|

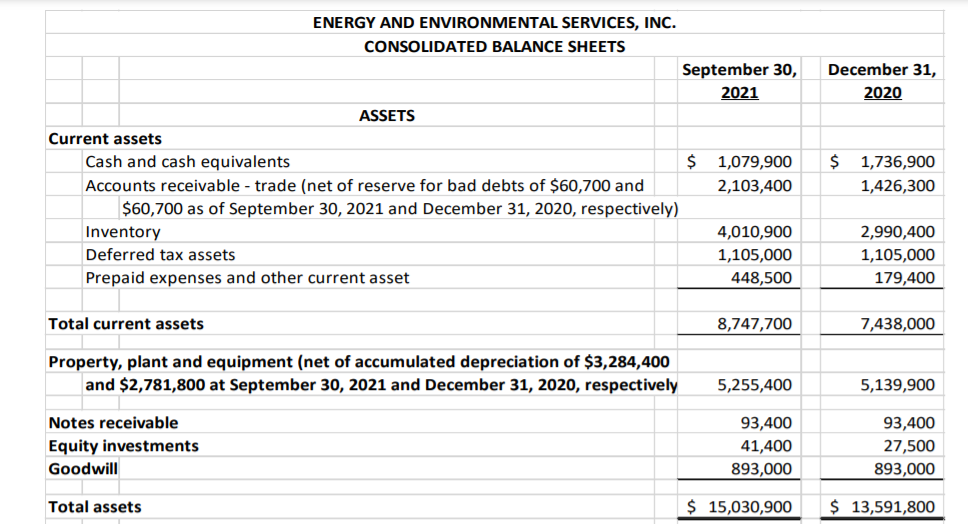

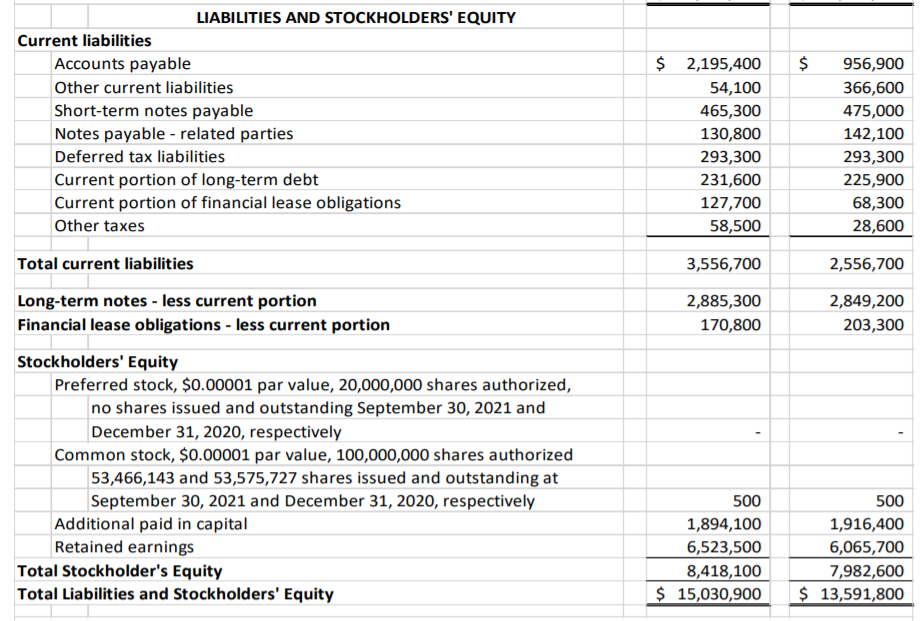

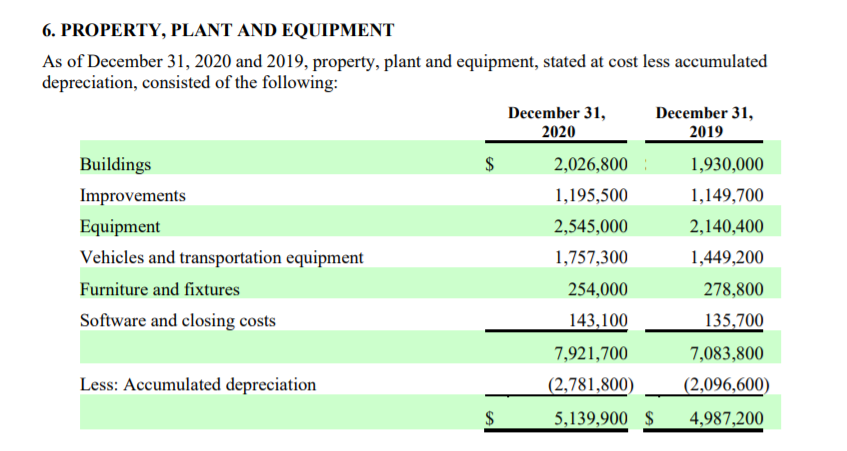

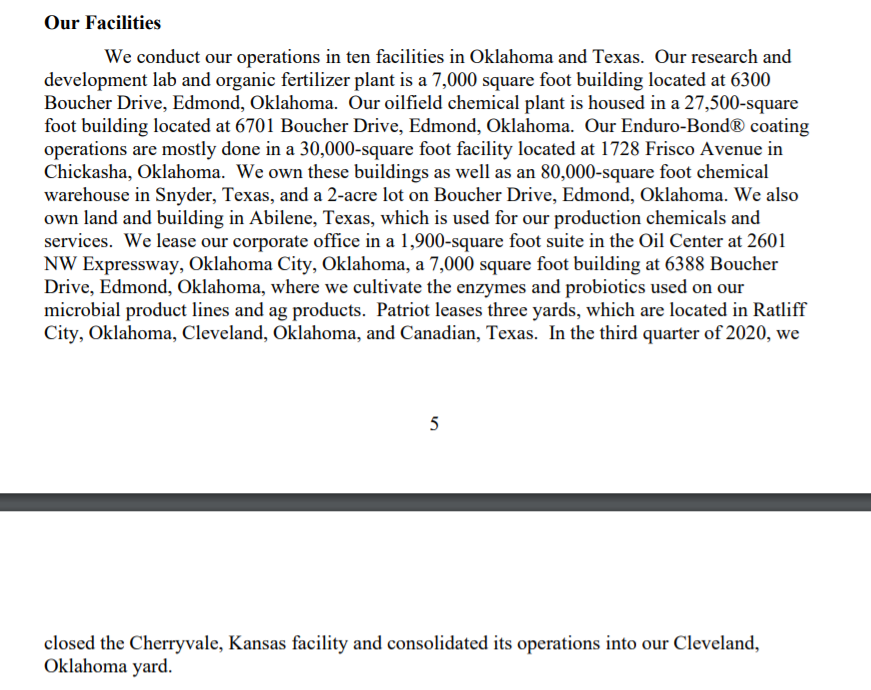

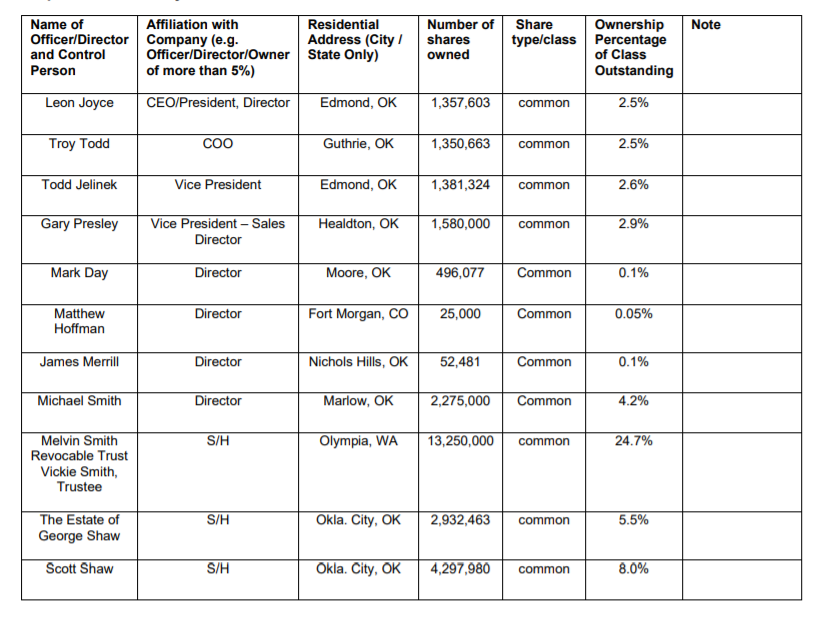

Energy & Environmental Services Inc (EESE) is sat on the pink-sheets building a base and the market has left it for dead. I've been buying. EESE is a pico-cap holding company with a bunch of subsidiaries primarily engaged in the business of O&G services. Market Cap = $4,576,391 Share price = $0.085 Common outstanding = 53,839,893 Float = 28,597,661 TBV = $6,420,100 (Net of all liabilities, Goodwill and Deferred Tax Assets) TTM Revenue = $11,211,200 TTM Op. Income = $12k TTM Net Income = -$107k (Net of PPP Loan forgiveness and Tax benefit) Here's a company description from the latest quarterly report; "The Company, headquartered in Oklahoma City, manufactures specialized liquid and solid chemicals used primarily in the oil and gas industry and high-tech specialized protective coatings for oil and gas and other industrial applications. It also has products under development using enzyme technologies for animal feed supplements and odor solutions. The Company’s operations are maintained and occur through its wholly owned subsidiaries: Enduro-Tech Energy Services, Inc. (formerly EES) (“Enduro-Tech”), Patriot, EnduroBond Manufacturing Company, LLC (“EMC”), EcoZyme System Technologies, LLC (“EST”) and Celex. Enduro-Tech, Patriot, EMC and EST were formed in the state of Oklahoma. " EESE started out life back in 1989 as Energas Resources Inc. in British Colombia, Canada. In 2001 the company registered as a Delaware Corporation and then in 2002 they filed with the SEC and began trading on the OTC Bulletin Board Market. Fast forward to 2011 and they delisted and moved to the pink-sheets. In 2012 they changed their name to Enerlabs Inc. and conducted a 10-1 reverse split. In 2015 they redomiciled to Colorado and then in late 2016 they signed a share exchange with the sole shareholder of Energy & Environmental Services Inc (Est. in 1991). He got 32 Million shares of Enerlabs in the deal and EES became a subsidiary, then the parent changed names again to Energy & Environmental Services Inc. (EESE). After going back through the financials it's pretty clear that Energas/Enerlabs was a badly managed business that destroyed a lot of capital. Since the merger in 2016 the new management have been making acquisitions which have grown revenues from just shy of $2 Mil in FY2016 to around $8.5 Mil in FY2020 and $11.2 Mil for TTM. It should be noted that within this period they've only turned a profit in 2018. Since the pre-merger EES was a private company I've not been able to find any historical financial data to see how they performed in past energy bull markets but in a 2018 presentation they said their chemical manufacturing segment (Enduro-Tech) did around $30 Mil in Gross Revenue in 2014. There's a 2020 Investor presentation on their website which shows the subsidiaries they own and gives a rough break down of their operations. Chart time! This is the kind of long range price chart I like to see. Quiet periods where a stock is just sat drifting along at support followed by huge upward moves. The big run up to a high of $1.50 in late 2016/early 2017 was the result of the merger announcement. Tiny stocks which have been left for dead can print massive moves when they emit signs of life. It can be a merger announcement, a change of CEO, a swing to profit, a big contract win. Anything which changes the market's sentiment toward a stock and creates interest is a potential catalyst. I initially bought EESE after it bottomed out in late 2020 then sold into the little stock spike in March 2021 when it ran up to a high of 43 cents. When it dropped back down I began buying again as my sentiment on the O&G industry grew increasingly bullish. These kind of companies are highly cyclical and their fortunes are tied to the price of the underlying commodity which their business is dependent upon, they can go for years without turning a profit and just sit among the detritus struggling to survive until things improve. Then once a blue moon the skies clear and they have their day in the sun. I'm betting that at some point in this energy bull market EESE stops bleeding red and books a decent profit, I'm betting it prints another big upward move as its fortunes temporarily improve and the market's attention is drawn to it once again. On to the balance sheet. The cap stack is pretty clean, no pref's, convertible debt or warrants outstanding, just some stock options. Tangible book value is $6,420,100 net of all liabilities, Goodwill and Deferred Tax Assets. As well as the cash and receivables EESE carries a bunch of properties. It looks like these account for around 40% of PPE so if my calculations are correct their depreciated value looks to be around $2.1 Mil. Here's a break down from the 2020 Annual report since the quarterly doesn't list it. Here's a list of EESE's facilities. I managed to dig up some valuations on the properties on various county tax assessment sites. R&D Lab/Fertilizer Plant at 6300 Boucher Drive = $502,740 Oilfield Chemical Plant at 6701 Boucher Drive = $466,872 2 Acre lot at Boucher Drive = ? (Couldn't track this down) Enduro-Bond coating facility at 1728 Frisco Avenue = $862,986.00 80,000 sqft Snyder, TX building = ? (Scurry County tax assessment site wouldn't work) Abilene ,TX property = ? (Couldn't track this down) By the looks of it I'm guessing the current carrying value of the properties is below fair value. I'm willing to bet the 80,000 sqft building they own in Snyder, Texas is worth $1 Mil or more. Add in the other 3 properties I managed to find a value on plus the Abilene, TX property and the 2 Acre lot on Boucher Drive, I bet far value for their properties is closer to $3 Mil or more. I think the Balance Sheet is strong enough for EESE to keep going till business picks up. Revenues are growing and I think they have a decent chance of swinging to a profit pretty soon. Here's a break-down of current ownership Melvin Smith, the Gentleman who owned EES which merged with the public company formerly known as Enerlabs, owns a quarter of the stock. Insiders have skin in the game too though they only hold relatively modest amounts of stock. The public float is reasonably tight with all those shares locked up. That's how I like it to be. What's the stock worth? For me it's hard to say. In a sense it's justified that the market is pricing the stock below book since it is loss making. On the other hand revenues are growing, we could see EESE book a profit pretty soon if oil prices keep climbing. With situations like this I prefer to just see how things develop, without having any data on what the private pre-merger company was earning through past cycles I'm reluctant to start throwing numbers around. Instead I'll wait and watch. What are the risks? It's a minuscule company trading on the pink-sheets. It's accounts are unaudited. All kinds of bad things can happen. Current management is trying to grow market share via mergers and acquisitions, this can be a risky move if not executed well. Maybe this energy cycle ends sooner rather than later, maybe revenues stop growing and start to contract. Maybe EESE doesn't turn a profit and has to dilute to keep the lights on. Maybe the oil price keeps climbing but the E&P's decide not to ramp up production. Maybe larger competitors get all the business and the little minnows like EESE are left trying to survive off the scraps. Maybe the stock goes dark This is a speculative play based upon the rising price of a commodity lifting all boats. Risks abound! Time to wrap it up.

EESE is sat way way down on the long-range chart and selling below TBV. No one really knows its earnings power potential at peak cycle since none of that pre-merger financial info is in the public domain. We know Enerlabs was a garbage business from the public filings but there are hints that the current incarnation of the company has some potential. When a stock is left for dead you only need a bit of good news to move it up, there is plenty that could go wrong here but if one or two things go right then the upside can be big. That's why I like to buy a stock when it's sat down in the low range. Thanks for reading, David Disclosure: Long EESE

5 Comments

Ralph S.

1/31/2022 04:39:31 pm

Hello. Thanks for the post. Where have you bought it? Which broker? Maybe people from Texas know the valuation of those hidden assets. Regards!

Reply

David

1/31/2022 06:38:12 pm

Hi Ralph,

Reply

chris w

3/5/2022 10:02:36 pm

here is a stupid question. what if the stock goes dark? then what?

Reply

David

3/5/2022 10:38:09 pm

Hi Chris,

Mike

2/4/2022 01:34:33 pm

I recently saw a study covering the smallest companies (with market cap less than EUR 15.3 million, see the link). Interestingly, the companies with a low financial risk (profits in the last three years on average and no over-indebtedness) performed much better than the companies with high financial risk. However, I don't have an explanation why these companies performed better than larger companies.

Reply

Leave a Reply. |

David J. FloodUK based Investor. I focus Archives

February 2023

Categories

All

BLOGS I FOLLOW

No Name Stocks Svenda's Manual of OTC Stocks Caveat Emptor Stocks Leaven Partners OTC Adventures Nothing But Net Nets Clark Street Value Value Investing Blog Alpha Vulture Deep Value Investments OddballStocks Value Stock Geek Barel Karsan - Value Investing Shadow Stock Hidden Value Yet Another Value Blog Streets Of Value TES Optimal Value Investing The Bad Investor Undervalued Japan Liquidation Almanac Adventures in Capitalism White Chip Stocks Light Blue Value Global Investing Insight Mesaba Range Value The Market Plunger Neto's Notes Battleship Investing Blog The Investment Long-List Oceania Value Grahamian Value Digest Stock Speaking Canadian Value Stocks Analyzing Bargain Stocks MicroValue Hidden Gem Investing |

RSS Feed

RSS Feed