat! So, is there any value here? The latest financials were released by CDTI back in Nov of 2018. Lets look at the balance sheet. Book value stood at $2,998,000

The firm was loss making having lost $1,459,000 or $0.37 a share in Q3 2018 alone. To compound the problem it has racked up an impressive accumulated deficit of $232 Mil! At this point I can hear you screaming at your computer, "Why on earth are you even telling me about this piece of garbage!?!" A few reasons. 1. The firm will likely start to save in excess of $1 Mil in fees and costs having delisted. CEO Matthew Beale had the following to say in the latest report; “Our transition from a niche manufacturer of emissions control solutions to a provider of advanced materials technologies has yet to deliver its anticipated revenue and cash flow potential. In order to best position CDTi for long-term profitable growth, we undertook a thorough and thoughtful review of our cost structure in light of our near and mid-term revenue prospects, including costs associated withbeing a Nasdaq listed and SEC reporting company. Our Board of Directors concluded that the costs of maintaining the Nasdaq listing and remaining a public reporting company, including costs of compliance, the demands on management time and the Company resources required to maintain its listed and registered status, outweigh the benefits to the Company and its stockholders of continued Nasdaq listing and SEC reporting. The Board voted unanimously to voluntarily delist from Nasdaq and deregister under the Exchange Act. This will enable us to better direct our financial and management resources on the commercialization of our high-performance catalysts solutions and technologies for the automotive emissions control markets, and conserve cash while we build long-term value in the company.” 2. Some of the losses stem from discontinued operations and this should further add to the narrowing of losses. Q3 2018 saw losses of $645K from discontinued operations 3. As noted by the CEO, CDTI is in the process of transitioning it's business and the anticipated revenues and earnings have yet to materialize. Maybe the picture will improve and the firm will get some orders in. Without seeing more up to date financials it's hard to know whether the firm is currently selling at a discount to tangible assets. Maybe the firm has burnt through more cash or maybe the cost cutting and delisting has plugged the holes in the ship. I contacted the company to tell them that I supported their cost cutting program including the delisting and to ask if the company had the intention of maintaining communication with shareholders/investors and continuing to provide finanical statements. Their response was both prompt and positive. "Dear Mr Flood, Thank you for your interest in CDTi and understanding of recent initiatives aimed at securing a solid financial foundation for the company and its technology. As we work toward achieving those objectives, our regular shareholder communication is anticipated to be focused on the release of our audited in annual financial statements together with a business update. As relates to our 2018 financial statements we would expect to make those available over the next couple of weeks. Yours sincerely, Matthew Beale Chief Executive Officer" There's no doubt that there are risks with this stock. The company could fail to turn things around. Maybe the cost cutting won't be enough to stave off the cash burn. Perhaps the firm will have to tap the markets for capital through debt or equity. Maybe the next set of financials reveal more of the same and the stock price continues to drop. On the other hand. Perhaps the cost savings might give the company enough time to right the ship, perhaps some good news will emerge and perhaps the firm will move into the black. For tiny illiquid companies like CDTI, it doesn't take much positive news to get the share price moving upward. Into the basket it goes and lets see what the next set of financials reveal. Thanks for reading, David Disclaimer: Long CDTI

4 Comments

Brandon

1/17/2020 03:41:36 pm

Hey David,

Reply

David

1/17/2020 04:46:20 pm

Hi Brandon,

Reply

Uri

10/1/2020 06:24:02 pm

Did u see the CDTI report?

Reply

David

10/1/2020 08:19:32 pm

Hi Uri,

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed