|

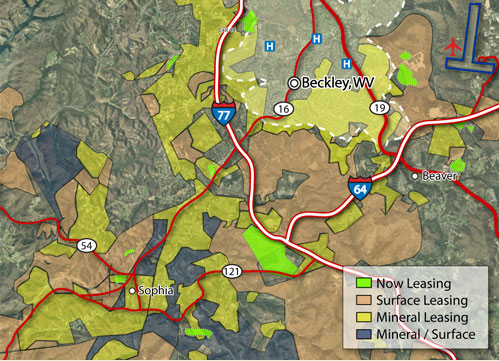

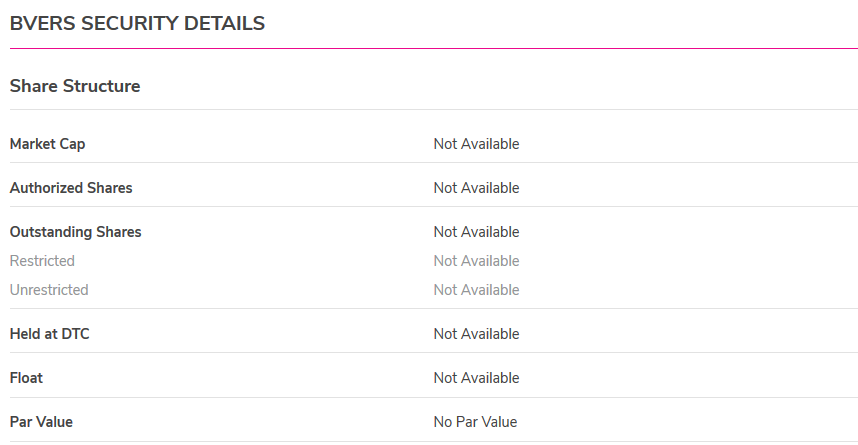

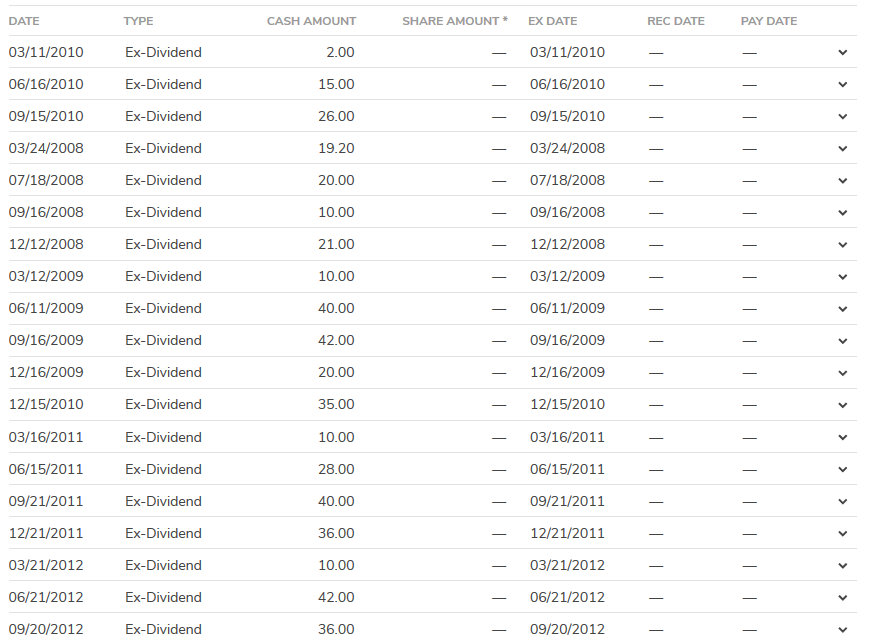

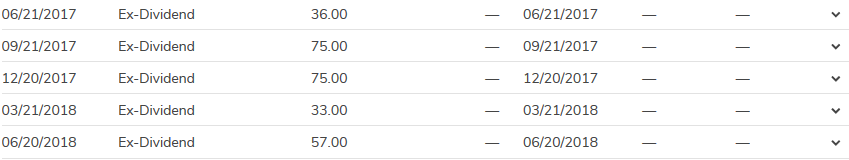

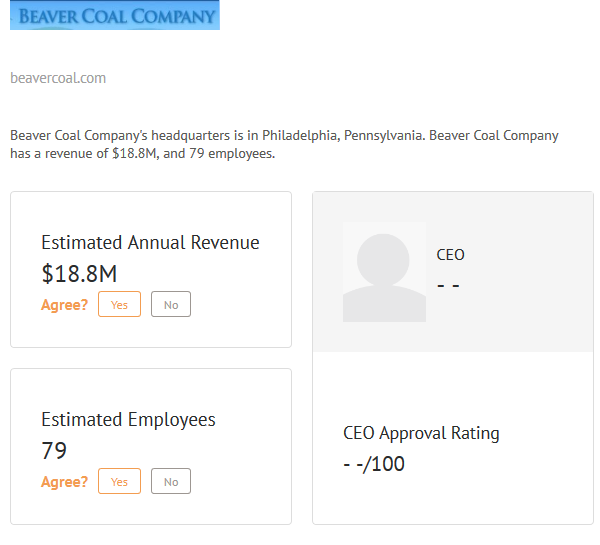

My journey through the shadowlands of dark stocks continues with Beaver Coal Co., Ltd (BVERS). This stock is as dark as they come with virtually no financial information available. I happened upon this stock whilst looking through highly priced dark stocks with high dividend yields. I almost didn't bother digging any further given its a coal company, "these companies are in secular decline aren't they?" I thought. I decided to continue digging to confirm my suspicions that this was a dead end . Okay, it was the dividend yield that kept me digging! First things first, this isn't actually a coal company. After finding the company's website I discovered the following "Beaver Coal Company, Limited owns approximately 50,000 acres of surface and mineral property centrally located in Raleigh County, West Virginia, and within a 10 mile radius of Beckley. Much of the property is serviced by all public utilities and is primed for commercial, industrial and residential development. Beaver Coal Company, Limited prefers to enter long-term ground leases of its surface property but has on numerous occasions sold property for development." Okay, I'm very interested now. After digging through the company's website some more I found that it had an interesting history. "In 1889, Anthony Drexel, Logan Bullitt and J.P. Morgan, three prominent men from Philadelphia, PA, sent their land agent, Azel Ford, to Raleigh County, WV, to purchase approximately 50,000 acres of property in and around the Beckley area. The acquired property was later placed under the banner of Beaver Coal Corporation, the predecessor to Beaver Coal Company, Limited, and a local superintendent was employed to manage the affairs of the company. The typical superintendent, or general manager, was employed by Beaver for more than 20 years and eventually retired from the company. In its 100 plus year history, Beaver has had only six superintendents or general managers. During the first 100 years, Beaver's primary source of income was generated through the leasing of its coal reserves to coal mining companies and the sale of its timber. Beaver has never mined or sold a single pound of coal, nor has it cut any timber from its property. Timbering and mining activities on Beaver's property has always been carried out through agreements with separate companies." As I continued to read I discovered that the company began to lease portions of its surface property for farming and commercial use but little effort was made to maximize the potential of its surface property. In 1992, with the appointment of the company's 6th General Manager in its history, the company began to revise and expand its income strategy and by 2005 was leasing property to 700 families and 90 businesses. These include, amongst other things, a mobile home park and storage facilities. Not only had the company significantly developed its surface property from the early 90's through 2005 but the company's website notes the following; "Beaver has also managed to maximize income generated from timber, coal and natural gas resulting in a nearly six-fold increase in Beaver's annual income" I now thought to myself, perhaps this dividend is more sustainable that I initially thought and I bet the surface and mineral property the company owns is worth a lot of money. The company appears cognizant of the fact that the income which it has generated from its coal and natural gas reserves is likely to plateau and decline over time and has taken steps to diversify its business. These include implementing a sustainable yield timber management program on the company's property and the company notes that; "Beaver purchased or developed ownership interests in separate companies that create income generation through residential development, mini-storage rentals, tourist property rentals and other commercial ventures." Now to the fun part, trying to figure out what this is worth! Here's what I found under the securities details tab of BVERS listing on the OTC Market site. Not what one would describe as illuminating information! So I've got no idea of market cap, shares outstanding and no financial statements to look at. What do I know? Current Share Price = $1174.98 52 wk range - $754.50 - $1,300.00 Avg Vol (30 Day) - 3 Current dividend per share/yield - $276/23.48% Both Morningstar and Gurufocus are listing the Fwd dividend yield as 19.40% which would work out at around $227 in dividends per share. Before attempting a valuation I decided to take a look at some historical charts to see what else could be discerned. Firstly I wanted to see if there were instances of higher volume with the stock. Over the past year there have been days where between 50-240 shares were traded suggesting the possibility that one may be able to take a meaniful position in the company. Looking at a 5 year chart shows that the stock has moved between a low of $655 in May/June of 2016 and a high of $1612 in Nov 2013 with periods of greater volume traded. My first thought for valuation is to assume no growth in future dividends and to simply value the stock with a no growth dividend discount model. Assuming dividends of $227 (equating to a Fwd Dividend yield of 19.40% at the current price) and a required rate of return of around 12% (Long-term S&P 500 return inc dividends of approx. 9% + long-term US inflation rate of approx 3%) 227/0.12 = $1891.66 This would equate to around a 38% discount to fair value. Thankfully I have some data on historical dividends to work with so I can try and estimate a growth rate Throwing all this into a table we get an idea of BVERS dividend payments over the last 10 years or so. Between 2008 and 2018 BVERS dividends per share have grown at an annualized rate of 12.45% so the possibility exists to purchase a stock with a dividend yield of 19.40% which is growing at an annualized rate of >10% Between Jan 2008 and the present the share price has grown at an annualized rate of 9.82% suggesting that the market's pricing of the stock has broadly tracked the growth in dividends. Next I attempted to try and figure out what the company might be earning and what its assets might be worth based upon what figures I could scrape together. My aim was to be roughly right here but the possibility exists that I'll end up being precisely wrong! Family Rent Income The company lists upon its site that it has 35 lots for rent for both single and double mobile homes. Rent for these is $190 and $200 per month for the respective lots. We also know that by 2005 the firm was leasing to 700 families though these may not all be mobile home lots since the company has other sites with log cabins etc. For now I'll assume they are; Assuming 700 families are paying $200 per month gets us to a yearly income of $1.68 Million. Timber Now to the timber property, the company tells us the following on its website here; "In 1993, Beaver Coal Company, Limited began a sustained yield timber harvest program to assist the company in maintaining a healthy forest cover and to maximize yield of forest products. This program ensures that the volume of timber harvested from the property each year remains less than or equal to the volume that is grown on the property." Each year three to four million board feet of timber is harvested from the property. Approximately one-half of the harvest is performed by timber companies that bid for specific harvest units. The remaining half of the annual harvest is performed by an operator working under a longer-term timber purchase contract from Beaver Coal Company." From what I can find on the web the average acre of timber land contains 3,000 Bd Ft of merchantable timber with a stumpage value (land owner's share) of $600. So assuming $600 per 3,000 Bd Ft, the 3-4 million Bd Ft being harvested from BVERS property would be generating income of around $0.6-0.8 Million per annum. Coal Property The following information relating to the company's coal assets is found on their website; "Beaver Coal Company owns approximately 41,000 acres of coal property. All of the property is located in the low-volatile metallurgical coal fields of Raleigh County, West Virginia. Although most of the mining rights are leased to large, nationally recognized coal producers, some opportunity remains to obtain lease rights on various portions of the property. Throughout the years Beaver Coal Company has worked closely with the Department of Environmental Protection's Abandoned Mine Lands Program. This cooperative effort resulted in the reclamation of numerous coal refuse areas left from pre-1969 mining operations. Some of the reclaimed areas included mine refuse with as much as a 30 percent coal content. The opportunity to recover the coal from these "coal rich" mine refuse sites remains open to interested parties." At present Coal is priced at around $66-67 per tonne, assuming the coal property BVERS owns has a coal content of 30 inches thickness, tonnage per acre would be 4350. The company says that most of the coal property is leased so I'll assume 35,000 acres are leased. Assuming a value of $287,000 per acre and that BVERS receieve a 5% equity share would put the value at $14,350 per acre. For 35,000 acres that would be about $502.25 Million. I have no idea if this figure is way off the mark and how the company's leases are structured with regards to equity share and royalties but if it was receiving 1% per annum on the gross figure this would be around $5 Million per year. Oil & Gas With regards to Oil & Gas, the company relays the following information on its website; "Since the late 1920s, natural gas has been produced from Beaver Coal Company's property. The first natural gas lease was made with Godfrey Cabot in 1929. Since then at least eight other natural gas producers have operated on Beaver Coal Company's property, including United Fuel Gas Co., Appalachian Exploration & Development, Peake Oil & Gas, North Coast Energy, Columbia Natural Resources, American Gas Utilities, Co., EOG Resources, Milton Oil & Gas, and CDX, Inc. There are presently six natural gas production companies that have gas rights leased from Beaver Coal Company. Until 2001, gas production from the property was limited to production from gas wells drilled vertically into conventional sandstone and limestone natural gas reservoirs. In 2001, EOG Resources produced pipeline quality methane gas from a horizontally drilled well in the Pocahontas No. 3 Coal Seam on Beaver Coal Company's property. More recently, CDX, Inc. began a horizontal coal bed methane well drilling program on Beaver Coal Company's property. This program has the potential to double the gas production from the property during the years 2008 through 2014." After a fruitless search I was unable to find out the volume of natural gas reserves present on BVERS property or the likely earnings being generated from them. All in all I think its probable that BVERS is generating north of $10 million a year from its leases if we include its coal, natural gas, timber, commercial and private real estate operations but its impossible to know for sure. According to the website Owler, BVERS estimated annual revenues are around $18.8 Million per annum so perhaps I'm not too far off the mark after all. Without knowing how many shares are outstanding its impossible to figure out whether BVERS is selling below Book (Though I suspect it is). What I am confident about is that the dividend is probably more durable than I intially assumed. The only problem that remains is to find out how to buy the stock, every broker I've checked doesn't seem to cover the stock but no doubt there will be some that do.

Thanks for reading and if you have any comments, questions or criticisms leave them in the comments section and I'll get back to you. Regards, David

12 Comments

David

9/6/2018 07:33:21 pm

Hi Doug,

Reply

Brandon

11/8/2018 09:44:32 pm

It looks like Ally Invest lets you place a limit order on BVERS.

Reply

David

11/10/2018 03:55:39 pm

Hi Brandon,

Reply

Brandon

11/10/2018 06:01:30 pm

Nice! Are you planning to purchase a share to request more financial info?

Reply

URI

4/21/2019 04:20:50 pm

Eastabrook capital management looks to be an investor. They are listed on fidelity where looks like you can trade.

Reply

David

4/21/2019 05:02:28 pm

Hi Uri,

Reply

Mark

2/24/2020 06:53:47 pm

Hi David,

David

3/1/2020 08:19:27 pm

Hi Mark,

Reply

David

10/8/2020 08:40:56 pm

Hi Greg,

Reply

Greg Cox

10/15/2020 09:28:00 pm

Just rechecked and Fidelity and Ameritrade told me NO on BVERS (I'm a US investor). I emailed Beaver Coal directly and they said they knew of unit holders that had used Charles Schwab and Boenning & Scattergood (I have not heard of them). I contacted Charles Schwab and they told me I could trade in BVERS. I don't currently have an account with them, so I will look into that.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed